- Home

- »

- Advanced Interior Materials

- »

-

Middle East Ultraviolet Disinfection Equipment Market Report, 2033GVR Report cover

![Middle East Ultraviolet Disinfection Equipment Market Size, Share & Trends Report]()

Middle East Ultraviolet Disinfection Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Component Type (UV Lamps, Ballasts/Controller Units), By End Use (Municipal, Residential), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-730-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Ultraviolet Disinfection Equipment Market Summary

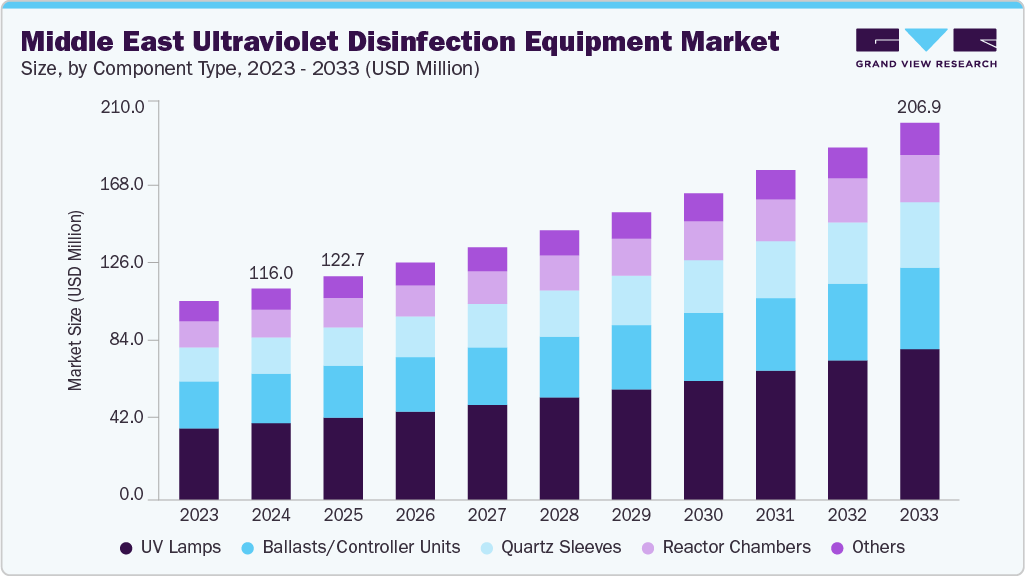

The Middle East ultraviolet disinfection equipment market size was estimated at USD 116.0 million in 2024 and is projected to reach USD 206.9 million by 2033, growing at a CAGR of 6.8% from 2025 to 2033. Water scarcity remains the primary factor shaping the market.

Key Market Trends & Insights

- The ultraviolet disinfection equipment market in Saudi Arabia is expected to grow at a substantial CAGR of 7.4% from 2025 to 2033.

- By component type, UV lamps segment is expected to grow at a considerable CAGR of 7.9% from 2025 to 2033 in terms of revenue.

- By application, air treatment segment is expected to grow at a considerable CAGR of 7.9% from 2025 to 2033 in terms of revenue.

- By end use, commercial segment is expected to grow at a considerable CAGR of 7.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 116.0 Million

- 2033 Projected Market Size: USD 206.9 Million

- CAGR (2025-2033): 6.8%

The region has one of the lowest per-capita renewable water levels globally, while Gulf nations dominate desalination production, contributing to nearly half of the world’s total. This reliance on treated water makes non-chemical disinfection methods like UV more attractive for municipal supply, desalination post-treatment, and water reuse projects. Rising demand from Saudi Arabia, the UAE, Qatar, and Oman further accelerates adoption. Government-led wastewater reuse targets are another strong driver for UV disinfection. Saudi Arabia plans to fully reuse urban wastewater, while the UAE and Dubai aim to recycle over 90% of the wastewater within the next decade. Achieving these ambitions requires advanced tertiary treatment, where UV is favored for avoiding harmful chemical by-products. Expanding public-private partnerships and utility upgrades reinforce UV systems' role across municipal, industrial, and cooling water applications.Market Concentration & Characteristics

