- Home

- »

- Next Generation Technologies

- »

-

Product Lifecycle Management Market Size Report, 2030GVR Report cover

![Product Lifecycle Management Market Size, Share & Trends Report]()

Product Lifecycle Management Market (2023 - 2030) Size, Share & Trends Analysis Report, Component (Software, Services), By Deployment (On-premise, Software-as-a-Service), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-631-8

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Product Lifecycle Management Market Summary

The global product lifecycle management market size was estimated at USD 28.02 billion in 2022 and is anticipated to reach USD 54.36 billion by 2030, growing at a CAGR of 9.2% from 2023 to 2030. The major factors expected to drive growth include a rising focus on developing smart products and factories and the increasing demand for cloud-based product lifecycle management (PLM) solutions for secure IT infrastructure.

Key Market Trends & Insights

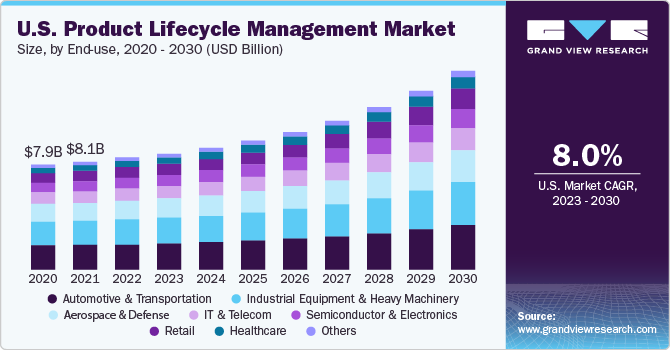

- North America dominated the market with the largest revenue share of 35.4% in 2022.

- The Asia Pacific is expected to grow at the fastest CAGR of 10.7% during the forecast period.

- By component, software segment held the largest market share of 63.3% in 2022.

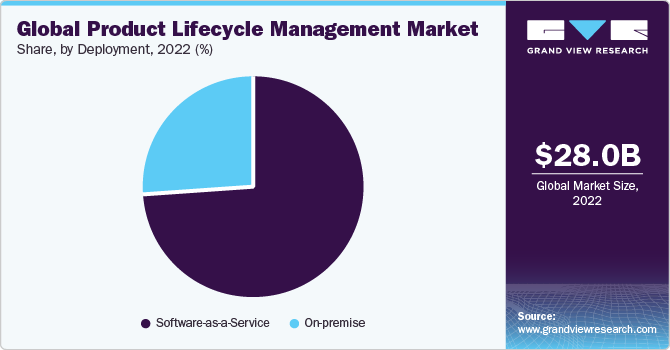

- By deployment, the software-as-a-service (SaaS) segment dominated the market with the highest revenue share of 74.1% in 2022.

- By end-use, the automotive & transportation segment dominated the market with the highest revenue share of 23.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 28.02 Billion

- 2030 Projected Market Size: USD 54.36 Billion

- CAGR (2023-2030): 9.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The outbreak of the COVID-19 pandemic prompted businesses to adopt cloud technology to facilitate remote working and ensure business continuity. In addition, several organizations opted for remote working and deployed cloud-based solutions, which fueled the demand for PLM solutions. The pandemic positively impacted the market's growth due to the high adoption of cloud-based solutions across various organizations. Product lifecycle management envisages systematic information management in real-time through the entire product lifecycle. The information typically includes production and product design, development, and delivery. The product lifecycle processes continuously evolve with variables such as functions, time, price, and performance. As a result, product innovation is flexible to match the new market requirements, which have become extremely important owing to these continuously changing variables. These product lifecycle management solutions can achieve low operational costs and time efficiency while encouraging innovations in business operations. These benefits are expected to impact the market growth positively over the forecast period.

The increasing demand for product lifecycle management solutions in small and medium enterprises across various industry verticals to optimize manufacturing costs fosters market growth. Companies must find ways to invest to maximize their business profit potential throughout their life cycle. However, concerns over data security and other factors, such as integration and implementation costs, are expected to restrain the market's growth over the forecast period. Technological trends such as additive manufacturing and engineering and Augmented Reality (AR) are predicted to drive the market during the forecast period. These technologies are expected to encourage companies to enable their PLM solutions with new capabilities, which is projected to increase demand.

Currently, an outsized number of commercial enterprises are instrumental in completing digital transformation initiatives or developing their roadmap toward digitalization. One of the significant developments includes the integration of the Internet of Things (IoT) with PLM solutions. This integration has amplified the capabilities of product lifecycle management solutions, enabling real-time performance and quality management post-manufacturing. IoT sensors embedded in smart products and systems generate a vast set of actionable data, such as insights regarding the early signs of failure of a particular part of the product.

