- Home

- »

- Next Generation Technologies

- »

-

Military Simulation And Virtual Training Market Report, 2030GVR Report cover

![Military Simulation And Virtual Training Market Size, Share & Trends Report]()

Military Simulation And Virtual Training Market (2023 - 2030) Size, Share & Trends Analysis Report By Platform Type (Flight, Vehicle, Battlefield, Virtual Boot Camp), By Application (Ground, Air, Naval), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-717-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Simulation And Virtual Training Market Summary

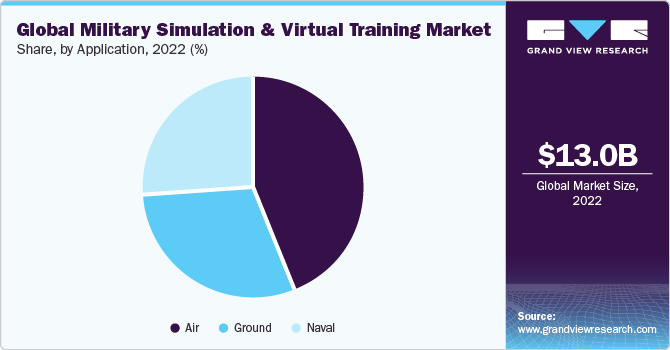

The global military simulation and virtual training market size was valued at USD 13.02 billion in 2022 and is projected to reach USD 18.75 billion by 2030, growing at a CAGR of 4.7% from 2023 to 2030. The rising need for a trained workforce in the navy and rising demand for conventional and unconventional military equipment and software is anticipated to drive the market.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 34.9% in 2022.

- Based on application, the air application segment accounted for the largest revenue share of 44.0% in 2022.

- Based on application, the ground application segment is expected to witness the highest CAGR of 4.9% over the forecast period.

- Based on platform type, flight simulation segment accounted for the largest revenue share of 39.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 13.02 Billion

- 2030 Projected Market Size: USD 18.75 Billion

- CAGR (2023-2030): 4.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Real-time training is time-consuming and expensive, and it also requires a large amount of raw materials, such as fuel and explosives, with a high degree of risk involved. Therefore, defense ministries increasingly opt for virtual training and simulation-based games, including technologies such as big data, Artificial Intelligence (AI), and cloud computing.

Military simulation can train soon-to-be soldiers and depict a real-time scenario with realistic computerized scenarios. The increasing investments in simulation software are anticipated to be one of the important factors driving market growth. Also, defense ministries of different countries are reorganizing and modifying their militaries with innovative solutions, which drives the market.

Military simulation and virtual training are progressively being adopted by the armed forces of many countries across the globe. They help reduce training costs as they are based on Commercial-off-the-Shelf (COTS) components. The simulators are created at a low development cost. These factors are significant for the armed forces to invent massive innovations in simulation-based training technologies.

The increasing need for modification of existing equipment and orders for new advanced equipment is anticipated to drive the growth of the military simulation and virtual training market. For instance, Bohemia Interactive Simulation developed an Augmented Reality (AR) visual system for Textron, Inc. These systems support a trainee’s interactions with the real world using VR/AR technologies and offer a synthetically generated visual scene.

Developing portable simulation systems such as vehicle, flight, and battlefield simulation is expected to offer tailoring solutions per specific needs and individual missions. These systems can improve the techniques for applications related to air, ground, and naval platforms, offering strategic experience to soldiers. Simulation training solution helps to improve capabilities and the overall understanding of soldiers. These systems allow the armed forces to boost the overall capabilities related to knowledge of handling advanced missile systems and complex electronic military equipment, which is anticipated to spur market growth.

The global market is anticipated to be driven by the rising need for a trained workforce in the Naval coupled with increasing demand for unconventional and conventional military equipment and software. The increasing need for modification of existing equipment and orders for new advanced equipment is anticipated to drive the growth of the market. Governments across the world are reducing military costs due to reduced financial resources. The defense ministries of many countries are reducing their training budgets and are downscaling the militaries. It has increased the military's focus on attaining cheaper and more effective solutions for their requirement. These factors are expected to drive the market over the forecast period further.

Military simulation and virtual training software allow military personnel to commence many simulations without the associated costs, thus massively plummeting training budgets. Thus, simulation-based training is gaining popularity across defense organizations as it provides the dual benefit of reducing costs and boosting operational effectiveness. This software can put soldiers in different environments, situations, or places. Simulations offer environmental fidelity by considering topography, weather, and lighting effects. Besides, military simulation and virtual training software allow military personnel to be trained simultaneously in one room without sacrificing the quality of learning.

