- Home

- »

- Power Generation & Storage

- »

-

Military Battery Market Size, Share & Growth Report, 2030GVR Report cover

![Military Battery Market Size, Share & Trends Report]()

Military Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (Ground, Airborne, Marine), By Type (Non-Rechargeable, Rechargeable, Propulsion), By Composition, By Installation, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-352-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Battery Market Summary

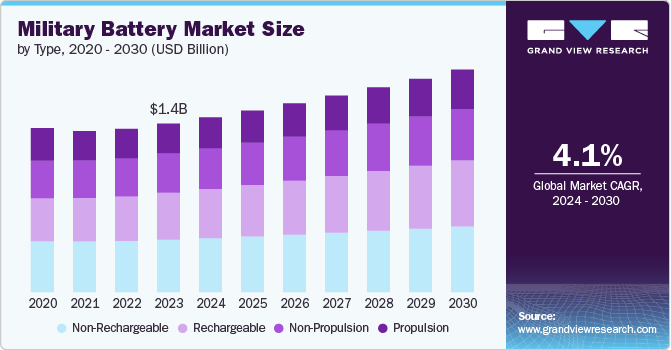

The global military battery market size was estimated at USD 1.40 billion in 2023 and is projected to reach USD 1.85 billion by 2030, growing at a CAGR of 4.11% from 2024 to 2030. Technological advancements in battery chemistry and design significantly impact the military battery market.

Key Market Trends & Insights

- The North America accounted for 15.49% market revenue share in 2023.

- The U.S. dominates the military battery market in North America and accounted for a share of over 78.0% in 2023.

- Based on type, non-rechargeable segment led the market and accounted for 31.02% revenue share in 2023.

- Based on composition, rotary lithium-based segment led the market and accounted for 48.87% revenue share in 2023.

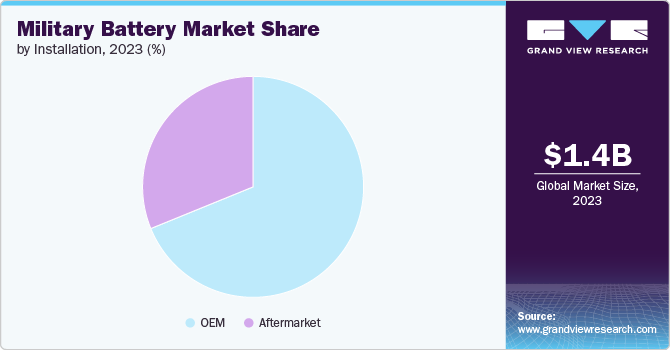

- Based on installation, OEM segment led the market and accounted for 68.84% revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.40 Billion

- 2030 Projected Market USD 1.85 Billion

- CAGR (2024-2030): 4.11%

- North America: Largest market in 2023

Developments in lithium-ion, solid-state, and other advanced battery technologies provide higher energy densities, longer life cycles, and improved safety features. These improvements enhance the performance and reliability of military equipment, including drones, communication devices, and electric vehicles, making them more efficient and effective in various operational scenarios.

Rising defence budgets of various countries drive the demand for advanced military batteries. Governments are investing heavily in modernizing their armed forces, which includes procuring sophisticated electronic warfare systems, unmanned systems, and portable power solutions. This increase in military expenditure ensures a steady demand for high-performance batteries that can power a wide range of military applications, from handheld devices to large-scale weaponry.

Drivers, Opportunities & Restraints

Continuous improvements in battery technology, such as higher energy densities, longer life cycles, and better safety features, are driving the military battery market. Innovations in lithium-ion and solid-state batteries provide more reliable and efficient power sources for various military applications, enhancing the performance and durability of equipment. Also, growing use of UAVs, UGVs, and UUVs in military operations is a significant market driver. These systems rely on high-capacity, lightweight batteries for extended missions, driving demand for specialized battery technologies.

Development of advanced battery materials such as graphene and silicon anodes, presents opportunities to create batteries with higher energy densities and faster charging capabilities. These advancements can meet the evolving power needs of military applications. In addition, incorporation of smart battery management systems that can monitor and optimize battery performance in real-time offers significant opportunities. These systems enhance the reliability and longevity of batteries, making them more suitable for critical military operations.

High development and production of advanced military batteries involve significant costs. High manufacturing costs and the expense of raw materials can restrain market growth, especially for smaller defense budgets. Also, stringent regulations and compliance requirements for battery storage systems can slow down the development and deployment of new technologies. Meeting these regulatory standards adds complexity and costs to the production process.

