- Home

- »

- Advanced Interior Materials

- »

-

Middle East Welding Equipment Market Size Report, 2033GVR Report cover

![Middle East Welding Equipment Market Size, Share & Trends Report]()

Middle East Welding Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Automatic, Semi-automatic, Manual), By Technology (Arc Welding, Resistance Welding), By End-use (Aerospace, Automotive), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-738-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Welding Equipment Market Summary

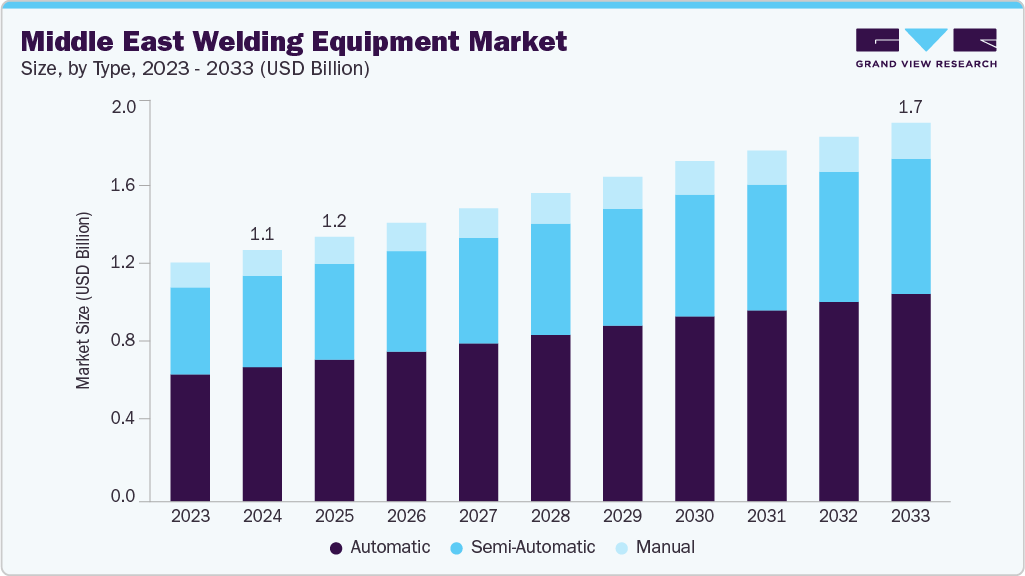

The Middle East welding equipment market size was estimated at USD 1,132.6 million in 2024 and is projected to reach USD 1,706.3 million by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The market growth is driven by the rapid expansion of infrastructure development projects, particularly across Saudi Arabia, the UAE, and Qatar.

Key Market Trends & Insights

- The welding equipment market in the UAE is expected to grow at a substantial CAGR of 5.3% from 2025 to 2033.

- By type, the automatic segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By technology, the laser beam welding segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By end use, the building & construction segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,132.6 Million

- 2033 Projected Market Size: USD 1,706.3 Million

- CAGR (2025-2033): 4.6%

Government-led initiatives such as Saudi Vision 2030 and large-scale investments in smart cities, transportation, and oil & gas facilities are creating strong demand for advanced welding technologies. Another key growth driver for the Middle East welding equipment industry is the region’s strong industrialization and increasing adoption of automation in manufacturing processes. Industries such as automotive, shipbuilding, oil & gas, and aerospace are investing in automated and robotic welding solutions to improve efficiency, precision, and safety.

The push towards higher productivity and reduced operational costs encourages companies to shift from conventional welding methods to technologically advanced systems. Additionally, the presence of global welding equipment manufacturers expanding their regional operations supports technology transfer and market development.

