- Home

- »

- Medical Devices

- »

-

Mobile ECG Devices Market Size And Share Report, 2030GVR Report cover

![Mobile ECG Devices Market Size, Share & Trends Report]()

Mobile ECG Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Modality (Pen, Handheld), By End-use (Ambulatory Care, Homecare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-138-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile ECG Devices Market Summary

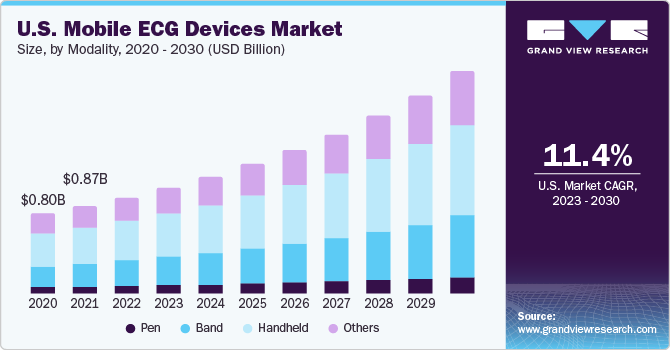

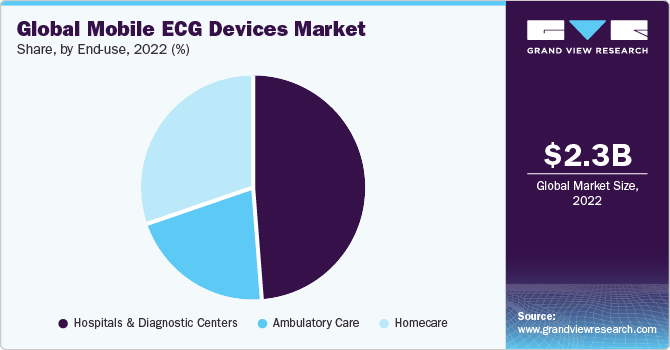

The global mobile ECG devices market size was estimated at USD 2.26 billion in 2022 and is projected to reach USD 5.42 billion by 2030, growing at a CAGR of 11.7% from 2023 to 2030. A mobile ECG device is a wireless diagnostic tool that transfers data via Bluetooth, WiFi, and other wireless connections.

Key Market Trends & Insights

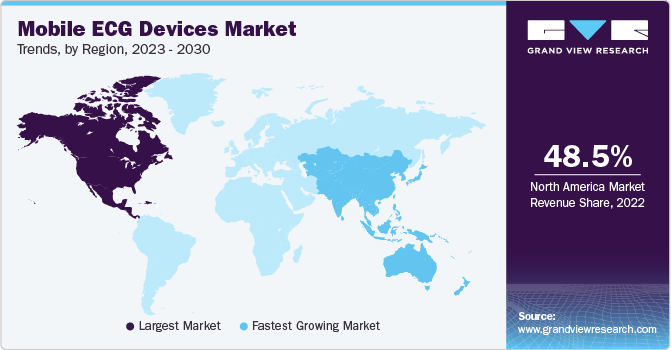

- North America dominated the global market in 2022 with a revenue share of 48.5%.

- Asia Pacific has been estimated to be the fastest-growing segment.

- Based on modality, the handheld segment dominated the market with a revenue share of 41.2%.

- Based on end use, the hospitals and diagnostic centers emerged as a leading segment with a revenue share of 48.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.26 Billion

- 2030 Projected Market Size: USD 5.42 Billion

- CAGR (2023-2030): 11.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

It exchanges, evaluates, and stores data by linking with mobile devices, tablets, and compatible apps. The increase in cardiac arrhythmia prevalence and rising geriatric population are major driving factors of the market. Furthermore, continuous technological advancement has led to the development of user-friendly mobile ECG devices.These advancements play a pivotal role in driving the market's growth by enhancing the capabilities and usability of these devices. In addition, the global increase in the elderly population significantly contributes to the market's expansion.

