- Home

- »

- Electronic Devices

- »

-

Mini LED Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Mini LED Market Size, Share & Trends Report]()

Mini LED Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Mini Display, Mini Lighting), By LED Type (Standard Mini LED, Low-current Mini LED, Ultra-high Output Mini LED), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-958-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

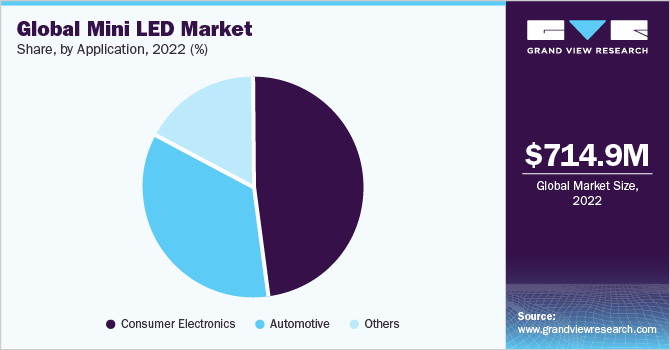

The global mini LED market size was estimated at USD 714.9 million in 2022 and is projected to reach USD 38,487.0 million by 2030, growing at a CAGR of 54.3% from 2023 to 2030. Light Emitting Diodes (LEDs) have witnessed significant adoption over the past few years with several advancements in next-generation LED technologies. Amidst the progress of micro LEDs and Organic Light Emitting Diodes (OLEDs), mini LEDs have recently gained attention to fulfill the technology and application gap between micro LEDs and traditional LEDs. Furthermore, the increasing development of mini LED technology has allowed display panel manufacturers to widely implement the technology across a broad range of consumer appliances and automotive. The rising adoption of mini LEDs across various industries is attributed to their compact size, which offers local dimming capabilities and high-density backlight designs. Mini LED is expected to emerge as a next-generation technology, offering significant advances in image quality, along with ultra-compact/thin design.

In recent years, LEDs have seen widespread adoption owing to their high efficiency across a range of applications, replacing conventional incandescent and fluorescent lighting. This has resulted in significant energy savings and longer operational lifespans for lighting systems. Moreover, LED lighting technology has continued to advance, particularly in general lighting applications, making LED bulbs the preferred choice for both households and commercial establishments due to their affordability and wide availability. Furthermore, cutting-edge technologies such as Organic Light-Emitting Diode (OLED) and micro-LED displays have emerged, which utilize self-illuminating pixels to enhance contrast and color performance compared to conventional LED-backlit LCDs. The continuous improvements in efficiency, brightness, and color management and the ongoing miniaturization of LEDs have fueled their growing popularity across diverse industries.

Mini LED technology envisages backlighting the display using several smaller LEDs or mini LEDs. Such mini LED displays tend to be more energy-efficient than conventional LCDs. Material advances in mini LED displays, such as integrating quantum dots, are contributing to greater energy efficiency and better picture quality. Quantum dots convert blue light from an LED backlight into narrower-bandwidth basic colors, resulting in a larger color gamut and enhanced color representation. For instance, in January 2023, SAMSUNG unveiled its new Micro LED, Neo QLED, and OLED lineups, which specialized in facilitating secured connectivity, powerful performance, and personalized experience.

The process of manufacturing mini LED displays is relatively complex, as it involves accurate placement and bonding of several miniature LEDs, affecting production efficiency and driving overall costs. As a result, achieving a consistent and high-yield production can be a challenging task. Although mini LED displays offer superior quality than conventional LCDs, they call for advanced techniques, such as forging high-density LED arrays, improving thermal management, and integrating AI-based image processing capabilities. The need for adopting such advanced techniques and the subsequent higher production costs could particularly restrain the adoption of mini LED displays among price-sensitive industries and applications.

Display makers are shifting to mini LED displays to cater to the evolving consumer requirements for improved visual experiences. Advances in technology are opening a myriad of opportunities to customize mini LED displays in various sizes and dimensions to make them suitable for various applications and use cases. Due to their adaptability, mini LED displays can be used across various use cases, including consumer electronics, automotive displays, gaming consoles, industrial displays, healthcare imaging, and AR/VR devices, among others.