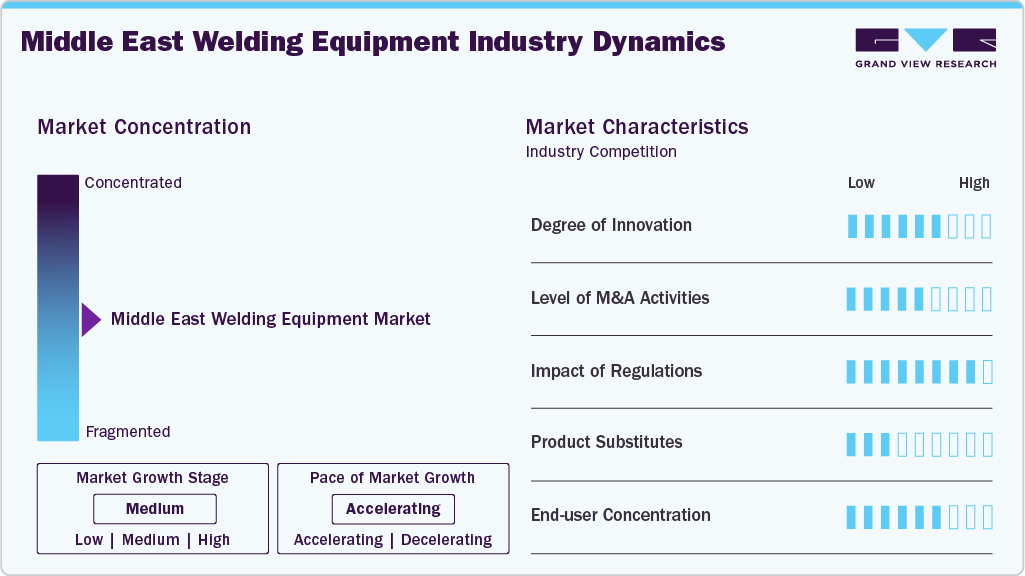

Market Concentration & Characteristics

The Middle East welding equipment market is moderately concentrated, with a limited number of large players controlling a significant portion of the market. Their dominance is supported by advanced technology offerings, strong distribution networks, and established customer bases. At the same time, regional manufacturers and low-cost entrants are adding competitive pressure across price-sensitive segments. This mix of dominant players and emerging challengers positions the market as semi-concentrated rather than fully fragmented.

The degree of innovation in the Middle East welding equipment industry is steadily increasing as industries demand higher efficiency, precision, and automation. Advanced welding technologies such as robotic systems, laser welding, and smart monitoring solutions are gaining traction in large-scale projects. Innovation is also driven by the need to improve energy efficiency and reduce operational downtime. This push for modern solutions is transforming traditional welding practices into more technology-driven processes.

The level of mergers and acquisitions in the regional market is moderate, often led by international firms seeking to strengthen their presence in the Middle East. Strategic partnerships and joint ventures are also common, particularly in the oil & gas and infrastructure sectors. Such consolidation allows companies to expand distribution networks and offer advanced technologies locally. These activities enhance competitiveness and bring global expertise into the regional market.

Regulatory impact plays a vital role in shaping the welding equipment industry across the Middle East. Governments enforce safety, quality, and environmental compliance standards to ensure reliability in critical applications. Regulations related to workplace safety and sustainable manufacturing are pushing companies to adopt advanced welding systems. This regulatory push not only safeguards operations but also accelerates the shift toward modern, automated equipment.

Drivers, Opportunities & Restraints

The key drivers for the Middle East welding equipment market include the rapid expansion of infrastructure, oil & gas projects, and large-scale construction activities. Growing demand for precision and efficiency is encouraging industries to adopt automated and advanced welding solutions. Industrial diversification initiatives by regional governments further support market growth. Together, these factors create a strong foundation for sustained equipment demand.

Opportunities in the market arise from the increasing shift toward automation, robotics, and digital welding technologies. Local manufacturing expansion, supported by industrialization and government investments, opens new avenues for suppliers. The growing emphasis on renewable energy projects and shipbuilding also generates fresh demand. Additionally, partnerships and technology transfers offer prospects for market penetration and innovation.

Restraints include the high initial investment cost of advanced welding systems, which limits adoption among small and medium enterprises. Economic fluctuations and dependency on oil revenues can slow down industrial investments in certain periods. Shortages of skilled welders and technical expertise also hinder the smooth adoption of complex systems. These challenges create barriers to growth despite the strong underlying demand.

