- Home

- »

- Next Generation Technologies

- »

-

Missile Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Missile Market Size, Share & Trends Report]()

Missile Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Launch Mode, By Range (Short Range, Medium Range, Long Range), By End-use (Air, Navy, Ground), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-417-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Missile Market Summary

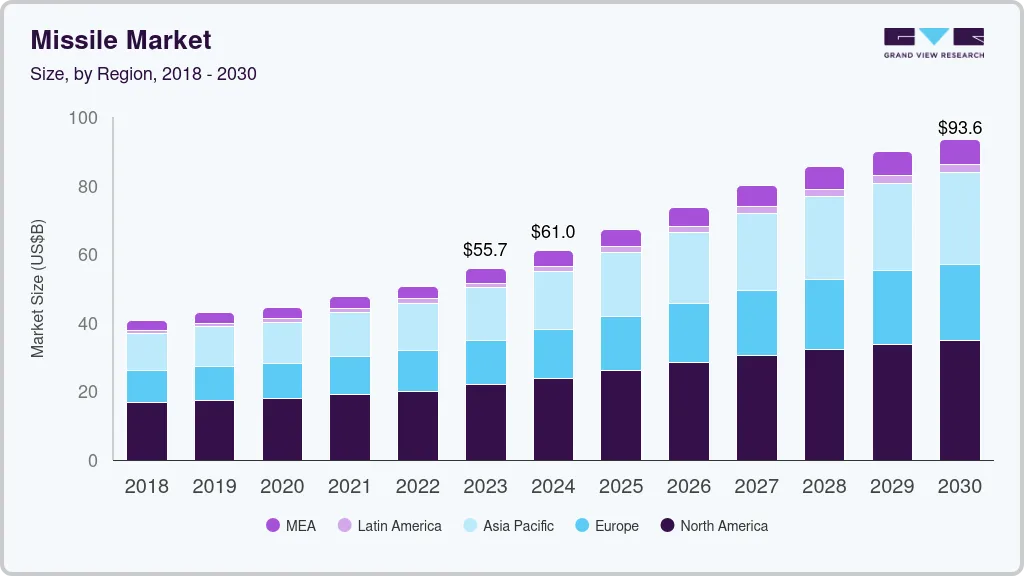

The global missile market size was estimated at USD 55.70 billion in 2023 and is projected to reach USD 93.56 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. Increasing defense expenditures, development of advanced missile technologies, growing focus on national security, and the need for effective deterrence against various threats, including terrorism and regional conflicts, are driving the market expansion.

Key Market Trends & Insights

- North America missile market dominated with a revenue share of over 39.37% in 2023.

- The U.S. missile market is expected to grow significantly from 2024 to 2030.

- By component, the guidance system segment led the market, accounting for over 27.36% of global revenue in 2023.

- By launch mode, the surface-to-surface segment accounted for the largest revenue share in 2023.

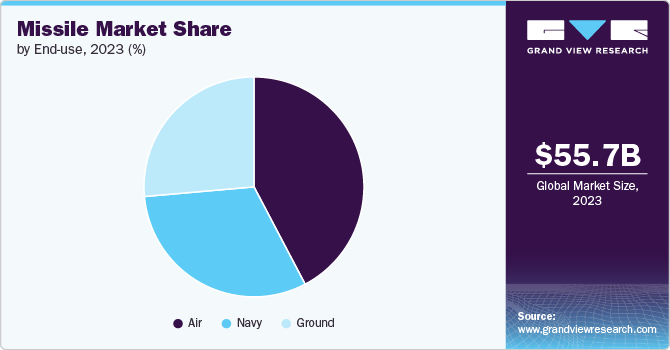

- By end use, the air segment led the market with a revenue share of 42.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 55.70 Billion

- 2030 Projected Market Size: USD 93.56 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the demand for advanced missile systems is constantly rising as nations seek to enhance their military capabilities and ensure national security, which is expected to further fuel the market growth in the coming years.