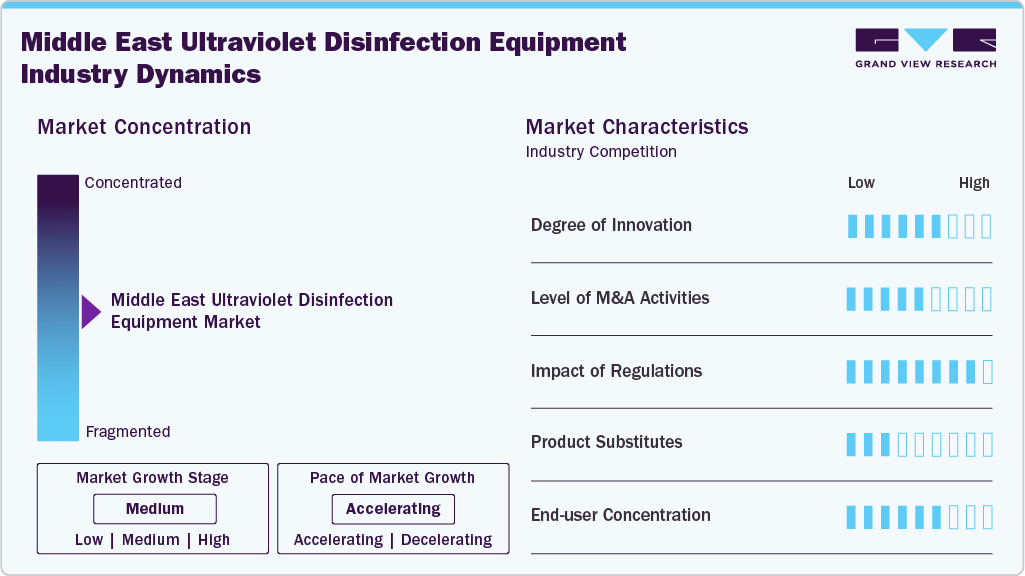

The Middle East ultraviolet disinfection equipment industry shows moderate concentration, as large-scale municipal and desalination projects are typically awarded to a limited pool of established suppliers. Regional integrators contribute by tailoring solutions, but high investment requirements and strict approval processes restrict widespread competition. Public tenders and government-led infrastructure programs further centralize opportunities within a smaller set of providers. This results in a market that leans toward concentration, especially in Gulf countries, where state-driven water projects dominate.

The Middle East ultraviolet disinfection equipment industry demonstrates a steady degree of innovation, driven by the region’s growing demand for energy-efficient and compact systems. Utilities and industries are exploring UV-LED and advanced monitoring technologies to enhance desalination and wastewater reuse performance. Innovation is also shaped by the need to operate in high-temperature environments and integrate into existing treatment plants. This push supports adopting smarter and more sustainable UV systems across the Gulf states.

The region's level of mergers and acquisitions is moderate, with global suppliers often partnering with local engineering firms to strengthen their presence. Rather than frequent buyouts, collaboration and joint ventures dominate as a way to access government contracts and comply with localization requirements. This trend ensures that regional expertise is combined with international technology. It reflects a market where strategic partnerships play a larger role than outright consolidation.

Regulation strongly impacts UV disinfection adoption in the Middle East, as water quality and reuse standards are tightly aligned with national sustainability agendas. Countries such as Saudi Arabia, the UAE, and Qatar have introduced strict guidelines for treated water quality in municipal and industrial use. These frameworks encourage utilities to adopt non-chemical methods that meet safety standards without creating harmful by-products. As regulations continue to tighten, UV systems are becoming integral to compliance in wastewater and desalination facilities.

Drivers, Opportunities & Restraints

Growing water scarcity and dependence on desalination are key drivers for ultraviolet disinfection adoption in the Middle East. Population growth, rapid urbanization, and rising industrial activity are increasing the demand for safe and reliable water sources. Governments invest heavily in wastewater reuse and advanced treatment infrastructure to meet sustainability goals. UV systems are favored as they provide effective disinfection without chemical by-products.

Opportunities emerge from national water reuse targets and expanding regional public-private partnerships. Initiatives in Saudi Arabia, the UAE, and Qatar to recycle nearly all treated wastewater are creating demand for advanced tertiary treatment solutions. The shift toward smart water networks and energy-efficient technologies also opens space for UV-LED innovations. Industrial sectors such as oil & gas, food & beverage, and district cooling further broaden the application base.

Restraints include high capital costs, which limit adoption for smaller-scale facilities and private users. The region's harsh climatic conditions and variable water quality require specialized system designs, adding to overall expenses. Dependence on government tenders and lengthy procurement processes can delay project execution. In addition, low awareness of UV benefits among smaller utilities and industries slows broader market penetration.

Component Type Insights

The UV lamps component type segment dominated the market in 2024 with a 36.4% market share, as they form the core component responsible for microbial inactivation. Their established efficiency, availability in various power ratings, and proven reliability in large municipal and desalination projects sustain their leading position. Utilities prefer these lamps for consistent performance in treating high water volumes. Their critical role in ensuring regulatory compliance makes them the most widely used component.

Quartz sleeves are witnessing significant growth as they enhance lamp performance by protecting against fouling and temperature fluctuations. Rising demand for durability in harsh regional climates and saline water applications is driving their adoption. Improved designs that enable easier cleaning and maintenance further support their expansion. As advanced systems gain traction, quartz sleeves boost overall UV system efficiency.

