- Home

- »

- Pharmaceuticals

- »

-

Missouri Medical Cannabis Market Size & Growth Report, 2030GVR Report cover

![Missouri Medical Cannabis Market Size, Share & Trends Report]()

Missouri Medical Cannabis Market Size, Share & Trends Analysis Report By Product (Flower, Oils & Tinctures), By Application (Chronic Pain, Tourette’s), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-978-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

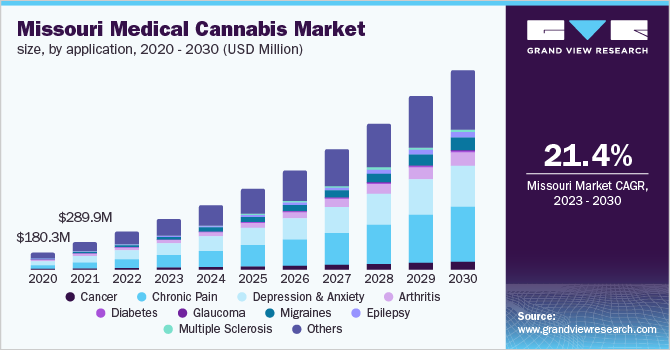

The Missouri medical cannabis market size was valued at USD 394.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 21.40% from 2023 to 2030. In Missouri, medical cannabis was legalized in November 2018. The factors contributing to market expansion in Missouri are growing research about the advantages of cannabis-based products on human health, increasing awareness regarding the benefits among the patients, and a rise in the prevalence of chronic conditions in the state. In addition, the legalization of cannabis in the state created enormous opportunities for market growth.

Medical cannabis has received varying degrees of approval in the medical community as a genuine treatment option for childhood seizures, glaucoma, bipolar disorder, PTSD, schizophrenia, weight loss during chemotherapy, and many others. However, the perception regarding marijuana as well as cannabis-based products is shifting toward a potential drug providing medical benefits, and hence the prescriptions for medical purposes are increasing in the state as well as at the national level. In addition, legalization has led to an increase in business opportunities, thereby increasing the presence of local, national, and international players in the market through strategic initiatives. For instance, BeLeaf Medical, situated in St. Louis, became Missouri's first medical cannabis farmer in June 2020, and it is a vertically integrated firm with ten total licenses in the state.

Furthermore, some of the main factors for the market expansion in Missouri include more research into the advantages of marijuana on human health, increased patient knowledge regarding such benefits, and an increase in the prevalence of chronic conditions. Moreover, the fact that marijuana is yet to be authorized for recreational use in the state may stifle market growth. However, the rising number of health conditions included under medical marijuana treatment is anticipated to boost the market growth during the forecast period. For instance, as of December 2019, the Department of Health and Senior Services (DHSS) had received 2,200 pre-filled application forms, and more than 22,000 Missourians had applied for and acquired a qualified patient ID card. This creates a lucrative opportunity for the industry in the near future.

In addition, the long history of Missouri regarding the utilization of marijuana, which dated back to the 1900s, impacted the government and finally led to the initiation of the legalization process of cannabis for medical use in the state. However, since the enforcement of the law was difficult owing to its status at the federal level and non-recognition of it as a medicine under the federal law, the idea of legalization was not further considered by the Missouri state. However, there were some reforms toward its decriminalization and in 2014, cannabis was decriminalized. The enforcement of Senate Bill 491 in January 2017 marked the decriminalization of cannabis and penalties on offenses were reduced under the bill. In addition, it eliminated the imprisonment and punishment for the possession of up to 10 grams of marijuana, thereby paving way for patients to cultivate cannabis for their personal consumption. Such instances fuelled the market growth and favorable government initiatives are anticipated to further bolster the market growth during the forecast period.

The medical cannabis business at the state as well as the national level has been impacted by COVID-19. The pandemic, for instance, has caused a temporary halt to medical and recreational cannabis launches and licensing rounds across the United States while state and local governments scurry to complete the duties and documentation required to take marijuana programs forward. This drastically impacted the growth of Missouri medical cannabis. However, with situations heading toward normalcy, the approval and licensing for cannabis are expected to regain their pace, thereby supporting the overall market growth.

Application Insights

In 2022, the chronic pain segment held the largest revenue share of over 25.7%. Factors contributing to the segment growth are research studies signifying the benefits of cannabis in alleviating pain and the high prevalence of chronic pain. Furthermore, neurogenic, cancer, headache, arthritis, low back, neck, and face pain are all examples of chronic pain. Chronic pain is linked to a slew of other medical disorders, boosting cannabis' popularity as a pain reliever. This has led to the increasing adoption of cannabis for chronic pain, thereby demonstrating a greater market share.

Tourette’s syndrome is expected to grow at a significant rate during the forecast period. The cannabis treatment for this medical condition has been extensively researched in recent years and positive results are anticipated to boost the segment growth. In addition, in circumstances where previous medicines have failed or patients have remained unresponsive, medical cannabis is being researched as an additional treatment option. Over the projected period, this segment is expected to develop due to the increased research in this field and increased usage of marijuana for treatment.