Technological advancements such as the Industrial Internet of Things (IIoT), virtual reality, augmented reality, and additive manufacturing are anticipated to boost the growth of the product lifecycle management market. The key market players, such as PTC Inc. and Siemens, are focused on integrating these technologies to strengthen their position in the market. For instance, in February 2021, Siemens launched AssistAR 3.0, which supports assembly, inspection, and maintenance procedures with a new generation of accurate and robust augmented reality (AR) technologies. It connects to the company's PLM system and uses regular PCs and displays to guide company operators through complex operations without using glasses or a headset.

Component Insights

The component segment is categorized into software and services. The software segment is further categorized into portfolio management, design & engineering management, quality & compliance management, simulation, testing, & change management, manufacturing operations management, and others. The services segment is also bifurcated into consulting, integration & deployment, support & maintenance, and quality assurance. The software segment held the largest market share of 63.3% in 2022. With businesses expanding their operations across geographies, there is a growing need for efficient communication and collaboration among teams and stakeholders in different regions. PLM software provides a centralized platform for managing product data, design changes, and requirements, facilitating seamless collaboration among dispersed teams.

The services segment is projected to register the fastest CAGR of 9.5% over the forecast period. As companies adopt PLM solutions, there is a need for proper training for employees to use the software effectively. Service providers offer training sessions to educate users about the PLM tools and functionalities, enabling them to make the most of the system. Additionally, ongoing technical support is essential to address any issues or challenges arising during the PLM implementation and usage.

Deployment Insights

The software-as-a-service (SaaS) segment dominated the market with the highest revenue share of 74.1% in 2022. SaaS solutions typically follow a subscription-based pricing model, eliminating the need for upfront hardware and software investments. This cost-effective approach allows companies to access advanced product lifecycle management capabilities without the burden of significant initial capital expenses, making product lifecycle management solutions more accessible to businesses of all sizes.

On the other hand, the on-premise segment is expected to grow at a significant CAGR of 8.0% over the forecast period. On-premises solutions help organizations understand the trends, challenges, and development in the market and also help to apply effective and efficient marketing and manufacturing decisions by integrating advanced technologies such as the Internet of Things (IoT) and big data. These solutions also allow organizations to reduce their dependency on the internet infrastructure and protect their data from online fraud and potential losses. Such benefits are anticipated to encourage organizations, especially large organizations, to opt for on-premise deployment.

End-use Insights

The automotive & transportation segment dominated the market with the highest revenue share of 23.6% in 2022. The increasing use of digital manufacturing and the rising integration of IoT in producing smart automobiles are the key trends expected to drive market growth in the automotive sector. For instance, Siemens product lifecycle management software offers a full set of smart vehicle solutions for all key technical domains, from chip design to full vehicle validation. Product lifecycle management helps minimize shipment errors, resulting in low product damage, on-time orders, high productivity, better alignment with customer requirements, and complete regulatory compliance. These factors are anticipated to drive the adoption of product lifecycle management software by the incumbents in the automotive & transportation industries.

The healthcare segment is expected to witness the fastest CAGR of 11.1% over the forecast period. The healthcare industry is highly regulated to ensure patient safety and product efficacy. Medical device manufacturers must comply with various standards and regulations, such as ISO 13485 and FDA regulations. Product lifecycle management solutions help companies manage documentation, track design changes, and maintain compliance throughout the product lifecycle, reducing the risk of non-compliance issues and potential penalties.

The aerospace & defense segment is anticipated to register a significant CAGR of 8.6% over the forecast period. The requirement for product lifecycle management solutions in the defense and aerospace sector is determined by budget reduction, rising global competition, and mounting backlog in commercial aircraft delivery and production. The growing demand for lifecycle management solutions from military aerospace & defense companies can be attributed to the evolving need for technologically advanced solutions that can potentially streamline core operations. These solutions include IoT, AI-based, and other automation solutions to manage critical activities. Moreover, some major lifecycle management solution providers, such as Siemens, provide various technological solutions to cater to the requirements of small and large-scale companies operating in the military aerospace & defense industry.

Regional Insights

North America dominated the market with the largest revenue share of 35.4% in 2022. The region's strong financial position enables it to invest heavily in advanced solutions, such as IoT, connected industries, telecommunication technologies (5G, LTE), additive manufacturing, and augmented reality providing a competitive edge in the market. Moreover, large enterprises are increasingly upgrading their product lifecycle management solutions in line with the evolving technology trends in their companies to aid customer-centric product development. For instance, in March 2020, IBM launched a new version of the Engineering Lifecycle Management (ELM) solution, ELM 7.0, to scale engineering operations and handle more complex projects. The solution will use AI to uncover valuable, real-time insights across engineering data.

The Asia Pacific is expected to grow at the fastest CAGR of 10.7% during the forecast period. The region's demand for PLM would increase with the exploding digitalization and industrialization in emerging nations such as India and China. The region has several large enterprises operating across diverse industries, including electronics, automotive, and telecommunications, focusing on transforming their respective processes engineering and product development functions and aggressively deploying product lifecycle management tools as a part of their growth strategies.

