- Home

- »

- Pharmaceuticals

- »

-

Middle East Pharmaceutical Market, Industry Report, 2033GVR Report cover

![Middle East Pharmaceutical Market Size, Share & Trends Report]()

Middle East Pharmaceutical Market (2025 - 2033) Size, Share & Trends Analysis Report By Molecule Type, By Product, By Type, By Disease, By Age Group, By Route Of Administration, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-728-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Pharmaceutical Market Summary

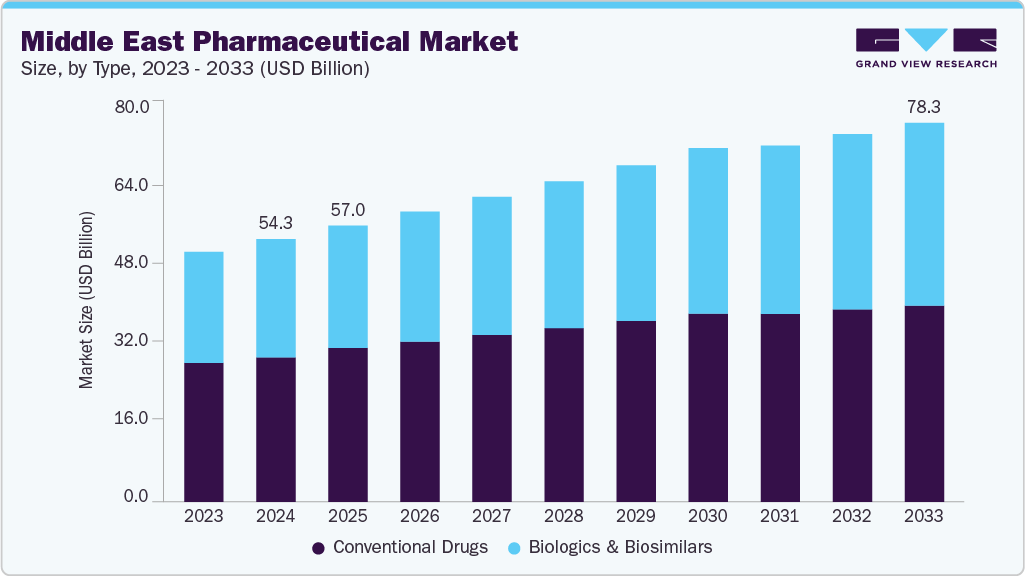

The Middle East pharmaceutical market size was estimated at USD 54.28 billion in 2024 and is projected to reach USD 78.30 billion by 2033, growing at a CAGR of 4.04% fom 2025 to 2033. The market is fueled by the growing prevalence of chronic diseases, an aging population, and increased healthcare expenditures.

Key Market Trends & Insights

- Saudi Arabia pharmaceutical market holds a leading position in 2024, accounting for 36.12% of the Middle East market.

- By molecule type, the Conventional drugs (small molecules) segment dominated the market with a revenue share of 54.92% in 2024.

- By product, the branded segment dominated the pharmaceutical market with a revenue share of 67.97% in 2024.

- By type, the prescription segment dominated the market with a revenue share of 87.46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 54.28 Billion

- 2033 Projected Market Size: USD 78.30 Billion

- CAGR (2025-2033): 4.04%

The pharmaceutical market in the Middle East is undergoing notable transformation due to strategic reforms and a growing focus on local production, technological integration, and evolving regulatory standards. In January 2025, the UAE’s Emirates Drug Establishment (EDE) introduced new regulations under Federal Decree-Law No. 38/2024, which provides an accelerated approval process for innovative drugs, including biosimilars. This policy aims to address the rising demand for cost-effective treatments for chronic diseases such as diabetes, cardiovascular diseases, and cancer. The fast-track approval process for biosimilars is expected to significantly lower drug prices and improve accessibility across the region. This move has been regarded as a critical development in enabling broader access to biologics in the Middle East, where healthcare expenditure has been rising sharply.Another major factor influencing the region’s pharmaceutical market is the increasing incidence of chronic diseases. The EMRO region has the highest prevalence of diabetes globally, ranging from 7% in Somalia to 18% in Egypt. In addition, countries such as Bahrain, Kuwait, Saudi Arabia, and the United Arab Emirates report high rates of overweight and obesity, exceeding 70%, particularly among women. Physical inactivity rates are also elevated, with about 50% of women and over a third of men not engaging in sufficient physical activity. To address this, A recent partnership in July 2025, between Jamjoom Pharma and Althera Laboratories aims to bring a dual-action cholesterol-lowering therapy to Saudi Arabia, with a targeted launch in 2027. This initiative reflects ongoing efforts to enhance access to modern lipid-lowering treatments.

