- Home

- »

- Advanced Interior Materials

- »

-

Mine Closure & Restoration Market Size, Share Report, 2033GVR Report cover

![Mine Closure And Restoration Market Size, Share & Trends Report]()

Mine Closure And Restoration Market (2025 - 2033) Size, Share & Trends Analysis Report By Mine Type (Coal Mines, Metal Mines), By Service (Land Reclamation, Tailings Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-773-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mine Closure And Restoration Market Summary

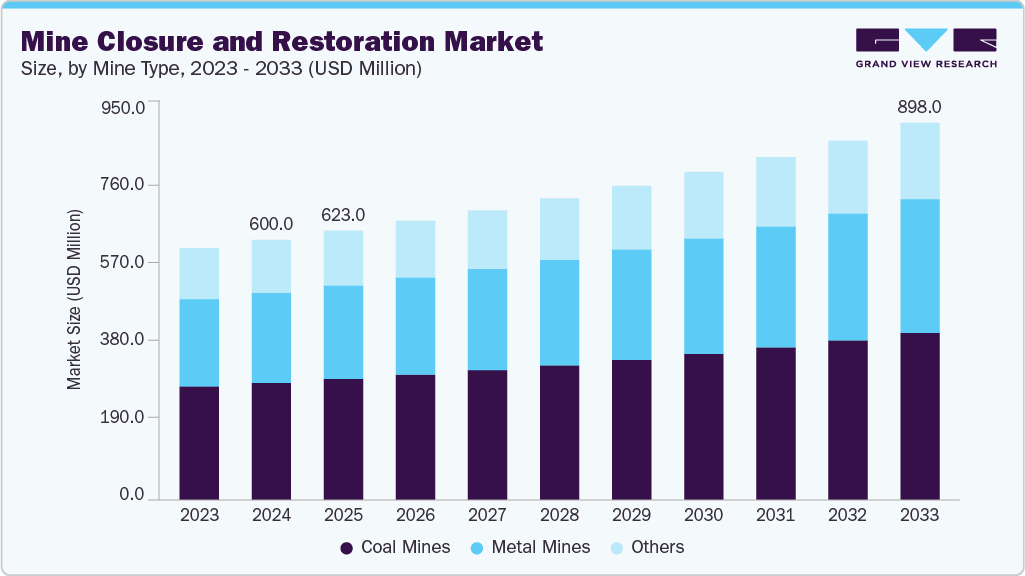

The global mine closure and restoration market size was estimated at USD 600.0 million in 2024 and is projected to reach USD 898.0 million by 2033, at a CAGR of 4.7% from 2025 to 2033. The market growth is driven by increasing regulatory pressure worldwide.

Key Market Trends & Insights

- Asia Pacific dominated the mine closure and restoration market with the largest market revenue share of 60.3%.

- By mine type, metal mines segment is anticipated to register a CAGR of 4.9% from 2025 to 2033.

