- Home

- »

- Next Generation Technologies

- »

-

ModelOps Market Size, Share, Trends, Industry Report 2030GVR Report cover

![ModelOps Market Size, Share & Trends Report]()

ModelOps Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering, By Deployment, By Application (CI/CD), By Model (ML Model, Graph-based Model), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-507-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

ModelOps Market Size & Trends

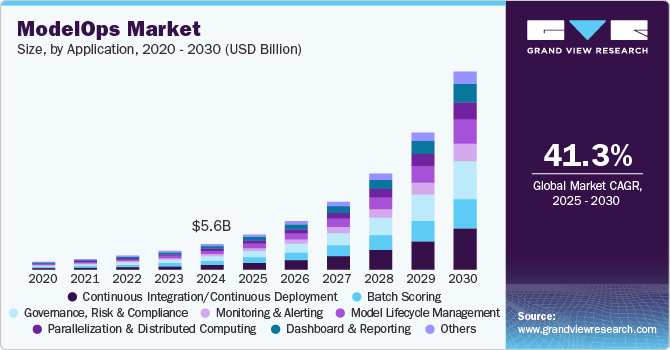

The global ModelOps market size was estimated at USD 5.64 billion in 2024 and is expected to grow at a CAGR of 41.3% from 2025 to 2030. Rapid AI and ML adoption across industries, needs for scalability large-scale AI deployment, cost efficiency and automation, and AI model performance monitoring are primarily drivers of the ModelOps market. ModelOps helps businesses mitigate operational risks by providing tools to detect and rectify model drift or failures before they impact critical business processes, ensuring consistent decision-making and reducing potential disruptions.

Strict regulations, in various industries such as, BFSI, and healthcare require transparent, explainable, and compliant AI models. ModelOps platforms provide governance frameworks that help businesses meet regulatory requirements, avoiding costly compliance breaches and ensuring auditability. For instance, in December 2024, ModelOp, a foremost provider of AI governance software for enterprises announced a significant surge in platform usage throughout the year. New customer acquisitions drove this growth, the adoption of generative AI, and an increasing demand for its AI portfolio intelligence and governance solutions. For the second year in a row, the company achieved substantial and sustained expansion, particularly in the healthcare, financial services, and consumer packaged goods (CPG) sectors.

ModelOps enhances the speed at which companies can move AI models from development to production. This reduction in time-to-market helps businesses quickly leverage AI-driven insights, ensuring agility in responding to market changes and customer demands. To ensure ongoing business value, ModelOps continuously monitors models for performance, drift, and bias. This proactive approach helps prevent revenue losses due to underperforming models, ensuring the consistency and accuracy of AI-driven decisions. Automating AI/ML model deployment, monitoring, and retraining reduces the need for manual intervention, leading to significant cost savings. For businesses, this means optimizing resources while maintaining high-quality AI operations.

As businesses across sectors increasingly adopt artificial intelligence (AI) and machine learning (ML) to gain competitive advantages, the need for ModelOps solutions to streamline deployment and management becomes critical. Operationalizing AI models efficiently is a top priority to ensure a faster return on investment (ROI). As companies scale their AI initiatives and deploy numerous models, ModelOps enables them to efficiently manage these models at scale, ensuring consistent performance across different environments and reducing operational costs.

Offering Insights

The platforms segment led the market in 2024, accounting for over 67.0% share of the global revenue. As organizations increasingly adopt advanced AI techniques, the complexity of models escalates. This complexity necessitates robust ModelOps platforms to streamline development, deployment, and monitoring processes. Furthermore, the shift toward agile methodologies in software development drives the need for continuous integration and continuous deployment (CI/CD) capabilities. ModelOps platforms facilitate rapid iteration and deployment of AI models, enhancing responsiveness to changing business requirements. For instance, in May 2024, ModelOp, the global leader in AI governance software for enterprises, announced the launch of ModelOp Version 3.3. This groundbreaking release introduces a world-first capability, enabling enterprise leaders to assess AI risks and maintain continuous governance of AI initiatives in line with evolving global regulations. The new AI Governance Score provides executives with real-time insights into all AI initiatives spanning in-house solutions, generative AI, third-party tools, and embedded AI systems, along with their associated risks across the organization.

The services segment is anticipated to exhibit highest CAGR over the forecast period. Numerous factors such as increasing complexity of AI models, focus on data-driven decision making, and customization requirements are primarily driving the growth of the services segment. The need for improved collaboration between data science, IT, and business units drives demand for services that facilitate better communication and workflow integration. Effective ModelOps services can bridge the gap between these diverse teams, promoting a more cohesive approach to AI deployment.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. Organizations are increasingly adopting cloud-based ModelOps solutions due to their ability to scale resources up or down based on demand. This flexibility allows businesses to manage fluctuating workloads efficiently. Moreover, cloud deployment reduces the total cost of ownership compared to on-premises solutions. Organizations can minimize upfront capital expenditures by leveraging pay-as-you-go pricing models, allowing for more efficient allocation of resources. Furthermore, the cloud environment facilitates faster implementation of ModelOps solutions, enabling organizations to deploy models more quickly in response to market demands. This agility is essential for maintaining competitive advantage.