The prioritization of national defense and the modernization of military capabilities is propelling the market growth. Countries around the world are increasingly investing in advanced missile systems to enhance their defense infrastructure. This includes the development of sophisticated long-range and precision-guided missiles to counter evolving threats and ensure national security. The focus on upgrading existing arsenals and developing new missile technologies to keep pace with advancements in warfare technology is propelling the market growth.

The integration of advanced guidance and control systems is significantly driving the market growth. Modern missiles are being equipped with state-of-the-art technologies, such as GPS-guided navigation, inertial navigation systems (INS), and advanced radar seekers. These systems enhance the accuracy and precision of missile strikes, reducing collateral damage and increasing mission success rates. The trend towards miniaturization and improved computational capabilities in guidance systems is enabling the development of more agile and efficient missiles.

The adoption of electric propulsion systems is reshaping the market landscape. Electric propulsion provides improved maneuverability, greater fuel efficiency, and extended mission lifetimes compared to conventional chemical propulsion systems. This transition towards electric propulsion is in line with increasing environmental concerns and regulatory demands to minimize space debris and enhance sustainability in space operations. As a result, missile manufacturers are investing in research and development to incorporate electric propulsion technologies into their products.

There is a rising emphasis on on-orbit servicing capabilities, which allow satellites to be refueled or repaired while in space. This trend necessitates versatile Missile designs that can support such operations, thereby extending the lifespan of satellites and maximizing return on investment for operators. The ability to perform maintenance tasks in orbit represents a significant advancement in satellite technology and opens new avenues for service providers looking to enhance their operational capabilities.

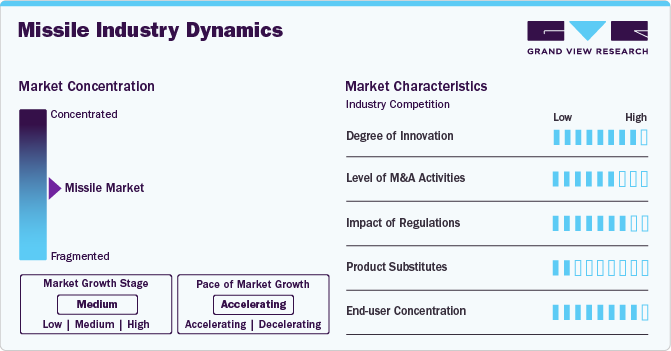

Industry Dynamics

The market is characterized by a high degree of innovation driven by advancements in technology and evolving defense requirements. Innovations in propulsion systems, guidance technologies, materials, and warhead capabilities are critical for maintaining competitive advantage. Countries and companies are heavily investing in research and development to produce more effective, longer-range, and precise missile systems. The integration of artificial intelligence, advanced sensors, and enhanced electronic warfare capabilities also highlights the sector's commitment to innovation.

The level of mergers & acquisition activities in the market is expected to be moderate. Defense contractors often engage in M&A to expand their technological capabilities, product portfolios, and market reach. These activities help companies to consolidate their positions in the market, achieve economies of scale, and access new technologies.

The impact of regulations on the market is expected to be moderate to high owing to the sensitive nature of its products and their implications for national and global security. Regulations are enforced by national governments and international bodies to control the proliferation of missile technologies. Compliance with treaties such as the Missile Technology Control Regime (MTCR) and various export control laws is mandatory. These regulations impact market dynamics, influencing which technologies can be developed, sold, or transferred internationally, and thus shaping the competitive landscape.

The product substitute in the market is expected to be low, owing to the specific and critical role that missiles play in defense and strategic operations.However, there are emerging technologies, such as directed-energy weapons and hypersonic glide vehicles that could potentially serve as substitutes in some applications.

The end user concentration in the market is high, with governments and military organizations being the primary customers. The market demand is driven by national defense budgets and strategic defense initiatives, further boosting the end-user concentration.

Component Insights

Based on component, the guidance system segment led the market with the largest revenue share of 27.36% in 2023.This growth can be attributed to the increasing importance of accuracy and precision in modern missile systems. As warfare becomes more sophisticated, the demand for advanced guidance technologies, including GPS, inertial navigation systems, and laser guidance, has surged. These systems are crucial for ensuring that missiles reach their targets with minimal error, particularly in complex and dynamic environments. The growing focus on minimizing collateral damage and enhancing the effectiveness of missile strikes has further fueled investments in guidance systems, further driving segmental growth.