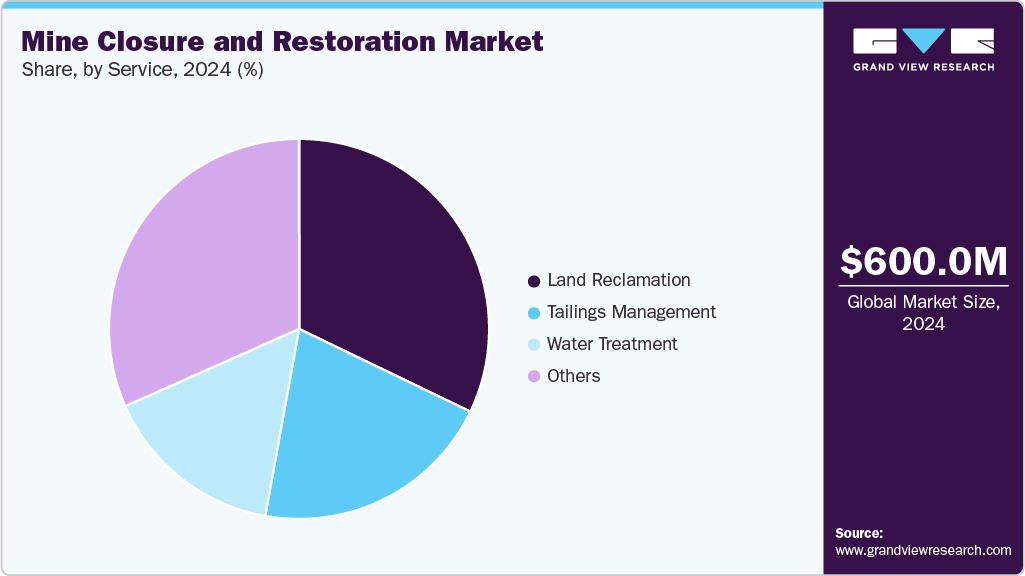

- By service, land reclamation segment accounted for the largest market revenue share of over 32% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 600.0 Million

- 2033 Projected Market Size: USD 898.0 Million

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Governments and environmental agencies are enforcing stricter policies requiring mining companies to close and rehabilitate mining sites responsibly. These regulations are designed to minimize environmental damage, including soil degradation, water contamination, and biodiversity loss. Compliance with these laws compels mining operators to invest in closure planning, site restoration, and post-mining land management, creating a consistent demand for specialized services and technologies in this sector. Sustainability and corporate social responsibility initiatives are emerging as key drivers for the market. Mining companies are increasingly aware that responsible closure practices enhance their public image, attract investment, and reduce long-term liability. Investors and stakeholders favour companies that demonstrate environmental stewardship, motivating mining operators to adopt the best reclamation, waste management, and ecosystem restoration practices. This shift towards sustainable mining practices fosters professional closure and market growth for restoration services.Technological advancements are playing a pivotal role in market growth. Innovative solutions such as remote sensing, geographic information systems, and drone-based monitoring enable more efficient planning and execution of mine closure projects. Advanced soil remediation techniques, vegetation management strategies, and water treatment technologies improve the success rate of rehabilitation efforts, making the process faster, cost-effective, and environmentally compliant. The adoption of these technologies drives demand for specialized equipment and expertise, boosting market expansion.

Economic considerations also influence market growth. Mining companies are increasingly factoring in closure costs during the operational phase to avoid unexpected financial liabilities later. Efficient closure and restoration processes can reduce long-term monitoring and maintenance expenses. In addition, governments and financial institutions are introducing financial assurance and bonding requirements, ensuring sufficient funds are allocated for post-mining rehabilitation, further stimulating market demand.

Furthermore, the rising awareness of environmental and social impacts associated with abandoned or poorly restored mines contributes to market growth. Public concern about landscape degradation, water pollution, and health risks drives demand for professionally managed closure and restoration projects. Communities living near mining sites often demand effective rehabilitation, prompting mining companies to engage restoration and land reclamation experts. This increasing social pressure ensures a steady requirement for mine closure services across developed and emerging mining regions.

Drivers, Opportunities & Restraints

Stringent environmental regulations and growing corporate focus on sustainability are driving the market. Governments across the globe are enforcing policies that require mining companies to rehabilitate sites post-extraction to minimize environmental degradation. Compliance with these regulations encourages investment in advanced restoration techniques, site monitoring, and ecological management. In addition, increasing awareness of corporate social responsibility and maintaining a positive public image motivates companies to adopt effective closure and restoration practices, fueling market growth.

Significant opportunities exist in emerging markets and regions with expanding mining activities. As mining operations in Africa, the Asia Pacific, and Latin America continue to grow, the demand for professional closure and rehabilitation services is rising. Technological innovations, such as drone-based site monitoring, remote sensing, and advanced soil remediation methods, offer the chance to improve efficiency and reduce costs, creating a potential for service providers to expand their offerings. Furthermore, repurposing closed mine sites for renewable energy projects, agriculture, or tourism presents additional avenues for market development.

The market faces certain restraints, primarily related to high operational costs and technical complexities. Closure and restoration processes often require specialized equipment, skilled labor, and long-term site monitoring, which can financially burden mining operators. In addition, variability in site conditions, climate, and soil types can complicate rehabilitation efforts, affecting the success rate of restoration projects.

