- Home

- »

- Consumer F&B

- »

-

Millet Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Millet Market Size, Share & Trends Report]()

Millet Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet), By End-use (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-323-5

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Millet Market Summary

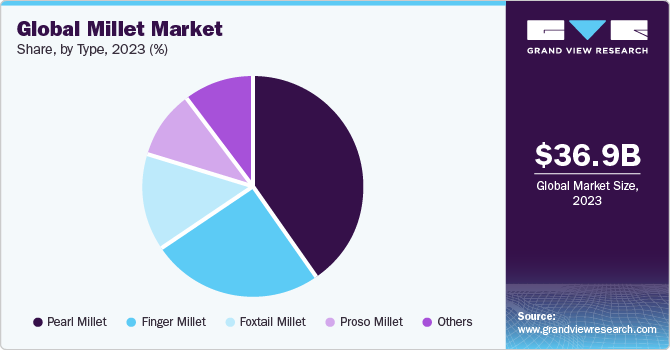

The global millet market size was estimated at USD 36.94 billion in 2023 and is projected to reach USD 55.71 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. Millets are known for their health benefits, including being a good source of protein, fiber, vitamins, and minerals.

Key Market Trends & Insights

- Asia Pacific dominated the market with a revenue share of 42.8% in 2023.

- India accounted for the largest share of the millet market in Asia Pacific in 2023.

- By type, pearl millet segment accounted for the revenue share of 40.5% in 2023.

- By end-use, B2B end use accounted for the revenue share of 85.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 36.94 Billion

- 2030 Projected Market Size: USD 55.71 Billion

- CAGR (2024-2030): 6.2%

- Asia Pacific: Largest market in 2023

The rising consumer awareness of these benefits drives demand. Moreover, there is a growing trend towards vegetarian and vegan diets, as well as a general increase in the consumption of plant-based proteins among omnivores. Millet, being a versatile and high-protein legume, is a key component of many plant-based diets.The expanding market for millet can be attributed to a convergence of consumer interests and broader market trends. The growing awareness of millet's health and nutritional benefits is the most essential. Millet appeals to health-conscious people, including those with gluten intolerance or celiac disease, because they are high in vitamins, minerals, dietary fiber, and protein, and they are gluten-free. This health-driven demand is augmented by a growing consumer interest in dietary diversity, with millet providing a nutritious alternative to traditional grains such as wheat and rice. Sustainability concerns also play a significant role in millet's rising popularity. As resilient crops require minimal water, they are an environmentally sustainable choice, aligning with the increasing consumer preference for eco-friendly food options. This trend is bolstered further by a cultural and traditional revival in areas where millets were once a staple, particularly in Asia and Africa.

Government policies and support in various countries have also contributed to the growth of the millet market. Through research, subsidies, and promotional campaigns, governments are advocating for millet due to their nutritional benefits and low environmental impact. The food industry's innovation in developing a wide array of millet-based products, from breakfast cereals to baking ingredients, has made these grains more accessible and appealing to a broad consumer base.

Based on data from the Food and Agriculture Organization (FAO), the worldwide production of millet reached approximately 28.33 million metric tons in 2019, and this figure rose to 30.08 million metric tons by 2021. Notably, India emerged as the largest global producer, holding a significant 43.0% share of the global millet market in 2021. Within India, various types of millet, including Sorghum (jowar), Pearl Millet (bajra), Finger millet (ragi), and other minor millet, are cultivated. According to the Ministry of Agriculture and Farmers Welfare, millet production in India has exhibited growth, increasing from 14.52 million metric tons in 2015-16 to 17.96 million metric tons in 2020-21.

Moreover, the globalization of diets and the willingness of consumers to explore different culinary traditions have led to a greater acceptance of millet. The grains are increasingly included in diets focused on fitness and weight management due to their high fiber content and low glycemic index, which aid in better sugar control and prolonged satiety.

Market Concentration & Characteristics

The millet market has seen innovation in product offerings, including millet-based flour, snacks, breakfast cereals, and ready-to-eat meals. These products cater to modern consumer preferences for convenience and variety. In May 2023, ITC Foods launched its first millet cookies as part of the Sunfeast Farmlite brand. This launch is in line with ITC's Mission Millet initiative, which aims to develop a range of millet-based products, promote sustainable farming, and raise consumer awareness about the benefits of millet. The cookies come in two variants: multi-millet and choco-chip multi-millet.

