- Home

- »

- Advanced Interior Materials

- »

-

Missile Warhead Market Size, Share & Growth Report, 2030GVR Report cover

![Missile Warhead Market Size, Share & Trends Report]()

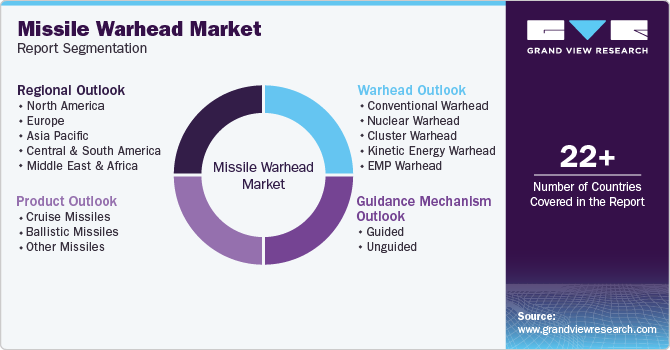

Missile Warhead Market (2024 - 2030) Size, Share & Trends Analysis Report By Warhead (Conventional, Nuclear), By Product (Cruise Missiles, Ballistic Missiles), By Guidance Mechanism, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-435-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Missile Warhead Market Size & Trends

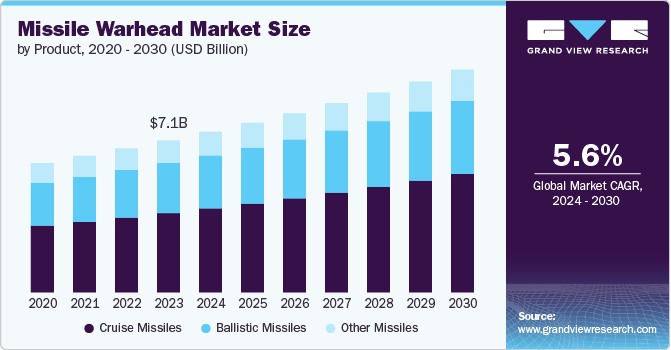

The global missile warhead market size was estimated at USD 7.10 billion in 2023 and is forecasted to grow at a CAGR of 5.6% from 2024 to 2030. This growth is attributed to the rising geopolitical tensions and regional conflicts, which drive defense spending and investment in advanced missile systems. Furthermore, innovations in missile technology, such as advanced guidance systems, propulsion, and stealth capabilities, enhance the effectiveness and precision of missiles. This drives the demand for newer and more sophisticated missile systems across the globe.

Many countries are modernizing their military arsenals and upgrading their missile systems to improve accuracy, range, and lethality, fueling growth in this market. In addition, the development and deployment of missile defense systems, including those designed to intercept and destroy incoming missiles, create a demand for advanced and complementary missile technologies.

Development, production, and maintenance of advanced missile systems involve significant costs. Compliance with arms control agreements and non-proliferation treaties can also increase production costs. Budget constraints and financial limitations can restrict the acquisition and deployment of advanced systems. Moreover, international regulations and export controls on missile technology can limit the market opportunities for product manufacturers.

Political instability, shifting alliances, and changing defense priorities can affect the demand for this product and influence market dynamics. Increasing reliance on digital systems and networks for missile guidance and control raises concerns about cybersecurity threats. Ensuring the protection of missile systems from cyber-attacks is a significant challenge.

Innovations of emerging technologies such as artificial intelligence, machine learning, and advanced sensors are expected to enhance their capabilities and effectiveness. In addition, developing advanced missile defense systems to counter evolving threats creates opportunities for manufacturers of both offensive and defensive missile technologies.

Nations with growing defense budgets, particularly in Asia and the Middle East, represent expanding markets. Companies are increasingly targeting these regions to secure new contracts and partnerships. Major manufacturers of this product include Northrop Grumman, General Dynamics Corporation, The Boeing Company, Lockheed Martin Corporation, Thales Group, Kongsberg Gruppen ASA, Saab AB, Rafael Advanced Defense Systems Ltd., MBDA Holdings SAS, and DRDO.

