- Home

- »

- Communications Infrastructure

- »

-

Millimeter Wave Sensors & Modules Market Report, 2030GVR Report cover

![Millimeter Wave Sensors & Modules Market Size, Share & Trends Report]()

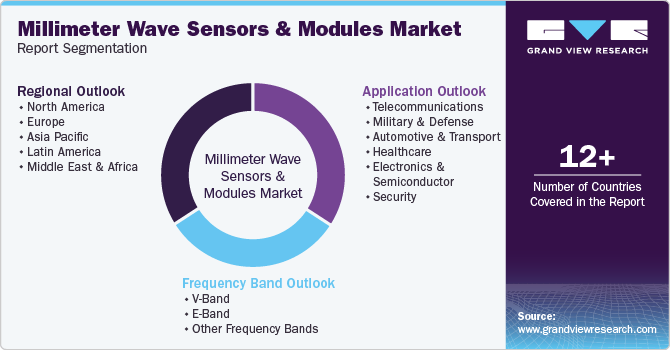

Millimeter Wave Sensors & Modules Market (2025 - 2030) Size, Share & Trends Analysis Report By Frequency Band (V-band, E-band, Other Frequency Bands), By Application, By Region, and Segment Forecasts

- Report ID: GVR-4-68038-697-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global millimeter wave sensors & modules market was valued at USD 103.0 million in 2024 and is projected to grow at a CAGR of 30.6% from 2025 to 2030. The rising demand for high-speed data transfer, driven by the proliferation of mobile broadband and high-definition multimedia applications, plays a significant role in the market's growth. In addition, advancements in telecommunication technologies, particularly the rollout of 5G networks, are heightening the necessity for millimeter wave technologies to support bandwidth-intensive applications such as video streaming and online gaming.

Furthermore, industries such as automotive are increasingly adopting millimeter wave sensors for their superior performance in low visibility conditions and their ability to provide accurate data in real-time scenarios. The automotive industry is a significant driver as manufacturers integrate these sensors into Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, enhancing safety and operational efficiency. In addition, continuous innovation in sensor technology and the growing adoption of smart devices across various sectors drive demand for millimeter-wave sensors and modules.

Moreover, expanding Internet of Things (IoT) applications necessitates enhanced connectivity solutions, further propelling the market forward. As smart cities evolve, integrating millimeter wave sensors into urban infrastructure facilitates improved traffic management, public safety monitoring, and environmental sensing. In addition, the military and defense sectors contribute significantly due to their increasing reliance on millimeter wave technology for surveillance and reconnaissance purposes. These sensors enhance target detection and tracking capabilities in challenging environments, solidifying their importance in the millimeter wave sensor and modules industry.

Frequency Band Insights

The e-band segment dominated the market with a revenue share of 63.4% in 2024, reflecting its widespread application in telecommunications and high-speed data transfer. The increasing demand for bandwidth-intensive applications, such as video streaming and online gaming, has driven the adoption of e-band frequencies, which offer high capacity and low latency. E-band frequencies, typically ranging from 60 GHz to 90 GHz, are particularly effective for point-to-point communications, enabling operators to deliver gigabit speeds over short distances. This segment's capacity to support advanced communication technologies, such as 5G networks and backhaul solutions, makes it an essential part of the changing landscape of the millimeter wave sensors & modules industry.

The v-band segment is projected to grow at a significant CAGR during the forecast period, fueled by its extensive use in military and defense applications. As organizations seek to enhance communication capabilities and data transfer speeds, the v-band's characteristics make it ideal for radar and satellite communications. Operating in the 57 GHz to 64 GHz range, v-band technology supports high data rates essential for modern military operations. For instance, defense contractors and original equipment manufacturers increasingly seek higher bandwidth to meet modern military and commercial needs, prompting a shift towards millimeter-wave frequencies for applications such as electronic warfare, satellite communications, and datalink systems. Manufacturers adapt their designs to leverage these higher frequencies as V-band technologies advance.

