- Home

- »

- Animal Health

- »

-

Middle East Veterinary Services Market Size Report, 2033GVR Report cover

![Middle East Veterinary Services Market Size, Share & Trends Report]()

Middle East Veterinary Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Production Animals), By Service Type (Medical Services, Non-Medical Services), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-745-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Veterinary Services Market Summary

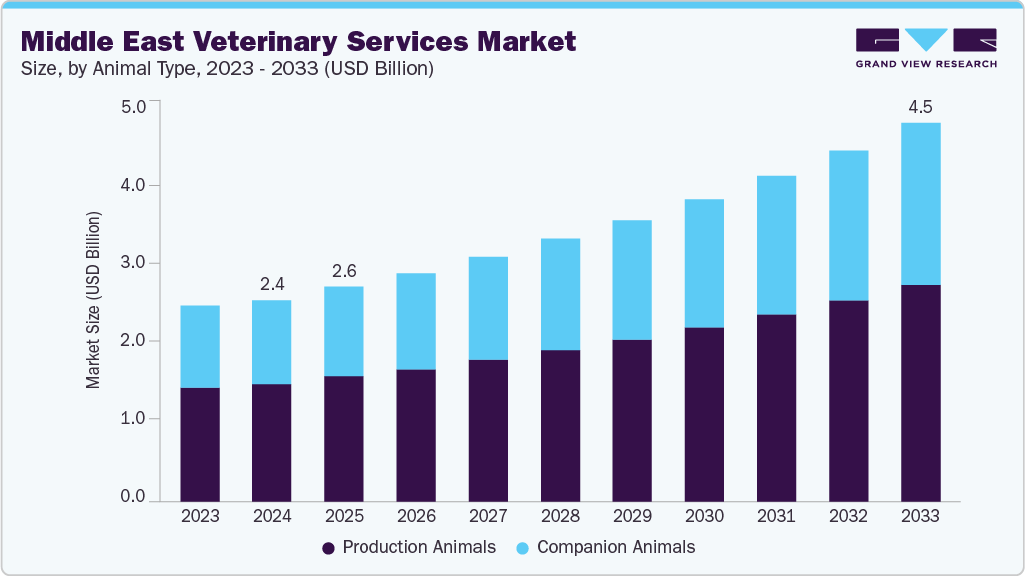

The Middle East veterinary services market size was estimated at USD 2.40 billion in 2024 and is projected to reach USD 4.51 billion by 2033, growing at a CAGR of 7.35% from 2025 to 2033. The market is witnessing steady growth driven by rising pet adoption, expanding livestock production, and government initiatives to modernize agri-food. A key trend is the increasing entry of global players through strategic partnerships to strengthen regional presence.

Key Market Trends & Insights

- Saudi Arabia veterinary services market held the largest share of 31.14% of the Middle East market in 2024.

- By animal, the production animals segment held the largest share of 58.29% of the market in 2024

