- Home

- »

- Beauty & Personal Care

- »

-

Mineral Cosmetics Market Size, Share & Growth Report 2030GVR Report cover

![Mineral Cosmetics Market Size, Share & Trends Report]()

Mineral Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Face Products, Lip Products, Eye Products), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-865-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mineral Cosmetics Market Summary

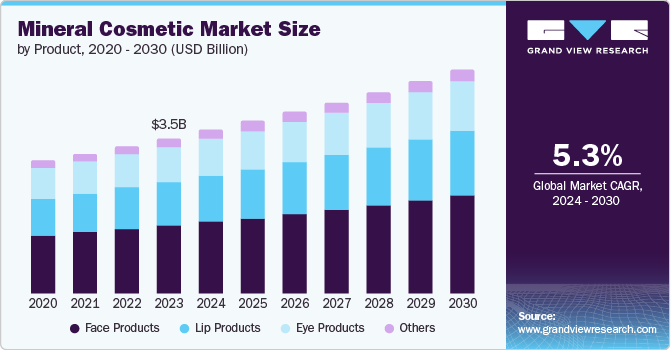

The global mineral cosmetics market size was valued at USD 3.46 billion in 2023 and is expected to reach USD 4.97 billion by 2030, growing at a CAGR of 5.34% from 2024 to 2030. The increasing awareness of harmful side effects of inorganic and chemical-based cosmetics is driving the market of natural beauty products.

Key Market Trends & Insights

- North America dominated the mineral cosmetics market, with the highest revenue share of 35.3% in 2023.

- The Asia Pacific region is expected to register the fastest growth at a CAGR of 5.88 % over the forecast period.

- Based on product, the face product segment held the largest share, accounting for 44.0% of the revenue in 2023.

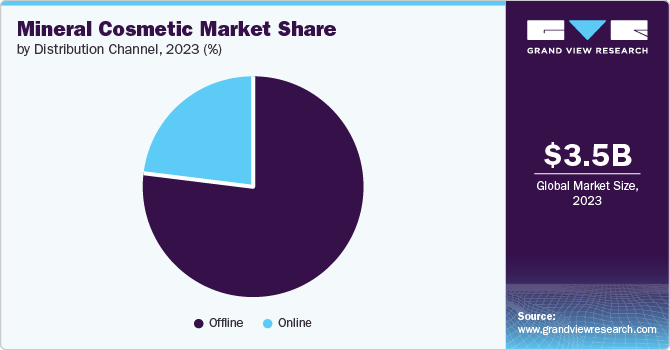

- Based on distribution channel, the offline segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.46 Billion

- 2030 Projected Market Size: USD 4.97 Billion

- CAGR (2024-2030): 5.34%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Mineral cosmetics are made of zinc oxide, iron oxides, titanium dioxide, organic oils, and mica powder instead of artificial preservatives, wax, or oils. Using these products as sunscreen protects the skin from harmful UV rays in sunlight and provides a soothing experience. Consumers are inclined more towards natural beauty products by their long-lasting and irritation-free experience. These products suit all skin types and provide better coverage, ultimately gaining huge popularity worldwide.Manufacturing companies are emphasizing research with an objective to develop multi-function products that can safely be used for multiple skin issues. Ultimately, consumers prefer these products instead of using different products. Also, key brands operating globally in this market are launching customized products according to skin types in various geographical regions, attracting a loyal customer base.

In February 2024, a new biotech company, Alys Pharma, launched with USD 100 million in seed financing to develop biological therapies for various skin diseases such as psoriasis, eczema, and vitiligo. Alys Pharma's strategic focus on harnessing the immune system's power to treat dermatological diseases underscores its commitment to pioneering effective therapies and improving the quality of life for patients worldwide.

Additionally, companies are deploying dedicated sales and marketing strategies, such as celebrity endorsements and influencer marketing, which result in direct communication with young and potential customers, further expanding the market.

Product Insights

The face product segment held the largest share, accounting for 44.0% of the mineral cosmetics market revenue in 2023. Women have comparatively more sensitive skin, and exposure to sunlight causes skin problems like aging, tanning, and dullness. Also, the number of working women across the world is gradually increasing, increasing the need for facial care products such as foundation, face powder, concealer, bronzer, and blush. Because of their built-in SPF features, mineral cosmetics are rapidly gaining popularity.

The lip products segment is projected to grow at the fastest CAGR, growing at a CAGR of 5.7% over the forecast period. Along with enhanced appearance, these products provide moisturization and protection to the lips. Additionally, a wide variety of colors and textures are available in the product segment. Particularly in the digital era, women prefer social media sites and beauty blogs to know about the latest makeup, skincare, and beauty product trends. Many influencers and celebrities promote mineral cosmetics and share their feedback, fueling the segmental growth over the forecast period.

Distribution Channel Insights

The offline segment held the largest revenue share in 2023. These products have a significant penetration in the offline market due to the widespread retail network and distribution. Also, most customers prefer in-store purchases as they can check the product quality and learn about usage. The number of supermarkets and hypermarkets is also expected to grow in developing countries such as India, Brazil, and China, with a growing middle-class population. Hence, manufacturers in these countries are aiming to expand their customer base through local retailers and supermarket chains.

The online segment is expected to register the fastest growth, with a CAGR of 6.06 % from 2020 to 2030. The growing popularity of e-commerce websites and mobile applications is boosting the sale of products worldwide. Additionally, the number of internet and smartphone users is continuously growing in developing countries, fueling the advancements in e-commerce. Companies are extending their distribution channels by focusing on sales through online channels.

