- Home

- »

- Next Generation Technologies

- »

-

Milking Robots Market Size & Share, Industry Report, 2030GVR Report cover

![Milking Robots Market Size, Share & Trends Report]()

Milking Robots Market (2024 - 2030) Size, Share & Trends Analysis Report By Robotics System (Single-Stall, Multi-Stall, Rotary System), By Herd Size (Upto 100, Between 100 And 1,000, Above 1,000), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-105-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Milking Robots Market Summary

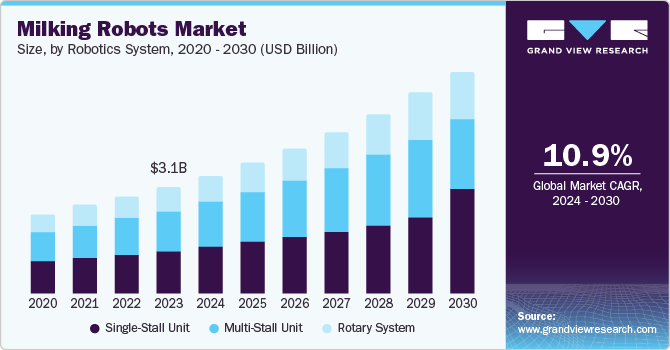

The global milking robots market size was estimated at USD 3.07 billion in 2023 and is projected to reach USD 6.32 billion by 2030, growing at a CAGR of 10.9% from 2024 to 2030. Key factors include technological advancements, the growing advantages of automatic milking solutions, and increasing labor costs.

Key Market Trends & Insights

- The Asia Pacific milking robots dominated the global market in 2023.

- The U.S. milking robots market dominated the North America industry and accounted for the revenue share of 80.7% in 2023.

- Based on robotics system, the single-stall unit segment held the largest revenue share of 39.7% in 2023.

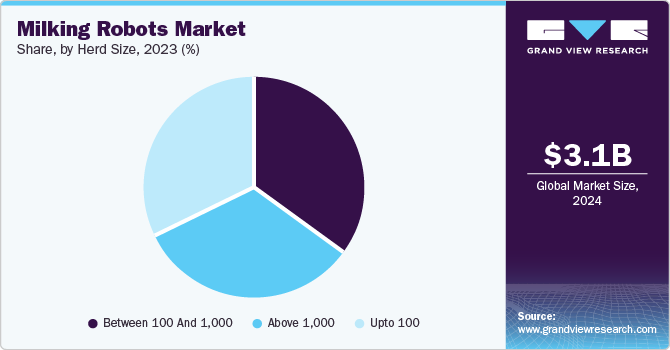

- Based on herd size, the herd size between 100 and 1,000 segment has the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.07 Billion

- 2030 Projected Market USD 6.32 Billion

- CAGR (2024-2030): 10.9%

- Asia Pacific: Largest market in 2023

Additionally, these automatic milking systems help in farm management and maximize milk production, resulting in increased economic benefits.

Increasing adoption of advanced technologies and equipment has improved the productivity and efficiency of dairy farms. The trend of expanding automation in every industry due to its ability to enhance procedures at maximum levels while minimizing the use of resources is driving the growth of the milking robot’s market. Conventional farm management and milking tasks are automated to attain higher efficiency while reducing the spilling and wastage to lowest levels. Robotic milking helps in lowering labor requirements on dairy farms of numerous scales and provides flexible lifestyles for farm families managing larger number of cows.

The ability of robots to provide a reliable and consistent workforce, eliminating the pressure of labor shortage, has contributed to rising demand for robotics in numerous industries. Moreover, these automated and gentle processes improve milk quality and optimize cow health. Key players are increasing investments in R&D activities to introduce innovative robotic solutions to cater to the changing needs of the dairy business. The increasing need for robotic solutions and expanding economies in various developing nations are creating additional opportunities for manufacturers.

Robotics System Insights

The single-stall unit segment held the largest revenue share of 39.7% in 2023. This growth is attributed to the several benefits of single-stall units, such as reducing labor costs and eliminating the necessity for manual milking. These systems are designed for small farms, which allows owners to experience the benefits of low capital investments. Furthermore, the integration of robotics in farms allows the farmers to keep track of the milk flow rate due to the robotics monitoring. This ensures enhanced animal wellbeing and efficient processing. These milking robots assist in collecting milk quality, cow health, and milk yield so farmers efficiently rely on and manage their farms.

The rotary system segment is expected to experience a noteworthy CAGR during the forecast period. This segment is mainly driven by the ability of automated milking rotaries (AMRs) to effectively work for large herds of animals. These robotic devices are often utilized by the farms operating at larger scales. The systems offer capacity to simultaneously milk multiple cattle in organized fashion. Growing modernization and transformation trends are projected to generate greater demand for this industry in approaching years.

Herd Size Insights

The herd size between 100 and 1,000 segment has the largest revenue share in 2023. The number of animals present in the farm primarily influences adoption of milking robots. Increasing automation results in cost savings and enhanced efficiency. This plays a vital role in reaching profitable margins for the farms with large herds. The growing demand for dairy products, increasing shift towards consumption organic food & beverages, and large amount of exports associated with dairy have resulted in growing size of herd in multiple pharms. This in turn is projected to drive the growth of this market. According to Agricultural and Processed Food Products Export Development Authority (APEDA), India exported 63,738.47 metric tons of dairy products during FY 2023-2024.

