- Home

- »

- Biotechnology

- »

-

Molecular Weight Marker Market Size, Industry Report, 2030GVR Report cover

![Molecular Weight Marker Market Size, Share & Trends Report]()

Molecular Weight Marker Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (DNA markers, Protein markers, RNA markers), By Type (Prestained, Unstained, Specialty), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-716-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molecular Weight Marker Market Trends

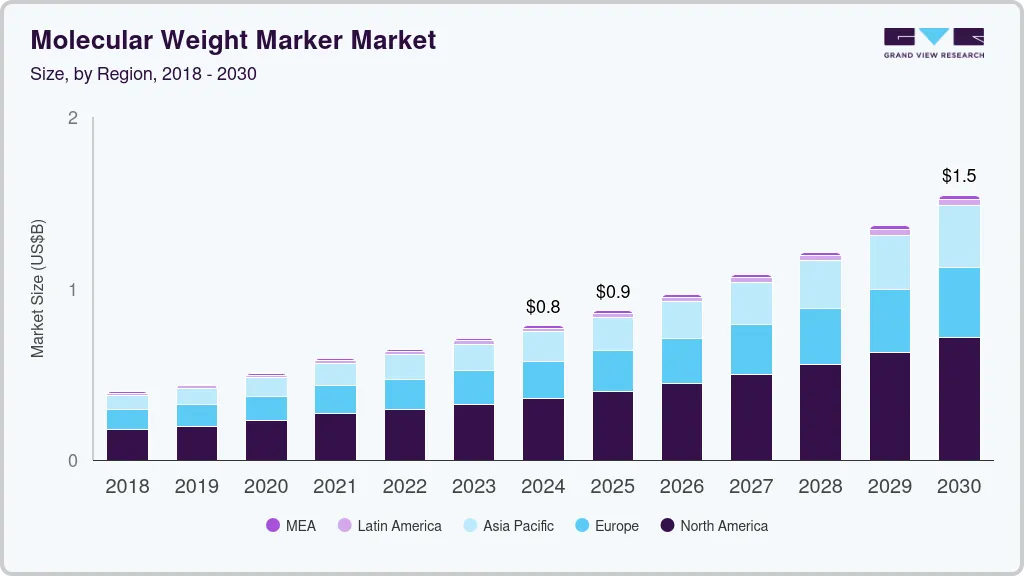

The global molecular weight marker market size was valued at USD 783.8 million in 2024 and is projected to grow at a CAGR of 12.2% from 2025 to 2030. The increased use of personalized medicines for the treatment of chronic diseases and rising genetic disorders is the primary factor for market growth. Precision medicines are used to identify genomic and molecular markers and predict patient’s responses. Precision medicine is being used widely by doctors and healthcare professionals to treat complex genetic diseases, which accelerated the growth of molecular markers.

The rising prevalence of chronic diseases, also known as non-communicable diseases (NCD), is a growing health concern worldwide. According to a World Health Organization (WHO) report published in September 2023, chronic diseases account for 74% of global deaths. These include cardiovascular diseases, cancers, and diabetes. Cardiovascular disease accounts for 17.9 million deaths for non-communicable diseases. Such rising chronic disease concerns drive the market growth for molecular weight markers.

Complex diseases require advanced solutions such as Illumina’s next-generation sequencing (NGS), which offers high throughput, scalability, and speed. This technology uses a different approach from the sanger-chain termination method. Next-generation sequencing produces masses of DNA sequencing data. Such technological developments in high-quality molecular weight markers are a major factor contributing to growth.

The increasing investment by pharmaceutical companies in molecular biology research and development, as well as development in proteomics research and genomics, is expected to drive the market soon. For instance, Pfizer Inc. and BioNTech collaborated in January 2022 with the aim of developing an improved vaccine for shingles, a painful disease combining BioNTech’s proprietary mRNA technology and Pfizer’s antigen technology.

