- Home

- »

- Automotive & Transportation

- »

-

Military Aerospace & Defense Lifecycle Management Market Report, 2030GVR Report cover

![Military Aerospace & Defense Lifecycle Management Market Size, Share & Trends Report]()

Military Aerospace & Defense Lifecycle Management Market Size, Share & Trends Analysis Report By Type (Product Lifecycle Management, Service Lifecycle Management), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-063-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

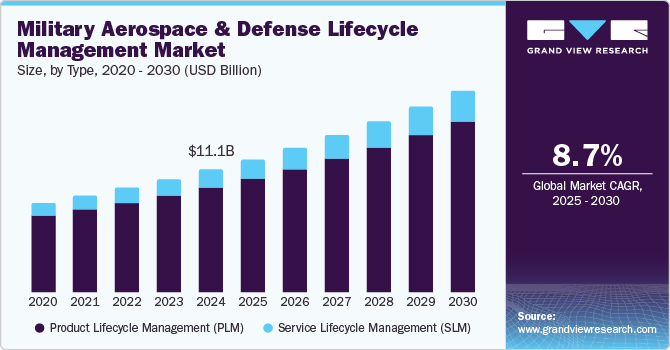

The global military aerospace & defense lifecycle management market size was valued at USD 10.20 billion in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. The increasing complexity of defense systems and aerospace platforms has fueled the need for comprehensive lifecycle management solutions. Modern military aircraft and defense systems are characterized by advanced technologies and intricate components that demand detailed management throughout their operational lifespan. To address such challenges, defense organizations are investing heavily in sophisticated lifecycle management tools and practices that can optimize maintenance, repair, and overhaul (MRO) processes, enhance reliability, and extend the operational life of critical assets.

Governments worldwide recognize the need to enhance their military capabilities in response to evolving geopolitical threats, terrorism, and regional conflicts. According to USAFacts, the U.S. military spent around USD 820 billion in 2023 to increase its military capabilities and strengthen its defense. This has led to significant investments in advanced technologies, including unmanned systems, cyber warfare capabilities, and next-generation aircraft. As countries allocate more funds towards modernization programs, the demand for lifecycle management services encompassing design, development, maintenance, and disposal grows correspondingly.

Geopolitical tensions and evolving security threats propel investments in defense capabilities and, consequently, in lifecycle management. Nations are modernizing their military fleets and upgrading defense systems to counter new and emerging threats. This modernization drives the demand for effective lifecycle management solutions to ensure that these advanced systems remain mission-ready and capable of adapting to new threats. The need for continuous updates and upgrades to defense systems further emphasizes the importance of robust lifecycle management practices.

The rise of autonomous systems and advanced robotics also impacts the military aerospace and defense lifecycle management market. Integrating autonomous drones, robotic systems, and other advanced technologies into defense operations introduces new challenges and opportunities for lifecycle management. These systems often require specialized maintenance and support, leading to the development of tailored lifecycle management solutions that address their unique needs. As autonomous systems' deployment grows, so does the demand for innovative lifecycle management strategies to ensure their effective operation and maintenance.

Type Insights

Product Lifecycle Management (PLM) dominated the market and accounted for a market revenue share of 85.7% in 2023. As defense organizations adopt more digital tools and technologies, integrating PLM systems becomes essential to harness the full potential of these advancements. PLM solutions support digital thread capabilities, allowing for real-time data sharing, collaboration, and decision-making across the lifecycle of defense assets. This digital integration helps improve accuracy, reduce errors, and accelerate time-to-market for new defense systems and upgrades. By leveraging digital technologies, PLM systems contribute to more efficient and agile management of military aerospace and defense products.

Service Lifecycle Management (SLM) is expected to register the fastest CAGR of 9.9% during the forecast period. Modern defense systems are increasingly equipped with sensors and connectivity features that generate vast amounts of operational data. SLM solutions leverage this data to provide real-time monitoring, diagnostics, and analysis of equipment health. By integrating IoT data with service management processes, SLM systems enable more accurate and timely maintenance actions, optimize service schedules, and improve overall asset management. The ability to harness digital data for enhanced service delivery is a significant factor contributing to the growth of SLM solutions.

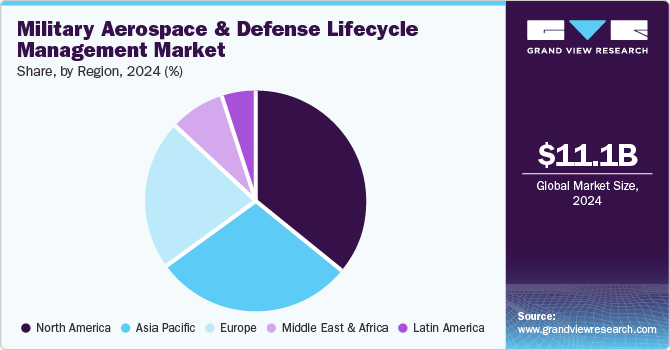

Regional Insights

North America military aerospace & defense lifecycle management market accounted for the largest market revenue share of 36.7% in 2023. The emphasis on enhancing operational readiness and reducing lifecycle costs proliferates the market in North America. The U.S. Department of Defense’s efforts to optimize maintenance practices and extend the life of existing assets are central to this objective. For instance, the U.S. Air Force’s Integrated Logistics System aims to streamline logistics and maintenance processes for aircraft such as the C-130 Hercules. By adopting lifecycle management solutions that enhance maintenance efficiency and cost-effectiveness, the Air Force seeks to maximize the availability and performance of its fleet while controlling expenses.