The Middle East is also witnessing a shift towards self-sufficiency in pharmaceutical production, a trend that is being actively supported by regional governments. In January 2025, the UAE's pharmaceutical sector experienced significant growth, with over 35 pharmaceutical factories now operating nationwide. The government aims to expand local drug production capacity by 40% in the next year, enhancing access to medicines and fostering a more self-reliant healthcare system. This initiative has led to significant collaborations with global pharmaceutical companies to build local production capacities, particularly in biologics and vaccines. In March 2025, Julphar announced a strategic licensing partnership with Dong-A ST, a South Korean biotech firm, to launch an innovative biotechnology product in the MENA region. This partnership aims to introduce a new biosimilar monoclonal antibody for rheumatoid arthritis, which is expected to enhance access to affordable treatment options in the region. This marks a significant step in reducing the region’s dependence on imported biologics and increasing its production capabilities for high-value therapeutic areas.

Technological advancements are also playing a critical role in shaping the pharmaceutical landscape in the Middle East. In January 2025, the DHA highlighted its adoption of Robotic Process Automation (RPA) technologies to enhance investor services and healthcare licensing processes. This initiative aligns with global trends toward digitalization and service quality improvement. The RPA program is one of the DHA’s most ambitious initiatives, developed to address the increasing demand from healthcare facilities and professionals seeking licensing to operate in Dubai. The program employs software robots that replicate human actions when interacting with digital systems, representing a transformative upgrade to the DHA's "Sheryan" platform.. This platform facilitating faster drug approvals and more efficient distribution networks. The DHA’s initiative is part of a broader effort to integrate digital health technologies across the UAE, enabling the country to become a leader in health-tech innovation and improving access to pharmaceutical products.

Furthermore, the Middle East has become a regional leader in combating counterfeit medicines, a growing problem across emerging markets. As of January 2024, all pharmaceutical products sold in Kuwait are required to be marked with a GS1 DataMatrix barcode containing four key data elements: Global Trade Item Number (GTIN), batch number, expiration date, and a unique serial number. In addition, the regulatory authorities in the GCC began implementing stricter guidelines for the distribution and storage of medicines, ensuring better control over the pharmaceutical supply chain. This framework aligns with the GHC's broader objectives to harmonize healthcare regulations and improve patient safety across region.These regulatory advancements, combined with growing local production capacity and technological innovation, underscore the Middle East's commitment to transforming its pharmaceutical market. The sector is expected to experience robust growth over the coming years, creating new opportunities for both local manufacturers and international stakeholders in the region.