The launch system segment is expected to witness at the fastest CAGR of 8.3% from 2024 to 2030, driven by advancements in missile launch technologies and the increasing need for flexible and rapid deployment capabilities. Innovations in mobile and modular launch platforms, which allow for quick adaptation to various combat scenarios, are key growth drivers. In addition, the rising demand for vertical launch systems and other sophisticated mechanisms that support a variety of missile types, including surface-to-air, air-to-surface, and surface-to-surface missiles, is expected to contribute significantly to the segment's expansion during the forecast period.

Launch Mode Insights

Based on launch mode, the surface-to-surface segment led the market with the largest revenue share of 35.24% in 2023. This growth can be attributed to its critical role in military and defense operations, where precision targeting and long-range capabilities are paramount. The increasing need for advanced missile systems that can engage a wide range of targets, including land-based threats and maritime operations, has driven significant investments in this segment. In addition, ongoing geopolitical tensions and modernization programs have enhanced demand for surface-to-surface missiles, further fueling the segmental growth.

The air-to-surface segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to advancements in missile technology and the increasing emphasis on air superiority in modern warfare. The shift towards multi-role combat aircraft equipped with precision-guided munitions is driving growth in this segment. Furthermore, the growing need for versatile and efficient air-to-ground attack capabilities in various combat scenarios, including anti-terrorism operations, is anticipated to propel the demand for air-to-surface missiles, leading to its robust expansion during the forecast period.

Range Insights

Based on range, the medium range segment led the market with the largest revenue share of 44.10% in 2023, owing to its broad applicability across various industries. Medium-range IoT solutions, typically involving devices and systems with moderate connectivity and data processing requirements, are ideal for applications such as industrial automation, smart homes, and mid-sized enterprises. These solutions offer a balance between cost-effectiveness and performance, making them attractive for organizations looking to deploy IoT without the complexities and higher costs associated with long-range systems.

The long range segment is anticipated to record at a significant CAGR from 2024 to 2030, driven by the increasing demand for extensive IoT networks capable of supporting large-scale and geographically dispersed operations. The expansion of smart city projects, remote monitoring in industries such as agriculture, oil and gas, and the development of large-scale industrial IoT (IIoT) systems are the key factors driving the segmental growth. In addition, advancements in communication technologies, such as 5G and LPWAN (Low Power Wide Area Networks), are enabling more efficient and reliable long-range IoT deployments, further boosting the segment's growth.

End-use Insights

Based on end use, the air segment led the market with the largest revenue share of 42.3% in 2023. Air-launched missiles, such as air-to-air and air-to-ground missiles, are increasingly favored due to their strategic flexibility and effectiveness in modern warfare. The global focus on strengthening air superiority, particularly among major military powers such as the U.S., China, and Russia, has led to significant investments in advanced air-launched missile systems. In addition, the development of stealth aircraft and the growing need for precision-guided munitions have further propelled the demand for sophisticated air-launched missiles.

The ground segment is anticipated to grow at a significant CAGR from 2024 to 2030, driven by rising geopolitical tensions and the increasing focus on enhancing ground-based defense capabilities. The proliferation of missile defense systems, such as surface-to-air missiles (SAMs) and anti-tank guided missiles (ATGMs), is a key trend supporting this growth. Nations are investing in modernizing their ground-based missile arsenals to counter evolving threats, including drones, ballistic missiles, and armored vehicles. The development of hypersonic and long-range missile technologies, coupled with advancements in precision targeting and mobility, is also expected to drive the expansion of the ground segment.

Regional Insights

North America dominated the missile market with the largest revenue share of 39.37% in 2023, driven by significant defense spending, which allocates substantial resources to maintaining and advancing its missile capabilities. Key trends in the region include the development and deployment of advanced missile defense systems, hypersonic weapons, and the modernization of existing arsenals, which is bolstering the market growth in the region.