The increased use of precision medicine is helping healthcare professionals to accurately predict the treatment that is likely to work on a particular patient, considering the individual’s genetic and molecular build. For instance, AstraZeneca applies precision medicine in its 90% portfolio to treat chronic diseases such as cancer, asthma, and heart failure. Such new advancements are driving market growth.

Product Insights

DNA markers dominated the market and accounted for a share of 45.6% in 2023. These DNA markers are also known as molecular markers or DNA sequencing. Some common DNA sequencing methods are whole-genome sequencing, exome sequencing, target enrichment, chromatin immunoprecipitation (ChIP) sequencing, and targeted resequencing. Companies involved in DNA sequencing are Illumina, Inc., Agilent Technologies, and Takara Bio Inc. DNA markers instances include restriction fragment lengthpolymorphisms (RFLP), variable number of tandem repeats (VNTRs), and microsatellites. For instance, AAT Bioquest, Inc., has developed the Gelite 100 bp-1 kb DNA Ladder for sizing and estimating the mass of double-stranded DNA and PCR products. This DNA ladder consists of 19 DNA fragments purified through chromatography. This increased activity in genomic sequencing is driving the segment growth.

The protein markers segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the rising applications in healthcare and various companies involved in the segment. For instance, Thermo Fisher Scientific Inc. has an array of products based on protein molecular weight markers such as PageRuler Plus Prestained Protein Ladder, Spectra Multicolor Low Range Protein Ladder, BenchMark Protein Ladder, MagicMark XP Western Protein Standard, and more to their portfolio. Such innovations are expected to drive the growth of the segment.

Type Insights

Prestained markers accounted for the largest market revenue share of 52.3% in 2023 and is expected to register the fastest CAGR during the forecast period. The rising prevalence of chronic diseases and complex degenerative diseases are major factors driving the segment growth. Various companies are involved in the prestained markers segment, which increases its use in the treatment of cancer.

Various types of prestained markers are available in the market, such as BlueEasy Prestained Protein Ladder, PageRuler Prestained Protein Ladder, and BlueStar PLUS Prestained Protein Marker. Some key players involved in this segment include Thermo Fisher Scientific Inc., Merck KGaA, and NIPPON Genetics, which are driving the market growth.

Application Insights

Nucleic acid applications accounted for the largest market revenue share of 66.4% in 2023. The applications of nucleic acid-based can be seen as a vaccine and as a gene-editing tool. The emergence of the COVID-19 pandemic caused an increase in nucleic acid-based vaccines. These vaccines were engineered with DNA or RNA encoding for viral antigenic proteins, according to a study published by ScienceDirect in 2021. In addition, according to Springer Nature published data in 2023, applications of nucleic acid can be seen as a vaccine and as a gene editing tool. Genome editing is a method for making peculiar changes to the DNA of a cell. For instance, a team of researchers and scientists from the Massachusetts Institute of Technology (MIT) developed a rapid gene-editing screen in March 2024 to identify and detect the effects of cancer mutations. Such activities are expected to drive the segment’s growth.

Polymerase chain reaction (PCR) is a laboratory technique used to rapidly create millions and billions of copies of the specific segment of DNA to be studied in detail. The high prevalence of cancer and efforts to develop more advanced and efficient diagnosis and treatment solutions drive the growth of PCR subsegment. For instance, researchers from the Queen Mary University of London developed the first rapid PCR test for oral cancer to improve oral cancer treatment.

Protein applications are expected to register the fastest CAGR during the forecast period. It uses western blotting, which is a laboratory technique used to detect a specific protein in blood or tissue samples. According to the World Health Organization (WHO), an estimated 39.0 million people were living infected with HIV in 2022. Western blotting is applied to diagnose a disease. These tests are usually performed to diagnose HIV. Blood samples are taken and are used for detecting HIV antibodies. Such rising prevalences of deadly diseases drive the growth of the segment.

