- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Paper Packaging Market Size Report, 2033GVR Report cover

![Middle East Paper Packaging Market Size, Share & Trends Report]()

Middle East Paper Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (Virgin Paper, Recycled Paper), By Product (Corrugated Boxes, Folding Cartons, Paper Bags & Sacks), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-733-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Paper Packaging Market Summary

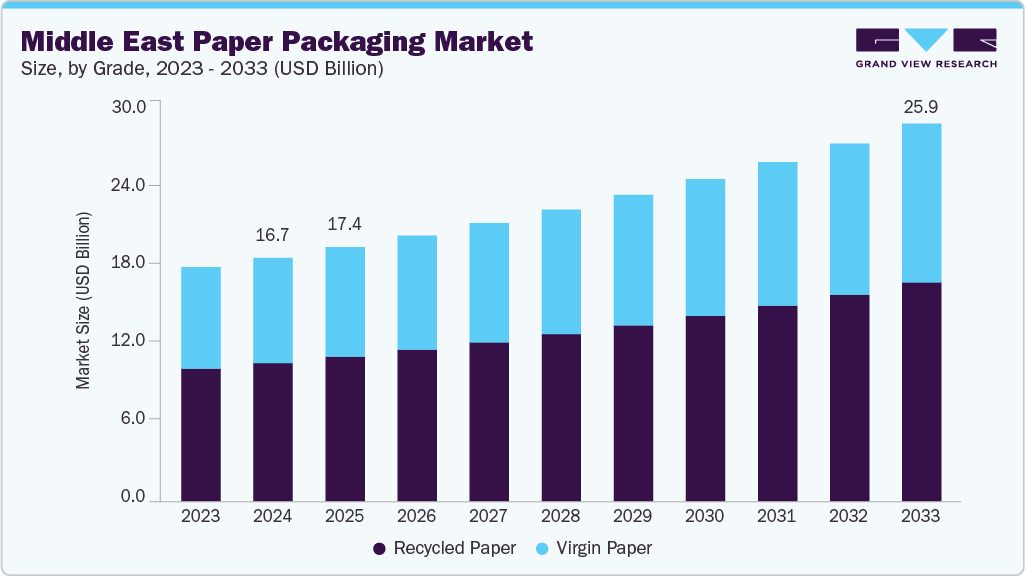

The Middle East paper packaging market size was estimated at USD 16.70 billion in 2024 and is projected to reach USD 25.90 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is driven by the region’s growing demand for sustainable and eco-friendly alternatives to plastic packaging, fueled by government-led bans and regulations on single-use plastics.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East paper packaging industry with the largest revenue share of over 38.0% in 2024 and is expected to grow at a substantial CAGR of 5.5% from 2025 to 2033.

- By grade, the recycled paper segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By product, the folding cartons segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By application, the e-commerce & retail segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 16.70 Billion

- 2033 Projected Market Size: USD 25.90 Billion

- CAGR (2025-2033): 5.1%

- Saudi Arabia: Largest & Fastest Market in 2024

In addition, rapid expansion in the food & beverage and e-commerce sectors is boosting the adoption of paper-based packaging solutions. The rapid growth of the food and beverage sector, supported by rising urbanization, tourism, and increasing demand for convenience foods. Countries such as the UAE and Saudi Arabia are seeing a surge in quick-service restaurants (QSRs), cafes, and food delivery services, which has created strong demand for paper-based packaging such as cartons, paper cups, and takeaway containers. For instance, Dubai’s thriving hospitality and foodservice industry, which caters to both residents and tourists, relies heavily on sustainable and lightweight packaging. In addition, with governments pushing for alternatives to single-use plastics, paper packaging has become the preferred solution for food delivery and retail applications.

Sustainability push and regulatory initiatives across the region are also positively influencing market growth. Middle Eastern countries are increasingly adopting bans or restrictions on plastic bags and packaging to address environmental concerns. For example, Saudi Arabia implemented SASO (Saudi Standards, Metrology, and Quality Organization) regulations limiting the use of conventional plastics, while the UAE announced bans on single-use plastic bags in Abu Dhabi (2022) and Dubai (2024). These measures are encouraging businesses to shift to recyclable and biodegradable options like paper and paperboard packaging. The emphasis on meeting global sustainability standards, especially in export-driven industries such as food and beverages, further amplifies the adoption of paper packaging.

The rise of e-commerce and retail modernization is also driving the paper packaging market in the Middle East. With platforms such as Noon, Amazon.ae, and local online retailers experiencing significant growth, demand for corrugated boxes, paper bags, and protective paper-based packaging has accelerated. Saudi Arabia and the UAE, as e-commerce hubs, are investing in supply chain and logistics infrastructure, which in turn boosts the consumption of corrugated packaging. Moreover, consumer preference is shifting toward eco-friendly and aesthetically appealing packaging, pushing retailers and FMCG brands to invest in innovative paper-based solutions. This blend of regulatory support, sustainability trends, and market demand makes paper packaging one of the fastest-growing packaging formats in the Middle East.