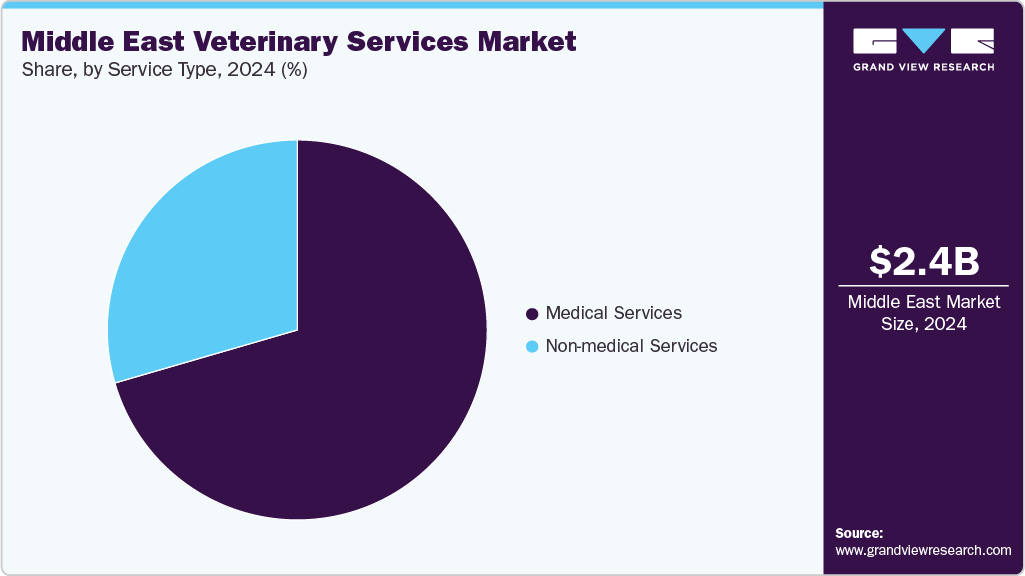

- By service type, the medical services segment held the largest market share of 70.47% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.40 Billion

- 2033 Projected Market Size: USD 4.51 Billion

- CAGR (2025-2033): 7.35%

- Saudi Arabia: Largest market in 2024

- UAE: Fastest growing market

For instance, in May 2025, Vetanco, a global animal health company, partnered with Saudi Arabia’s Arasco via its veterinary division Al-Emar International, granting Al-Emar exclusive distribution rights for Vetanco’s portfolio in Saudi Arabia. This alliance supports Saudi Vision 2030 by boosting local poultry, beef, and dairy production while enhancing access to innovative veterinary solutions. Such collaborations highlight the region’s growing demand for advanced animal healthcare and create significant opportunities for international veterinary companies to tap into the expanding Middle Eastern livestock and companion animal markets.

The Middle East market is strongly driven by the increasing adoption of companion animals, rising disposable incomes, and growing pet health and wellness awareness. For instance, in September 2024, Tree Digital Insurance Agency launched Saudi Arabia's first licensed pet insurance product, covering veterinary care, surgeries, and medications for cats and dogs. By improving affordability, pet insurance encourages owners to seek advanced veterinary treatments and preventive care, fueling the demand for companion animal healthcare services. This aligns with broader initiatives under Saudi Arabia's Vision 2030, which supports digital innovations and expanding lifestyle services, including pet care.

Technological advancements and digital solutions are also key drivers. For instance, in June 2025, Fetchway announced the UAE’s first AI-powered pet care ecosystem, integrating features such as smart discovery, appointment bookings, digital pet passports, loyalty rewards, and verified reviews. This platform streamlines access to veterinary services, grooming, training, and adoption, enhancing convenience, trust, and operational efficiency. By facilitating regular health monitoring and preventive care, such innovations are expected to increase service utilization and client engagement across veterinary clinics in the UAE.

In addition, the growing humanization of pets and the premiumization of pet products stimulate demand for high-quality veterinary services. Urban pet owners increasingly treat pets as family members, seeking specialized medical care, wellness programs, and diagnostic services. Similar trends are visible across other Gulf countries, including Qatar and Kuwait, where rising awareness of animal welfare and government support for pet-friendly policies further boost the adoption of veterinary services. These factors position the Middle East as a rapidly expanding companion and production animal veterinary services industry.