Application Insights

The telecommunications segment dominated the market with the largest share in 2024, driven by the rising demand for high-speed internet and connectivity solutions. With the adoption of smart devices and data-driven applications, telecom companies are investing heavily in millimeter wave technology to enhance their service offerings. For instance, HFCL's advanced millimeter wave products are undergoing trials to address the increasing demand for higher bandwidth in telecommunications. Moreover, the ongoing rollout of 5G networks is a significant factor contributing to this trend, as it requires robust infrastructure capable of supporting high-frequency transmissions. This emphasis on expanding network capabilities highlights the critical role of telecommunications in shaping the future of the millimeter wave sensors & modules industry.

The military and defense segment is expected to grow at the highest CAGR over the forecast period due to the adoption of millimeter wave sensors and modules for various applications. The demand for advanced communication systems, surveillance, and secure data transmission drives this expansion. Millimeter wave technology offers advantages such as higher bandwidth, lower latency, and improved security features, which are crucial for military operations. As defense strategies evolve to incorporate sophisticated technologies such as drones and real-time data analytics, the demand for reliable millimeter wave solutions continues to rise within the industry, emphasizing its strategic importance in modern warfare.

Regional Insights

The North America millimeter wave sensors & modules market is experiencing significant growth, driven by the demand for high-speed data transmission and advanced technologies. The region benefits from a strong telecommunications infrastructure and substantial investments in upgrading systems to support IoT applications and 5G networks. This environment fosters innovation and the development of new sensor technologies across various sectors.

U.S. Millimeter Wave Sensors & Modules Market Trends

The U.S. millimeter wave sensor and module market dominated the regional market in 2024, driven by key players such as Aviat Networks and E-band Communications. The focus on enhancing communication capabilities through advanced radar systems and telecom equipment is a major factor in this growth. In addition, the U.S. millimeter wave sensors & modules industry is characterized by a strong emphasis on integrating millimeter wave technology into consumer electronics, further expanding its applications across different industries.

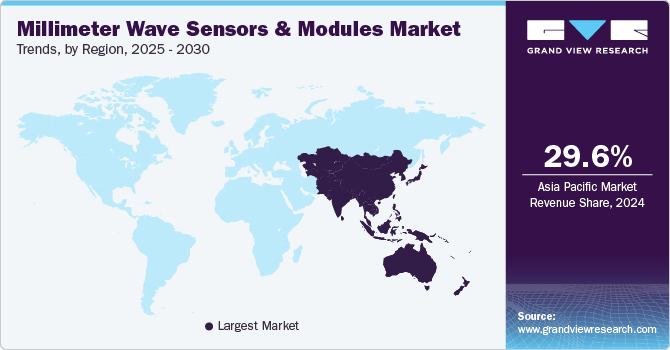

Asia Pacific Millimeter Wave Sensors & Modules Market Trends

The Asia Pacific millimeter wave sensors & modules market dominated the global market with a revenue share of 29.6% in 2024, largely due to its high population density, which makes millimeter wave solutions particularly effective for overcoming barriers and enhancing connectivity. Countries including Japan, South Korea, and India are investing heavily in telecommunications infrastructure to support the rollout of 5G networks, further propelling the adoption of millimeter wave sensors and modules across various applications.

The China millimeter wave sensor and module market dominated the regional market in 2024, supported by the country's position as a leading telecommunications equipment provider. Companies such as Huawei and ZTE are at the forefront of developing millimeter wave technologies, enabling extensive 5G coverage and innovative communication solutions. The Chinese government is also promoting initiatives such as "Made in China 2025" to boost manufacturing competitiveness and advance IT infrastructure.

Europe Millimeter Wave Sensors & Modules Market Trends

The Europe millimeter wave sensors & modules market is expected to witness significant growth due to the increasing demand for high-speed communication and the ongoing rollout of 5G networks across the region. Many European countries are investing heavily in telecommunications infrastructure, which facilitates the deployment of millimeter wave technology in various applications, including automotive radar systems and advanced imaging solutions. The rising integration of smart devices and the Internet of Things (IoT) further drives the need for enhanced connectivity solutions.