The on-premises segment is anticipated to exhibit the highest CAGR over the forecast period. Enterprises operate with legacy systems require direct integration with new ModelOps tools. On-premises solutions can facilitate smoother transitions and compatibility with established infrastructure. Moreover, on-premises deployments can provide better performance and lower latency for data processing, which is crucial for applications requiring real-time insights and responsiveness.

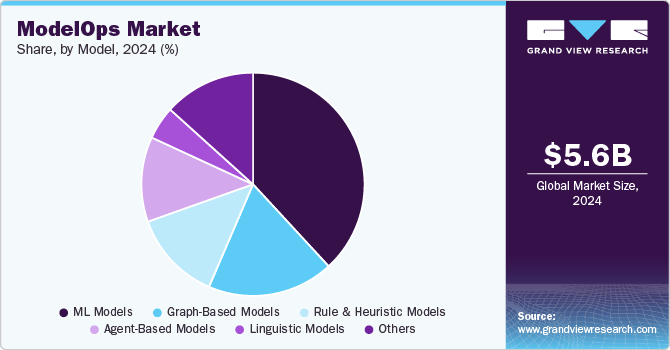

Model Insights

ML models segment accounted for the largest market revenue share in 2024 in the ModelOps industry. Continuous improvements in machine learning algorithms enhance the performance and accuracy of predictive models, making them more viable for diverse applications. Moreover, the exponential growth of data generated across various sectors necessitates robust machine learning models capable of processing and deriving insights from large datasets efficiently. Furthermore, the rising emphasis on predictive analytics also drives the need for machine learning models that can forecast trends, customer behavior, and operational risks, enabling better strategic planning.

The graph-based models segment is anticipated to exhibit the highest CAGR over the forecast period. As organizations increasingly deal with complex and interconnected data, graph-based models provide a robust framework for analyzing relationships and dependencies within datasets, enabling more insightful data interpretations. Moreover, graph-based models facilitate better decision-making by uncovering hidden patterns and connections within data, which can lead to more informed strategic planning and operational efficiencies.

Application Insights

The Continuous Integration/Continuous Deployment (CI/CD) segment accounted for the largest market revenue share in 2024. Organizations are increasingly adopting CI/CD practices to enhance their operational efficiency and accelerate the deployment of machine learning models. This approach allows for more frequent updates and quicker iterations, enabling teams to respond rapidly to changing business needs. The CI/CD framework promotes collaboration between data scientists, developers, and operations teams, fostering a culture of continuous improvement. By integrating workflows, organizations can streamline processes and reduce silos, leading to improved project outcomes.

The governance, risk and compliance segment is anticipated to exhibit the highest CAGR over the forecast period. There is a growing emphasis on ethical considerations in AI development and deployment. Companies are prioritizing transparency and accountability in their AI systems, leading to increased investments in governance structures that address ethical concerns. Organizations are facing increasing regulatory requirements related to data usage, privacy, and AI deployment. The need to adhere to these regulations drives the adoption of robust governance frameworks to ensure compliance and mitigate legal risks.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2024 in the ModelOps industry. The BFSI sector faces stringent regulatory requirements that necessitate robust governance and compliance frameworks. ModelOps solutions help organizations ensure adherence to these regulations while managing risk effectively. The need to streamline processes and improve operational efficiency drives the adoption of ModelOps. By automating model deployment and monitoring, organizations can reduce time-to-market for new financial products and services.

The healthcare & life sciences segment is anticipated to exhibit the highest CAGR over the forecast period. The complexity of healthcare challenges requires collaboration across various disciplines. ModelOps fosters a collaborative environment, enabling data scientists, clinicians, and IT professionals to work together effectively in developing and managing AI models. Healthcare systems increasingly incorporate AI-driven solutions, the need for effective deployment and lifecycle management of these models becomes crucial. ModelOps provides the necessary infrastructure for seamless integration and ongoing monitoring.

Regional Insights

The North America dominated with a revenue share of over 35.0% in 2024. The U.S. and Canada have stringent regulations, particularly in various sectors such as, BFSI, and healthcare. ModelOps frameworks are essential to help businesses meet compliance requirements for AI models, ensuring transparency and accountability.

U.S. ModelOps Market Trends

The U.S. ModelOps industry is anticipated to exhibit a significant CAGR over the forecast period. Businesses in the U.S. face growing demands for explainable AI due to regulatory pressures and consumer expectations. ModelOps platforms offer the governance and explainability required to ensure that AI models are transparent, traceable, and ethically deployed.

Europe ModelOps Market Trends

The ModelOps industry in the Europe region is expected to witness significant growth over the forecast period. European businesses face pressure to ensure their AI systems are secure and reliable. ModelOps helps mitigate risks by providing robust monitoring, alerting, and retraining capabilities to ensure models perform optimally and securely over time.