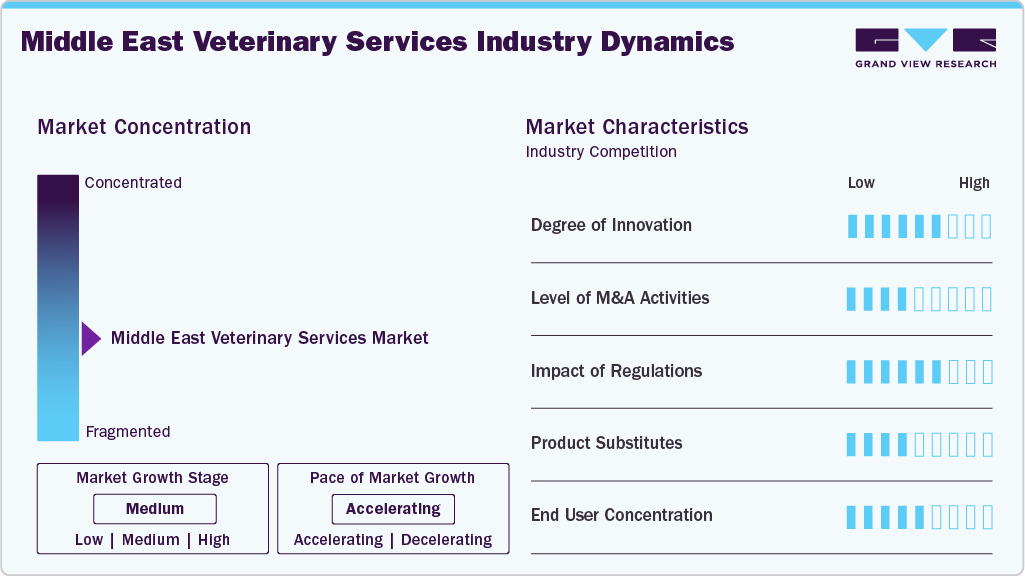

Market Concentration & Characteristics

The Middle East veterinary services industry is moderately fragmented, with no single player dominating the region. Leading providers, such as Royal Canin, ARENA Veterinary Holding, and local veterinary chains, coexist with numerous independent clinics and specialized service providers. This structure fosters competition, encourages service differentiation, and drives adoption of advanced medical and non-medical offerings, particularly in urban centers like the UAE, Qatar, and Kuwait.

The Middle East veterinary services industry is witnessing a rising degree of innovation, driven by the adoption of advanced diagnostics, telemedicine, AI-powered pet care platforms, and digital health monitoring. Innovative solutions such as AI-based appointment booking, digital pet passports, and innovative diagnostic tools improve efficiency, accessibility, and preventive care for pets. For example, the upcoming UAE platform Fetchway leverages AI to connect pet owners with veterinary services, grooming, and adoption centers while integrating health records digitally. Similarly, veterinary clinics in the region are increasingly incorporating modern surgical equipment, imaging technologies, and minimally invasive procedures, enhancing treatment precision and overall animal health outcomes. These innovations expand service offerings and elevate industry standards across the Middle East.

The Middle East veterinary services industry has seen increased M&A activity as companies seek to consolidate expertise, expand service networks, and meet rising demand for premium pet care. For instance, in January 2025, ARENA Veterinary Holding acquired Star Veterinary Clinics in the UAE, strengthening its footprint and service capabilities. Such strategic acquisitions enable access to state-of-the-art facilities, skilled veterinary professionals, and high-growth urban markets. The trend reflects a broader regional push toward market consolidation, premiumization, and integrated service offerings in companion and production animal care segments.

Regulations in the Middle East veterinary services industry play a critical role in ensuring animal health, food safety, and public welfare. Government initiatives mandate licensing for veterinary clinics, vaccination protocols, and biosecurity measures for livestock, enhancing service quality and compliance. For example, UAE authorities require licensed veterinary facilities for companion and production animals, fostering standardized care and consumer confidence. Regulatory oversight also encourages the adoption of advanced diagnostic tools and preventive care, supporting market growth and the professionalization of the sector.

In the Middle East veterinary services industry, product substitutes such as over-the-counter medications, herbal remedies, and online pet care consultations can impact demand for traditional veterinary services. However, the need for professional diagnostics, surgical procedures, and specialized treatments limits the effect of substitutes. For instance, while pet owners may use home remedies for minor ailments, chronic conditions and preventive care still require veterinary intervention. This dynamic emphasizes the importance of value-added services and expert care to maintain market share.