The procurement of military simulators and virtual training software predominantly depends on procuring other military equipment such as helicopters, submarines, armored vehicles, aircraft, cyber security systems, and naval ships. Therefore, the growing procurement of these systems is anticipated to witness robust expenditure in the coming future. Hence, the need to provide training at low operating costs is anticipated to augment the demand for military simulators and virtual training solutions over the forecast period.

Military simulation and virtual training software cannot completely recreate real-life situations. In these simulators, not every military situation can be included. Thus, the feedback and results are only as effective as the training provided. Moreover, training staff must be trained using military simulators and virtual training software. Therefore, it takes up time and costs money. For instance, flight simulators cannot replicate the psychological and physiological aspects of air combat training; they are suitable for tactical training. Thus, a major limitation of military simulation and virtual training software is that they cannot replicate the physiological effects on the human body, which is expected to pose a challenge to market growth.

Application Insights

Ground, air, and naval are the major application segments of the market. The air application segment accounted for the largest revenue share of 44.0% in 2022, owing to the rise in demand for border surveillance and battlefield operations.

The ground application segment is expected to witness the highest CAGR of 4.9% over the forecast period. Disputes over borders and natural resources have warranted the military to focus on modernizing their army troops. It is expected to drive the demand for ground-based military simulation and virtual training, making it the second-largest segment. Tanks are a key component of ground warfare, but their use in training results in high operating costs. Furthermore, the adoption of ground-based simulators is increasing owing to reduced training costs and improved accuracy in measuring the training objectives.

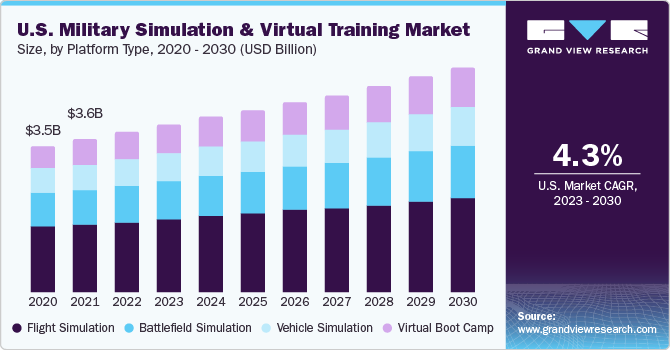

Platform Type Insights

Based on the platform, the market can be categorized into battlefield, vehicle, flight simulation, and virtual boot camp. The flight simulation segment accounted for the largest revenue share of 39.6% in 2022, owing to increasing penetration in commercial and military flight training practices. The high cost of flying an actual aircraft, the high risk concerning the loss of human lives, and the continuously increasing production cost of aircraft are some key factors that complement the growth of flight simulator adoption worldwide.

The virtual boot camp segment is expected to witness a significant CAGR of 5.5% over the forecast period. Factors such as territorial disputes, external and internal security threats, and increasing investments in the modernization of the military and associated training will contribute to the growth over the forecast period. Virtual boot camp simulators are highly effective in the Air Force, Navy, and Army as they help them learn relevant physical fitness routines and kill drill requirements during boot camp. The simulator also requires fewer instructors and helps free up many trainers for other necessary duties.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.9% in 2022. North American countries have mandated procuring these solutions owing to their policy of keeping their army troops ready for deployment in war-like situations at short notice. The U.S. Air Force minimizes the flying hours to reduce time and cost. Some of their programs include the army's Live Training Transformation (LT2) systems, F-35 aircraft simulators, US Air Force's F-16 Training System, and Long-Range Strike-B simulators.

Furthermore, North America held the dominant market share in 2021 and is expected to lead the market over the next few years. This growth can be attributed to the U.S. Navy’s expansion of various autonomous & unmanned ships, submarines, and aircraft. It led to an increase in the U.S. Sea fleet from 293 ships to more than 355 ships. Furthermore, increasing spending on the military by North American countries such as Canada and the U.S. has increased their share to 94 % of total regional spending in 2020. Demand for the Military Simulator and Virtual Training market is expected to increase.