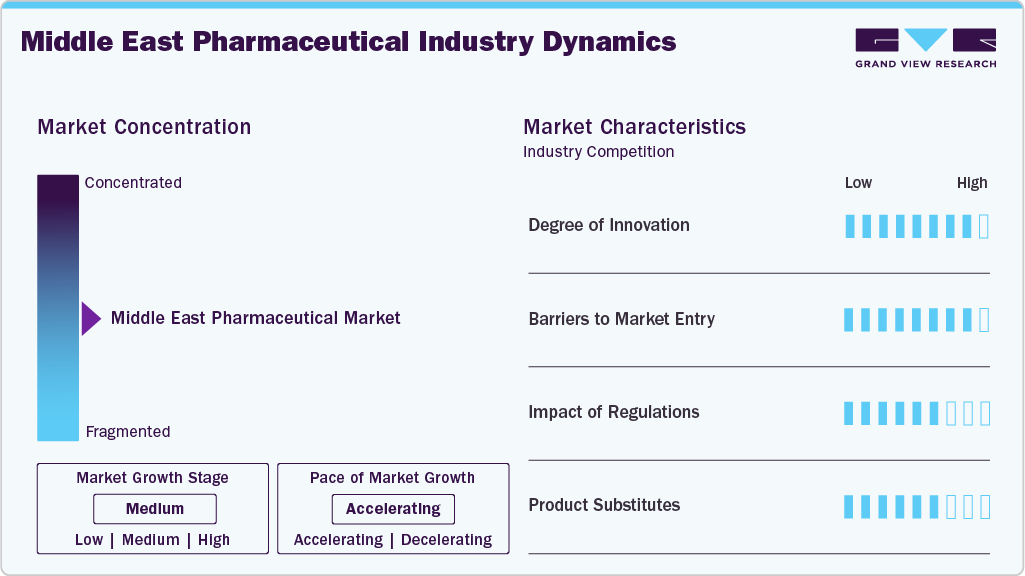

Market Concentration & Characteristics

The Middle East pharmaceutical market is characterized by moderate concentration, with a combination of global and local players dominating various therapeutic segments. The market is seeing increased local production, particularly in biologics, vaccines, and generics, as regional governments push for greater self-sufficiency. Despite the growing presence of local manufacturers, multinational pharmaceutical companies continue to lead in high-value therapeutic areas such as oncology and immunology. The competitive landscape is evolving, with investments in local manufacturing capacity and increased government focus on enhancing domestic production, which is expected to balance the market share between local and international companies. In October 2024, Egypt's Ministry of Health and Population, in collaboration with the Ministry of Industry and Transport, discussed strategies to encourage pharmaceutical factories and maximize in vestments in localizing the pharmaceutical and medical industry. This initiative aims to ensure the provision of quality and effective medicine and support the local industry.

Innovation remains a central factor in the Middle East pharmaceutical market, with multinational pharmaceutical companies leading in the development of new therapies for diseases such as cancer, diabetes, and cardiovascular disorders. Local pharmaceutical companies, however, are increasingly focused on developing biosimilars and generics, spurred by rising healthcare costs and a growing demand for affordable treatment options. There is also a notable push towards incorporating digital health solutions and AI in drug development. In March 2025, Julphar announced an exclusive licensing partnership with Dong-A ST, a South Korean pharmaceutical company, to exclusively tech transfer, manufacture, and commercialize Darbepoetin Alfa biosimilar in the MENA region. This biosimilar is a long-acting erythropoietin formulation developed by Dong-A ST, primarily used for treating anemia associated with chronic kidney disease (CKD)

Barriers to entry in the Middle East pharmaceutical market are substantial and can deter new players from entering the market. These barriers include complex regulatory frameworks, high capital investment requirements for establishing production facilities, and the difficulty of navigating multiple country-specific health regulations. The regulatory environment, while evolving, is still relatively fragmented across the region, requiring companies to comply with different standards and processes in each country. In 2024, the Gulf Cooperation Council (GCC) established guidelines for pharmaceutical companies regarding drug registration, which include specific data requirements. In addition, establishing pharmaceutical manufacturing facilities or entering joint ventures with local firms in the GCC requires significant capital investment and involves various financial considerations.For example, in September 2023, Saudi Arabia announced a SAR 500 million (approximately USD 133 million) investment in a vaccine manufacturing facility located in Sudair City. This facility, a joint venture between the Vaccine Industrial Company (VIC) and the Saudi Authority for Industrial Cities and Technology Zones (MODON), aims to bolster local vaccine production and reduce dependency on imported vaccines.

