- Home

- »

- Next Generation Technologies

- »

-

Mobile Payment Market Size, Share & Growth Report, 2030GVR Report cover

![Mobile Payment Market Size, Share & Trends Report]()

Mobile Payment Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Payment (B2B, B2C, B2G, Others), By Location (Remote Payment, Proximity Payment), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-461-1

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Payment Market Summary

The global mobile payment market size was valued at USD 88.50 billion in 2024 and is projected to reach USD 587.52 billion by 2030, growing at a CAGR of 38.0% from 2025 to 2030. Some of the key characteristics of mobile payments, such as enhanced safety, ease of use, quick functions, inexpensive operations, and ubiquity driven by the internet, have driven the growth of this market.

Key Market Trends & Insights

- The North America mobile payments market held a significant revenue share of the global mobile payment market in 2024.

- The U.S. mobile payments market held the largest revenue share of the regional industry in 2024.

- Based on technology, mobile web payment segment dominated the global market with revenue share of 23.8% in 2024.

- Based on payment, B2B mobile payments segment held largest revenue share of the global mobile payment market in 2024.

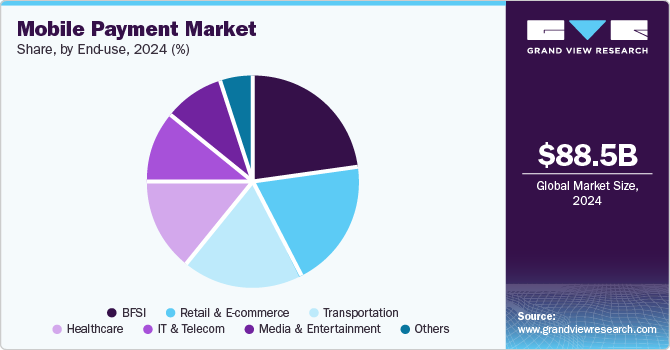

- Based on end use, the BFSI segment held the largest revenue share of the global mobile payment market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 88.50 billion

- 2030 Projected Market Size: USD 587.52 billion

- CAGR (2025-2030): 38.0%

- Asia Pacific: Largest market in 2024

The unprecedented rise in m-commerce activities, unceasing growth in the use of smartphones, the inclination of global and domestic businesses towards offering mobile payment alternatives through official platforms, and easy accessibility to high-speed internet connections are expected to fuel the growth of mobile payments over the forecast period.

Mobile payment solutions are fast and convenient. An increasing number of customers worldwide have embraced the concept of using smartphones and tablets to pay for products and services. Moreover, e-commerce and traditional businesses focus on adapting to changing customer behavior, including cashless payment methods through mobile devices.

In mobile payment technology, Near-Field Communication (NFC) effectively transmits encrypted data to the Point of Sale (POS) devices directly and instantly. This saves time significantly compared to PIN and chip technology. NFC in mobile devices uses proximity radio frequency identification to communicate effectively with NFC-enabled card machines. Customers need not come into physical contact with the POS devices to transfer information; only the mobile devices need to be near the terminal.

The increasing adoption of sound wave-based mobile payments is expected to drive market growth. Instead of using existing technologies, such as banking applications or mobile wallets, NFC, or card terminals, sound wave-based payment transactions are processed through unique sound waves containing encrypted payment information. The internet is not required for sound wave-based mobile payments. Sound wave-based mobile payment solutions are easy to deploy at a low cost, particularly in regions and countries where residents cannot afford the most advanced smartphones.

The continuous increase in the number of mobile transactions, growing penetration of associated technologies such as UPI (Unified Payments Interface), ease of use, enhanced accessibility, availability without restraints of time and holidays, and widespread acceptance are projected to fuel growth for this market. The declining use of cash, enhancing infrastructures for real time payments, availability of Digital Public Infrastructures (DPIs), and significant moves by multiple countries towards launch of central bank digital currency are also adding to the growth of this market.

For instance, in September 2024, the Bank of Russia (The Central Bank of the Russian Federation) announced that it had sent its proposals to the Russian Ministry of Finance regarding the amendment of relevant laws. In addition, it has set a timeline for trade and service companies in different categories to ensure the mandatory acceptance of digital rubles over the next few years. It also specified that major banks need to be equipped with the necessary systems and present opportunities for clients to conduct transactions using digital rubles.

