- Home

- »

- Advanced Interior Materials

- »

-

Middle East Lithium Market Size, Share, Industry Report 2033GVR Report cover

![Middle East Lithium Market Size, Share & Trends Report]()

Middle East Lithium Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide), By Application (Automotive, Consumer Goods, Grid Storage), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-707-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Lithium Market Summary

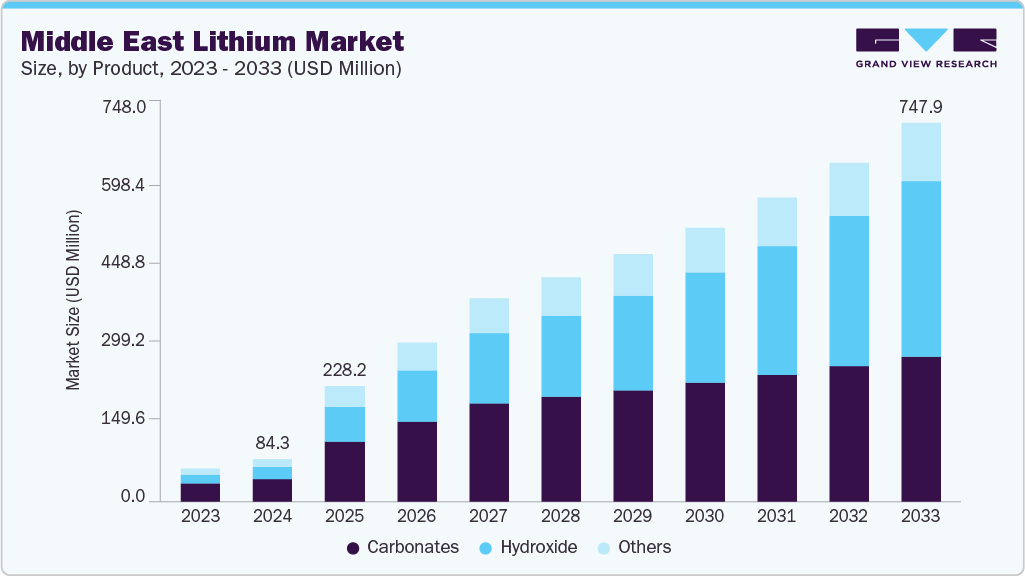

The Middle East lithium market size was estimated at USD 84.3 million in 2024 and is expected to reach USD 747.9 million in 2033, growing at a CAGR of 16.0% from 2025 to 2033. Vehicle electrification is projected to attract a significant volume of lithium-ion batteries, which is anticipated to drive market growth over the forecast period.

Key Market Trends & Insights

- The Saudi Arabia lithium market held the largest regional revenue share of over 26.0% in 2024.

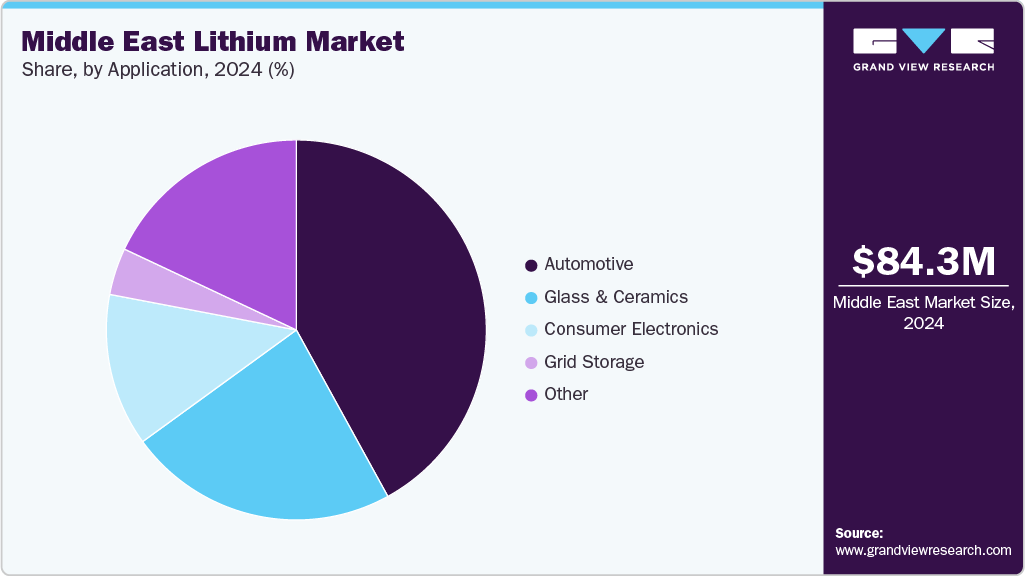

- By product, the carbonates segment held the largest revenue share of over 53.0% in 2024.