Application Insights

The water & wastewater treatment application segment led the market with a revenue share of 70.6% in 2024. Water and wastewater treatment applications dominate market, supported by large-scale desalination plants and municipal reuse projects. Governments are investing heavily in advanced treatment to secure long-term water sustainability. UV systems are preferred here as they eliminate pathogens without chemical residues, ensuring safe reuse in agriculture, industry, and urban supply. Their role in meeting strict water quality standards keeps this segment at the forefront.

Air treatment is the fastest-growing application, driven by rising concerns over indoor air quality in healthcare, commercial, and residential spaces. The pandemic highlighted the importance of controlling airborne pathogens, accelerating UV integration in HVAC systems, and air purifiers. Growing awareness of respiratory health and regulatory emphasis on safer environments fuel this trend. As infrastructure and healthcare facilities expand in the region, demand for UV-based air treatment continues to rise.

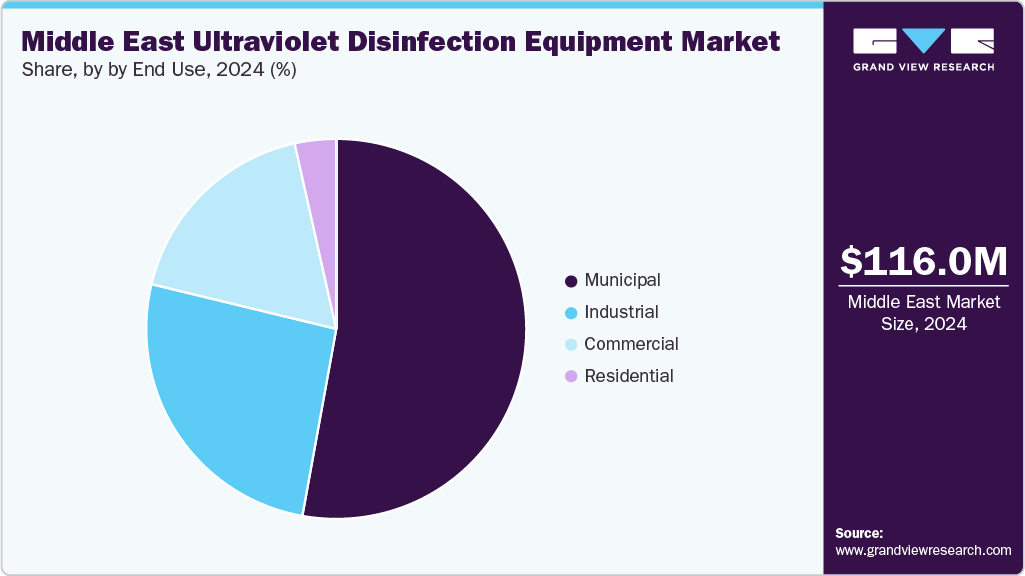

End Use Insights

The municipal end use segment dominates the market and accounted for a 52.8% share in 2024, as governments prioritize safe drinking water, wastewater reuse, and large-scale desalination projects. National strategies in Saudi Arabia and the UAE emphasize sustainable water management through advanced treatment methods. UV systems are widely integrated into municipal plants to ensure compliance with strict water quality regulations. Their ability to provide effective disinfection without harmful by-products reinforces their leading role.

The commercial end use segment is the fastest-growing, driven by rising demand in the region's hospitality, healthcare, and office facilities. Increasing awareness of hygiene, coupled with regulatory pressure for safer water use in buildings, is boosting adoption. Compact UV systems are deployed for localized water disinfection and surface sanitation in hotels, malls, and hospitals. Rapid infrastructure development and tourism growth in Gulf economies further accelerate this segment.

Country Insights

Saudi Arabia Ultraviolet Disinfection Equipment Market Trends

Saudi Arabia dominates the Middle East ultraviolet disinfection equipment market and accounted for a 36.6% share, driven by its large-scale desalination capacity and ambitious water reuse targets. The government’s National Water Strategy emphasizes 100% reuse of treated urban wastewater, creating strong demand for advanced UV systems. Significant investments in municipal infrastructure and industrial water projects reinforce this leadership. As a result, Saudi Arabia remains the region's key hub for UV adoption.

UAE Ultraviolet Disinfection Equipment Market Trends

The UAE is the fastest-growing market, supported by its aggressive sustainability goals and infrastructure expansion. Dubai aims to completely recycle treated wastewater by 2030, while national targets push for 95% reuse by 2036. Rapid growth in hospitality, healthcare, and commercial real estate further fuels demand for UV in water and air treatment. With strong regulatory frameworks and rising public-private partnerships, the UAE is becoming a major growth center for UV technologies.