Regional Insights

North America dominated the mineral cosmetics market, with the highest revenue share of 35.3% in 2023. Increasing consciousness about the use of organic products and the cons of chemical-based cosmetics has increased the demand for natural products in the region. Because of the widespread influence of social media, consumers are well aware of the advantages of mineral cosmetics and strictly prefer natural skin care products.

Asia Pacific Mineral Cosmetics Market Trends

The Asia Pacific region is expected to register the fastest growth at a CAGR of 5.88 % over the forecast period. Highly populated countries such as China and India contribute majorly to growing product demand. The increasing number of working women and the continuously improving income range of the middle-class population are accelerating the market growth. Grooming has become an integral part of the lifestyles of working women, and multifunction products cater to safe and quick solutions for many skin problems. Additionally, the influence of celebrities through various media platforms to use beauty products and the risk-free nature of mineral cosmetics help women strike a balance between self-care and enhanced appearance. Ultimately, the popularity of these products is continuously increasing.

U.S. Mineral Cosmetics Market Trends

The U.S. mineral cosmetics market has seen a remarkable surge in the demand for these products because of consumer tendency towards personal hygiene and emphasis on appearance. Consumers are particular about skincare and seek help from dermatologists to find suitable products. According to YouGov PLC, 60% of women in the U.S. have a consistent skincare routine and are willing to spend more money on quality products. The increased spending capacity of consumers and aggressive marketing strategies from various brands have positively influenced the market. Additionally, the availability of these products through offline and online distribution has boosted the market growth. Many e-commerce websites provide timely delivery to consumers' doorsteps at discounted pricing.

Europe Mineral Cosmetics Market Trends

Europe is anticipated to be one of the fastest-growing regions in the global market over the forecast period. The inclination of young people towards skincare routines and adopting organic products is the main reason for fostering the regional market. Europe being the capital of the fashion industry, consumers are keenly open to experiments and new cosmetic products. It has been observed that many working women consider self-care a relaxation from their daily schedule.

Key Mineral Cosmetics Company Insights

Some key companies in the mineral cosmetics market include Mineralissima, Glo Skin Beauty, and Shiseido Company Limited. Manufacturers are focusing on product enhancements and modifications through formulation research and development. Additionally, to expand the customer base, companies are taking initiatives such as mergers and acquisitions. New products are launched to acquire young potential customers, considering their needs.

-

Mineralissima is a manufacturing company of natural beauty products that provides eco-friendly products and accessories. These products are natural and vegan, suitable for sensitive skin and are not tested on any animal. They have a wide range of products such as foundations, concealers, highlighters and also sale make up tools such as brushes as well.

-

Glo Skin Beauty provides clinically tested skin care products and solutions. Their product range is designed to use at home particularly. Also, these products are for daily wear and even for sensitive skin. Company is aiming to bring new advancements through continuous research and develop formulations that will cater skincare to next generation consumers.

Key Mineral Cosmetics Companies:

The following are the leading companies in the mineral cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- Mineralissima

- Glo Skin Beauty

- Shiseido Company, Limited

- Iredale Cosmetics, Inc.

- BWX Limited

- L'Oréal S.A.

- Revlon, Inc.

- The Estée Lauder Companies Inc.

- Ahava Dead Sea Laboratories, Limited

- Cover FX

Recent Developments

-

In September 2023, Shiseido Company, Limited, a Japanese cosmetics company announced launch of their makeup brand named NARS Cosmetics in India. The company partnered with Shoppers Stop Ltd. to open 14 stores in new Delhi and Mumbai. NARS will cater color cosmetics and premium skin care segments in Indian market.

-

In March 2023, Revlon Inc. announced their plan to invest Rs. 100 cr. In Indian cosmetics market to strengthen the distribution network, marketing strategy and introduce direct to customer brands. The objective behind this initiative will be to acquire new customer base and cater premium color cosmetics at lower price points. Company also iterated their aim to focus on building sales team and supply chain to expand their customer reach.

Mineral Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.64 billion

Revenue forecast in 2030

USD 4.97 billion

Growth Rate

CAGR of 5.34% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Mineralissima, Glo Skin Beauty, Shiseido Company Limited, Iredale Cosmetics, Inc., BWX Limited, L'Oréal S.A., Revlon, Inc., The Estée Lauder Companies Inc., Ahava Dead Sea Laboratories, Limited, Cover FX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mineral Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the mineral cosmetics market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Face Products

-

Lip Products

-

Eye Products

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mineral cosmetics market size was estimated at USD 3.2 billion in 2019 and is expected to reach USD 3.3 billion in 2020.

b. The global mineral cosmetics market is expected to grow at a compound annual growth rate of 5.3% from 2019 to 2025 to reach USD 4.3 billion by 2025.

b. North America dominated the mineral cosmetics market with a share of 35.5% in 2019. This is attributable to the rising consumers’ awareness about the harmful effects of chemical-based personal care products.

b. Some key players operating in the mineral cosmetics market include Mineralissima Mineral Make-up; Glo Skin Beauty; Shiseido Company, Limited; Iredale Cosmetics, Inc.; BWX Limited; L'Oréal S.A.; Revlon, Inc.; The Estée Lauder Companies Inc.; Ahava Dead Sea Laboratories, Limited; and Cover FX.

b. Key factors that are driving the market growth include increasing consciousness about the harmful effects of chemical-based beauty products that have paved the way for consumers to look for alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.