Mine Type Insights

The coal mines segment is witnessing strong growth due to the increasing global shift toward cleaner energy sources and the gradual phase-out of coal-based power generation. Governments are introducing strict environmental regulations that mandate proper closure, rehabilitation, and post-mining land use of coal sites. This has created a consistent need for professional restoration services involving land reclamation, soil stabilization, water treatment, and vegetation recovery. In addition, several countries are launching transition funds and policy frameworks to support the sustainable closure of coal mines, which is driving investments in mine remediation projects.

The metal mines segment is anticipated to register the fastest CAGR over the forecast period. Regulatory agencies are mandating detailed closure plans that include soil and water remediation, tailings stabilization, and long-term monitoring to ensure minimal ecological damage. The growing focus on sustainable mining practices has prompted companies to invest in closure strategies from the early stages of mine planning. In addition, the increased scrutiny from investors and environmental groups is compelling mining firms to demonstrate their commitment to responsible closure and post-mining land rehabilitation.

Service Insights

The land reclamation segment under the service category is experiencing strong growth due to the increasing emphasis on restoring land disturbed by stockpiled materials such as overburden, tailings, and waste rock. Growing interest in recovering value from legacy stockpiles and advances in reclamation technology are creating additional growth for the land reclamation segment under stockpiling entities. Interest in secondary resource recovery, such as reprocessing stockpiled ore and tailings for critical minerals, turns previously abandoned stockpiles into commercial opportunities, making reclamation economically attractive. New techniques in soil amendment, ecological restoration, and remote monitoring lower long-term maintenance costs and improve success rates for revegetation and habitat restoration, which increases the number of projects that proceed from planning to execution.

Tailings management is anticipated to register the fastest CAGR over the forecast period. Mining companies are increasingly required to implement robust tailings containment, monitoring, and rehabilitation measures to prevent soil and water contamination, dam failures, and long-term environmental liabilities. Investor and community pressure for sustainable mining practices also pushes companies to adopt advanced tailings management solutions that reduce risk and improve site safety, thereby creating higher demand for professional tailings management services.

Regional Insights

The mine closure and restoration market in the Asia Pacific region is experiencing robust growth, driven by regulatory frameworks, technological advancements, and increasing environmental awareness. Governments across the region are implementing stringent environmental regulations that mandate comprehensive mine closure and rehabilitation plans. For instance, China's "Green Mine" program aims to reclaim over 8,000 abandoned mines by 2025, promoting environmentally friendly mining practices and reclamation efforts. Similarly, India's Maharashtra state has introduced new mining regulations to transform abandoned coal mines into safe and stockpiling production community assets, emphasizing land restoration and safety measures.

North America Mine Closure And Restoration Market Trends

The mine closure and restoration market in North America is experiencing significant growth due to strict environmental regulations and an increased focus on sustainability. In the U.S., laws require mining companies to restore mined lands to their original condition or an approved alternative use, which has driven mining operators to invest in comprehensive closure and rehabilitation programs. Growing awareness of environmental degradation caused by mining activities has encouraged public and private sectors to prioritize ecological restoration, creating steady demand for specialized services and technologies.

The U.S. mine closure and restoration market is expected to grow significantly over the forecast period. The U.S. government has implemented comprehensive policies that mandate the restoration of mined lands, compelling mining companies to invest in reclamation efforts. For instance, the Surface Mining Control and Reclamation Act (SMCRA) requires operators to restore mined areas to their original or equivalent condition, ensuring that land is returned to beneficial use. In addition, the U.S. Interior Department has introduced measures to enhance the recovery of critical minerals from mine waste, including streamlining federal regulations and making mine waste projects eligible for federal funding. This initiative supports environmental cleanup and strengthens domestic mineral stockpiling production, reducing reliance on foreign sources.

Europe Mine Closure And Restoration Market Trends

The mine closure and restoration market in Europe is experiencing significant growth, propelled by stringent environmental regulations, technological advancements, and a heightened emphasis on sustainability. The European Union has implemented comprehensive policies that mandate the restoration of mined lands, compelling mining companies to invest in reclamation efforts. For instance, the EU's Directive on Environmental Liability requires operators to restore mined areas to their original or equivalent condition, ensuring that land is returned to beneficial use. In addition, countries such as the United Kingdom, Germany, and France are investing heavily in mine reclamation projects to address the legacy of historic mining activities, further driving market expansion.

