- Home

- »

- Medical Devices

- »

-

Moist Wound Dressings Market Size & Share Report, 2030GVR Report cover

![Moist Wound Dressings Market Size, Share & Trends Report]()

Moist Wound Dressings Market Size, Share & Trends Analysis Report By Product (Foam Dressings, Film Dressings), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-665-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global moist wound dressings market size was estimated at USD 4.25 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.49% from 2023 to 2030. Wound dressings have evolved from simple dressings that cover the wound to advanced products that release pharmaceutically active ingredients for accelerating the healing process and reducing pain and inflammation. Wound care is essential to enhance the healing process and minimize the risk of associated infections. The rising incidence of diabetic pressure, venous stasis, and foot ulcers are among the key factors driving the market growth. The COVID-19 pandemic had a profound effect on the capacity of healthcare systems to keep up with curative and preventive services, particularly for more vulnerable populations.

During the pandemic, the wound treatment centers in Italy managed a major reduction in the frequency of hospital admissions, since just urgencies, like extreme infections or wound hemorrhagic complexities, were permitted in the hospitals. The launch of novel therapies, such as electromagnetic therapy, electrical stimulation, nanotechnology, and the use of silver and other combination dressings are boosting market growth. These advancements ensure better wound care and thus increase product adoption. A major advancement in the market includes the ability of these dressings to regulate moisture at the wound site, which aids in the regeneration of tissue and reduces infection and pain. Advanced products facilitate wound protection, gas exchange, antibacterial protection, thermal insulation, and exudate absorption, thereby boosting market growth.

In addition, the growing incidence of burn injuries is projected to boost moist wound dressings demand. As per the statistics by the WHO, every year, about 180,000 deaths occur due to burn injuries. Moreover, the growing geriatric population across the globe is estimated to support market expansion. As per the WHO estimates, the global geriatric population (aged 60 years and above) is anticipated to reach about 2 billion by 2050. This age group is susceptible to injuries and chronic wounds, such as venous leg and pressure ulcers, which is expected to spur the market growth in the years to come. Emerging regions, such as Southeast Asia, are expected to witness considerable growth on account of the rising cases of burn injuries. Growing disposable income, rising awareness regarding these dressing products, and the availability of better-quality products in such regions are also contributing to the market growth.

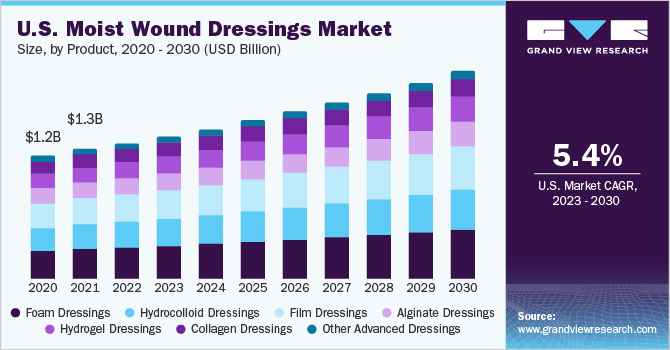

Product Insights

The foam dressings segment accounted for the largest market share of 23.4% in 2022 due to the soft and comfortable feel of these dressings. Moreover, they help prevent and stop exudation from burn injuries, which is also driving the segment growth. Due to their highly absorbent nature, these dressings can be changed after around 3-4 days and are used for wounds with heavy exudation without the complication of maceration. According to the American Burn Association, approximately 450,000 patients are hospitalized due to burns each year and the risk of infection is higher in these patients. These dressings are recommended for chronic wounds like pressure and diabetic foot ulcers and burn injuries as they help create and maintain a moist environment, which facilitates a faster healing process.

The hydrocolloid dressings segment is expected to grow at the fastest CAGR of 6.02% during the forecast period. These dressings create a moist environment around the wound that helps complement the healing process. Hydrocolloid dressings also provide an occlusive barrier over the wound, protecting it from external contaminants, bacteria, and other pathogens. These dressings are flexible and conform well to the body contours, making them suitable for use in various anatomical locations. They can be easily applied to areas with irregular surfaces, such as elbows, knees, and heels.

Application Insights

The chronic wounds segment accounted for the largest revenue share of 59.9% in 2022. This can be attributed to the rising prevalence of chronic wounds and the increasing demand for innovative treatment options. For instance, according to an article published by The British Diabetic Association in 2021, around 4.1 million people in the UK were suffering from some type of diabetes, whereas 850,000 people were expected to have type 2 diabetes in the future. In addition, as per the NCBI, the annual incidence rate of diabetic foot ulcers is predicted to be around 2% - 5%.