- Grid storage is expected to remain the fastest-growing application segment from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 84.3 Million

- 2033 Projected Market Size: USD 747.9 Million

- CAGR (2025-2033): 16.0%

The automotive application segment is expected to grow substantially, driven by stringent regulations imposed by government bodies on ICE automakers to reduce vehicle carbon dioxide emissions. This has shifted automakers' interest toward producing EVs, which is anticipated to benefit from the demand for lithium and related products.Government subsidies for electric vehicles (EVs) and growing investments in the sector are expected to significantly accelerate the expansion of the Middle East lithium industry. While some regions hold substantial lithium resources, actual domestic production remains relatively small, far below what’s needed to meet surging demand. Recognizing the strategic importance of securing a stable supply of battery materials, there is a growing emphasis in the Middle East on investing in resource development, mining projects, and next-generation battery manufacturing technologies.

Efforts are also underway to streamline permitting and regulatory processes that can unlock faster development of lithium and other critical minerals. Major initiatives are being launched to bring platform technologies and flexible, scalable processes into the region’s battery-manufacturing ecosystem, with the aim of building greater self-reliance in the clean energy supply chain.

For Middle Eastern nations advancing their EV and clean energy strategies, there is a clear opportunity to integrate natural resource development with domestic manufacturing capacities. By fostering partnerships focused on securing supply chains, technology innovation, and processing capabilities, the region can capitalize on its industrial potential and strategic positioning, aligning mining investments with local EV production and clean energy deployment.

Drivers, Opportunities & Restraints

The Middle East lithium market is poised for growth, driven by rapid electric vehicle (EV) adoption and ambitious clean energy targets under national strategies such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050. These initiatives are accelerating the need for lithium-ion batteries (LIBs) to power EVs and support the expansion of renewable energy storage solutions. The increasing deployment of solar and wind projects across the region is boosting demand for energy storage systems (ESS), where LIBs dominate due to their high energy density, scalability, and long cycle life. Additionally, government-backed economic diversification plans are encouraging investments in mining, refining, and advanced battery manufacturing, positioning lithium as a strategic sector. The Middle East’s geographic proximity to Europe, Asia, and Africa also offers a competitive advantage in becoming a global hub for lithium supply chains and battery components.

Opportunities for the region lie in developing domestic lithium extraction and processing capabilities to reduce reliance on imports, attracting global battery manufacturers through its low-cost energy and robust logistics infrastructure, and integrating lithium-based storage solutions into mega renewable energy projects like NEOM and Masdar. The development of a complete value chain-from mining and refining to cell manufacturing and battery recycling-could capture greater economic value. At the same time, strategic partnerships and technology transfer agreements with global innovators could accelerate the adoption of advanced processing methods and sustainable mining practices.

However, several challenges remain. The Middle East currently has limited proven large-scale lithium reserves compared to major producing regions, which may slow domestic supply growth. Water scarcity in the region could pose environmental challenges, given that lithium extraction processes can be water-intensive. Additionally, the establishment of mining, refining, and battery production facilities requires high capital investment and advanced technical expertise. The market is also exposed to global price volatility and strong competition from established producers. At the same time, supply chain concentration risks remain significant as a few countries still dominate global lithium refining. Developing local processing capacity or securing reliable refining partnerships will be critical to overcoming these constraints and establishing a sustainable lithium industry in the Middle East.