Type Insights

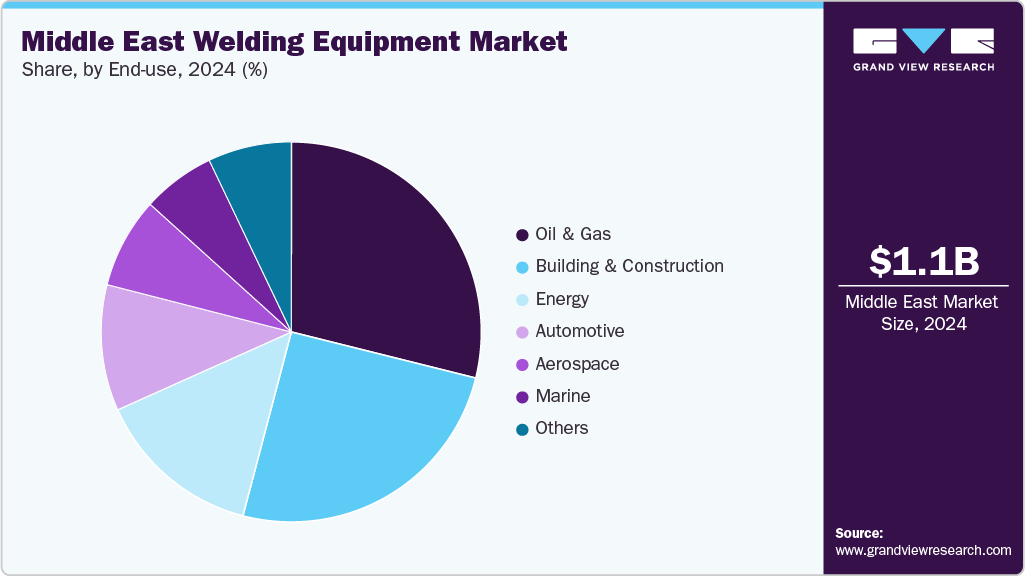

The automatic welding equipment led the Middle East welding equipment industry with a revenue share of 53.4% in 2024, due to its ability to deliver higher precision, consistency, and efficiency in large-scale projects. Industries such as oil & gas, construction, and shipbuilding prefer automated systems for their reliability and reduced labor dependency. The growing need for faster project completion timelines further boosts the adoption of automatic technologies. This dominance is reinforced by increasing investments in industrial automation across the region.

The semi-automatic segment is expected to grow at a significant CAGR of 4.4% from 2025 to 2033 in terms of revenue, driven by its balance of affordability and functionality for medium-scale applications. Many small and mid-sized enterprises opt for these systems as they offer flexibility and lower upfront costs compared to fully automated solutions. The rising demand for welding in manufacturing, automotive repair, and fabrication sectors also supports this trend. As industries modernize gradually, semi-automatic equipment serves as a transitional step toward full automation.

Technology Insights

Arc welding dominated the Middle East welding equipment market with a revenue share of 71.9% in 2024, as it is widely used in construction, oil & gas, and heavy fabrication industries. Its cost-effectiveness, versatility, and ability to handle diverse materials make it the preferred choice across large projects. The availability of skilled labor familiar with arc welding techniques also supports its strong market share. This widespread adoption ensures its continued dominance in the regional landscape.

The Laser Beam Welding segment is expected to grow at a fastest CAGR of 6.2% from 2025 to 2033 in terms of revenue, due to its precision, speed, and suitability for high-end applications. Industries such as aerospace, automotive, and electronics are increasingly adopting this method for complex and delicate operations. Its ability to deliver clean welds with minimal heat distortion makes it attractive for advanced manufacturing needs. Growing industrial modernization in the region further accelerates its uptake.

End-use Insights

The oil & gas sector dominates the Middle East welding equipment industry and accounted for a 28.9% share in 2024, driven by extensive pipeline projects, refinery expansions, and offshore developments. Welding equipment is essential for ensuring durability and safety in these high-pressure environments. The sector’s continuous investments in maintenance and new capacity further reinforce equipment demand. As oil & gas remain the backbone of regional economies, they sustain the largest share of market consumption.

The building and construction segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue, fueled by mega infrastructure projects, urban development, and government-backed initiatives like Saudi Vision 2030. High-rise buildings, transportation networks, and smart city projects require reliable welding solutions. The sector’s focus on modern, large-scale construction drives the adoption of both automatic and semi-automatic equipment. This rising demand positions construction as a key growth engine for the market.

Country Insights

Saudi Arabia Welding Equipment Market Trends

Saudi Arabia dominated the Middle East welding equipment market and accounted for a 34.4% share in 2024, supported by its extensive oil & gas operations, large-scale infrastructure projects, and industrial diversification plans. Ongoing refinery upgrades, pipeline developments, and mega construction projects like NEOM create strong demand. Government initiatives under Vision 2030 further push industrial modernization and automation. This combination of energy and infrastructure investment secures Saudi Arabia’s leading position in the market.

UAE Welding Equipment Market Trends

The UAE is the fastest-growing market due to its rapid urban development, expansion of manufacturing, and strong focus on renewable energy projects. Mega projects in Dubai and Abu Dhabi, including smart cities and transportation networks, are boosting welding equipment adoption. The country’s strategic push to diversify its economy beyond oil is also creating new opportunities. These factors position the UAE as the most dynamic growth driver in the region’s welding equipment landscape.