Technology Insights

Based on technology, mobile web payment segment dominated the global market with revenue share of 23.8% in 2024. This is attributed to the security and flexibility provided by mobile web payment solutions. The growing popularity of m-commerce also bodes well for the segment's growth. The mobile web payment platforms have properly bookmarked URLs, making it easier for customers to revisit or share the website if necessary. Unceasing growth in use of e-commerce website, rising number of transaction stimulated by social media platforms, ease of use, and enhanced network and infrastructural capabilities of BFSI companies and quick commerce businesses are expected to drive growth of this market in approaching years.

Near Field Communication technology is projected to experience the fastest CAGR of 39.6% from 2025 to 2030. NFC technology allows merchants to integrate customer loyalty programs into their payment processes and customers to redeem their coupons immediately using mobile phones. The rise in e-commerce platforms and continued implementation of the latest technologies in financial transactions are expected to drive the growth of the segment. Factors such as the increasing adoption of wearable payment devices and the growing mobile commerce trend are expected to drive the adoption of NFC-based payments.

Payment Insights

B2B mobile payments segment held largest revenue share of the global mobile payment market in 2024. This is attributed to increasing use by enterprises, adoption of advanced technologies in mobile applications, ease of use, availability of high-functioning smartphone devices, and growing accessibility of high-performance internet services. In addition, continuously evolving regulatory scenarios associated with financial transactions and the security of user data have encouraged businesses to establish and prefer safe and compliant modes of payment.

The B2C mobile payments segment is expected to experience the fastest CAGR during the forecast period. This is attributed to the growing use of mobile payments for convenience, use of mobile payment services for employee salaries, and rising use of subscription-based services for media, on demand videos, e-commerce or quick commerce memberships, and more. New launches by prominent companies worldwide for B2C payment networks are also contributing to the growth of this segment.

Location Insights

Remote payment segment dominated the global market in 2024. Increasing ubiquity of smartphone driven payments apps, rising inclination towards online shopping, use of mobile payments app for paying bills of different sorts such as power supply, water, television, gas, credit card, streaming subscriptions, etc., unprecedented increase in QR code transactions, and availability of multiple mobile applications for payments is expected to drive growth of this segment in approaching years.

The proximity payment segment is expected to expand at the highest CAGR over the forecast period. Proximity payments require the payer and the payee to be in proximity and the transactions take place between the payer’s and the payee’s devices via QR codes, NFC, or Bluetooth connectivity. This payment method allows paying for goods and services by mobile phones and other devices at a physical POS terminal. In recent years, preference for proximity payments has significantly increased as banks, fintech industries, and merchants are aiming to improve the digital experience for their customers and reduce their operational costs.

End Use Insights

The BFSI segment held the largest revenue share of the global mobile payment market in 2024. Multiple BFSI organizations are putting enormous effort into developing and delivering user-friendly mobile payment applications. The penetration of modern technologies, ease of availability factor for smartphone technology, advancements in technical capabilities, and rising customer acceptance add growth opportunities for this segment. Businesses also focus on adopting a custom suite of comprehensive payment solutions, which helps resolve unique challenges across wealth management, lending, and insurance sectors. Mobile banking and payments create new opportunities for banks to offer additional convenience to their existing customers and reach a large population of unbanked customers in developing countries.

The retail & e-commerce segment is expected to experience the fastest CAGR during the forecast period. This is attributed to aspects such as the growing focus of retail businesses on delivering enhanced online shopping experience, the rising number of new entrants in the quick commerce industry, unceasing growth in online grocery shopping, lucrative features added by retail industry participants, and enhanced efforts by key companies to integrate modern technologies with existing payment methods. For instance, in August 2024, one of the key companies in the Indian retail industry, super.money introduced a credit-first UPI service platform, which offers special offers and cashback to Flipkart and Myntra as merchant partners.

Regional Insights

The North America mobile payments market held a significant revenue share of the global mobile payment market in 2024. Presence of multiple global retailers, large enterprises operating in industries such as e-commerce, media & entertainment, healthcare, IT & telecom, transportation, BFSI, and others, growing focus on enabling users with seamless payment experiences, and early adoption trends in terms of technology are expected to drive the growth of this market.