Regulations play a critical role in shaping the pharmaceutical market in the Middle East. Across the region, regulatory bodies are working towards streamlining and harmonizing drug approval processes, which has improved the efficiency of market entry for pharmaceutical companies. However, despite these advancements, the regulatory environment remains complex, with considerable variation in approval procedures, pricing regulations, and distribution rules. In 2024, the UAE's Ministry of Health and Prevention continued to enforce regulations that require pharmaceutical companies to submit pricing proposals for their products, ensuring consistent and fair pricing across the market. Similarly, In March 2024, Qatar's Ministry of Public Health (MoPH) initiated a joint project with the GS1 Qatar Office, operating under the Qatar Development Bank, to enhance the country's pharmaceutical supply chain. This initiative involves implementing a global standard system to regulate and track the commercial circulation of drugs from manufacturers to patients. These regulations are part of a broader effort by regional health authorities to ensure the safety and efficacy of medicines but can create challenges for pharmaceutical companies seeking to quickly enter the market.

Product substitutes in the Middle East pharmaceutical market are becoming more prominent, especially in the generic and biosimilar sectors. With the rising cost of healthcare, the demand for more affordable alternatives to branded drugs is increasing. Local pharmaceutical companies are increasingly focused on producing generics and biosimilars in response to this demand, particularly in areas such as oncology and autoimmune diseases. The availability of over-the-counter (OTC) medications is also expanding, providing alternatives in segments such as pain management, gastrointestinal disorders, and common cold treatments. Also, the GCC countries introduced a region-wide regulatory framework to promote the use of OTC medicines, which is expected to further increase the availability of substitutes for commonly prescribed medications, especially for chronic conditions such as diabetes and hypertension.

Molecule Type Insights

Conventional drugs (small molecules) hold the largest revenue share of 54.92% in the Middle East pharmaceutical market in 2024 due to their widespread use, cost-effectiveness, and established market presence. The demand for small molecules is driven by their effectiveness in treating a broad range of common conditions such as cardiovascular diseases, diabetes, and infections. In addition, the availability of generics has contributed to their affordability. In January 2024, Saudi Arabia's Local Content and Government Procurement Authority (LCGPA) signed four pivotal agreements aimed at boosting local drug production. These agreements were made with Jamjoom Pharma and the American company MSD for the production of sitagliptin phosphate, a medication vital for treating type 2 diabetes, further enhancing their accessibility in the market.

Biologics and biosimilars represent the fastest-growing segment in the Middle East pharmaceutical market in 2024 due to increasing healthcare demands, government support for local manufacturing, and the affordability of biosimilars. The rise in chronic diseases such as cancer, autoimmune disorders, and diabetes is driving the demand for biologics. In February 2024, the UAE Ministry of Health and Prevention continued to promote the use of biosimilars in clinical practice by establishing regulatory frameworks and supporting consensus-based recommendations aimed at enhancing the safe and effective use of biosimilars in the treatment of inflammatory arthritis.

Product Insights

Branded products hold the largest revenue share of 67.97% in 2024, driven by higher consumer trust, greater perceived efficacy, and strong marketing strategies. These products are often preferred in areas such as oncology, immunology, and rare diseases due to their specialized formulations and proven track records. Similarly, Saudi Arabia has been fostering collaborations between global pharmaceutical companies and local distributors to enhance vaccine accessibility and production. For instance, in July 2023, Sanofi partnered with Lifera and Arabio to manufacture vaccines locally, including influenza vaccines, aiming to increase accessibility and reduce reliance on imports.

Generics are the fastest-growing segment in the Middle East pharmaceutical market in 2024, driven by increasing healthcare costs and government initiatives to improve access to affordable medicines. The availability of generics allows for cost-effective alternatives to branded medications, particularly in chronic disease management. In 2024, the UAE's Ministry of Health approved a range of generics for hypertension and diabetes, significantly reducing treatment costs for these conditions.

Type Insights

Prescription medications hold the largest revenue share of 87.46% in the Middle East pharmaceutical market in 2024, driven by the increasing prevalence of chronic diseases and a higher demand for specialized treatments. The growth is also supported by healthcare reforms and improved access to prescription drugs across the region. In January 2024, Saudi Arabia’s Ministry of Health launched a new initiative to expand access to prescribed medications for cancer and diabetes, reflecting the growing need for prescr iption drugs. In addition, In October 2024, the UAE Ministry of Health and Prevention continued to enhance its digital healthcare infrastructure through initiatives such as the electronic prescription system and the Riayati platform, aiming to improve medication safety and streamline healthcare services.