Market Concentration & Characteristics

The Middle East paper packaging industry is heavily shaped by government-led regulations and sustainability initiatives aimed at reducing plastic usage. Countries such as the UAE, Saudi Arabia, and Qatar have introduced strict bans and levies on single-use plastics, which has accelerated the adoption of paper-based alternatives. This regulatory push creates a compliance-driven market where packaging manufacturers and suppliers are compelled to innovate in recyclable, compostable, and biodegradable paper packaging solutions. Sustainability is not just a trend but a core characteristic of the industry’s long-term direction.

Despite growing demand, the Middle East region has limited domestic production of paper and paperboard, making the industry highly dependent on imports of raw materials and semi-finished products from Europe and Asia. This dependency exposes the industry to global supply chain fluctuations, freight cost volatility, and currency risks. As a result, players in the region focus more on converting, processing, and designing paper packaging rather than producing raw materials. Local production facilities are gradually expanding, but capacity remains constrained compared to demand.

Grade Insights

The recycled paper segment recorded the largest market revenue share of over 56.0% in 2024 and is expected to grow at the fastest CAGR of 5.3% during the forecast period. Recycled paper is derived from post-consumer or post-industrial waste and is increasingly being used in the Middle East for applications such as corrugated boxes, secondary packaging, and shipping cartons. The primary driver for recycled paper packaging is the sustainability push and circular economy initiatives in the Middle East. Moreover, consumer awareness about eco-friendly packaging is steadily increasing in urban centers such as Dubai, Riyadh, and Doha, further supporting the demand for recycled paper-based packaging solutions.

Virgin paper is produced directly from fresh wood pulp and is widely used in the Middle East paper packaging industry, where premium quality, strength, and hygiene are required. It is particularly dominant in sectors such as food & beverage, pharmaceuticals, and high-end consumer goods packaging due to its superior printability, durability, and ability to maintain product integrity. For instance, aseptic cartons, luxury packaging, and branded food boxes often rely on virgin paper to ensure consistent performance and meet stringent safety standards.

Product Insights

The corrugated boxes segment recorded the largest market revenue share of over 42.0% in 2024. Corrugated boxes dominate the market as they are widely used in shipping, e-commerce, food, and industrial packaging. Their strength, cost-effectiveness, and recyclability make them a preferred choice for businesses seeking durable and sustainable packaging. They also play a critical role in the retail and FMCG industries, where secondary packaging and bulk transportation require strong, protective materials. The surge in e-commerce, cross-border trade, and retail distribution networks across countries like the UAE and Saudi Arabia is fueling demand for corrugated boxes.

The folding cartons segment is expected to grow at the fastest CAGR of 5.7% during the forecast period. Folding cartons are increasingly used for consumer-facing products such as cosmetics, pharmaceuticals, personal care, and packaged food. These cartons are lightweight, easy to print on, and allow brand differentiation through attractive designs. Their adaptability across industries makes them a key segment within the Middle East’s paper packaging sector. The growth of retail chains, organized supermarkets, and branded product launches in the Middle East drives demand for folding cartons.

Application Insights

The food & beverages segment recorded the largest market revenue share of over 31.0% in 2024. This dominance is driven by the extensive use of cartons, boxes, trays, and flexible paper solutions for packaged foods, snacks, bakery products, dairy, and beverages. Increasing consumer preference for eco-friendly and lightweight packaging, coupled with the region’s expanding processed food industry, positions paper packaging as a sustainable alternative to plastics. Growth in urban populations, rising disposable incomes, and changing dietary habits toward packaged and ready-to-eat foods are fueling demand.

The e-commerce & retail segment is expected to grow at the fastest CAGR of 5.7% during the forecast period. Paper packaging in e-commerce and retail is witnessing rapid adoption, with corrugated boxes, paper mailers, and protective fillers replacing single-use plastics. The sector benefits from the growth of online shopping platforms and omnichannel retail strategies across the Middle East. Accelerated digital adoption, government initiatives supporting e-commerce growth, and consumer preference for sustainable packaging in deliveries are driving this segment.

Country Insights

Saudi Arabia paper packaging industry dominated the Middle East market, accounting for over 38.0% of revenue, and it is also projected to register the fastest CAGR of 5.5% during the forecast period. Saudi Arabia is the largest market for paper packaging in the Middle East, driven by its robust food & beverage, healthcare, and retail sectors. The Kingdom’s packaging industry benefits from mega-infrastructure projects under Vision 2030, which have accelerated demand for consumer goods and packaging. Domestic paper mills also support local supply, lowering dependence on imports. The Saudi Vision 2030 initiative, which emphasizes sustainability and local manufacturing, drives the adoption of paper packaging.