U.S. Mobile Payment Market Trends

The U.S. mobile payments market held the largest revenue share of the regional industry in 2024. This is attributed to multiple factors, including the robust consumer goods industry, the ubiquity of smartphones and the internet, the growing focus of companies on offering enhanced customer experience, a large share in global trade, a strong tourism industry, and increasing infrastructural capabilities associated with mobile payment.

Asia Pacific Mobile Payment Market Trends

Asia Pacific mobile payments market dominated the global industry with a revenue share of 35.4% in 2024. There has been unprecedented growth in UPI transactions in India. Collaborations and availability of UPI services designed by India in countries such as UAE, France, and others, the growing availability of uninterrupted high-speed internet connections, increasing focus on enhanced infrastructures, and increasing utilization are expected to fuel the growth of this market.

India mobile payments market held largest revenue share of the regional industry in 2024. Rising accessibility and availability to high-performance internet, the rise of businesses with the availability of QR code options, increasing focus of government on digitizing the economic activities in the country, growing utilization by consumers, expanding retail industry and quick commerce businesses, and additional services and offerings introduced by key companies in the market are expected to drive the growth of this market.

Europe Mobile Payment Market Trends

Europe mobile payment market is expected to experience significant growth during the forecast period. The rapid pace of digitization, declining use of cash, an increasing number of foreign visitors in the region, growing participation in global trade, presence of multiple tourism attractions in the area, increasing focus of companies and BFSI organizations to offer seamless payment experience and availability of various alternatives are driving the growth of this market.

The UK mobile payments market is projected to grow rapidly from 2025 to 2030. This is attributed to government support, the rising capabilities of the country's digital payment ecosystem, increasing trade activities, the growing availability of uninterrupted internet services offered by key telecom companies, and the inclination towards adopting new technologies in the BFSI and retail industries.

Key Mobile Payment Company Insights

Some of the key companies operating in the mobile payment market are Google (Google Pay), Alipay, Amazon.com, Inc. (Amazon Payments), Apple, Inc. (Apple Pay), PayPal Holdings, Inc., and others. The major market players are adopting strategies such as technology enhancements, capacity improvements, tie-ups and collaborations, partnerships with merchants, and more to address growing competition and unceasing growth in demand.

-

Alipay, one of the key players in the global digital payments industry, offers safe, secure, and frictionless payment services that are streamlined according to consumer requirements. A digital transaction platform is extensively used in China and other parts of the world. The application deployed by the company enables users to make in-store and online purchases using smartphones.

-

Amazon.com, Inc. (Amazon Payments), a major market participant in the mobile payment market, offers mobile and web-based payment services with abilities associated with immediate charges, deferred payments, recurring payments, split payments, one-off purchases, refunds, and more.

Key Mobile Payment Companies:

The following are the leading companies in the mobile payment market. These companies collectively hold the largest market share and dictate industry trends.

- Google (Alphabet Inc)

- Alipay

- Amazon.com, Inc. (Amazon Payments)

- Apple, Inc. (Apple Pay)

- C-SAM, Inc. (MasterCard Incorporated)

- Tencent Holdings Ltd. (WeChat)

- MoneyGram International Inc.

- PayPal Holdings, Inc.

- Samsung Group (Samsung Pay)

- Visa, Inc.

Recent Developments

-

In August 2024, Windcave, one of the key payment technology companies in New Zealand, partnered with Alipay+ to deliver flawless mobile payment solutions to businesses in Australia and New Zealand. The newly established solution by this partnership is expected to enable merchants with the capabilities to accept payments from travelers visiting countries from parts of Asia and Europe.

Mobile Payment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 117.53 billion

Revenue forecast in 2030

USD 587.52 billion

Growth rate

CAGR of 38.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, payment, location, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Google (Alphabet Inc), Alipay, Amazon.com, Inc. (Amazon Payments), Apple, Inc. (Apple Pay), C-SAM, Inc. (MasterCard Incorporated), Tencent Holdings Ltd. (WeChat), MoneyGram International Inc., PayPal Holdings, Inc., Samsung Group (Samsung Pay), Visa, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Payment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile payment market report based on technology, payment, location, end use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Near Field Communication

-

Direct Mobile Billing

-

Mobile Web Payment

-

SMS

-

Interactive Voice Response System

-

Mobile App

-

Others

-

-

Payment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

B2C

-

B2G

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Remote Payment

-

Proximity Payment

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Retail & E-commerce

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.