Mobile ECG Devices are well-suited to address the specific healthcare requirements of aging individuals, making them a crucial component of healthcare solutions tailored to this demographic. However, the regulatory challenges and privacy and data security concerns are restraining the market.

The market is witnessing a significant boost due to compelling factors within the global healthcare landscape. According to the BMC public health article published in 2022, With an estimated 59.70 million AF/AFL (Atrial Fibrillation/Atrial Flutter) patients worldwide in 2019, the demand for cardiac monitoring tools such as mobile ECG devices is rising. The advent of these devices comes at a crucial time, considering the 4.72 million new cases reported in 2019, leading to 0.315 million deaths and 8.39 million disability-adjusted years. High systolic blood pressure, elevated body mass index, alcohol consumption, smoking, and high-sodium diets are identified as major risk factors for AF/AFL-related deaths and disability-adjusted years. These risk factors emphasize the critical role of mobile ECG devices in cardiac healthcare, as they offer efficient and accessible solutions for monitoring and early detection.

Growing technological advancements in the mobile ECG devices industry are witnessing substantial growth. A notable breakthrough in this sector is the recent FDA approval of a single-lead ECG smartwatch, demonstrating its effectiveness in detecting atrial fibrillation (AF) within the general population. This development underscores the potential for smartwatches to become powerful tools for continuous AF monitoring. Beyond smartwatches, various innovative devices designed for AF monitoring and detection have entered the market. According to the NCBI article published in May 2023, a single-lead wireless ECG patch is designed to comfortably be worn on the chest. This patch offers real-time ECG monitoring capabilities and utilizes cloud-based data analysis, enabling seamless data sharing with healthcare professionals. A wrist-worn ECG recorder, after rigorous testing, exhibited impressive sensitivity (99.4%) and specificity (99.8%) in detecting AF, making it a user-friendly choice for arrhythmia detection. A single-lead ECG chest belt achieved a remarkable sensitivity of 100% and specificity of 95.4%, preferred by 77% of users over a standard 3-lead Holter monitor. Commercial heart rate monitors and ECG systems have also proven effective in AF detection. These technological advancements underscore the growing significance of mobile ECG devices in healthcare.

The FDA categorizes mobile ECG devices as medical devices, and their classification depends on their intended use and risk level; these hamper the market. According to the FDA, accurate classification is crucial because different classes have varying regulatory requirements. Many of these devices fall into Class II, which necessitates FDA's 510(k) clearance before marketing.

Modality Insights

Based on modality, the market is divided into pen, band, handheld, and others segments. The handheld category dominated the market with a revenue share of 41.2% primarily due to its balanced combination of portability and functionality. These devices offer a practical solution for healthcare professionals and patients, ensuring a user-friendly experience while maintaining the precision required for ECG monitoring. Handheld devices often have advanced features, intuitive interfaces, and wireless connectivity options, enhancing their versatility and adaptability across various healthcare settings. Moreover, their ergonomic design and ease of use make them accessible to a wide spectrum of users, further solidifying their popularity and widespread adoption in the market.

However, the band and other wearables are likely to show lucrative growth owing to the rising adoption of wearables such as smart bands, patches, and others. Wearable cardiac monitoring has more applications than just atrial fibrillation, and these applications are constantly expanding, which is contributing to the market growth.

End-use Insights

Based on end-use, the market is divided into hospitals and diagnostic centers, ambulatory care, and homecare segments. The hospitals and diagnostic centers emerged as a leading segment with a revenue share of 48.7% in 2022. This growth is primarily attributed to the significant patient population served by hospitals, particularly in emerging and low-income nations, which is driving the demand for mobile ECG devices.

However, the homecare segment is poised to register the fastest CAGR of 12.2% in the market during the forecast period. This growth is attributed to its cost-effectiveness and convenience for medical treatment at home. Technological advancements and the miniaturization of healthcare products drive the demand for home healthcare devices, making them more accessible and user-friendly. In addition, factors such as a growing target population, the increasing need to manage healthcare costs, and a high prevalence of diseases targeted by these devices are expected to have a significant positive impact, driving the adoption of mobile ECG devices.