The herd size above 1000 segment is projected to experience a significant CAGR during the forecast period. This is attributed to increasing automation adopted by the farms with cattle count above 1000. These farms often operate with collaborations and tie-ups with multiple manufacturers of finished dairy products. This develops the need to continuous flow of milking and delivery while following the efficient manner. Reduced expenditure on labor, time saving, ease of record keeping, availability of reliable data, and attainment of enhanced management are some of the key growth driving factors for milking robots utilized in such farms.

Regional Insights & Trends

Asia Pacific milking robots dominated the global market in 2023. This is attributed to the rising consumption of milk and milk products, resulting in an increased need for effective technology-based solutions for milking and other tasks related to dairy farm management. Presence of countries such as India and China have driven the growth for this regional industry. Both countries and some of the other key market such as Japan export large number of dairy products such as milk powder, condensed milk and cheese to developed nations. Presence of multiple farms with large herds, availability of advanced robotic solutions, increased accessibility through international brands, and growing awareness regarding significance of automated processes are expected to generate greater demand for this market.

India Milking Robots Market

India milking robots market held noteworthy share in 2023. This is attributed to unceasing growth in total milk production, presence of large herd farms and increasing adoption of automation processes. According to Agricultural and Processed Food Products Export Development Authority (APEDA), in 2022-2023, nearly 230.58 million tons of milk production was recorded in India. Growing demand for dairy products, increasing levels of export, encouraging government policies and availability of advanced technology is projected to fuel growth of this industry during forecast period.

North America Milking Robots Market

North America milking robots market held significant revenue share in the global market in 2023. Rising demand for dairy products, the increasing necessity to reduce labor costs, and advancements in technology associated with milking robotic systems are the factors driving the growth of this region. These robots are highly preferred over manual milking methods, resulting in improved efficiency and productivity of livestock farms, ultimately connecting to the increasing economic benefits.

U.S. Milking Robots Market Trends

The U.S. milking robots market dominated the North America industry and accounted for the revenue share of 80.7% in 2023. This market is primarily driven by factors such as growing adoption of automated processes, cost reduction benefits provided by the automated milking rotaries (AMRs), presence of global and domestic brands in the country, and early adoption trends.

Europe Milking Robots Market Trends

Europe milking robots’ market was identified as a lucrative region in 2023. The existence of leading milk producers, growing demand for milk and milk products and availability of innovation-backed automation solutions are projected to drive growth for this market. Research & development activities by institutes and companies, presence of multiple large enterprises in the region and growing awareness regarding the benefits offered by the milking robots are some of the key growth drivers for this regional industry.

The UK milking robots’ market is anticipated to experience a significant CAGR during forecast period. The availability of advanced machines, enhanced productivity and animal well-being attained through monitored milking, and data driven operations accomplished by farms have driven the growth of this industry in recent past. Enhanced availability, growing demand for milk & milk products and innovative products introduced by numerous global players are expected to generate greater demand in this market.

Key Milking Robots Company Insights

Some of the key companies in the milking robots market include AMS Galaxy USA, DeLaval., DAIRYMASTER, Fullwood JOZ, GEA Group Aktiengesellschaft, and others. Players are focusing on R&D activities to introduce innovative robotics solutions to meet the changing requirements of the dairy industry. Some of the key strategies adopted by the major market participants include collaborations, global expansions, adoption of the latest technology and effective post-sale services.

- DeLaval, a global milking robots technology company, offers comprehensive solutions designed to enhance dairy farmers' production through improved technology assistance and animal well-being.

Key Milking Robots Companies:

The following are the leading companies in the milking robots market. These companies collectively hold the largest market share and dictate industry trends.

- AMS Galaxy USA

- BouMatic (Madison One Holdings, LLC)

- DeLaval

- DAIRYMASTER

- Fullwood JOZ

- GEA Group Aktiengesellschaft

- Lely

- Milkomax Solutions laitières

- Nedap N.V.

- System Happel GmbH

- Waikato Milking Systems NZ LP.

- YASKAWA ELECTRIC CORPORATION.

Recent Developments

-

In January 2024, DeLaval introduced the VMS Batch Milking system, a novel method aiming to improve efficiency and decrease labor in robotic milking technology. Rancho Pepper Dairy installed 22 DeLaval VMS V300 units to manage 2,000 cows in 2022.

-

In August 2023, Fullwood JOZ the launched improved milking robot software named, FULLSENSE. An offering capable of converting complex data into easy to interpret information, enabling the dairy farmers to make informed decisions. The enhancement in software technology has resulted in data availability related to areas such as changes in input, fluctuations in milk production, and abnormal behavior in animals.

Milking Robots Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.39 billion

Revenue forecast in 2030

USD 6.32 billion

Growth Rate

CAGR of 10.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Robotics system, herd size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Netherlands, Poland, Italy, China, Japan, India, New Zealand, Australia, Brazil, South Arabia, UAE, and South Africa

Key companies profiled

AMS Galaxy USA; BouMatic (Madison One Holdings, LLC); DeLaval.; DAIRYMASTER; Fullwood JOZ; GEA Group Aktiengesellschaft; Lely; Milkomax solutions laiteres ; Nedap N.V.; System Happel GmbH; Waikato Milking Systems NZ LP.; YASKAWA ELECTRIC CORPORATION.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Milking Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the milking robots market report based on robotics system, herd size and region.

-

Robotics System Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Stall Unit

-

Multi-Stall Unit

-

Rotary System

-

-

Herd Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 100

-

Between 100 and 1,000

-

Above 1,000

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

Poland

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

New Zealand

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.