Several market players such as ADM, Willmar International Limited, Cargill, Incorporated are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations related to import/export restrictions, tariffs, and non-tariff barriers can limit the global trade of millet. This can hinder the growth of the millet market and limit access to millet products in regions where they are not locally produced. Inconsistencies in regulations or standards across regions or countries can create confusion and challenges for millet producers and traders. Harmonizing standards can facilitate trade and market growth.

Millet is a diverse group of small-seeded grasses that are grown for their grains, which are used as food. While millets have unique properties and are valued for their nutritional content and resilience, there are some potential substitutes available for millet in various culinary applications, such as rice, wheat, barley, oats, corn, and so on.

Type Insights

Pearl millet accounted for the revenue share of 40.5% in 2023, due to its exceptional resilience to harsh climatic conditions, particularly drought and high temperatures, making it a vital crop in arid and semi-arid regions such as Africa and India. Its high nutritional value, including rich iron, fiber, and protein content, makes it a staple food in these areas, ensuring steady demand. In addition, pearl millet's versatility extends beyond human consumption to include animal feed and biofuel production, broadening its market appeal. Government initiatives promoting sustainable agriculture and food security in major producing countries further bolster its dominant position in the millet market.

Finger millet is anticipated to register a CAGR of 6.6% over the forecast period, due to increasing health awareness and its exceptional nutritional profile, which includes high calcium content, essential amino acids, and antioxidants. The rising demand for gluten-free products has significantly boosted its popularity, particularly among health-conscious and gluten-intolerant consumers. Finger millet is also being incorporated into a variety of modern food products, from health bars to baby foods, expanding its appeal.

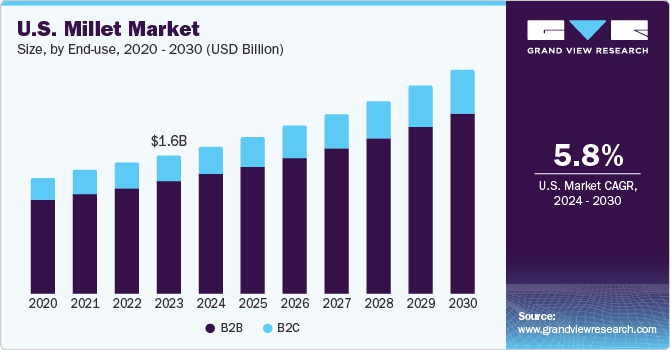

End-use Insights

B2B end use accounted for the revenue share of 85.9% in 2023. Millets are widely used in the food processing industry to manufacture various products such as breakfast cereals, snack foods, and bakery items. The demand from food manufacturers for healthy and sustainable ingredients is driving the bulk procurement of millets. The livestock feed industry relies on millets as a nutritious feed option, especially in regions where other grains might be less viable due to climatic conditions. In addition, millets are utilized in the brewing industry, particularly for producing traditional and craft beers in certain regions.

The biofuel industry also contributes to the B2B demand for millets, utilizing their high biomass yield for ethanol production. Government and institutional procurement programs aimed at promoting food security and sustainable agriculture further bolster B2B market share, as these entities often purchase large quantities for distribution in public programs.

In B2B end use, breakfast foods application accounted for the revenue share of 32.8% in 2023. Consumers are becoming increasingly health-conscious, and many are looking for nutritious breakfast options. Millets are naturally rich in nutrients, including fiber, vitamins, and minerals, making them an attractive choice for those seeking a healthy start to their day. In addition, millets are naturally gluten-free, which appeals to individuals with gluten sensitivities or celiac disease. As awareness of gluten-related issues grows, there is a higher demand for gluten-free breakfast options, and millet-based cereals and breakfast products fit this niche.

B2C end use is anticipated to register a CAGR of 6.87% over the forecast period due to rising consumer awareness about the health benefits of millets. As more people seek nutritious, natural, and gluten-free food options, millets are becoming increasingly popular for their high fiber, vitamins, and minerals content. The trend towards healthier eating habits and the desire for diverse, sustainable food sources drive demand for millet-based products directly from consumers. Furthermore, the expansion of e-commerce platforms and health food stores has made it easier for consumers to access a wide variety of millet products, including flours, snacks, and ready-to-eat items.