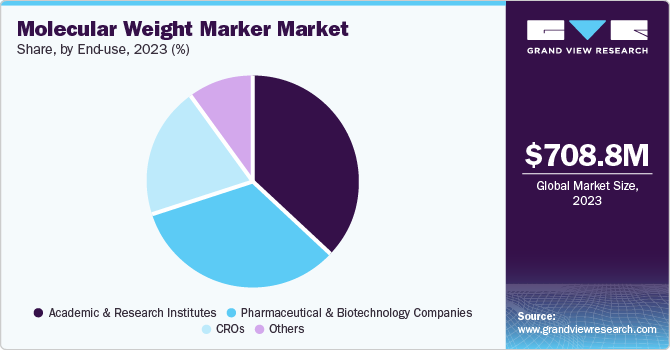

End-use Insights

The academic and research institutions segment dominated the market in 2023. The growing disease incidences are driving academic and research institutes to focus on research-based projects in molecular weight markers which increases the application of these weight marker. The emergence of research areas such as genomics, synthetic biology, gene editing, and personalized medicine is further expected to drive segmental growth.

Contract Research Organization (CROs) is projected to grow at the fastest CAGR over the forecast period. Contract research organizations and biotech companies are forming partnerships in the molecular weight marker projects. Companies are collaborating to improve treatment options to drive market growth. For instance, Illumina Inc. and F. Hoffmann-La Roche Ltd formed a 15-year collaboration in January 2020 to broaden the aspects of distributable next-generation sequencing-based testing in the oncology field. Such strategic initiatives taken by companies are expected to drive the growth of the market.

Regional Insights

North America’s molecular weight marker market dominated in 2023. The rising prevalence of chronic diseases such as cancer is expected to drive the market growth. For instance, according to the Canadian Cancer Society, 22% of new cases of prostate cancer among males and 25% new breast cancer among females are estimated to be registered in 2024. Lung cancer would be the most common cancer after prostate and breast cancer among males and females. Such growing incidences of diseases are expected to increase research and development activities, resulting in the growth of the molecular weight marker market in the region.

U.S. Molecular Weight Marker Market Trends

The U.S. molecular weight marker market accounted for the 35.1% share in the global market in 2023. According to the American Cancer Society report published in 2024, 2 million new cancer cases are projected in the year. This encourages the companies to innovate advanced options for treating underlying causes. For instance, the Center for Disease Control and Prevention (CDC) announced funding of USD 90 million in September 2022 to improve and innovate technical capacity in pathogen genomics and molecular epidemiology.

Europe Molecular Weight Marker Market Trends

Europe accounted for a significant market share in 2023 in the molecular weight marker market. As per the European Environment Agency report published in 2023, environmental risks are estimated to cause 18% of cardiovascular deaths in Europe. Each year, 6 million cases of cardiovascular disease are diagnosed. Such rising prevalences are encouraging research institutions and companies to drive market growth. For instance, NIPPON Genetics EUROPE has a wide range of molecular weights from 6.5 to 270 kDa; their BlueEasy Prestained Protein Ladder is designed for monitoring protein separation. Owing to the presence of such companies and research laboratories, the molecular weight marker market is growing.

Germany’s geriatric population and rising chronic diseases are attributed to the growth of the molecular weight marker market. Companies such as Biomol GmbH are involved in this market with a wide range of products such as BLUEplus Prestained Protein Ladder, BLUEplus-wide Prestained Protein Ladder, NZYColour Protein Marker II, and NZYBlue Protein Marker.

The market growth in the UK is attributed to the growing cases of cancer across the nation. According to British Liver Trust, the liver cancer has become a prominent cause of concern as the death statistic rose to 79% for women and 82% for men, as per a report published in March 2024. Companies are coming forward and are involved in the innovation of advanced treatment alternatives. Some key players driving the market growth are Thermo Fisher Scientific Inc., VWR International, LLC, and Alpha Laboratories.