Product Insights

Carbonate segment held the revenue share of over 53.0% in 2024. The carbonate segment is expected to dominate the Middle East lithium market, mirroring global trends, with Lithium Carbonate (Li₂CO₃) playing a central role in regional demand growth. Lithium carbonate, the most stable inorganic lithium compound, is essential for producing other derivatives such as lithium hydroxide (LiOH) and pure lithium metal. Beyond its role in the battery industry, lithium carbonate also finds niche applications in the construction sector, including waterproofing slurries, specialized adhesives, and certain chemical treatments. In the healthcare sector, it is also utilized in the treatment of bipolar disorder, although industrial demand far outweighs medical use in the region.

Lithium hydroxide, a white hygroscopic crystalline compound available in both anhydrous and monohydrate forms, is increasingly in demand in the Middle East due to its critical role in battery manufacturing. This demand is driven by the region’s strategic push toward EV adoption and large-scale renewable energy storage projects. LiOH is also used in specialized transportation applications, including air purification systems in submarines and spacecraft, but its largest growth driver remains its application in high-performance lithium-ion batteries. Rapid advancements in battery technology, combined with the entry of regional automotive manufacturing and assembly operations, are expected to fuel LiOH consumption in the coming years.

Several Middle Eastern governments and private-sector players are actively working to secure lithium supply chains, including both carbonate and hydroxide products, to support emerging EV and energy storage industries. Strategic agreements between regional industrial groups and global lithium producers are being explored to ensure long-term supply stability and price security. These efforts align with national clean energy visions and industrial diversification strategies, positioning the Middle East not just as a consumer but potentially as a processing and manufacturing hub for lithium-based products.

Application Insights

Automotive segment held the revenue share of 42.0% in 2024. In the Middle East lithium industry, the automotive segment is poised for robust growth in terms of lithium demand, driven by the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Government-led sustainability initiatives, favorable EV policies, and rising fuel costs are accelerating the shift toward cleaner transportation solutions. The expansion of EV charging infrastructure, coupled with strategic investments from global and regional automakers, is further fueling market penetration. Lithium-ion (Li-ion) batteries, with their high energy density, fast charging capability, and long lifecycle, are increasingly becoming the preferred energy storage solution for EV manufacturers across the region. As consumer awareness of environmental benefits grows and automotive technology advances, the demand for lithium in the Middle East automotive sector is expected to witness sustained momentum.

The consumer electronics segment is also experiencing a surge in lithium usage, driven by rising sales of smartphones, laptops, tablets, cameras, wireless audio devices, and other portable electronics powered by Li-ion batteries. Increasing disposable incomes, expanding internet penetration, and strong consumer preference for high-performance, lightweight, and compact devices are accelerating adoption rates. Li-ion batteries’ low weight, compact size, and high energy storage capacity make them ideal for a wide range of electronics, both rechargeable and single-use. Applications extend beyond everyday gadgets to include remote controllers, handheld gaming consoles, digital cameras, and smoke detectors. With the rapid growth of e-commerce platforms and the increasing presence of global electronics brands in the Middle East, the penetration of advanced electronic devices-and consequently Li-ion battery demand-is set to expand significantly.

In 2024, several Middle Eastern governments and private sector stakeholders announced multi-million-dollar investments aimed at establishing commercial-scale facilities for lithium and other critical minerals. These initiatives focus on developing extraction and processing capabilities, manufacturing key battery components, recycling used batteries, and supporting next-generation battery technologies. Such projects are integral to national strategies for energy transition, industrial diversification, and reducing reliance on imported battery materials.

For example, the UAE has been advancing large-scale battery storage projects to complement its solar and wind energy capacity, integrating lithium-based systems into the national grid to enhance energy reliability. Similarly, Saudi Arabia, under its Vision 2030 framework, is exploring lithium processing and battery manufacturing partnerships to support its growing EV and renewable energy sectors. Large-scale energy storage installations, designed to stabilize grids and maximize renewable energy utilization, are increasingly being prioritized, positioning the Middle East as an emerging hub for advanced energy storage infrastructure.

Regional Insights

Saudi Arabia Lithium Market Trends

Saudi Arabia held over 26% revenue share of the Middle East lithium market in 2024. The Middle East lithium market is still in its early stages compared to leading global regions, holding a relatively small share of the overall market. While the region is not yet a major producer of lithium, its strategic focus on clean energy, electric vehicles (EVs), and large-scale energy storage is driving growing interest in developing a domestic lithium supply chain.