Regional Insights

The millet market in North America is expected to grow at a CAGR of 5.5% from 2024 to 2030.The millet market in North America is experiencing growth primarily due to the increasing health consciousness among consumers. With a rising awareness of gluten intolerance and celiac disease, millet's gluten-free nature makes it a preferred choice. In addition, North Americans are seeking out ancient grains for their superior nutritional profiles, and millet's high protein, fiber, and mineral content fits this demand. The region's strong vegan and plant-based movement also drives millet's popularity as a versatile plant protein source. Furthermore, the farm-to-table trend and support for sustainable agriculture align with millet's low water requirement and resilience to climate change, appealing to environmentally conscious consumers.

The millet market in the U.S. held a market share of 77.1% of the North America market in 2023. The nation's efforts to combat obesity and diabetes have highlighted millet's low glycemic index and high fiber content, making it a popular choice for managing weight and controlling blood sugar. The fitness and sports nutrition industry also values millet's balanced amino acid profile and quick digestibility, making it ideal for muscle recovery and endurance.

Asia Pacific Millet Market Trends

Asia Pacific dominated the market with a revenue share of 42.8% in 2023. Millet has a long history of cultivation and consumption in many countries across the Asia Pacific region. They are staples in traditional diets and hold cultural significance. As people reconnect with their culinary heritage, there is a renewed interest in millet. The region is home to a wide variety of millet species, including finger millet, pearl millet, foxtail millet, and more. This diversity allows for a range of culinary applications and preferences.

India accounted for the largest share of the millet market in Asia Pacific in 2023. India is the world's largest millet producer, growing about 41% of the total global supply in 2020. Millets are adapted to a wide range of ecological conditions and are often grown on skeletal soils, making them a perfect solution for dryland smallholder farmers. Millets are popular in developing regions, such as India and Africa, where food and nutritional security are major challenges. The high drought tolerance capacity of the crop allows it to be cultivated in adverse conditions, and it can withstand high temperatures and grow on poor soils with little or no external inputs. In addition, the Indian government has taken several initiatives to promote millet cultivation and consumption, including the launch of the National Mission on Sustainable Agriculture (NMSA) and the National Food Security Mission (NFSM). India's millet exports are also on the rise, with most of the exports going to the Middle East and North Africa.

Europe Millet Market Trends

The millet market in Europe is projected to grow at a CAGR of 5.9% from 2024 to 2030.In Europe, the millet market's growth is largely attributed to the continent's strong organic food sector. European consumers prioritize organic, non-GMO products, and millet, often grown without pesticides, meets these criteria. The region's focus on biodiversity conservation also favors millet, as it helps maintain crop diversity. Europe's aging population is another factor; they seek out millet for its potential benefits in managing type 2 diabetes and its high magnesium content, which supports bone health.

The millet market in Germany is projected to grow at a CAGR of 6.1% from 2024 to 2030. The robust organic food sector, the largest in Europe, favors millet for its low pesticide requirements and non-GMO status, meeting the stringent Bio-Siegel (organic seal) standards. Germany's focus on sustainability and the circular economy promotes millet cultivation, as its short growing season allows for double cropping, maximizing land use efficiency.

Central & South America Millet Market Trends

The market for millet in the Central & South America region is expected to grow at a significant CAGR of 3.0% from 2024 to 2030. Central and South America's millet market is growing as the region grapples with food sovereignty issues. Countries are seeking to reduce dependence on imported grains, and millet, adaptable to various climates, offers a viable local crop. Its compatibility with intercropping systems suits the region's traditional farming practices. There's also a strong connection between millet and indigenous heritage in countries like Peru and Mexico, driving interest as part of a broader cultural revival.

Middle East And Africa Millet Market Trends

The market for millet in the Middle East and Africa (MEA) region is experiencing significant growth due to a convergence of factors. These include the inherent health and nutritional benefits of millet, which are rich in dietary fiber, vitamins, and minerals, making them a popular choice among health-conscious consumers. Millets are also gluten-free and have a low glycemic index, catering to those with specific dietary requirements and fueling the demand for healthier food options.