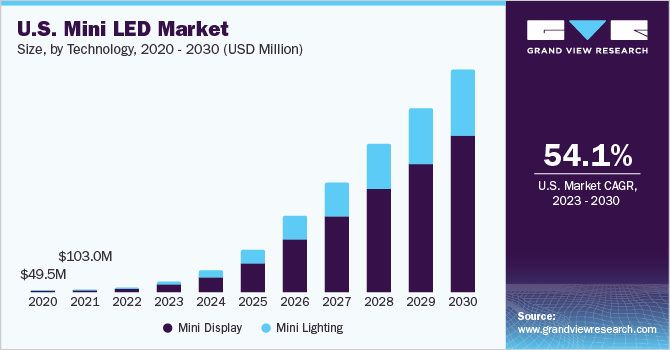

Technology Insights

The mini display segment held the highest revenue share of 67.4% for the market in 2022. Mini screens are known for their small dimensions and high-end technology capabilities. Mini LED displays have outperformed traditional LED displays in terms of image quality. Backlighting with multiple tiny LEDs enables more accurate local dimming, higher contrast levels, and improved High Dynamic Range (HDR) performance. The improved picture quality of mini displays offers consumers an immersive and appealing viewing experience.

The mini lighting segment is expected to register growth at a CAGR of 52.4%, over the forecast period. Mini lightings are small-sized fixtures or systems designed to illuminate small places or for specialized lighting applications. They are characterized by small dimensions, low power consumption, and numerous mounting options. They are miniature LED spotlights with high-intensity illumination that highlight artwork, architectural features, or specific points of interest.

LED Type Insights

The standard mini LED segment held the highest revenue share of 42.57% for the market in 2022. Standard mini LEDs are extensively used in various applications owing to their energy efficiency, small size, and long lifespan compared to incandescent and fluorescent lights. As mini LEDs are compact, they are used as creative and space-saving technology in various applications. They have become popular as a lighting option for home and commercial applications.

The ultra-high output mini LED segment is expected to register the growth at a CAGR of 53.7% over the forecast period. Ultra-high output mini LEDs are identified by their high luminous effectiveness, or the amount of visible light produced per unit of energy consumed. These mini LEDs are widely utilized in applications that demand a large amount of light output and where standard lighting sources such as incandescent or fluorescent bulbs cannot match the brightness standards. Ultra-high output mini LED displays are used in high-bay lighting fixtures for large indoor environments such as distribution centres, factories, gymnasiums, and airports.They offer sufficient lighting over large areas, lowering the fixtures required and saving energy. Ultra-high output mini LED displays are utilized in streetlights, floodlights, and external signage where bright and energy-efficient lighting is critical for safety and visibility.

Application Insights

The consumer electronics segment held the highest revenue share of 47.99% for the market in 2022. As technology progresses, consumer electronics that integrate tiny LED technology are becoming increasingly popular. Mini LEDs in smartphones and tablets facilitate improved brightness, contrast, and battery performance. Mini LED technology has the potential to improve the visual experience of mobile device users, particularly for individuals who engage in entertainment and gaming. The usage of mini LEDs in consumer electronics can differ based on factors such as manufacturing costs, user demand, and technological improvements.

The automotive is expected to register a CAGR of 55.8% through 2030. Mini LEDis employed in modern automobile headlight systems to boost brightness, beam control, and precision adaptive lighting. The compact size of mini LEDs enables more precise pixelation and individual control, offering adaptive lighting that responds to changing driving conditions, such as approaching traffic or road curves. Mini LEDs are used in daytime running lights to provide energy-efficient, long-lasting, and distinctive lighting systems, which improve vehicles’ visibility throughout the day.

Regional Insights

North America held the largest market share of 41.82% in 2022. The regional market growth can be attributed to the rising demand for consumer electronics products, growth in the automotive sector, and advancements in technology. Furthermore, the proliferation of Internet of Things (IoT) and LED lighting integration into different lighting fixtures have created new opportunities for lighting system customization and energy efficiency. Moreover, government-funded initiatives play a crucial role in promoting the adoption of mini and micro LED lighting.

Middle East & Africa is expected to register the fastest growth, at a CAGR of 57.2%, over the forecast period. The regional market growth can be attributed to the increasing use of LED screens in military and automotive industries and the growing popularity of internet of things, which is projected to increase the demand for laptops, projectors, smartwatches, and smartphones. For instance, in June 2023, Shoprite Holdings Ltd., a South African retailer, announced that the company saved USD 17.5 billion in electricity costs in the financial year 2022 - 2023, owing to the installation of LED lightbulbs across its stores, which are located across 11 African countries. The company announced the installation of 1,001,932 LED lightbulbs across 1,647 distribution centers and supermarkets. Such initiatives are expected to propel the growth of the MEA mini LED market.