Key Middle East Ultraviolet Disinfection Equipment Company Insights

Some of the key players operating in the market include Xylem, Trojan Technologies Group ULC, and Halma PLC.

-

Xylem delivers a broad range of solutions across water supply, treatment, and analytics. Its offerings span industrial and municipal pumps, filtration and clarification systems, and UV/ozone disinfection units. The company also provides smart metering, data analytics platforms, and monitoring instruments tailored for water networks. Xylem supports utilities, industries, buildings, and agricultural industries with integrated digital tools and hardware.

-

Trojan Technologies specializes in ultraviolet water treatment systems for municipal, industrial, and residential applications. Its product range includes UV disinfection units, advanced oxidation processes, and membrane filtration solutions. The company serves critical sectors like drinking water, wastewater, and ultrapure water for industries such as semiconductors. Trojan emphasizes chemical-free, energy-efficient treatment with installations in numerous Middle East facilities.

Key Middle East Ultraviolet Disinfection Equipment Companies:

- Xylem Inc.

- Trojan Technologies Group ULC.

- Halma PLC

- Calgon Carbon Corp.

- Atlantic Ultraviolet Corp.

- Evoqua Water Technologies LLC

- Atlantium Technologies Ltd.

- Dr. Hönle AG

- ENAQUA

- Hitech Ultraviolet Pvt. Ltd.

Recent Developments

-

In June 2025, Atlantic Ultraviolet Corporation launched the SaniUV-Cube, a UV-C disinfection cabinet tailored for commercial, industrial, and institutional use. The unit features high-output UV-C lamps and adjustable quartz shelves to disinfect various items effectively. Built-in safety measures include an interlock switch, a viewing window with UV protection, and a programmable timer. It is designed to inactivate a wide range of pathogens on surfaces, including viruses and bacteria.

-

In May 2023, Xylem acquired Evoqua Water Technologies in an all-stock deal. This merger created a global leader in water technology with over $7 billion in annual revenue. The move strengthens Xylem’s ability to address water challenges like scarcity and contamination. Leadership from both companies will guide the integrated operations moving forward.

Middle East Ultraviolet Disinfection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 122.7 million

Revenue forecast in 2033

USD 206.9 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component type, application, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman; Israel; Kuwait

Key companies profiled

Xylem Inc.; Trojan Technologies Group ULC.; Halma PLC; Calgon Carbon Corp.; Atlantic Ultraviolet Corp.; Evoqua Water Technologies LLC; Atlantium Technologies LTD.; Dr. Hönle AG; ENAQUA; Hitech Ultraviolet Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Ultraviolet Disinfection Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East ultraviolet disinfection equipment market report based on component type, application, end use, and country:

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

UV Lamps

-

Mercury

-

Low-Pressure

-

Medium-Pressure

-

Amalgam

-

-

Xenon/LED

-

-

Ballasts/Controller Units

-

Quartz Sleeves

-

Reactor Chambers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Water & Wastewater Treatment

-

Air Treatment

-

Residential

-

Healthcare Facilities

-

Retail Shops

-

Offices

-

Hospitality

-

Schools & Educational Institutions

-

Industrial

-

Others

-

-

Surface Disinfection

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

Israel

-

Oman

-

Qatar

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East ultraviolet disinfection equipment market size was estimated at USD 116.0 million in 2024 and is expected to be USD 122.7 million in 2025.

b. The Middle East ultraviolet disinfection equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 206.9 million by 2033

Which segment accounted for the largest Middle East ultraviolet disinfection equipment market share?b. The water & wastewater treatment application segment led the market with a revenue share of 70.6% in 2024. Water and wastewater treatment applications dominate the Middle East ultraviolet disinfection equipment market, supported by large-scale desalination plants and municipal reuse projects. Governments are investing heavily in advanced treatment to secure long-term water sustainability.

b. Some of the key players operating in the Middle East ultraviolet disinfection equipment market include UV Disinfection Equipment market include Xylem Inc.; Trojan Technologies Group ULC.; Halma PLC; Atlantic Ultraviolet Corp.; Evoqua Water Technologies LLC; Atlantium Technologies LTD.; Dr. Hönle AG; Lumalier Corp.; ENAQUA; Hitech Ultraviolet Pvt. Ltd

b. The Middle East ultraviolet disinfection equipment market is driven by rising demand for safe drinking water, stricter regulations on wastewater reuse, and the need to reduce chemical-based treatment methods. Growing urbanization and industrial expansion are increasing pressure on water resources, boosting UV adoption. In addition, advancements like UV-LEDs and energy-efficient systems are expanding applications across municipal, commercial, and healthcare sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.