The paper packaging industry in the UAE is a regional hub for packaging innovation and exports, with Dubai serving as a logistics and distribution gateway. Strong demand comes from luxury retail, food services, and pharmaceutical industries. The government’s plastic ban, effective across several emirates, has accelerated the switch to paper and paperboard packaging. The UAE’s strict plastic bans, especially in Dubai and Abu Dhabi, and its global logistics hub status are the key drivers. High tourist inflow and growing online food delivery services also increase consumption of sustainable paper-based packaging.

Qatar’s paper packaging industry is expanding with rising demand in retail, food delivery, and construction-related packaging needs. Hosting major international events such as the FIFA World Cup 2022 has boosted consumption of consumer goods, food products, and packaging. Investment in domestic recycling facilities is also supporting sustainable paper packaging growth. Governmental emphasis on sustainability and circular economy goals, combined with the country’s growing hospitality and F&B industries, is driving the adoption of paper packaging.

Turkey paper packaging industry has one of the largest and most diversified paper packaging markets in the region, serving both domestic consumption and export markets in Europe and the Middle East. Its strong manufacturing base, particularly in textiles, automotive, food processing, and household goods, drives packaging demand. The main driver is Turkey’s strong manufacturing and export-oriented economy, which requires large volumes of corrugated boxes and folding cartons. In addition, EU-linked sustainability requirements for Turkish exports are accelerating the adoption of eco-friendly paper packaging.

Key Middle East Paper Packaging Company Insights

The competitive environment of the Middle East paper packaging industry is moderately fragmented, with a mix of global packaging giants and strong regional players competing to capture market share. Multinational companies such as International Paper and Mondi have established a presence through partnerships and investments, while local manufacturers in Saudi Arabia, the UAE, and Turkey play a vital role in serving domestic demand and offering cost-effective, customized solutions. Competition is further shaped by pricing strategies, technological adoption in printing and barrier coatings, and strategic M&A activities aimed at expanding capacity and geographic reach.

-

In December 2024, ZamZam Packaging Mat. Ind. LLC opened a new state-of-the-art plant in Umm Al Quwain, UAE. The new facility is equipped with the latest machinery, including fully automated corrugation, printing, folding, and stitching equipment.

-

In November 2024, Tetra Pak, in partnership with Union Paper Mills (UPM), launched the UAE’s first-of-its-kind recycling line for carton packages, backed by a joint investment of AED 2.5 million (approx. USD 0.68 million). This innovative recycling facility can process up to 10,000 tonnes of post-consumer carton packaging annually, diverting waste from landfills and enabling the recovery of high-quality virgin paper fibers for paperboard production and recycled polymers and aluminum. The initiative aligns with Tetra Pak’s sustainability goals and the UAE’s Green Agenda 2030.

-

In August 2024, Hotpack Packaging Industries LLC opened its largest retail outlet in the UAE for disposable food packaging products, covering over 5,600 square feet in Al Barsha on Umm Suqiem Street. This outlet, the biggest among Hotpack's 32 sales centers, caters to both retail and wholesale customers, offering a wide range of food packaging solutions focused on quality, innovation, and hygiene.

Key Middle East Paper Packaging Companies:

- International Paper

- Mondi

- Hotpack Packaging Industries LLC

- Silver Corner Packaging

- Spectrum Converting Industry

- Bony Packaging

- ZamZam Packaging Mat. Ind. LLC

- Arabian Packaging

- Universal Carton Industries LLC

- RAK PACKAGING COMPANY LTD

- Four Corner Carton and Packaging

- Takamul Industrial Company

Middle East Paper Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.43 billion

Revenue forecast in 2033

USD 25.90 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application, country

Country scope

UAE, Saudi Arabia, Oman, Kuwait, Qatar, Bahrain, Israel, Turkey

Key companies profiled

International Paper; Mondi; Hotpack Packaging Industries LLC; Silver Corner Packaging; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Arabian Packaging; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; Four Corner Carton and Packaging; Takamul Industrial Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Paper Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East paper packaging market report based on grade, product, application, and country:

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

Virgin Paper

-

Recycled Paper

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrugated Boxes

-

Folding Cartons

-

Paper Bags & Sacks

-

Liquid Packaging Cartons

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Healthcare

-

Consumer Goods

-

E-commerce & Retail

-

Industrial Packaging

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

Frequently Asked Questions About This Report

b. The Middle East paper packaging market was estimated at around USD 16.70 billion in the year 2024 and is expected to reach around USD 17.43 billion in 2025.

b. The Middle East paper packaging market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach around USD 25.90 billion by 2033.

b. The food & beverages segment dominates the Middle East paper packaging market due to rising demand from QSRs, cafes, and food delivery services, which require sustainable and disposable packaging solutions.

b. The key players in the Middle East paper packaging market include International Paper; Mondi; Hotpack Packaging Industries LLC; Silver Corner Packaging; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Arabian Packaging; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; Four Corner Carton and Packaging; and Takamul Industrial Company.

b. The market is driven by the region’s growing demand for sustainable and eco-friendly alternatives to plastic packaging, fueled by government-led bans and regulations on single-use plastics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.