In the Middle East veterinary services industry, end-user concentration is moderate, with services catering to both companion animal owners and livestock producers. Urban pet owners in countries like the UAE and Qatar drive demand for premium veterinary care, while rural and agricultural regions rely on livestock-focused services. Key clients include commercial farms, veterinary hospitals, and individual pet owners, reflecting a diverse customer base that balances small-scale and large-scale service requirements. This distribution influences service offerings and pricing strategies across the region.

Animal Type Insights

Production animals represented the largest segment in the market in 2024, capturing a 58.29% revenue share, driven by the region’s reliance on livestock for food security and economic output. Veterinary services for cattle, poultry, sheep, goats, and camels focus on disease prevention, vaccination, reproductive management, and productivity enhancement, ensuring safe and high-quality animal products. For instance, governments and private enterprises are increasingly investing in rural veterinary infrastructure, herd health programs, and artificial insemination services to boost livestock performance and meet rising demand for meat, dairy, and eggs. The growing emphasis on biosecurity, sustainable farming practices, and livestock disease control further reinforces the dominance of the production animal segment in the market.

The companion animals segment is projected to be the fastest-growing market due to rising pet ownership, increasing disposable incomes, and a shift toward treating pets as family members. Dogs, cats, birds, and small mammals are becoming integral to urban households, driving demand for preventive healthcare, diagnostics, nutrition, and wellness services. For instance, the launch of premium pet care facilities like Gallagroom Pets Grooming and Spa in Dubai highlights the growing emphasis on specialized services, including grooming, dermatology, and wellness treatments. This trend, combined with increased awareness of pet health and the adoption of pet insurance, is fueling growth in veterinary services tailored to companion animals across the region.

Service Type Insights

Medical services accounted for the largest segment, with a 70.47% share in the market in 2024, driven by increasing prevalence of zoonotic and infectious diseases, growing awareness of preventive care, and expanding access to veterinary healthcare across urban and semi-urban regions. Advanced diagnostics, surgical procedures, and specialized treatments are in high demand and supported by modern veterinary facilities and technologies. For example, regional clinics and hospitals are adopting digital imaging, laboratory testing, and minimally invasive surgical techniques, enhancing treatment precision and outcomes. The rising focus on companion animal health, livestock productivity, and regulatory standards for animal welfare further reinforces the dominance of medical services in the market.

The non-medical services segment is the fastest-growing market due to increasing demand for pet-focused services such as grooming, boarding, sitting, travel, funeral care, and livestock non-medical services like artificial insemination. Rising pet ownership, urbanization, and a growing preference for premium and convenient care options drive this trend. For instance, the Gallagroom Pets Grooming and Spa launch in Dubai in January 2024 highlights the regional appetite for high-quality, stress-free grooming and wellness services, illustrating how ancillary offerings are expanding the veterinary services ecosystem and contributing to overall market growth.

Country Insights

The UAE veterinary services market is rapidly growing, driven by rising pet ownership, increasing disposable incomes, and heightened awareness of pet health and wellness. The sector is benefiting from the expansion of premium veterinary clinics and technology-driven solutions, such as AI-powered platforms for bookings and digital pet health records. For instance, in 2025, ARENA Veterinary Holding acquired Star Veterinary Clinics in Dubai, enhancing its network of high-quality pet care services. Fetchway launched the UAE’s first AI-powered pet care ecosystem to streamline veterinary appointments, health tracking, and service discovery. These developments reflect a trend toward technologically integrated, accessible, and premium veterinary care, catering to the growing demand for companion animal health services in urban areas.

Saudi Arabia Veterinary Services Market Trends

The veterinary services market in Saudi Arabia is experiencing steady growth, driven by rising livestock production, expanding pet ownership, and increasing government initiatives to improve animal health and food security. The country’s Vision 2030 strategy emphasizes self-sufficiency in meat, dairy, and poultry production, boosting demand for veterinary care in production animals. For example, partnerships like Vetanco and Arasco have enhanced the availability of innovative veterinary solutions, supporting local producers with validated animal health products, particularly in the poultry and livestock sectors. This trend highlights a growing focus on preventive care, disease management, and sustainable livestock practices.