Over-the-counter (OTC) products are the fastest-growing segment in the Middle East pharmaceutical market in 2024, driven by increasing consumer demand for self-care, convenience, and accessibility. The shift towards self-medication, particularly for common ailments such as headaches, colds, and digestive issues, is fueling the growth of this segment. In January 2, 2025, UAE introduced significant reforms to the regulation of medical products and pharmaceutical practices in the UAE. It replaced Federal Law No. 8 of 2019 and implemented changes aimed at enhancing safety, stricter compliance, and modernized regulatory frameworks. Similarly, in April 2024, A study conducted in Al-Ahsa, Saudi Arabia, assessed public awareness and practices regarding OTC medications. The findings indicated that many individuals had moderate knowledge and good practices concerning OTC medicines. However, the study also highlighted the need for more concrete regulatory control and public education to protect the public from potential harm associated with improper use of OTC drugs.

Disease Insights

Cancer holds the largest revenue share of 14.75% in the Middle East pharmaceutical market in 2024 due to the increasing prevalence of cancer cases and the demand for advanced treatments. Factors driving this growth include improved diagnostic capabilities, increased healthcare awareness, and access to innovative therapies. In November 2024, MoHAP signed an agreement with AstraZeneca to advance the early detection of lung cancer through the latest technology. This collaboration aims to improve national health indicators and position the UAE as a leader in adopting innovative health solutions.

Obesity is the fastest-growing segment in the Middle East pharmaceutical market in 2024, driven by rising obesity rates, increasing awareness of associated health risks, and greater demand for effective treatments. The prevalence of obesity-related diseases such as diabetes, hypertension, and cardiovascular disorders is further propelling the growth of this segment. In March 2025, MoHAP, in collaboration with the World Health Organization (WHO), has been implementing the National Programme to Combat Obesity, focusing on both adult and childhood obesity.

Route of Administration Insights

Oral medications hold the largest revenue share of 58.07% in 2024, driven by their convenience, ease of use, and cost-effectiveness compared to other administration routes. Oral drugs are preferred for long-term management of chronic conditions such as diabetes, hypertension, and cardiovascular diseases. In January 2024, the UAE's Ministry of Health approved several new oral medications for diabetes, enhancing treatment accessibility. Similarly, in March 2025, Financial time published that companies such as Hikma Pharmaceuticals are actively working to introduce generic versions of popular oral medications, such as those used for diabetes and weight loss. This strategy aims to provide more affordable oral treatment options to the Middle Eastern market.

Parenteral medications are the fastest-growing segment in the Middle East pharmaceutical market in 2024, driven by their effectiveness in delivering biologic therapies, vaccines, and treatments for serious conditions that require rapid action, such as cancer and autoimmune diseases. The increased adoption of biologics and monoclonal antibodies has led to a rise in parenteral drug administration. In 2024, the UAE launched a nationwide initiative to improve access to parenteral vaccines for infectious diseases, further contributing to the growth of this segment.

Age Group Insights

Adults hold the largest revenue share of 62.65% in the in 2024, primarily driven by the high prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and hypertension, which are more common in this age group. Increased healthcare access and the growing use of prescription medications for these conditions are further supporting the market’s expansion. In March 2023, The Ministry of Health has conducted awareness campaigns to educate the public about the risks of hypertension and the importance of regular blood pressure monitoring, reflecting the importance of this age group in chronic disease treatment.

The geriatric segment is the fastest-growing in the Middle East pharmaceutical market in 2024, driven by the increasing aging population and the rising prevalence of age-related diseases such as Alzheimer’s, osteoporosis, and cardiovascular conditions. The growth is also supported by greater awareness and healthcare infrastructure focused on elderly care. In May 2024, Saudi Arabia ministry of health states, Hospitals provide specialized treatment for elderly patients referred from primary healthcare centers, including services for osteoporosis, hearing or vision impairments, and rehabilitation. Similarly