Middle East & Africa Mine Closure And Restoration Market Trends

The mine closure and restoration market in the MEA is experiencing significant growth, driven by several key factors. Governments in the region are implementing stringent environmental regulations, compelling mining companies to invest in sustainable practices and post-mining land rehabilitation. For instance, the UAE's Federal Law No. 24 of 1999 mandates environmental protection, influencing mining operations to adopt responsible closure and restoration strategies. In addition, the increasing awareness of environmental degradation caused by mining activities is prompting both public and private sectors to prioritize ecological restoration, leading to a surge in demand for specialized services and technologies.

Latin America Mine Closure And Restoration Market Trends

The mine closure and restoration market in Latin America is experiencing significant growth, driven by regulatory frameworks, environmental concerns, and technological advancements. Governments across the region are implementing stringent environmental regulations that mandate the restoration of mined lands, compelling mining companies to invest in reclamation efforts. For instance, Brazil has introduced progressive restoration mandates, while Chile and Peru show accelerating growth in ecological restoration services. These regulatory frameworks create a favorable environment for market development.

Key Mine Closure And Restoration Company Insights

Some key players operating in the market include Tetra Tech, WSP, and others.

-

Tetra Tech is a global consulting and engineering firm specializing in water, environment, infrastructure, resource management, and energy projects. With a strong presence across North America, Europe, and Asia-Pacific, the company leverages scientific expertise and technological solutions to address complex environmental challenges. Tetra Tech provides comprehensive services in the mine closure and restoration sector, including environmental impact assessments, closure planning, reclamation design, waste management, and post-closure monitoring.

-

WSP is an international professional services firm with expertise in engineering, design, and environmental consulting. The company operates in over 40 countries and delivers infrastructure, energy, resources, and environmental solutions. WSP emphasizes sustainability and resilience, providing strategic planning, technical consulting, and project management services to help clients address complex environmental and engineering challenges. Its multidisciplinary teams combine local knowledge with global expertise to support large-scale projects and regulatory compliance initiatives.

Key Mine Closure And Restoration Companies:

The following are the leading companies in the mine closure and restoration market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Forgen

- Geosyntec Consultants

- RESPEC

- SLR Consulting

- Sovereign Consulting

- Stantec

- Tetra Tech

- Veolia

- WSP

Recent Development

-

In July 2025, India’s mining sector marked a significant milestone by initiating scientific closure of mines, with ten sites closed under updated frameworks and 147 more planned for closure using advanced restoration techniques. These closures embraced the “6Rs” approach-focusing on reclamation, rehabilitation, reuse, and restoration, while the sector adopted the new ‘Reclaim Framework’ to ensure community participation and transparent, sustainable recovery of mining lands.

Mine Closure & Restoration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 623.0 million

Revenue forecast in 2033

USD 898.0 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service, mine type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia; UAE

Key companies profiled

AECOM; Forgen; Geosyntec Consultants; RESPEC; SLR Consulting; Sovereign Consulting; Stantec; Tetra Tech; Veolia; WSP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mine Closure And Restoration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mine closure and restoration market report based on mine type, service, and region:

-

Mine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Coal Mines

-

Metal Mines

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Land Reclamation

-

Tailings Management

-

Water Treatment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mine closure and restoration market size was estimated at USD 600.0 million in 2024 and is expected to reach USD 623.0 million in 2025.

b. The global mine closure and restoration market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 898.0 million by 2033.

b. The coal mines segment dominated the market with a revenue share of 44.9% in 2024.

b. Some of the key players of the global mine closure and restoration market are Tetra Tech, Stantec, Geosyntec Consultants, WSP, RESPEC, SLR Consulting, Veolia, Sovereign Consulting, AECOM, Forgen, and others.

b. The key factor driving the growth of the global mine closure and restoration market is the increasing emphasis on environmental sustainability and regulatory compliance, which compels mining companies to adopt comprehensive closure and rehabilitation practices to mitigate ecological impact and ensure safe land reuse.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.