Key Companies & Market Share Insights

Market players are investing aggressively in R&D activities, improving their internal processes, actively engaging in new product development, and improving their existing products to acquire new customers and increase their respective market shares. They also focus on mergers & acquisitions and strategic partnerships to develop technologically advanced products and gain a competitive edge in the market.

For instance, in January 2022, Aras Corporation announced the merger with Minerva Group, a software provider that optimizes business and product processes. With this merger, Minerva brings product lifecycle management functionality built on the Aras platform for medical devices and high-tech electronics companies. The company also provides extensive vertical industry expertise in manufacturing automotive, aerospace, defense, and industrial equipment.

Market players are aggressively investing in R&D activities to drive organic growth. For instance, in June 2021, PTC Inc. and KPMG piloted a private cellular network (5G) designed to provide clients and professionals with a controlled environment to collaborate, experiment, and explore new business models. It will also showcase how companies can leverage next-generation networks to drive digital transformation for their business purposes.

Key Product Lifecycle Management Companies:

- ANSYS, Inc

- Aras

- PTC Inc

- Seimens

- Oracle

- SAP

- Autodesk Inc.

- Dassault Systèmes

- Synopsys, Inc.

- PTC

Recent Developments

-

In July 2023, Quadrant Knowledge Solutions released a comprehensive SPARK MatrixTM analysis of the global market. The analysis covers various aspects, including market dynamics, major trends, the vendor landscape, and competitive positioning. It empowers users to make informed decisions by evaluating vendor capabilities, competitive advantages, and market positions. Businesses can effectively assess PLM solutions and find the most suitable providers with this strategic information.

-

In February 2023, Bricsys, a division of Hexagon specializing in design and collaboration solutions, joined forces with MechWorks, a part of ITI Technegroup, a WIPRO Company, to develop an integration between BricsCAD and Siemens' Teamcenter software. Through this collaboration, BricsCAD users can benefit from cutting-edge features that optimize the design workflow and simplify product development. The integration is expected to significantly enhance productivity and efficiency in the design and engineering domains, offering industry-leading capabilities to streamline various aspects of the design process.

-

In February 2023, Siemens and IBM joined forces to expedite sustainable product development and operations. Their collaboration aims to create an innovative software solution integrating systems engineering and asset management. This combined solution will facilitate traceability and sustainable product development by seamlessly connecting various mechanical, electronics, electrical, and software engineering domains. The partnership seeks to enhance the efficiency and effectiveness of product development processes while promoting sustainability practices.

-

In April 2022, ITC Infotech and PTC have formed a strategic agreement to expedite customer digital transformation initiatives. This collaboration aims to empower businesses with cutting-edge PLM solutions, facilitate digital transformation, and elevate the overall customer experience. By joining forces, PTC and ITC Infotech are committed to delivering exceptional value to customers looking to optimize their product lifecycle management processes.

-

In January 2022, Aras, a low-code platform provider offering applications for designing, building, and operating complex products, announced its merger with Minerva Group, the foremost Aras Innovator PLM implementation partner. By joining forces, the companies aim to deliver enhanced product lifecycle management solutions tailored to the needs of these specialized industries.

Product Lifecycle Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.44 billion

Revenue forecast 2030

USD 54.36 billion

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end-use , region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ANSYS, Inc; Aras; PTC Inc.; Seimens; Oracle; SAP; Autodesk Inc.; Dassault Systèmes; Synopsys, Inc.; PTC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Product Lifecycle Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global product lifecycle management marketon the basis of component, deployment, end-use, and region:

-

Component Outlook (Revenue in USD Million, 2018 - 2030)

-

Software

-

Portfolio Management

-

Design & Engineering Management

-

Quality & Compliance Management

-

Simulation, Testing, & Change Management

-

Manufacturing Operations Management

-

Others

-

-

Services

-

Consulting

-

Integration & Deployment

-

Support & Maintenance

-

Quality Assurance

-

-

-

Deployment Outlook (Revenue in USD Million, 2018 - 2030)

-

On-premise

-

Software-as-a-Service

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive & Transportation

-

Healthcare

-

IT & Telecom

-

Industrial Equipment & Heavy Machinery

-

Retail

-

Semiconductor & Electronics

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global product lifecycle management market size was estimated at USD 28.02 billion in 2022 and is expected to reach USD 29.44 billion in 2023.

b. The global product lifecycle management market is expected to witness a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 54.36 billion by 2030.

b. North America dominated the market with the largest revenue share of 35.4% in 2022. The region's strong financial position enables it to invest heavily in advanced solutions, such as IoT, connected industries, telecommunication technologies (5G, LTE), additive manufacturing, and augmented reality, providing a competitive edge in the market.

b. Some key players operating in the PLM market are ANSYS, Inc., Aras Corporation, Arena Solutions, Inc., Oracle Corporation, SAP SE, AUTODESK, INC., Siemens AG, PTC Inc., Dassault Systèmes, and Synopsys Inc.

b. The major factors expected to drive growth include a rising focus on developing smart products and factories and the increasing demand for cloud-based product lifecycle management (PLM) solutions for secure IT infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.