- Home

- »

- Animal Health

- »

-

Monoclonal Antibodies In Veterinary Health Market Report, 2030GVR Report cover

![Monoclonal Antibodies In Veterinary Health Market Size, Share & Trends Report]()

Monoclonal Antibodies In Veterinary Health Market Size, Share & Trends Analysis Report By Application (Dermatology, Pain), By Animal Type, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-973-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global monoclonal antibodies in veterinary health market size was estimated at USD 700 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.1% from 2023 to 2030. The increasing prevalence of atopic dermatitis coupled with the growing pet adoption rate is one of the major factors boosting the market growth. Furthermore, rising research & development expenditure by market players for the development of cancer therapeutics is also likely to fuel the market growth over the forecast period. Despite the prolonged lockdowns and supply chain disruptions during the COVID-19 pandemic, market players did not report any decline in their revenues. For instance, Zoetis reported an increase of 22% in its dermatology segment revenue from 2019 to 2020 and an increase of 25% from 2020 to 2021.

In contrast, there was an increase in pet adoption. Around a 50% rise in pet adoption was reported in the U.S. during the first quarter of the pandemic. This led to significant growth in the total number of pet households along with the expenditures on them, which included medical expenditures.

According to a 2023-24 report published by the American Pet Products Association (APPA), about 86.9 million families, i.e., 66% of households in the U.S., owned a pet. As NAPHIA’s 2023 report highlights, the total number of pets insured in the U.S. in 2022 was 4.8 million, a 22% increase since 2021. An increase in the number of pet adoption rates has simultaneously increased the health concerns among pet owners, which is resulting in rising health expenditure on pets. This increasing pet expenditure leads to rising demand for more effective therapeutics, which is anticipated to fuel market growth.

The increasing prevalence of canine atopic dermatitis is also likely to act as a driving factor in market growth. Canine atopic dermatitis is a hereditary clinical syndrome in domestic dogs. Furthermore, it is also the most common cause of itchy allergic skin disease in dogs. According to data published by Frontiers Media S.A. in October 2020, the disease is estimated to affect around 10-15% of the canine population. The publication also stated that this number is likely to increase with time. Market players such as Zoetis have products such as Cytopoint, which was the first-ever monoclonal antibody treatment for allergic and atopic dermatitis.

The increasing incidences of cancer, especially in canines, are expected to impact market growth positively. As per a study published by the Animal Cancer Foundation, 32 million cats and 65 million dogs suffer from tumors in the U.S. Dogs are more likely to suffer from conditions like malignant neoplasia and lymphoma, according to the American Veterinary Medical Association. Moreover, the market is supported by various health initiatives by the government and private organizations, especially focusing on cancer treatment.

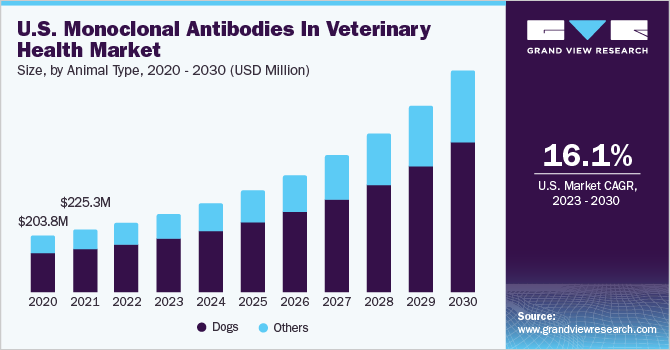

Animal Type Insights

The dog segment held the highest market share in 2022 owing to the availability of more monoclonal antibody products for dogs in the market. In addition to this, the population of dogs as pets is also rising, along with expenditure on their health, which is further boosting the market growth. According to data published by the Pet Food Manufacturers’ Association, as of 2021, there were 12 million pet dogs in the U.K. This accounted for 33% of households.