Asia Pacific is expected to grow at the fastest CAGR of 5.5% during the forecast period. Countries such as China and India have increased their military expenditure, thus supporting the procuring of these equipment. Additionally, focusing on offering cost-effective and best-in-class training to forces is expected to propel regional demand. A few major programs include Rafale simulators and fifth-generation aircraft simulators by India, the J15 flight simulators and J-13 flight simulators by China, and Sea 1000 future submarine simulators and the Helicopter Aircrew Training System (HATS) program by Australia, among others.

The increasing military equipment procurement and modernization of armed forces mainly fuel military budget spending in the Asia Pacific region. It subsequently resulted in the proliferating demand for military simulators and virtual training systems. Military spending in Asia and Oceania has been on an upward trend for decades, reaching USD 575 billion in 2022. Similarly, military expenditure in the Middle East increased by 3.2% in 2022 to an estimated USD 184 billion. It was up from USD 178 billion in 2021. The increase in 2022 was mainly due to a 16% increase in spending by Saudi Arabia, the largest military spender in the region. Other countries in the region also saw increased military spending but to a lesser extent. Besides, various government-run programs such as the J-15 and J-31 flight simulators by China, fifth-generation aircraft simulators and Rafale simulators deal by India, and the Helicopter Aircrew Training System program and the Sea 1000 future submarine simulators by Australia, among others, are anticipated to bode well for the market growth.

Key Companies & Market Share Insights

The key players are focusing on add-on acquisition strategies to boost their industry presence. The industry participants are expected to continue to seek strategies such as acquisitions and product launches, as the military simulation and training market is still in the development phase. Many key players adopted contractual agreements as their key strategy to achieve growth in the market. For instance, in November 2022, BAE Systems, a UK-based defense company, partnered with Inzpire, a training specialist company, to bring Inzpire’s training expertise into BAE Systems’ future Operational Training Services. The experts from Inzpire work with BAE Systems to create a single synthetic environment that allows military forces to train using tactics and software to deliver immersive training securely and in high fidelity.

Key Military Simulation And Virtual Training Companies:

- Northrop Grumman.

- Cubic Corporation

- CAE Inc.

- Aai Corporation

- Collins Aerospace

- Lockheed Martin Corporation.

- BAE Systems.

- L3Harris Technologies, Inc.

- Thales

- Bohemia Interactive Simulations

Recent Developments

-

In October 2022, PLEXSYS Interface Products, Inc. released Simulation Platform Interface (SPI) 1.4 software. The interface provides a mission crew training capability that leverages simulation to make the real-world operational scenario come to life.

-

In October 2022, Red Hat and Lockheed Martin collaborated to integrate advanced artificial intelligence (AI) innovation in the Lockheed Martin military platforms. The collaboration enables the integration of the Red Hat Device Edge in Lockheed Martin military platforms to help U.S. security missions by standardizing and applying AI technologies in geographically constrained conditions.

-

In July 2022, PLEXSYS, Thales, and Hadean partnered to deliver next-generation operational training solutions to the UK Ministry of Defence (MoD). The partnership aims to combine the expertise of PLEXSYS in simulation and training, Thales in defense systems, and Hadean in synthetic environments and digital twins.

Military Simulation And Virtual Training Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.62 billion

Revenue forecast in 2030

USD 18.75 billion

Growth Rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Northrop Grumman.; Cubic Corporation; CAE Inc.; Aai Corporation; Collins Aerospace; Lockheed Martin Corporation.; BAE Systems.; L3Harris Technologies, Inc.; Thales; Bohemia Interactive Simulations

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Simulation And Virtual Training Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global military simulation and virtual training market report based on platform type, application, and region:

-

Platform Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Flight Simulation

-

Vehicle Simulation

-

Battlefield Simulation

-

Virtual Boot Camp

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Ground

-

Air

-

Naval

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global military simulation and virtual training market size was estimated at USD 13.02 billion in 2022 and is expected to reach USD 13.62 billion in 2023.

b. The global military simulation and virtual training market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 18.75 billion by 2030.

b. North America dominated the military simulation and virtual training market with a share of 34.9% in 2022. North American countries have mandated procuring these solutions owing to their policy of keeping their army troops ready for deployment in war-like situations at short notice.

b. Key players include in the military simulation and virtual training market are Northrop Grumman.; Cubic Corporation; CAE Inc.; Aai Corporation; Collins Aerospace; Lockheed Martin Corporation.; BAE Systems.; L3Harris Technologies, Inc.; Thales; and Bohemia Interactive Simulations; among others.

b. Key factors that are driving the military simulation and virtual training market growth include the rising need for a trained workforce in the navy and the surging demand for conventional and unconventional military equipment and software is anticipated to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.