The lifetime risk of diabetic foot ulcers is projected to be 15% - 20%. Therefore, as a result of the above-mentioned factors, the chronic wound segment is expected to dominate the market even during the forecast period. The acute wounds segment is expected to grow at the fastest CAGR of 5.6% during the forecast period due to the increasing prevalence of the disease and related complications. On account of the availability of advanced wound dressing products, such ulcers can be treated and healed quickly while reducing hospital stays & overall costs.

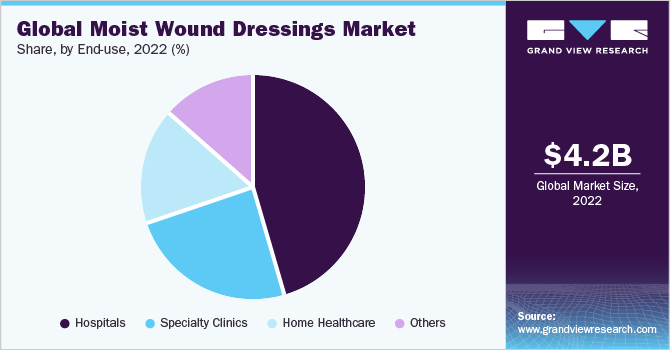

End-use Insights

On the basis of end-uses, the market can be further categorized into hospitals, specialty clinics, home healthcare, and others. The hospitals segment dominated the global industry in 2022 and accounted for the largest share of 45.2% of the overall revenue. This growth can be attributed to the rising number of surgeries performed in these settings.

The segment growth is also driven by the increasing prevalence of chronic diseases and wounds. In addition, the high prevalence of hospital-acquired infections (HAIs) is anticipated to drive the segment growth. The home care settings segment is anticipated to register a considerable growth rate of 6.1% over the forecast period owing to the increasing awareness.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 45.4% in 2022 owing to the presence of the target population and increased patient awareness levels. The market is estimated to expand further due to the increasing cases of chronic wounds, such as diabetic foot and pressure ulcers, in the region. As per the CDC, around 2.5 million patients suffer from pressure ulcers annually. The easy availability of products as a result of the presence of major market players and their wide distribution network will also contribute to the regional market growth.

The Asia Pacific regional market is expected to grow at the fastest CAGR of 6.07% during the forecast period. The region has witnessed a significant increase in healthcare expenditure, government support, and investment in research and development activities. Moreover, the presence of emerging nations like Thailand, Malaysia, and Singapore is anticipated to fuel the regional market growth.

Key Companies & Market Share Insights

The market is highly competitive and product launches, approvals, strategic acquisitions, and innovations are some of the strategies being undertaken by the players to gain a competitive edge. For instance, in October 2022, Healthium Medtech Limited, a provider of surgical support products, announced the launch of its TRUSHIELD NXT surgical wound dressing. The new launch will extend the company’s existing infection prevention and wound care product portfolio. The following are some of the major participants in the global moist wound dressings market:

-

Coloplast A/S

-

Medline Industries, Inc.

-

Smith & Nephew

-

Convatec, Inc.

-

Systagenix

-

Derma Sciences, Inc.

-

Cardinal Health

-

Acelity

-

3M

-

B. Braun Medical Inc.

Moist Wound Dressings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.47 billion

Revenue forecast 2030

USD 6.50 billion

Growth rate

CAGR of 5.49% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Coloplast A/S; Medline Industries, Inc.; Smith & Nephew; Convatech Inc.; Systagenix; Derma Science, Inc.; Cardinal Health; Acelity; 3M; B. Braun Medical Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Moist Wound Dressings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global moist wound dressings market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global moist wound dressings market size was estimated at USD 4.25 billion in 2022 and is expected to reach USD 4.47 billion in 2023.

b. The global moist wound dressings market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 6.5 billion by 2030.

b. The foam dressing segment held the largest share in the global market in 2022 with a market share of more than 23.3% and is expected to maintain its position over the forecast period.

b. Some key players operating in the moist wound dressings market include 3M Healthcare; Coloplast A/S; Medline Industries, Inc.; Cardinal Health, Inc.; B. Braun Melsungen AG; Smith & Nephew PLC; ConvaTec Group PLC; Derma Sciences, Inc.

b. Key factors that are driving the moist wound dressings market growth include the rising incidence of various chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."