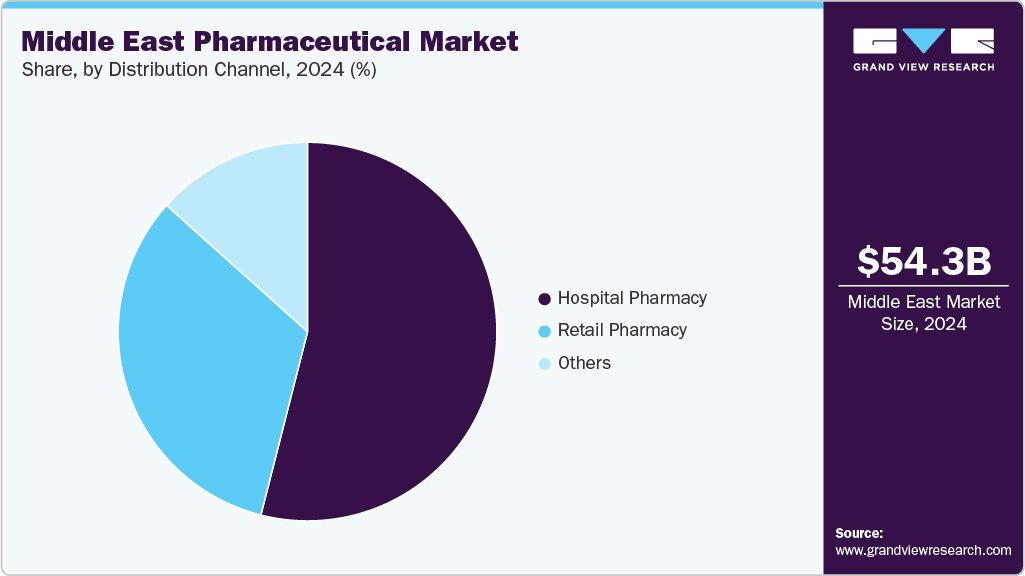

Distribution Channel Insights

Hospital pharmacies hold the largest revenue share of 53.98% in the Middle East pharmaceutical market in 2024, primarily due to the growing number of hospital-based treatments for complex and chronic conditions such as cancer, cardiovascular diseases, and diabetes. The increasing adoption of biologics, specialized therapies, and the growing preference for hospital care for high-risk patients are key drivers. In February 2024, The MOH has introduced initiatives focusing on pharmacy safety and occupational health. These programs aim to enhance the safety and well-being of pharmacy staff and patients by implementing quality management policies and procedures.

Retail pharmacies are the fastest-growing segment in the Middle East pharmaceutical market in 2024, driven by increasing consumer preference for over-the-counter (OTC) products, convenience, and the expansion of retail pharmacy chains. The rise in self-medication, especially for common conditions such as colds, headaches, and digestive issues, is contributing to this growth.

Country Insights

Saudi Arabia Pharmaceutical Market Trends

Saudi Arabia pharmaceutical market hold the largest market share of 36.12% in Middle East pharmaceutical market, driven by factors such as increasing healthcare expenditures, a rising prevalence of chronic diseases, and strategic initiatives under Vision 2030 aimed at enhancing healthcare infrastructure and self-sufficiency in pharmaceutical production. For instance, in May 2025, Saudi Arabia launched the world's first AI-powered doctor clinic in Al Ahsa, developed collaboratively by Shanghai-based Synyi AI and the local Almoosa Health Group. This clinic utilizes an AI-driven virtual physician, "Dr. Hua," capable of independently diagnosing and prescribing treatments, marking a significant advancement in integrating technology into healthcare services.

Furthermore, the Saudi Food and Drug Authority (SFDA) plays a crucial role in regulating pharmaceutical products to ensure safety and efficacy. According to article of SFDA in July 2025, The SFDA has been advancing healthcare innovation through clinical trials and gene therapy, aiming to enhance patient access to advanced medical technologies and position the Kingdom as a regional hub for research and innovation.