U.S. Missile Market Trends

The missile market in the U.S. is projected to grow at the fastest CAGR of 6.4% from 2024 to 2030, driven by advancements in defense technologies, increased defense spending, and the need to counter emerging threats from near-peer adversaries. The growing focus on developing next-generation missile systems with enhanced precision, longer ranges, and hypersonic capabilities is expected to further drive the market growth in the U.S.

Europe Missile Market Trends

The missile market in Europe is anticipated to grow at a significant CAGR of 7.8% from 2024 to 2030. In Europe, the market is influenced by increasing defense budgets and collaborative initiatives among European Union and NATO members to enhance collective security. Furthermore, the modernization of missile systems to counter evolving threats, the development of joint missile projects and a growing emphasis on autonomous and precision-guided munitions are further accelerating the market growth in the region.

The UK missile market is anticipated to grow at a substantial CAGR from 2024 to 2030. The market is driven by the need to modernize its defense capabilities. The focus is on developing and acquiring advanced missile systems, including precision-guided munitions and long-range strike capabilities, to address emerging threats, which are expected to drive the market growth in the country.

The missile market in Germany is expected to grow at a significant CAGR from 2024 to 2030. The country's defense policy, shaped by a growing recognition of the need for a stronger military posture, is pushing for advancements in both offensive and defensive missile systems, further driving the market growth.

The France missile market is projected to grow at the fastest CAGR from 2024 to 2030, driven by increasing investments in the development of hypersonic and long-range precision-guided missiles to enhance its conventional strike capabilities. The country's defense industry, known for its technological innovation, is also focused on expanding export opportunities for its missile systems, further boosting the market growth.

Asia-Pacific Missile Market Trends

The missile market in the Asia Pacific region is expected to grow at a significant CAGR of 8% from 2024 to 2030. The market in the region is characterized by rising defense expenditures and a focus on strengthening missile capabilities amid regional tensions. In addition, the need for advanced missile systems to deter threats from neighboring countries, investments in indigenous missile development programs, and strategic partnerships with global defense contractors are accelerating the market expansion in the region.

The China missile market is projected to grow at a significant CAGR from 2024 to 2030.China's substantial investment in research and development, coupled with its focus on self-reliance in defense technology, is fueling the market growth.

The missile market in Japan is expected to grow at a substantial CAGR from 2024 to 2030. The Japanese government has been increasing its defense budget to enhance missile defense systems and develop indigenous long-range cruise missiles. Furthermore, the shift towards acquiring offensive missile capabilities is driving the market growth in the country.

The India missile market is expected to grow at the fastest CAGR from 2024 to 2030. The country's focus on indigenous development of a diverse missile arsenal, including ballistic, cruise, and anti-ship missiles, is key to enhancing its defense capabilities. India's defense modernization efforts, along with increasing defense budgets, are enhancing the market growth.

Middle East & Africa Missile Market Trends

The missile market in the Middle East and Africa is expected to grow at a significant CAGR of 8.2% from 2024 to 2030, driven by the need to address security challenges, internal conflicts, and geopolitical tensions. In addition, there is an increasing emphasis on developing local defense industries to enhance self-reliance and reduce dependency on foreign suppliers, which is further expected to boost the market growth in coming years.

The Saudi Arabia missile market is anticipated to grow at the fastest CAGR from 2024 to 2030. Saudi Arabia's market is characterized by the significant investments in defense capabilities, driven by regional security concerns and the need to counter missile threats from neighboring countries, which is expected to further enhance the market growth.

Key Missile Company Insights

Some of the key players operating in the global market include Lockheed Martin Corporation, Northrop Grumman Corporation among others.

-

Lockheed Martin Corporation is a global security and aerospace company that specializes in advanced technology systems and services for government and commercial customers, primarily focusing on defense, space exploration, and aeronautics. The company specializes in designing and manufacturing advanced satellite buses that support various applications, including communication, Earth observation, and military reconnaissance

-

Northrop Grumman Corporation is a leading global aerospace and defense technology company that specializes in the development and production of advanced autonomous systems. The company has a strong focus on developing satellite buses that cater to both civilian and military applications, contributing to its significant presence in the market. Northrop Grumman has also been awarded contracts for the SDA's Transport Layer, working alongside Lockheed Martin to deliver advanced satellite systems

Airbus SE, Honeywell International Inc. are some of the emerging market participants in the global market.