Key Middle East Welding Equipment Company Insights

Some of the key players operating in the market include The Lincoln Electric Company, Miller Electric Mfg. LLC, and ESAB

-

Lincoln Electric has built a strong foothold in the Middle East by delivering specialized welding systems and consumables designed for high-demand sectors. Its portfolio supports critical applications in oil & gas, construction, and infrastructure, where reliability and performance are essential. The company partners with regional distributors to ensure consistent product availability and technical service. It also brings advanced automation and robotic welding solutions to meet the region’s shift toward higher precision and efficiency. This localized approach allows Lincoln Electric to align with the industrial growth strategies of countries like Saudi Arabia and the UAE.

-

ESAB expanded its Middle East operations with a new production site in Al Ahsa, Saudi Arabia, which began operating in 2025. The facility manufactures filler metals that are crucial for welding processes across the energy, construction, and industrial sectors. Alongside this, ESAB’s UAE base acts as a hub for logistics, technical training, and customer support. By producing locally, the company reduces supply delays and strengthens responsiveness to regional project needs. This integration of manufacturing and service has reinforced ESAB’s role as a major supplier in the Middle East welding market.

Key Middle East Welding Equipment Companies:

- The Lincoln Electric Company

- Miller Electric Mfg. LLC

- ESAB

- voestalpine Böhler Welding Group GmbH.

- Kemppi Oy

- Panasonic Connect Co., Ltd.

- Carl Cloos Schweißtechnik GmbH

- OTC Daihen.

- Ador Welding.

- Polysoude S.A.S.

Recent Developments

-

In August 2025, ESAB strengthened its role in the Middle East welding equipment market by opening a new manufacturing plant in Al Ahsa, Saudi Arabia. Spanning about 6,000 square meters, the facility is dedicated to producing high-performance filler metals, a vital consumable in welding operations. This expansion boosts local availability, reduces reliance on imports, and ensures faster delivery for regional oil & gas, construction, and infrastructure projects. The investment directly supports the rising demand for welding equipment and consumables, positioning ESAB as a stronger player in the Middle East market.

-

In June 2025, Qapqa secured a contract with A-HAK Pijpleidingen Saudi for Package #9 of Saudi Aramco’s MGS-3 project. The deal involves deploying three automatic welding spreads and expert teams to construct over 300 km of 56-inch X70 gas pipeline. This agreement strengthens Qapqa’s role in the Middle East pipeline welding market, showcasing its automation expertise. The project supports Aramco’s strategy to expand and enhance the Kingdom’s natural gas network.

-

In February 2025, SteelFab reinforced its position as the Middle East’s premier trade fair for metalworking, steel fabrication, and welding technologies. The event featured specialized segments including welding, cutting, machine tools, and tube & pipe solutions, attracting strong participation from regional and global players. It served as a platform for governments, associations, and businesses to exchange knowledge and explore industrial partnerships. Since its launch in 2004, SteelFab has continued to create opportunities for technology adoption and industry growth across the UAE and wider MENA region.

Middle East Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,192.4 million

Revenue forecast in 2033

USD 1,706.3 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, country.

Regional scope

Middle East

Country scope

Saudi Arabia; Oman; UAE; Qatar; Israel; Kuwait

Key companies profiled

The Lincoln Electric Company; Miller Electric Mfg. LLC; ESAB; voestalpine Böhler Welding Group GmbH.; Kemppi Oy; Panasonic Connect Co., Ltd.; Carl Cloos Schweißtechnik GmbH; OTC Daihen.; Ador Welding.; Polysoude S.A.S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Welding Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East welding equipment market report based on type, technology, end-use, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Arc Welding

-

Shielded Metal/ Stick Arc Welding

-

MIG

-

TIG

-

Plasma Arc Welding

-

Others

-

-

Resistance Welding

-

Laser Beam Welding

-

Oxy-fuel Welding

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Israel

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East welding equipment market was estimated at USD 1,132.6 million in 2024 and is expected to reach USD 1,192.4 million in 2025.

b. The Middle East welding equipment market's revenue is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033, reaching USD 1,706.3 million by 2033.

b. Arc welding dominates the Middle East welding equipment market and accounted for 71.9% share in 2024, as it is widely used in construction, oil & gas, and heavy fabrication industries. Its cost-effectiveness, versatility, and ability to handle diverse materials make it the preferred choice across large projects.

b. Some of the key players operating in the Middle East welding equipment market include The Lincoln Electric Company; Miller Electric Mfg. LLC; ESAB; voestalpine Böhler Welding Group GmbH.; Kemppi Oy; Panasonic Connect Co., Ltd.; Carl Cloos Schweißtechnik GmbH; OTC Daihen.; Ador Welding.; Polysoude S.A.S.

b. The Middle East welding equipment market is driven by large-scale infrastructure development, oil & gas expansion, and rapid industrialization across the region. Rising demand for automation, precision, and efficiency in fabrication processes further supports growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.