Warhead Insights

Conventional warheads emerged as the most widely used missile warheads, accounting for over two-thirds of the market revenue in 2023. These include blast, fragmentation, shaped charge, penetration, and thermobaric warheads. In recent years, there has been an increasing demand for shaped charge warheads due to their ability to focus energy in a specific direction, making them effective against tanks and armored systems.

However, fragmentation warheads are the most widely deployed systems due to their versatility and effectiveness across various combat scenarios. These missile warheads work by detonating and dispersing metal fragments at high speeds, effectively targeting large areas.

Product Insights

Based on product, the market is segmented into cruise and ballistic. Cruise missiles dominated the market with a revenue share of 52.07% in 2023 and are further expected to grow significantly over the forecast period. This product is equipped with advanced guidance systems, including GPS, radar, infrared, and laser guidance. Furthermore, unlike ballistic, cruise type follow a relatively low and level flight path, which can be adjusted during the flight. This allows them to navigate through complex terrains and avoid detection by radar systems.

Ballistic missiles come in various ranges, including short-range (SRBM), medium-range (MRBM), intermediate-range (IRBM), and intercontinental (ICBM). Moreover, technological developments are enhancing the capabilities of this product, including extended ranges, improved accuracy, and advanced payloads. This includes improvements in multiple-warhead technologies and re-entry vehicle designs.

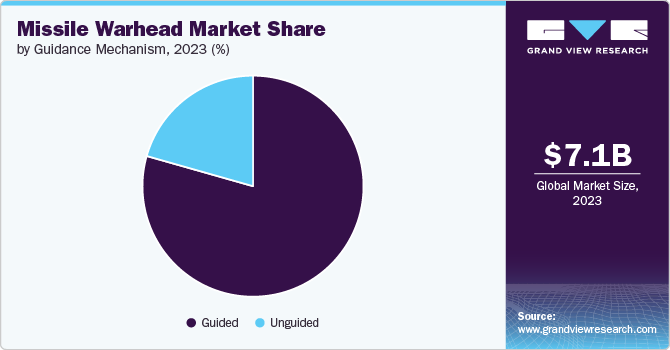

Guidance Mechanism Insights

Guided mechanism accounted for the largest revenue share of 79.39% in 2023 and is expected to grow fastest over the forecast period. These types of guidance mechanisms are used for precision strikes in various military applications, including air-to-air, surface-to-air, and ground-to-ground engagements. They are employed to hit specific targets with high accuracy, reducing collateral damage and increasing effectiveness. Furthermore, there is an increasing preference for guided product types due to their ability to deliver precise strikes and minimize collateral damage.

Lower cost of unguided compared to guided systems makes them an attractive option for certain applications, especially in large-scale or less precise engagements. Furthermore, Unguided missiles are often used for general bombardment or strategic deterrence, primarily focusing on delivering payloads over long distances or saturating an area.

Regional Insights

The missile warhead market in North America is expected to grow significantly over the forecast period, and demand for this product is expected to grow significantly over the years. The U.S. and Canada are investing in next-generation missile systems, including hypersonic and advanced missile defense systems, to maintain a technological edge. Therefore, continuous advancements in product technology and integration with new systems are expected to offer opportunities in North America.

The U.S. missile warhead market is growing at a CAGR of 5.4% over the forecast period. The country invests heavily in developing and deploying cutting-edge missile defense systems, including those capable of intercepting ballistic and cruise product types, which drives its market growth. In addition, the U.S. is at the forefront of developing next-generation technologies, including hypersonic missiles and advanced air defense systems. This is expected to provide growth opportunities to manufacturers.

Asia Pacific Missile Warhead Market Trends

Asia Pacific dominated this market in 2023 with a revenue share of 32% and is further expected to grow significantly over the forecast period. Many countries in the Asia Pacific region are investing heavily in modernizing their military forces. This includes upgrading existing missile systems and acquiring new technologies to strengthen their strategic and tactical capabilities. This is driving market demand in the region.