The market also benefits from the rising adoption of companion animal care services. Urban centers such as Riyadh and Jeddah are witnessing increased pet ownership, which is driving demand for clinics, grooming, diagnostics, and preventive healthcare. For instance, Tree Digital Insurance Agency launched the Kingdom's first pet insurance in 2024, covering veterinary diagnostics, treatments, and surgeries, thereby encouraging pet owners to access veterinary services more frequently. In addition, government-supported research initiatives, such as the Animal Disease Research Center in Arar, aim to strengthen veterinary diagnostics, disease control, and biosecurity measures, further advancing the overall veterinary ecosystem in Saudi Arabia. These developments collectively indicate robust growth prospects across companion and production animal segments.

Key Middle East Veterinary Services Company Insights

The market is moderately fragmented, with key players leveraging M&A and partnerships to expand regional presence. Key players in the Middle East increasingly focus on expansion, digital integration, and service diversification to capture the growing pet care demand. Companies like ARENA Veterinary Holding and Fetchway leverage acquisitions, AI-powered platforms, and premium service offerings to enhance client experience and operational efficiency. Insurers like Tree Digital are entering the pet insurance segment, boosting affordability and utilization of veterinary services. Market leaders invest in specialized care, wellness programs, and preventive services, reflecting a strategic shift toward high-quality, technology-enabled veterinary solutions.

Key Middle East Veterinary Services Companies:

- CVS Group Plc

- Mars Incorporated

- National Veterinary Associates

- Pets at Home Group PLC

- Greencross Vets

- Fetch! Pet Care

- IVC Evidensia

- A Place for Rover, Inc.

- PetSmart LLC

- Airpets International

Recent Developments

-

In May 2025, Vetanco, a global animal health company, partnered with Saudi Arabia’s Arasco via its veterinary division Al-Emar International, granting Al-Emar exclusive distribution rights for Vetanco’s portfolio in Saudi Arabia.

-

In March 2025, Pet Madness Inc. launched the world's first AI-driven pet ecosystem, integrating software, hardware, and partnerships to connect pet owners, veterinarians, brands, and service providers.

-

In October 2024, VetPlus launched in Saudi Arabia, introducing advanced nutritional supplements and innovative veterinary solutions to enhance preventive and therapeutic pet care. The launch events in Riyadh and Jeddah fostered knowledge-sharing and collaboration among regional veterinary professionals.

-

In September 2024, Tree Digital Insurance Agency launched Saudi Arabia's first licensed Pet Insurance product, providing coverage for veterinary care, surgeries, and medications for cats and dogs.

Middle East Veterinary Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.56 billion

Revenue forecast in 2033

USD 4.51 billion

Growth rate

CAGR of 7.35% from 2025 to 2033

Historical Period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, service type, country

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Veterinary Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East veterinary services market report based on animal, type, service type, and country:

-

Animal Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Medical Services

-

Diagnosis

-

In-Vitro Diagnosis

-

In-Vivo Diagnosis

-

-

Preventative Care

-

Treatment

-

Consultation

-

Surgery

-

Others

-

-

-

Non-Medical Services

-

Pet Services

-

Livestock Services

-

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

Frequently Asked Questions About This Report

b. The Middle East veterinary services market size was estimated at USD 2.40 billion in 2024 and is expected to reach USD 2.56 billion in 2025.

b. The Middle East veterinary services market is expected to grow at a compound annual growth rate of 7.35% from 2025 to 2033 to reach USD 4.51 billion by 2033.

b. Medical services accounted for the largest segment, with a 70.47% share in the middle east veterinary services market in 2024, driven by increasing prevalence of zoonotic and infectious diseases, growing awareness of preventive care, and expanding access to veterinary healthcare across urban and semi-urban regions.

b. Some key players operating in the Middle East veterinary services market include CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International.

b. Key factors that are driving the market growth include rising pet adoption, expanding livestock production, and government initiatives to modernize the agri-food sector. A key trend is the increasing entry of global players through strategic partnerships to strengthen regional presence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.