Furthermore, millets hold cultural and historical significance in many communities across the MEA region, driving a resurgence in their consumption as people seek to embrace traditional and local foods.

Key Millet Company Insights

Nestlé S.A., Seedway, LLC, ADM, Cargill, Incorporated, Mayoora Foods are some of the dominant players operating in millet market.

-

Nestlé has a vast geographical presence and operates in nearly every corner of the world. They have a significant presence in various countries across Europe, the Americas, Asia, and Africa.

-

ADM has a global presence with significant operations in various regions including North America, Europe, Asia Pacific, and Middle East and Africa.

Pristine Organics,Sresta Natural Bioproducts Pvt. Ltd. are some of the emerging market players functioning in millet market.

- Pristine Organics offers a range of organic grains and pulses, including rice, wheat, lentils, and more. Various millet-based food products, including millet flours, millet flakes, and millet-based snacks.

Key Millet Companies:

The following are the leading companies in the millet market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- ADM

- Seedway, LLC.

- Ernst Conservation Seeds

- Eastern Colorado Seeds, LLC.

- Roundstone

- Mayoora Foods

- Nestlé S.A.

- Sresta Natural Bioproducts Pvt. Ltd.

- Pristine Organics

Recent Developments

-

In September 2023, Nestlé India launched a range of Nestlé a+ Masala Millet-based porridges. These porridges are made with a blend of locally sourced ingredients, including bajra (pearl millet), barley, vegetables, and a variety of spices. They come in two flavors, Tangy Tomato, and Veggie Masala, and can be prepared in just 2 minutes.

-

In May 2023, Bonn Group of Industries, a major FMCG food manufacturer in India, has introduced a range of millet-based bakery products, including Millet Pizza, Millet Bread, and Millet Burger. These products are made with Bajra, Jowar, and Ragi, offering a nutrient-rich superfood option. The initiative, with the tagline "Go Healthy With Millets," supports the International Millets Year and the Indian government's Millet Mission, promoting a healthy, millet-based diet for Indians.

-

In May 2023, ITC launched Sunfeast Farmlite Super Millets Cookies as part of its mission to "Help India Eat Better." The cookies, available in Multi Millet and Choco-chip Multi Millet variants, are made from a blend of millets like jowar and ragi and contain no added maida. They are a source of protein, iron, and fiber, balancing taste and nutrition. The Choco-chip variant adds a touch of indulgence, making these cookies a nutritious and enjoyable snacking option. This launch supports ITC's Mission Millet initiative.

Millet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.90 billion

Revenue forecast in 2030

USD 55.71 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy Spain; China; India; Japan; Indonesia; Australia & New Zealand; Brazil; South Africa.

Key companies profiled

Cargill; Incorporated; ADM; Seedway, LLC.; Ernst Conservation Seeds; Eastern Colorado Seeds, LLC.; Roundstone; Mayoora Foods; Nestlé S.A.; Sresta Natural Bioproducts Pvt. Ltd.; Pristine Organics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Millet Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global millet market report on the basis of type, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pearl Millet

-

Finger Millet

-

Foxtail Millet

-

Proso Millet

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

Breakfast Foods

-

Bakery Foods

-

Beverages

-

Fodder

-

Infant Foods

-

Others

-

-

B2C

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global millet market size was estimated at USD 36.94 billion in 2023 and is expected to reach USD 38.90 billion in 2024.

b. The global millet market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 55.71 billion by 2030.

b. Pearl millet accounted for the largest revenue share of 40.5% in 2023, due to its exceptional resilience to harsh climatic conditions, particularly drought and high temperatures, making it a vital crop in arid and semi-arid regions like Africa and India. Its high nutritional value, including rich iron, fiber, and protein content, makes it a staple food in these areas, ensuring steady demand. Additionally, pearl millet's versatility extends beyond human consumption to include animal feed and biofuel production, broadening its market appeal. Government initiatives promoting sustainable agriculture and food security in major producing countries further bolster its dominant position in the millet market.

b. Some key players operating in millet market include Cargill, Incorporated, ADM, Seedway, LLC., Ernst Conservation Seeds, Eastern Colorado Seeds, LLC., Roundstone, Mayoora Foods.

b. Key factors that are driving the market growth include rising preference for plant based diets and increasing processed food industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.