Regional Insights

North America dominated the global market in 2022 with a revenue share of 48.5%. The significant growth of this region's market is driven by several factors, including the substantial geriatric population, advanced healthcare infrastructure, and relatively high disposable incomes. Government initiatives to reduce healthcare expenditures by endorsing home healthcare are expected to play a crucial role in driving market growth.

Asia Pacific has been estimated to be the fastest-growing segment. Factors such as underdeveloped healthcare infrastructure, expensive in-hospital healthcare facilities, and chronic diseases that require long-term care are increasing home healthcare products and services. Thailand, Australia, South Korea, and New Zealand are some of the emerging countries in the region. Technological advancements in patient monitoring devices and an increasing geriatric population coupled with the growing prevalence of lifestyle diseases, such as obesity & diabetes, are anticipated to drive the market's growth.

Key Companies & Market Share Insights

The market is highly competitive with a large number of manufacturers. The market players are focusing on various strategic initiatives such as new product launches, geographical expansion, mergers and acquisitions, collaboration, product upgradation, and partnerships. For instance, in May 2023, VivaLNK, Inc. launched an updated multi-parameter wearable ECG patch. The product is expected to provide continuous 14-day livestream capabilities, which improve patient comfort and reduce the clinic’s administrative tasks. Some prominent players in the global mobile ECG devices market include:

-

New York Plastic Surgical Group

-

Nihon Kohden Corporation

-

GE Healthcare

-

Medtronic

-

iRhythm Technologies, Inc.

-

Koninklijke Philips N.V.

-

Emay

-

Dr Trust

-

Omron

Mobile ECG Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.50 billion

Revenue forecast in 2030

USD 5.42 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

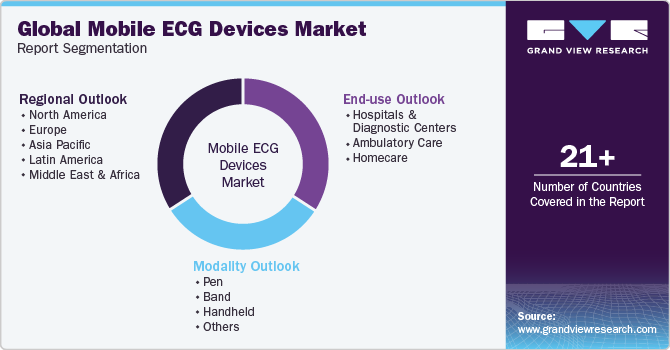

Segments covered

Modality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

New York Plastic Surgical Group; Nihon Kohden Corporation; GE Healthcare; Medtronic; iRhythm Technologies, Inc.; Koninklijke Philips N.V.; Emay; Dr Trust; Omron

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile ECG Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile ECG devices market report based on modality, end-use, and region:

-

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pen

-

Band

-

Handheld

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals And Diagnostic Centers

-

Ambulatory Care

-

Homecare

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East And Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mobile ECG devices market size was estimated at USD 2.26 billion in 2022 and is expected to reach USD 2.50 billion in 2023

b. The global mobile ECG devices market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 5.42 billion by 2030.

b. North America dominated the global mobile ECG devices market and accounted for 48.5% of the total market share in 2022. The significant growth of this region's mobile ECG device market is driven by several factors, including the substantial geriatric population, advanced healthcare infrastructure, and relatively high disposable incomes.

b. Some of the key players in the mobile ECG devices market are Nihon Kohden Corporation, GE Healthcare, Medtronic, iRhythm Technologies, Inc., Koninklijke Philips N.V., Emay, Dr Trust, Omron

b. The mobile ECG devices market is expected to grow due to several factors, such as increasing cardiac arrhythmias prevalence, growing technological advancement, and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.