-

Airbus SE is a European multinational aerospace corporation known for designing, manufacturing, and selling commercial aircraft, helicopters, military transports, satellites, and launch vehicles. The company's Defense and Space division focuses on developing satellite systems, including satellite buses, which serve as the platform for various payloads. With a strong emphasis on innovation and technology, Airbus SE is at the forefront of providing advanced solutions in the global market, leveraging its extensive experience and robust capabilities in aerospace engineering

-

Honeywell International Inc. is a globally recognized conglomerate and operates across various industries, including aerospace, building technologies, performance materials, and safety solutions. The company's involvement in the global market primarily revolves around its advanced guidance, navigation, and control systems, which are critical components in ensuring the precision and effectiveness of missile operations. Honeywell’s technology portfolio includes inertial measurement units (IMUs), gyroscopes, and accelerometers that are integral to missile guidance systems

Key Missile Companies:

The following are the leading companies in the missile market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- Honeywell International Inc.

- Lockheed Martin Corporation

- Northrop Grumman

- Thales Group

- BAE Systems Inc.

- Israel Aerospace Industries Ltd. (IAI)

- ISRO

- RTX Corporation

- The Boeing Company

Recent Developments

-

In April 2024, Sierra Space Corporation introduced its new eclipse Missile line, comprising three models: Eclipse Velocity, Eclipse Horizon, and Eclipse Titan. This launch aims to meet the evolving demands of the space industry by providing scalable solutions for various missions, including Earth observation, logistics, and communications

-

In October 2023, Northrop Grumman and Airbus SE have signed a Memorandum of Understanding (MOU) to jointly address the United Kingdom Ministry of Defence's (MOD) military satellite communication system requirements for the SKYNET Enduring Capability (SKEC) program. Both the companies will leverage their strong relationship, with Airbus SE recently awarded to provide 42 satellite buses for the Tranche 1 Transport Layer (T1TL) constellation that Northrop Grumman is developing for the U.S. Space Development Agency

-

In August 2023, ISRO transferred the IMS-1 Missile Technology to Alpha Design Technologies Pvt. Ltd. (ADTL), marking a significant advancement in private sector involvement in India's space industry. This transfer was facilitated by NewSpace India Limited (NSIL) through an agreement

Missile Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 61.05 billion

Revenue forecast in 2030

USD 93.56 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, launch mode, range, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Airbus SE; Honeywell International Inc.; Lockheed Martin Corporation; Northrop Grumman Corporation; Thales Group; BAE Systems Inc.; Israel Aerospace Industries Ltd. (IAI); ISRO; RTX Corporation; The Boeing Company.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Missile Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global missile market report based on component, launch mode, range, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Guidance System

-

Propulsion System

-

Warhead

-

Airframe

-

Launch System

-

Others

-

-

Launch Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surface-to-surface

-

Surface-to-air

-

Air-to-surface

-

Air-to-air

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Short Range

-

Medium Range

-

Long Range

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air

-

Navy

-

Ground

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global missile market size was estimated at USD 55.70 billion in 2023 and is expected to reach USD 61.05 billion in 2024.

b. The global missile market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 93.56 billion by 2030.

b. The missile market in North America accounted for a significant revenue share of over 39% in 2023, driven by significant defense spending, which allocates substantial resources to maintaining and advancing its missile capabilities.

b. Some key players operating in the missile market include Airbus SE, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman, Thales Group, BAE Systems Inc., Israel Aerospace Industries Ltd. (IAI), ISRO, RTX Corporation, The Boeing Company

b. Key factors that are driving the missile market growth include the increasing defense expenditures, development of advanced missile technologies, growing focus on national security and the need for effective deterrence against various threats, including terrorism and regional conflicts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.