Moreover, because of its therapeutic benefits and as medical treatment can effectively address psychological issues, cannabis is increasingly being used to treat psychological problems such as autism, epilepsy, muscle spasms, post-traumatic stress disorder (PTSD), multiple sclerosis, and Parkinson's disease, or convulsions. This is further expected to support the growth of the market during the forecast period.

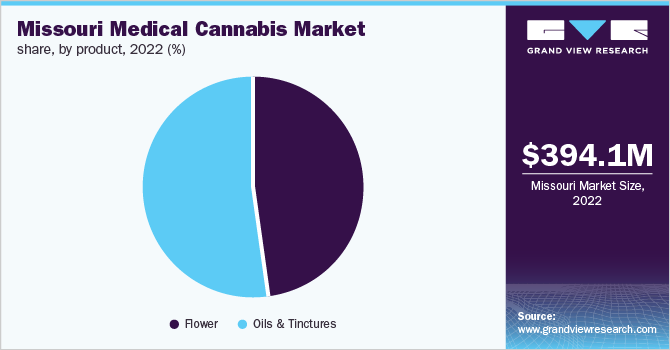

Product Insights

The oils and tinctures segment led the market with a revenue share of over 53.7% in 2022. In addition, it is predicted to be the fastest-growing segment over the forecast period, thanks to the rising demand from patients seeking treatment for epilepsy, PTSD, autism, chronic pain, or muscle spasms caused by multiple sclerosis, Parkinson's disease, and convulsions.

Furthermore, oils and tinctures are a safe form of medication that can be easily supplied to patients without causing harm to their health. Smoking flower buds have been shown to irritate the lungs, induce chronic cough and phlegm, and raise the risk of lung cancer. The side effects caused due to smoking buds are minimized when replaced with the consumption of oils and tinctures, thereby signifying a greater market share and growth rate during the forecast period.

However, despite the negative points, flowers are often used for smoking as they are less expensive and serve the low-income population, hence the category is predicted to grow. Such characteristics are crucial to the flower's rising popularity. Additionally, the industry is being propelled forward by the quick response time concerning flower smoking and its applications in easing chronic pain, reducing cancer, and slowing the course of Alzheimer's illness.

Key Companies & Market Share Insights

Cannabis products give a variety of medical benefits to consumers, which has led to a surge in their use for the treatment of a variety of chronic illnesses. As a result, they are quickly gaining traction. Furthermore, strategic initiatives such as partnerships, mergers & acquisitions, collaborations with other market players, and product launches are some of the initiatives being undertaken by key market players in order to increase their market shares. For instance, in January 2022, Organic Remedies Missouri announced the launch of its product line for medical marijuana patients in the state. Such initiatives will help in supporting the market growth over the forecast period. Some prominent players in the Missouri medical cannabis market include:

-

BeLeaf Medical

-

Blue Sage Cannabis Co.

-

Show Me Alternatives

-

Heya Wellness

-

Missouri Wild Alchemy

-

Organic Remedies

-

Holistic Industries

-

Kansas City Cannabis

-

LOCAL CANNABIS COMPANY

-

MOcann Extracts

Missouri Medical Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 518.7 million

Revenue forecast in 2030

USD 2.0 billion

Growth Rate

CAGR of 21.40% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

State scope

Missouri

Key companies profiled

BeLeaf Medical; Blue Sage Cannabis Co.; Show Me Alternatives; Heya Wellness; Missouri Wild Alchemy; Organic Remedies; Holistic Industries; Kansas City Cannabis; LOCAL CANNABIS COMPANY; MOcann Extracts

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Missouri Medical Cannabis Market SegmentationThis report forecasts revenue growth at the state level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Missouri medical cannabismarket report on the basis of product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flower

-

Oils & Tinctures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

Others

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Frequently Asked Questions About This Report

b. The Missouri medical cannabis market size is expected to reach USD 394.1 million in 2022 and is expected to reach USD 518.7 million in 2023.

b. The Missouri medical cannabis market is expected to grow at a compound annual growth rate of 21.4% from 2023 to 2030 to reach USD 2.0 billion by 2030

b. Oil & tinctures dominated the Missouri medical cannabis market with a share of 53.7% in 2022. This is attributable to the legalization of medical cannabis, increasing awareness among patients about these benefits, and rising prevalence of chronic disease purpose in Missouri.

b. Some prominent market players are BeLeaf Medical, Blue Sage Cannabis Co., Show Me Alternatives, Heya Wellness, Missouri Wild Alchemy, Organic Remedies, Holistic Industries, Kansas City Cannabis, LOCAL CANNABIS COMPANY and MOcann Extracts.

b. Key factors that are driving the market growth include increasing research about the benefits of marijuana on human health, increasing awareness among patients about these benefits, and rising prevalence of chronic diseases are key factors likely to boost the market in this U.S. state.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."