Key Millimeter Wave Sensors & Modules Company Insights

The millimeter wave sensors & modules market is growing rapidly, driven by several innovative companies. Aviat Networks enhances communication infrastructure with its microwave transport solutions for high-capacity data transmission. Keysight Technologies offers advanced design and test solutions for developing high-performance millimeter wave applications. Ceragon specializes in wireless backhaul solutions that utilize millimeter wave technology to improve connectivity for mobile operators, while NEC Corporation integrates millimeter wave technology into its telecommunications and IT solutions to meet the demand for high-speed data transmission. These companies are significantly advancing the millimeter wave sensors & modules industry.

-

Aviat Networks is a microwave transport solutions provider specializing in high-capacity wireless communication systems. The company delivers innovative and reliable connectivity solutions that enhance communication infrastructure for various industries, including telecommunications, public safety, and utilities. Aviat Networks offers a range of products that leverage millimeter wave technology to provide efficient backhaul and front-haul solutions, ensuring high-speed data transmission and improved network performance.

-

Ceragon is a global innovator in wireless connectivity solutions, primarily focusing on 5G wireless transport. The company designs and manufactures advanced communication systems that facilitate high-capacity wireless backhaul and front-haul connections. With its recent acquisition of Siklu, Ceragon has expanded its portfolio to include a wide range of millimeter wave products, enabling point-to-multipoint connectivity and supporting diverse applications across various sectors.

Key Millimeter Wave Sensors & Modules Companies:

The following are the leading companies in the millimeter wave sensors & modules market. These companies collectively hold the largest market share and dictate industry trends.

- AVIAT NETWORKS

- Ceragon

- E-band Communications LLC

- Eravant

- QuinStar Technology, Inc.

- Farran

- Keysight Technologies

- Mistral Solutions Pvt. Ltd.

- Smith’s Interconnect

- NEC Corporation

Recent Development

-

In February 2024, Sivers Semiconductors AB announced the launch of its new cost-effective Radio Frequency (RF) Module BFM02803. This module covers the 5G FR2 millimeter wave bands N258, N257, and N261, ranging from 24.25 to 29.5 GHz. The BFM02803 supports 2x2 MIMO with dual-layer polarization for both uplink and downlink across channels up to 1.2 GHz. It features 32 dual-polarized antenna elements with advanced 2D beam steering capacity in both elevation and azimuth. With a transmitter power exceeding +50 dBm per polarization, this innovative RF module is positioned to support a wide range of Fixed Wireless Access (FWA) deployments while minimizing total ownership costs.

-

In December 2023, Ceragon Networks Ltd., a 5G wireless transport solutions provider, announced Siklu’s acquisition. This acquisition enhanced Ceragon's offerings by creating end-to-end comprehensive solutions tailored to global private networks and small service providers. The merger allows Ceragon to gain direct access to Siklu's leadership in the millimeter wave market across North America.

Millimeter Wave Sensors & Modules Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 139.3 million

Revenue forecast in 2030

USD 529.4 million

Growth rate

CAGR of 30.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD thousand and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frequency Band, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

AVIAT NETWORKS; Ceragon; E-band Communications LLC; Eravant; QuinStar Technology, Inc.; Farran; Keysight Technologies; Mistral Solutions Pvt. Ltd.; Smiths Interconnect; NEC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Millimeter Wave Sensors & Modules Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global millimeter wave sensors & modules market report based on frequency band, application, and region:

-

Frequency Band Outlook (Revenue, USD Thousand, 2018 - 2030)

-

V-Band

-

E-Band

-

Other Frequency Bands

-

-

Application Outlook (Revenue, USD Thousand, 2018 - 2030)

-

Telecommunications

-

Military & Defense

-

Automotive & Transport

-

Healthcare

-

Electronics & Semiconductor

-

Security

-

-

Regional Outlook (Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.