Key Companies & Market Share Insights

The key market players in the global market in 2022 include Hon Hai Precision Industry Co., Ltd., AUO Corporation, BOE Technology Group Co., Ltd., Innolux Corporation, EPISTAR, and others. Intense competition among leading players for introducing advanced and innovative products is encouraging companies to invest in the research and development of products and automation of processes.

Companies are adopting strategies to leverage new opportunities in the market and target new customers by developing customized products. For instance, in July 2023, Japan Display Inc. announced that its subsidiary, JDI Design and Development G.K. (JDIDD), acquired JOLED’s OLED, a manufacturer of OLED displays. With this acquisition, JDI is boosting its METAGROWTH 2026 growth strategy while providing game-changing consumer and shareholder benefits. Some prominent players in the global mini LED market include:

-

AUO Corporation

-

BOE Technology Group Co., Ltd.

-

EPISTAR Corporation

-

EVERLIGHT ELECTRONICS CO., LTD.

-

Foshan NationStar Optoelectronics Co.Ltd

-

Harvatek Corporation

-

Innolux Corporation

-

Japan Display Inc.

-

Suzhou Dongshan Precision Manufacturing Co., Ltd. DSBJ.

-

Tianma Microelectronics Co., Ltd.

-

Unity Opto

-

Hon Hai Precision Industry Co., Ltd.

-

San’an Optoelectronics

-

Lextar Electronics Corporation

-

ams-OSRAM International GmbH

Mini LED Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,848.5 million

Revenue forecast in 2030

USD 38.49 billion

Growth rate

CAGR of 54.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, LED type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

AUO Corporation, BOE Technology Group Co., Ltd., EPISTAR Corporation, EVERLIGHT ELECTRONICS CO., LTD., Foshan NationStar Optoelectronics Co.Ltd, Harvatek Corporation, Innolux Corporation, Japan Display Inc., Suzhou Dongshan Precision Manufacturing Co., Ltd. DSBJ., Tianma Microelectronics Co., Ltd., Unity Opto, Hon Hai Precision Industry Co., Ltd., San’an Optoelectronics, Lextar Electronics Corporation, and ams-OSRAM International GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mini LED Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 - 2030. For the purpose of this study, Grand View Research has segmented the global mini LED market report on the basis of technology, LED type, application, and region.

-

Technology Outlook (Revenue; USD Million; 2018 - 2030)

-

Mini Display

-

Mini Lighting

-

-

Type Outlook (Revenue; USD Million; 2018 - 2030)

-

Standard Mini LED

-

Low-current Mini LED

-

Ultra-high Output Mini LED

-

-

Application Outlook (Revenue; USD Million; 2018 - 2030)

-

Consumer Electronics

-

Mobile Phone

-

Laptops/ Notebooks

-

Television

-

-

Automotive

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mini LED market size was estimated at USD 714.9 million in 2022 and is expected to reach USD 1,848.5 million in 2023.

b. The global mini LED market is expected to grow at a compound annual growth rate of 54.3% from 2023 to 2030 to reach USD 38.49 billion by 2030.

b. The consumer electronics segment dominated the global mini LED market with a share of 48% in 2022. This is attributable to their ability to deliver desirable brightness and contrast along with conformability, ruggedness, and durability.

b. Some of the key players in the global mini LED market include AUO Corporation, BOE Technology Group Co., Ltd., EPISTAR Corporation, EVERLIGHT ELECTRONICS CO., LTD., Foshan NationStar Optoelectronics Co.Ltd, Harvatek Corporation, Innolux Corporation, Japan Display Inc., Suzhou Dongshan Precision Manufacturing Co., Ltd. DSBJ., Tianma Microelectronics Co., Ltd., Unity Opto, Hon Hai Precision Industry Co., Ltd., San’an Optoelectronics, Lextar Electronics Corporation, and ams-OSRAM International GmbH.

b. Key factors that are driving market growth include rising adoption of mini LEDs across various industries is attributed to their compact size, which offers local dimming capabilities and high-density backlight designs. Mini LED is expected to emerge as a next-generation technology, offering significant advances in image quality, along with ultra-compact/thin design.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.