- Home

- »

- Medical Devices

- »

-

Middle East Medical Devices Market, Industry Report, 2030GVR Report cover

![Middle East Medical Devices Market Size, Share & Trends Report]()

Middle East Medical Devices Market Size, Share & Trends Analysis Report By Product (In Vitro Diagnostics(IVD), Cardiology), By FDA Classification (Class I, Class II and Class III), By End-use, By Region, And Segment Forecast, 2024 - 2030

- Report ID: GVR-1-68038-548-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Middle East Medical Devices Market Trends

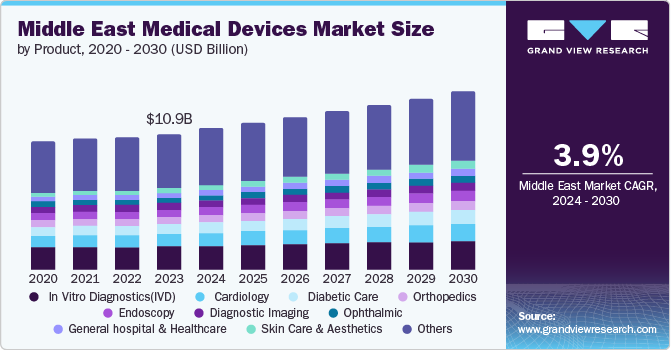

The Middle East medical device market size was valued at USD 10.97 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. The Middle East medical devices market is driven by increasing chronic diseases, rising healthcare expenditure, increasing number of market players in the region, population growth, and improving healthcare infrastructure. Continuous technological advancements in medical devices, growing number of research and development activities, such as wearable health tech, telemedicine solutions, and AI-driven diagnostics, are enhancing patient care and driving market growth.

Most of the Middle Eastern countries are adopters of new technologies and thus offer extensive opportunities for medical device companies. The United Arab Emirates ranks 20th in the World Index of Healthcare Innovation. There is a growing investment in healthcare infrastructure across the Middle East. This includes the building of new hospitals and clinics, as well as the upgrading of existing facilities.

Chronic diseases such as diabetes, cancer, and cardiovascular diseases are becoming increasingly common in the Middle East, due to aging populations and lifestyle changes. This is driving up demand for medical devices used in the diagnosis, treatment, and management of these conditions. People in the Middle East are becoming increasingly aware of the latest medical technologies. This is leading to a demand for more sophisticated medical devices that can provide better care and outcomes.

Product Insights

In vitro diagnostics dominated the market and accounted for a share of 17.1% in 2023. The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in the region has led to a higher demand for diagnostic tests to facilitate early detection and monitoring of these conditions. The prevalence of type 2 diabetes mellitus increased in last decade in Middle East region. Advancements in technology have resulted in the development of more efficient diagnostic devices, driving the adoption of in vitro diagnostics in the Middle East.

Neurology is expected to register the fastest CAGR of 9.5% during the forecast period. The aging population in the region is more susceptible to neurological disorders such as Alzheimer's disease and Parkinson's disease, leading to a demand for neurology devices. Parkinson’s disease is the second most common neurodegenerative disorder in the region. Furthermore, ongoing research and development activities focused on enhancing neurology devices’ efficacy and safety, such as minimally invasive surgical tools for brain tumors and advanced imaging equipment for neurological diagnostics have contributed to market growth.

FDA Classification Insights

Class II dominated the market and accounted for a share of 65.2% in 2023. This is attributed to advancements in technology and innovation driving the development of more sophisticated medical equipment, including surgical instruments and blood glucose meters. This growth of segment is driven by the rising prevalence of chronic diseases such as diabetes and cardiovascular ailments.

Class I is expected to register a CAGR of 3.4% during the forecast period due to their low risk level and the relatively simple regulatory requirements associated with them. As these devices are considered low-risk and do not require premarket approval, manufacturers find it easier to introduce class I devices into the market.

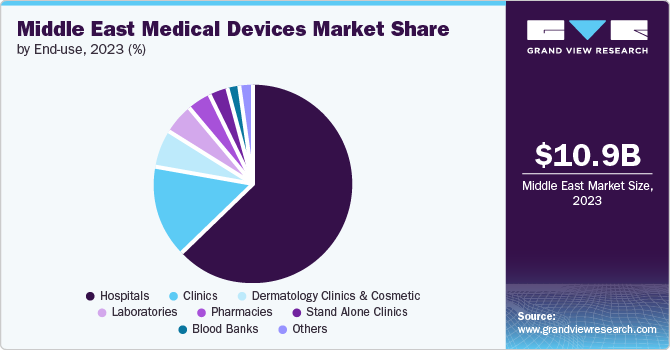

End-use Insights

Hospitals accounted for the largest market revenue share of 62.8% in 2023. The increasing prevalence of chronic diseases in the region has led to a higher demand for advanced medical devices in hospitals to diagnose and treat these conditions effectively. As healthcare in the Middle East becomes more specialized, hospitals are investing in advanced medical devices for specific departments such as cardiology, oncology, and neurology.