UAE Pharmaceutical Market Trends

The UAE pharmaceutical market is experiencing steady growth, driven by government investments in healthcare, a rise in chronic diseases, and strategic reforms to enhance healthcare infrastructure. A key driving factor is the government's focus on innovation, including initiatives like the "National Innovation Strategy" that encourages pharmaceutical companies to invest in research and development. For instance, In January 2023, the UAE Ministry of Health and Prevention (MOHAP) was recognized for its leadership in approving innovative pharmaceutical products. According to a report by Emirates 24/7, the UAE led the Middle East and Africa (MEA) region in terms of the number of approved medicines containing new active substances and the speed at which regulatory dossiers for medicines were evaluated and approved. This accomplishment was attributed to the ministry's efforts in shortening the time required to assess new drug dossiers, enabling the approval of 187 new drugs containing active ingredients over the study period from 2010 to 2018.

In addition to these efforts, the UAE introduced Federal Decree-Law No. 38 of 2024, which came into effect on January 2025. This law introduced significant reforms to the regulation of medical products and pharmaceutical practices, including the establishment of the Emirates Drug Establishment (EDE) as the central authority overseeing medical product approvals, pharmacovigilance, and market monitoring. The law also introduced new types of regulatory approval for products, such as conditional marketing approval for orphan drugs or treatments for rare diseases, emergency use authorizations, and a fast-track pathway for innovative medical products of therapeutic importance. These changes aimed to enhance the governance of medical products and solidify the UAE's position as a globally trusted hub for the pharmaceutical and medical industries.

Kuwait Pharmaceutical Market Trends

The Kuwait pharmaceutical market is experiencing gradual growth, influenced by factors such as an increasing prevalence of chronic diseases, a growing elderly population, and government initiatives aimed at enhancing healthcare services. A significant development occurred in December 2023 when the Ministry of Health introduced measures to strengthen the country's pharmaceutical resilience and prevent medicine shortages. These measures include improving drug storage capacities and enhancing monitoring of drug consumption and demand. However, despite these efforts, Kuwait continues to lag behind neighboring markets in the development of its pharmaceutical sector due to challenges such as limited domestic manufacturing capabilities and a high reliance on imported pharmaceuticals.

In response to these challenges, the government has been working to diversify the economy and attract foreign direct investment into the pharmaceutical sector. For instance, the Kuwait Direct Investment Promotion Authority (KDIPA) has been facilitating investments in various sectors, including healthcare and pharmaceutical manufacturing. However, as per report published in 2023, Kuwait's pharmaceutical industry remains underdeveloped, with the Kuwait Saudi Pharmaceutical Industries Company being the sole local manufacturer, offering a limited portfolio of generic painkillers and antibiotics. This situation underscores the need for continued investment and development to reduce dependency on imports and enhance the country's pharmaceutical capabilities.

Qatar Pharmaceutical Market Trends

Qatar pharmaceutical market is experiencing notable growth, driven by factors such as an aging population, increasing prevalence of chronic diseases, and government initiatives aimed at enhancing healthcare infrastructure. For instance, in July 2023, the Investment Promotion Agency Qatar (IPA Qatar) highlighted that the pharmaceutical industry is poised for remarkable growth, projecting a 165.2% increase in the market size between 2020 and 2030. This growth is attributed to a competitive business climate, comprehensive medical infrastructure, and investments in research and development.

The country's emphasis on research and development is further exemplified by the Biomedical Research Center at Qatar University, which focuses on areas such as infectious diseases, metabolic disorders, and biomedical omics. Collaborations with institutions such as Hamad Medical Corporation and the Ministry of Public Health have bolstered Qatar's position as a regional hub for clinical trials and pharmaceutical innovation. In addition, the government's commitment to healthcare is evident in its substantial healthcare expenditure per capita, the highest in the GCC at USD 1,827, which supports the expansion of pharmaceutical services and access to medications.

Oman Pharmaceutical Market Trends

Oman’s pharmaceutical market is experiencing gradual growth, driven by strategic government initiatives and an increasing demand for healthcare services. In early 2023, the government launched 19 healthcare investment projects, 11 targeted investment opportunities, and 14 empowerment initiatives, aligning with Oman Vision 2040 to enhance healthcare quality and operational efficiency.

Despite these advancements, challenges persist in the pharmaceutical sector. In December 2023, locally manufactured pharmaceuticals accounted for only 4.6% of total medicine purchases, with imports comprising the remaining 95.4%. To address this, the government introduced a new strategic policy to attract investments into the pharmaceutical sector, aiming to strengthen drug security and reduce reliance on imports.