Platform Insights

Ground segment led the market and accounted for 47.74% revenue share in 2023. Ground platforms constitute a significant portion of the military battery market, driven by the extensive use of batteries in vehicles, portable devices, and soldier systems. Many countries are investing in modernizing their ground forces with advanced armored vehicles, communication systems, and wearable technologies. These upgrades often require high-capacity, durable batteries to ensure reliable performance. These factors are expected to drive the demand of the segment over the forecast period.

Marine platforms is expected to grow at the fastest CAGR over the forecast period. Submarines rely heavily on batteries for underwater operations, where silence and stealth are crucial. The demand for high-capacity, long-lasting batteries that can provide sustained power is a key driver in this segment.

Type Insights

Non-rechargeable segment led the market and accounted for 31.02% revenue share in 2023. These batteries are designed for single-use applications where reliability, energy density, and long shelf life are paramount. Non-rechargeable batteries are widely used in portable military devices such as communication equipment, GPS units, and handheld radios. The reliability and ease of use of primary batteries make them ideal for these applications, especially in critical missions where recharging is not feasible. In emergencies, such as rescue operations or battlefield medical scenarios, non-rechargeable batteries provide immediate and reliable power. Their readiness for use without prior charging is a significant advantage in such urgent situations.

Rechargeable segment is anticipated to grow at the fastest CAGR of more than 5.0% over the forecast period. Rechargeable batteries power a wide range of portable military devices, including communication systems, night vision goggles, and GPS units. Their ability to be recharged and reused makes them cost-effective and suitable for devices that are used frequently. Modern soldiers often use wearable technology, such as health monitoring systems and exoskeletons, which require reliable and lightweight rechargeable batteries to enhance their operational capabilities and endurance.

Composition Insights

Rotary lithium-based segment led the market and accounted for 48.87% revenue share in 2023. Rotary lithium-based batteries, known for their high energy density, longevity, and reliability, are crucial in the military battery market. These batteries, typically comprising lithium-ion and lithium-polymer chemistries, are integral to various military applications.Lithium-based batteries power a wide range of portable communication devices, including radios, satellite phones, and tactical communication systems. Their ability to provide consistent power ensures reliable communication in the field.

Nickel-based battery composition is expected to grow at the fastest CAGR over the forecast period. Nickel-based batteries are widely used in military communication devices such as radios and satellite phones. Their reliability and ability to deliver consistent power make them ideal for ensuring uninterrupted communication in the field.Many types of portable military equipment, including flashlights, night vision goggles, and GPS units, rely on nickel-based batteries. These batteries provide the necessary power for extended use in demanding environments.

Installation Insights

OEM segment led the market and accounted for 68.84% revenue share in 2023. OEM-installed batteries are crucial for the functioning of various military vehicles, including tanks, armored personnel carriers, and utility vehicles. These batteries provide power for starting engines, operating communication systems, and running electronic subsystems. Military aircraft, including fighter jets, helicopters, and unmanned aerial vehicles (UAVs), rely on OEM-installed batteries for a range of functions. These include powering avionics, emergency backup systems, and propulsion systems in the case of electric or hybrid drones.

Aftermarket batteries are essential for the regular maintenance and upgrading of military equipment. These batteries ensure that older systems continue to operate efficiently and meet evolving performance standards.Aftermarket battery installations help extend the operational lifespan of military vehicles, aircraft, and other equipment. By ensuring reliable power sources, these installations prevent premature obsolescence and maintain mission readiness.

Regional Insights

North America accounted for 15.49% market revenue share in 2023. North America is at the forefront of technological innovation in military batteries. There is a strong emphasis on developing batteries with higher energy densities, faster recharge times, and improved safety features. Advancements in lithium-ion and other advanced battery technologies are driving these developments.

U.S. Military Battery Market Trends

U.S. dominates the military battery market in North America and accounted for a share of over 78.0% in 2023. The U.S. military battery market is influenced by several key trends that shape its dynamics, procurement strategies, and technological advancements. Military forces are prioritizing lightweight and portable battery solutions that enhance mobility and operational flexibility. This trend is particularly significant for soldier-wearable devices, communication equipment, and unmanned aerial systems (UAS) where minimizing weight without compromising power output is essential.

Military battery market in Canada is expected to grow at significant CAGR. Canada's ongoing efforts to modernize its military equipment and infrastructure include upgrading battery systems to meet current operational demands and environmental standards.

Asia Pacific Military Battery Market Trends

Many countries in the Asia Pacific region, including China, India, Japan, South Korea, and Australia, are significantly increasing their defense budgets. This surge in defense spending is driving investments in advanced military technologies, including batteries, to enhance operational capabilities.