Asia Pacific Molecular Weight Marker Market Trends

The Asia Pacific molecular weight marker market is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to a rise in non-communicable diseases such as cancers, cardiovascular diseases, and diabetes. According to the World Health Organization (WHO), about 62% of deaths are caused by non-communicable diseases such as cancer, diabetes, and cardiovascular disease. Companies such as Takara Bio Inc. and Genetix Biotech Asia Pvt. Ltd. are involved in molecular weight marker and are innovating advanced alternatives for the treatment, such as 3 colour Prestained Protein Ladder has a range of 10-250kDa.

The India molecular weight marker market is expected to grow significantly over the forecast period due to the increasing prevalence of chronic diseases. According to the World Health Organization (WHO), about 77 million people are suffering from type 2 diabetes, and approximately 25 million are prediabetics. These growing incidences are encouraging research institutes and companies to introduce a range of molecular weight markers. Key companies involved in the country are Promega Corporation, OPRL Biosciences Private Ltd with a wide range of DNA, markers and enzyme products such as Protein Molecular Weight marker. Such companies are driving the market growth of molecular weight markers in the country.

Key Molecular Weight Marker Company Insights

Some key companies in the molecular weight marker market include Thermo Fisher Scientific Inc., F Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., and Promega Corp. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Thermo Fisher Scientific Inc. is a global company offering chemical analysis to clinical diagnosis and biological-based therapeutics and manufacturing. The company provides a range of molecular weight markers, including Thermo Scientific Unstained Protein Molecular Weight Marker, Novex Sharp Prestained Protein Standard, SeeBlue Plus2 Prestained Standard, Novex Sharp Unstained Protein Standard, IEF Marker 3-10, Thermo Scientific Prestained Protein Molecular Weight Marker, and Thermo Scientific Unstained Protein Molecular Weight Marker.

-

Bio-Rad Laboratories, Inc. is dedicated to developing and manufacturing innovative products for life science research and clinical diagnostics, public health and commercial laboratories, biotechnology, and pharmaceuticals. The company offers a range of molecular weight marker types such as Prestained natural protein standards, Unstained natural protein standards, western blotting protein standards, and IEF and 2D protein standards.

Key Molecular Weight Marker Companies:

The following are the leading companies in the molecular weight marker market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- F Hoffmann-La Roche Ltd

- Merck KGaA

- QIAGEN

- TAKARA BIO, INC.

- Bio-Rad Laboratories, Inc.

- Promega Corp

- New England Biolabs

- Agilent Technologies

- Danaher

Recent Developments

-

Oncodesign Precision Medicine signed a strategic collaboration in May 2024 with Navigo Proteins GmbH to strengthen the development of new systematic radio theranostic agents.

-

Thermo Fisher Scientific Inc. announced its 15-year collaboration with Moderna, Inc. in February 2022 to enable large-scale manufacturing of Spikevax, Moderna Inc.’s COVID-19 vaccine with other investigational mRNA medicines.

-

Bio-Rad Laboratories, Inc. announced a partnership in June 2021 with Seegene Inc. for molecular diagnostic testing products used for clinical development and commercialization of infectious disease.

Molecular Weight Marker Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 869.5 million

Revenue forecast in 2030

USD 1.54 billion

Growth rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Thermo Fisher Scientific Inc., F Hoffmann-La Roche Ltd, Merck KGaA, QIAGEN, TAKARA BIO, INC., Bio-Rad Laboratories, Inc., Promega Corp, New England Biolabs, Agilent Technologies, Danaher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Weight Marker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global molecular weight marker market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA markers

-

Below 50 bp

-

50 bp t100 bp

-

100 bp t1 kb

-

1 kb t5 kb

-

Above 5 kb

-

-

Protein markers

-

Below 10 kDa

-

10 k Da t100 kDa

-

10 k Da t100 kDa

-

100 k Da t200 kDa

-

Above 200 kDa

-

-

RNA markers

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prestained markers

-

Unstained markers

-

Specialty markers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleic acid applications

-

PCR

-

Sequencing

-

Northern blotting

-

Southern blotting

-

Molecular cloning

-

Others

-

-

Protein applications

-

Western Blotting

-

Gel extraction

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic and research institutes

-

Pharmaceutical and biotechnology companies

-

CROs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.