Dermatology clinics & cosmetic are projected to grow at the fastest CAGR of 5.3% over the forecast period. Rising disposable incomes and a growing emphasis on aesthetics are leading to an increased demand for cosmetic procedures such as laser skin treatments, injectables, and body contouring in dermatology clinics and cosmetic centers. These procedures often rely on specialized medical devices. The growing awareness about skincare and beauty standards has further propelled the demand for innovative medical devices.

Regional Insights

The Middle East medical device market is expected to experience significant growth in coming years due to several factors, including a growing demand for healthcare services, an increasing prevalence of chronic diseases, and a rise in healthcare expenditure.

Saudi Arabia Medical Device Market Trends

The Saudi Arabia medical device market is expected to grow rapidly in the coming years due to government’s focus on enhancing healthcare services and infrastructure through initiatives. The Saudi government's Vision 2030 plan prioritizes healthcare transformation. This includes initiatives to promote domestic manufacturing of medical devices, attract foreign investment, and expand access to high-quality healthcare services.

Key Middle East Medical Devices Company Insights

Some key companies in Middle East medical device market include Medtronic, Koninklijke Philips N.V., GE HealthCare, Abbott, Smith+Nephew, COLOPLAST, Siemens, Roche Diagnostics and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Medtronic specializes in designing, developing, and manufacturing a wide range of medical devices and solutions. The company’s offerings cover various health conditions such as heart valve disorders, heart failure, coronary artery diseases, peripheral vascular diseases, neurological disorders, spine and musculoskeletal disorders, as well as ear, nose, and throat conditions.

-

Saudi Mais Co. specializes in the manufacturing of single-use consumable medical devices. It offers a wide range of advanced medical disposable products, including syringes, catheters, surgical instruments, wound care products and others.

Key Middle East Medical Devices Companies:

- Medtronic

- Koninklijke Philips N.V.

- GE HealthCare

- Abbott

- Smith+Nephew

- COLOPLAST

- Saudi Mais CO.

- Zimmer Biomet

- Siemens

- Roche Diagnostics

- BD

- Olympus

Recent Developments

-

In April 2024, Johnson & Johnson announced the launch of the Cereglide aspiration catheter and the Ethizia haemostatic sealing patch in the Europe, and Middle East & Africa (EMEA).

-

In December 2022, Saudi Arabia launched its first intensive care ventilator that was locally manufactured. Al-Rowad Technical Systems Company and Medtronic Saudi Arabia partnered to develop this product. The firms had partnerships and support from the Ministry of Industry and Mineral Resources, Ministry of Investment, and the Local Content and Government Procurement Authority.

Middle East Medical Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.37 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, FDA classification, end-use, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman; Bahrain; Egypt; Iran; Iraq; Cyprus; Jordan; Turkey; Lebanon

Key companies profiled

Medtronic; Koninklijke Philips N.V.; GE HealthCare; Abbott; Smith+Nephew; COLOPLAST; Saudi Mais CO. ; Zimmer Biomet; Siemens; Roche Diagnostics; BD; Olympus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Medical Devices Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East medical device market report based on product, FDA classification, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vitro Diagnostics(IVD)

-

Cardiology

-

Orthopedics

-

Diagnostic imaging

-

Ophthalmic

-

General and plastic surgery

-

Drug delivery

-

Endoscopy

-

Dental

-

Wound management

-

Diabetic care

-

Nephrology

-

Ear, Nose, and Throat

-

General hospital and Healthcare

-

Neurology

-

Skin Care & Aesthetics

-

Others

-

-

FDA Classification Outlook (Revenue, USD Million, 2018 - 2030)

-

Class I

-

Class II

-

Class III

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Laboratories

-

Blood Banks

-

Pharmacies

-

Stand Alone Clinics

-

Dermatology Clinics & Cosmetic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

Bahrain

-

Egypt

-

Iran

-

Iraq

-

Cyprus

-

Jordan

-

Turkey

-

Lebanon

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."