U.S. Military Aerospace & Defense Lifecycle Management Market Trends

The U.S. military aerospace & defense lifecycle management market dominated the North America market in 2023 due to its strong emphasis on technological superiority, operational efficiency, and cost-effectiveness. The aging military equipment fleet necessitates comprehensive lifecycle management strategies to maintain operational readiness while reducing acquisition costs. Additionally, the U.S. government's increasing reliance on outsourcing non-core functions to private sector companies is creating substantial growth prospects for lifecycle management service providers.

Europe Military Aerospace & Defense Lifecycle Management Market Trends

Europe military aerospace & defense lifecycle management market was identified as a lucrative region in 2023. The European Union's commitment to enhancing defense capabilities and interoperability among member states drives the market in the region. Initiatives such as the European Defence Fund (EDF) and the European Defence Agency (EDA) are aimed at bolstering defense research, development, and procurement across Europe. For instance, the EDF's support for collaborative projects, such as the European Future Combat Air System (FCAS), underscores the need for advanced lifecycle management solutions to ensure the effective maintenance and integration of new technologies across multiple national forces.

Germany military aerospace & defense lifecycle management market is anticipated to grow significantly over the forecast period. Germany's strategic position in Europe and its role as a leading NATO member state necessitate advanced defense capabilities. The country is committed to maintaining a modern and technologically superior military force, which drives the demand for sophisticated aerospace systems and comprehensive lifecycle management solutions. The need to keep pace with evolving threats and integrate cutting-edge technologies into defense platforms is fueling investment in lifecycle management services to ensure operational efficiency and extended service life of military assets.

Asia Pacific Military Aerospace & Defense Lifecycle Management Market Trends

Asia Pacific military aerospace & defense lifecycle management market is anticipated to register the fastest CAGR over the forecast period. Countries in the region invest heavily in acquiring advanced military systems, necessitating effective lifecycle management strategies to ensure operational readiness and cost-efficiency. The region's diverse landscape presents challenges and opportunities for lifecycle management providers, requiring tailored solutions to meet the specific needs of different countries.

India military aerospace & defense lifecycle management market is expected to grow rapidly in the coming years. The Indian government has been ramping up its defense budget to modernize and expand its military capabilities, including aerospace and defense systems. Recent investments in advanced platforms such as the Rafale fighter jets, P-8I maritime patrol aircraft, and the indigenously developed Tejas fighter jets underline the need for effective lifecycle management. These high-cost assets require ongoing maintenance, upgrades, and support to ensure operational readiness and longevity, driving demand for comprehensive lifecycle management services.

Key Military Aerospace & Defense Lifecycle Management Company Insights

Some of the key companies in the military aerospace & defense lifecycle management market include Aras Corporation, ATS Global B.V., Dassault Systèmes SE, and others.

-

Aras Corporation offers a robust Product Lifecycle Management (PLM) platform specifically designed for the intricacies of the military aerospace and defense industry. Their solution empowers organizations to manage complex product lifecycles, from conceptualization to disposal, by providing capabilities in global configuration management, digital thread, supply chain management, quality management, maintenance, repair, and overhaul (MRO), and compliance management.

-

ATS Global B.V. specializes in providing enterprise asset management (EAM) and maintenance, repair, and overhaul (MRO) solutions tailored for the military aerospace and defense sector. Their offerings focus on optimizing asset utilization, reducing maintenance costs, and improving operational efficiency. ATS Global's solutions often encompass asset tracking, work order management, inventory control, predictive maintenance, and compliance management.

Key Military Aerospace & Defense Lifecycle Management Companies:

The following are the leading companies in the military aerospace & defense lifecycle management market. These companies collectively hold the largest market share and dictate industry trends.

- Aras Corporation

- ATS Global B.V.

- Dassault Systèmes SE

- Honeywell International Inc.

- Infor

- PROLIM

- PTC Inc.

- Cyient Limited

- Siemens AG

- Nikon SLM Solutions AG

Recent Developments

-

In June 2024, Honeywell International Inc. acquired CAES (Cobham Advanced Electronic Solutions) to enhance its capabilities across various domains, including land, sea, air, and space. By integrating CAES’s advanced electronic systems and technologies into its portfolio, Honeywell aims to bolster its position as a leader in providing comprehensive solutions for defense applications.

-

In December 2023, Dassault Systèmes extended its collaboration with Dassault Aviation to enhance aircraft maintenance, repair, and overhaul (MRO) capabilities through cloud-based solutions. By leveraging Dassault Systèmes’ 3DExperience platform, the collaboration seeks to streamline workflows, improve data accessibility, and enhance real-time decision-making for military operators.

Military Aerospace & Defense Lifecycle Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.06 billion

Revenue forecast in 2030

USD 18.20 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, China, Japan, India, South Korea, Australia, Brazil, Mexico, South Africa, Saudi Arabia, and UAE

Key companies profiled

Aras Corporation, ATS Global B.V., Dassault Systèmes SE, Honeywell International Inc., Infor, PROLIM, PTC Inc., Cyient Limited, Siemens AG, Nikon SLM Solutions AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Aerospace & Defense Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military aerospace & defense market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Lifecycle Management (PLM)

-

Service Lifecycle Management (SLM)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."