Asia Pacific ModelOps Market Trends

The ModelOps industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Various countries in APAC region, such as China, India, and Japan, are undergoing large-scale digital transformation initiatives. This is increasing demand for AI and ML technologies, where ModelOps is essential to manage the scale and complexity of AI/ML model deployments effectively.

Key ModelOps Company Insights

Some key companies in the ModelOps market include Amazon Web Services, Inc., IBM Corporation, and Hewlett Packard Enterprise Development LP.

-

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, is a global leader in cloud computing and a dominant player in the ModelOps market. Renowned for its extensive suite of cloud-based services, AWS empowers enterprises to manage, deploy, and scale machine learning (ML) models across diverse use cases. With its robust ModelOps tools, such as Amazon SageMaker and its suite of governance capabilities, AWS simplifies the ML lifecycle, ensuring model explainability, compliance, and operational efficiency. Its scalable infrastructure and integration with generative AI further position AWS as a critical partner for businesses navigating complex AI ecosystems. Serving industries such as financial services, healthcare, and retail, AWS continues to set the benchmark for innovation and operational excellence in the ModelOps domain.

-

IBM Corporation is a global leader in technology and a prominent player in the ModelOps market, leveraging decades of expertise in artificial intelligence and enterprise solutions. Through its flagship platform, IBM Watson, and tools such as Watson Studio and Watson OpenScale, IBM offers end-to-end capabilities for managing, deploying, and monitoring AI and machine learning (ML) models at scale. Focused on trust, transparency, and compliance, IBM provides advanced features for AI explainability, bias detection, and governance, ensuring alignment with evolving regulatory standards. Serving industries such as healthcare, financial services, and manufacturing, IBM empowers organizations to operationalize AI seamlessly while mitigating risks.

Key ModelOps Companies:

The following are the leading companies in the modelOps market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Cloud Software Group, Inc.

- Cloudera, Inc.

- DataRobot, Inc.

- Domino Data Lab, Inc.

- Google Cloud

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- SAS Institute Inc.

Recent Developments

-

In July 2024, Teradata, cloud analytics platform provider, partnered with DataRobot, Inc., open AI platform provider to integrate DataRobot, Inc.’s AI Platform with Teradata’s ClearScape Analytics and VantageCloud.This integration is intended to enable enterprises to fully realize their AI potential by providing increased flexibility and options for developing and scaling secure, efficient AI models.

-

In May 2024, Microsoft launched GPT-4o, OpenAI’s new model on Azure AI. This multimodal model incorporates audio, vision, and text capabilities, enabling generative and conversational AI functionalities. GPT-4 is now accessible in Azure OpenAI Service for preview, with support for text and image inputs.

-

In May 2024, Google Cloud launched Generative AI Ops, a new service offering.This offering, available through Google Cloud Consulting or Google Cloud’s partner ecosystem, is designed to assist organizations in advancing their generative AI prototypes into production-ready solutions. It provides support in key areas such as security, model tuning, feedback, and optimization.

ModelOps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.73 billion

Revenue forecast in 2030

USD 43.60 billion

Growth rate

CAGR of 41.3% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, model, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; Cloud Software Group, Inc.; Cloudera, Inc.; DataRobot, Inc.; Domino Data Lab, Inc.; Google Cloud; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ModelOps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ModelOps market report based on the offering, deployment, model, application, vertical, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Platforms

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Model Outlook (Revenue, USD Million, 2017 - 2030)

-

ML Models

-

Graph-based Models

-

Rule & Heuristic Models

-

Linguistic Models

-

Agent-based Models

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Continuous Integration/ Continuous Deployment

-

Batch Scoring

-

Governance, Risk and Compliance

-

Parallelization & Distributed Computing

-

Monitoring & Alerting

-

Dashboard & Reporting

-

Model Lifecycle Management

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare & Life sciences

-

IT & Telecommunications

-

Energy & Utilities

-

Manufacturing

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

Frequently Asked Questions About This Report

b. The global ModelOps market size was estimated at USD 5.64 billion in 2024 and is expected to reach USD 7.73 billion in 2025.

b. The global ModelOps market is expected to grow at a compound annual growth rate of 41.3% from 2025 to 2030 to reach USD 43.60 billion by 2030.

b. North America dominated the market in 2024, accounting for over 35.0% share of the global revenue. The U.S. and Canada have stringent regulations, particularly in various sectors such as, BFSI, and healthcare. ModelOps frameworks are essential to help businesses meet compliance requirements for AI models, ensuring transparency and accountability.

b. Some key players operating in the ModelOps market include Amazon Web Services, Inc.; Cloud Software Group, Inc.; Cloudera, Inc.; DataRobot, Inc.; Domino Data Lab, Inc.; Google Cloud; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; and SAS Institute Inc.

b. Key factors driving the ModelOps market growth include integration of ModelOps with DataOps and DevOps and integration of automated CI/CD pipelines

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.