Government-led diversification programs, such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050, are encouraging exploration activities, attracting foreign investments, and fostering partnerships with global mining and battery technology companies. These initiatives aim to establish local capabilities in lithium processing, battery manufacturing, and recycling, ensuring supply security for emerging industries. As renewable energy projects expand and EV adoption accelerates, the Middle East is expected to play a more prominent role in the global lithium ecosystem over the coming decade.

UAE Lithium Market Trends

The UAE lithium market is emerging as the country focuses on expanding its electric vehicle ecosystem, renewable energy storage, and high-tech manufacturing sectors. While the nation does not have significant domestic lithium reserves, it is increasingly active in importing lithium compounds and forming strategic partnerships with global suppliers. Investments in battery production facilities and recycling technologies are driving demand growth. The market is also benefiting from government initiatives aimed at supporting clean energy and reducing carbon emissions.

Key Middle East Lithium Company Insights

Market players compete against product quality, reliability in terms of supply, customer service, and diversity in product portfolio. They invest in the battery sector, a key lithium application. Some of the key players operating in the Middle East lithium industry include Albemarle, Ganfeng Lithium Co., Ltd., Mineral Resources, and Gulf Minerals & Chemicals LLC (Middle East).

-

Saudi Aramco, in partnership with Ma’aden, is spearheading a major push into lithium production. The two have signed a non-binding Heads of Terms for a joint venture focused on lithium exploration and direct lithium extraction (DLE), with a target of commercial-scale production by 2027. Aramco brings decades of geoscience infrastructure, while Ma’aden contributes mining and exploration expertise.

-

The UAE is making significant strides in lithium processing. Titan Lithium has committed AED 5 billion (~USD 1.36 billion) to develop a state-of-the-art lithium processing facility in Abu Dhabi’s KEZAD, focused on producing battery-grade lithium carbonate and hydroxide from imported raw material, with expected operational significance in the coming years.

-

King Abdullah University of Science and Technology (KAUST) unveiled a breakthrough DLE technology capable of extracting lithium from oilfield brine and seawater even at low concentrations like 20 ppm, with proven pilot-scale feasibility. Its startup, Lihytech, is testing this innovation in partnership with Aramco, aiming for full-scale production by 2028.

-

Additionally, the kingdom is exploring lithium extraction from oilfield brine, targeting production sufficient for “one million batteries a year” for both domestic use and exports Saudi Arabia is also positioning itself as a critical minerals hub, attracting international collaboration such as a recent critical minerals supply-chain partnership with the UK and securing over $9 billion in metals and mining investment deals, including plans for a lithium carbonate facility via Zijin Group.

Key Middle East Lithium Companies:

- Lihytech (KAUST spinout, Saudi Arabia)

- Manara Minerals (JV between Ma’aden and PIF, Saudi Arabia)

- Ma’aden (Saudi Arabian Mining Company)

- Saudi Aramco (Saudi Arabia)

- Titan Lithium (UAE).

Middle East Lithium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 228.2 million

Revenue forecast in 2033

USD 747.9 million

Growth rate

CAGR of 16.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Omar; Qatar

Key companies profiled

Lihytech; Manara Minerals; Ma’aden; Saudi Aramco; Titan Lithium

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Lithium Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East lithium market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East lithium market is experiencing robust growth, driven by the escalating demand for lithium-ion batteries (LIBs) across various industries. This surge is primarily attributed to the increasing adoption of electric vehicles (EVs), advancements in consumer electronics, and the expansion of renewable energy storage solutions.

b. The Middle East lithium market size was estimated at USD 84.3 million in 2024 and is expected to reach USD 228.2 million in 2025.

b. The Middle East lithium market is expected to grow at a compound annual growth rate of 16.0% from 2025 to 2033, reaching USD 747.9 million by 2033.

b. The carbonate segment held the revenue share of 53.7% in 2024.

b. Some of the key vendors of the Middle East lithium market are Lihytech, Manara Minerals, Ma’aden, Saudi Aramco, Titan Lithium.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.