Key Middle East Pharmaceutical Company Insights

Key players in the Middle East pharmaceutical market include multinational giants such as Pfizer, Novartis, Roche, and GlaxoSmithKline (GSK), as well as regional players such as the Saudi Pharmaceutical Industries and the Jordanian Pharmaceutical Manufacturing Company (JPM). These companies dominate the market by offering a broad range of innovative and generic drugs, especially in therapeutic areas such as oncology, diabetes, and cardiovascular diseases. Pfizer and Roche, for example, have a strong presence in the oncology segment, while local manufacturers such as Saudi Pharmaceutical Industries are focusing on generic drug production to meet rising regional demand. The growing emphasis on healthcare infrastructure improvements, biotechnology research, and regulatory reforms across the Middle East further enables these companies to expand their footprint in the region. Local pharmaceutical firms are also benefitting from government incentives aimed at boosting domestic manufacturing capabilities, thus reducing reliance on imports and increasing competition within the market.

Key Middle East Pharmaceutical Companies:

- F. Hoffmann-La Roche Ltd

- Novartis AG

- AbbVie Inc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Sanofi

- GlaxoSmithKline plc.

- AstraZeneca

- Takeda Pharmaceutical Co., Ltd.

Recent Developments

-

in August 2025, the SFDA approved Elrexfio (Elranatamab) for the treatment of adult patients with relapsed or refractory multiple myeloma, marking a significant advancement in the availability of monoclonal antibody therapies in the country .

-

In January 2025, the UAE government passed Federal Law No. 38 of 2024, effective from January 2, 2025, to uphold its status as a regional leader in the pharmaceutical sector, adhering to strict guidelines regarding patient safety.

-

In December 2024, companies from the UAE, Jordan, Egypt, and Bahrain signed 12 industrial agreements worth over USD 2 billion at the Higher Committee meeting of the Industrial Partnership for Sustainable Economic Development in Amman, Jordan.

-

In June 2024, BeiGene and NewBridge Pharmaceuticals FZ LLC mutually agreed to conclude their partnership concerning BRUKINSA® (zanubrutinib) in the Middle East and Africa (MENA) region. This strategic decision aligns with BeiGene’s goals to expand its presence and directly manage operations in the MENA region. The collaboration between the two companies began in 2020 and included sales, distribution, and commercialization activities for BRUKINSA® in the MENA region.

Middle East Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 57.05 billion

Revenue forecast in 2033

USD 78.30 billion

Growth rate

CAGR of 4.04% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, route of administration, distribution channel, and country

Country scope

UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

F. Hoffmann-La Roche Ltd; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GlaxoSmithKline plc.; AstraZeneca; Takeda Pharmaceutical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East pharmaceutical market report based on molecule type, product, type, disease, route of administration, age group, distribution channel, and country.

-

Molecule Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Branded

-

Generics

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s health diseases

-

Genetic and rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Tablets

-

Capsules

-

Suspensions

-

Other

-

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

Rest of Middle East

-

-

Frequently Asked Questions About This Report

b. The Middle East pharmaceutical market size was estimated at USD 54.28 billion in 2024 and is expected to reach USD 57.05 billion in 2025.

b. The Middle East pharmaceutical market is projected to grow at a CAGR of 4.04% from 2025 to 2033 to reach USD 78.30 billion by 2033.

b. Based on molecule type, conventional drugs (small molecules) hold the largest revenue share of 54.92% in the Middle East pharmaceutical market in 2024 due to their widespread use, cost-effectiveness, and established market presence.

b. Key players in the Middle East pharmaceutical market are Pfizer, Novartis, Roche, and GlaxoSmithKline (GSK), as well as regional players such as the Saudi Pharmaceutical Industries and the Jordanian Pharmaceutical Manufacturing Company (JPM).

b. Key factors driving the market include increasing healthcare needs, the rise of chronic diseases, growing aging populations, advancements in medical technologies, government investments in healthcare infrastructure, and expanding access to healthcare services

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.