The China military battery market accounted for the largest share of over 42.2% in 2023 in Asia Pacific. China has been actively modernizing its military forces, investing in advanced technologies, including high-tech weaponry and equipment. This modernization drive requires reliable and high-performance batteries to support various military applications, from communication systems to unmanned vehicles.

India military battery market is expected to progress with a CAGR of about 5.0% over forecast period. India's ongoing military modernization programs, such as Make in India initiatives and efforts to enhance indigenous defense production capabilities, are driving demand for advanced military batteries. These programs aim to reduce dependency on foreign suppliers and strengthen domestic defense manufacturing.

Europe Military Battery Market Trends

European defense agencies are emphasizing energy efficiency and sustainability in military operations, leading to increased adoption of rechargeable batteries and integration of renewable energy sources. This trend is driving investments in energy storage solutions that incorporate batteries capable of storing energy from solar, wind, and other renewable sources.

Military battery market in Germany accounted for market revenue share of about 30.0% in 2023. Germany, known for its strong technological base, is increasingly focusing on advanced battery technologies. This includes improvements in energy density, safety features, and sustainability aspects of military batteries.

The military battery market in Italy is expected to grow at significant rate with CAGR of about 4.0%. Italy's military is actively modernizing its equipment and systems, including the adoption of advanced battery technologies to enhance operational capabilities and efficiency. Italy is leveraging advancements in battery technology such as lithium-ion and lithium-polymer batteries, which offer higher energy densities and longer lifespans.

Key Military Battery Company Insights:

New product launches are a common strategy for companies to gain a competitive edge. Examples include Epsilor's recent launch of NATO 6T Li-ion batteries catering to the growing demand for high-performance and safety-compliant solutions. The military battery market hasn't seen a significant number of major acquisitions in recent years. However, some strategic acquisitions such as Saft acquiring Brush Eveready and EnerSys acquiring AlphaBatt highlight the potential for companies to expand their offerings or production capabilities.

Key Military Battery Companies:

The following are the leading companies in the military battery market. These companies collectively hold the largest market share and dictate industry trends.

- EnerSys

- GS Yuasa International Ltd

- Saft

- Exide Industries

- EaglePicher Technologies

- Bren-Tronics

- Kokam Co., Ltd.

- Ultralife Corporation

- Arotech Corporation

- CBAK Energy Technology

Recent Developments

-

In January 2024, the U.S. army launched its second Typhon battery at Joint Base Lewis-McChord in Washington, U.S. to operate the ground-based Typhon missile system.

-

In March 2023, the U.S. Defense Logistics Agency Research & Development team launched two innovative projects to enhance its military batteries. A BATTNET project will develop a 6T prototype battery with 35% less weight than existing batteries to enhance efficiency.

Military Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.46 billion

Revenue forecast in 2030

USD 1.85 billion

Growth rate

CAGR of 4.11% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, type, composition, installation, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; Australia; Saudi Arabia; UAE; South Africa; Brazil; Argentina

Key companies profiled

EnerSys; GS Yuasa International Ltd.; Saft; Exide Industries; EaglePicher Technologies; Bren-Tronics; Kokam Co., Ltd.; Ultralife Corporation; Arotech Corporation; CBAK Energy Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Battery Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global military battery market on the basis platform, type, composition, and installation.

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground

-

Airborne

-

Marine

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Rechargeable

-

Rechargeable

-

Propulsion

-

Non-Propulsion

-

-

Composition Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary Lithium-based

-

Lead acid

-

Nickel-based

-

Thermal

-

Others

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military battery market size was estimated at USD 1,403.50 million in 2023 and is expected to reach USD 1.46 billion in 2024.

b. The global military battery market is expected to grow at a compound annual growth rate of 4.11% from 2024 to 2030 to reach USD 1.85 billion by 2030.

b. Based on the platform, ground segment led the market and accounted for over 47.74% revenue share in 2023. Many countries are investing in modernizing their ground forces with advanced armored vehicles, communication systems, and wearable technologies.

b. Some of the key players operating in this industry include EnerSys, GS Yuasa International Ltd., Saft, Exide Industries, EaglePicher Technologies, Bren-Tronics, Kokam Co., Ltd, among others.

b. Developments in lithium-ion, solid-state, and other advanced battery technologies provide higher energy densities, longer life cycles, and improved safety features. These improvements enhance the performance and reliability of military equipment, including drones, communication devices, and electric vehicles, making them more efficient and effective in various operational scenarios.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.