Europe Missile Warhead Market Trends

Europe faces security concerns from regional threats and geopolitical instability, such as the ongoing conflict in Ukraine and Russia. This drives demand for advanced product systems for both defense and deterrence. Furthermore, as NATO members, many European countries are committed to modernizing their military capabilities and investing in advanced product technologies as part of their defense strategies, further driving product growth.

Key Missile Warhead Company Insights

Some of the key players operating in the market are Northrop Grumman, BAE Systems, and General Dynamics Corporation, among others:

-

Northrop Grumman is a multinational aerospace and defense technology company that designs and manufactures various products for the aeronautics, space, cyberspace, and defense industries. The company has approximately 100,000 employees and about 550 facilities spread across 25 countries globally.

-

General Dynamics Corporation was incorporated in 1952 and is headquartered in Virginia, U.S. The company consists of 10 business units organized into four operating segments: Aerospace, Marine Systems, Combat Systems, and Technologies. With approximately 50 airport sites throughout North America, Europe, the Middle East, and Asia, it offers MRO, FBO, and aircraft management services. It also offers customized solutions for narrow-body and wide-body aircraft.

Saab AB and Thales Group are some of the emerging participants in the market.

-

Saab AB, a Swedish company founded in 1937, manufactures aerospace, defense, and security systems. This includes military aircraft, satellite systems, missile systems, and anti-aircraft systems, among other products.

-

Thales Group is a French company operating through four business segments: aerospace, defense, security, and space. This company produces products such as missiles, aircraft communication systems, satellite communication, and flight management systems.

Key Missile Warhead Companies:

The following are the leading companies in the missile warhead market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman

- General Dynamics Corporation

- BAE Systems

- Lockheed Martin Corporation

- Thales Group

- Kongsberg Gruppen ASA

- Saab AB

- Rafael Advanced Defense Systems Ltd.

- MBDA Holdings SAS

- Bharat Dynamics Ltd.

- DRDO

- Ensign-Bickford Aerospace & Defense

Recent Developments

-

In July 2024, DRDO successfully flight-tested the Phase-II Ballistic Missile Defence (BMD) system. The test result demonstrated indigenous capability to defend against ballistic missiles of the 5,000 km class. Furthermore, the test validated all the trial objectives, proving long-range sensors, advanced interceptor missiles, and low-latency communication systems.

Missile Warhead Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.50 billion

Revenue forecast in 2030

USD 10.40 billion

Growth Rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Warhead, product, guidance mechanism, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Northrop Grumman; General Dynamics Corporation; BAE Systems; Lockheed Martin Corporation; Thales Group; Kongsberg Gruppen ASA; Saab AB; Rafael Advanced Defense Systems Ltd.; MBDA Holdings SAS; DRDO, Bharat Dynamics Ltd; Ensign-Bickford Aerospace Defense

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Missile Warhead Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global missile warhead market based on warhead, product, guidance mechanism, and region:

-

Warhead Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Warhead

-

Blast Warhead

-

Fragmentation Warhead

-

Penetration Warhead

-

Thermobaric Warhead

-

Shaped Charge Warhead

-

-

Nuclear Warhead

-

Fission Warhead

-

Fusion (Thermonuclear) Warhead

-

-

Cluster Warhead

-

Kinetic Energy Warhead

-

EMP Warhead

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cruise Missiles

-

Ballistic Missiles

-

Other Missiles

-

-

Guidance Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Guided

-

Unguided

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global missile warhead market size was estimated at USD 7.10 billion in 2023 and is expected to reach USD 7.50 billion in 2024.

b. The global missile warhead market is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030 to reach USD 10.40 billion by 2030.

b. Guided mechanism accounted for largest revenue share of 79.3% in 2023 as there is an increasing preference for guided missiles due to their ability to deliver precise strikes and minimize collateral damage.

b. Some key players operating in the missile warhead market include Northrop Grumman, General Dynamics Corporation, The Boeing Company, Lockheed Martin Corporation, Thales Group, Kongsberg Gruppen ASA, Saab AB, Rafael Advanced Defense Systems Ltd., MBDA Holdings SAS, and DRDO.

b. The key factors that are driving the missile warhead market growth is the rising geopolitical tensions and regional conflicts which are driving defense spending and investment in advanced missile systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.