The others segment is estimated to witness the fastest growth rate of more than 17.5% over the forecast period. Other animals include cats, horses, and livestock animals. The rising prevalence of various chronic diseases in animals, along with the rising adoption of pet insurance, is also anticipated to fuel market growth. Furthermore, according to the American Society for the Prevention of Cruelty to Animals, in the U.S., around 85.8 million pets owned are cats, compared to dogs (78 million). In terms of ownership, this amounts to 35% of households.

Application Insights

The dermatology segment is estimated to hold the largest market share of around 50% in 2022, owing to the presence of various products in this category. In addition to this, the growing incidences of atopic dermatitis in animals coupled with other infectious skin diseases are expected to boost market growth. According to a report published by Scientific Reports in 2021, the prevalence of S. pseudintermedius in healthy and sick cats was 2.49% and 7.61%, respectively, in Poland. S. pseudintermedius or Staphylococcus pseudintermedius is a type of bacterial infection in canines and felines.

The others segment is anticipated to witness the fastest growth rate of more than 17.7% over the projected period. Others included diseases such as cancer, arthritis, and various infectious diseases, among others. The fastest growth is attributed to various R&D activities to develop innovative treatment options. Furthermore, the pain segment is also expected to account for a significant market share in 2022, owing to the presence of various products in the segment.

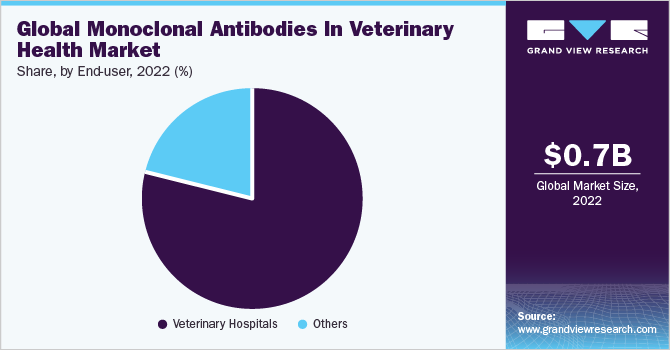

End-user Insights

By end-user, the veterinary hospital segment accounted for the largest share of the market in 2022. This is owing to the presence of novel therapies. Furthermore, the number of veterinary hospitals, along with the number of veterinarians, is rising, which leads to positive market growth. According to a report published by Petpedia. co, in 2018, there were 84,200 veterinarians in the U.S. This number was estimated to increase by around 14,200 by 2029.

The others segment is anticipated to grow at the highest CAGR of 18% during the projected period. The others segment includes clinics, research organizations, and academic institutes, among others. Increasing research activities for developing novel monoclonal antibody therapeutic options is also anticipated to fuel market growth. Furthermore, growing awareness regarding advanced veterinary therapeutic alternatives is also estimated to boost market growth.

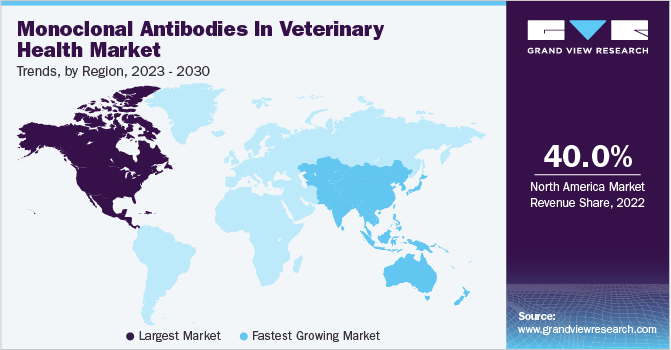

Regional Insights

North America is anticipated to dominate the global market with a revenue share of more than 40% in 2022. This is owing to the various initiatives undertaken by the government and private sector coupled with the growing adoption of pet insurance. Furthermore, the presence of key companies in the U.S. is also likely to boost market growth. North American Pet Health Insurance Association, Inc. reported that the pet insurance industry has grown at a notable rate of 23.4% over the last few years. Moreover, at the end of 2020, about 3.45 million pets were insured across North America.

The market in the Asia Pacific is likely to grow at the highest CAGR of around 20% over the projected period owing to the rising emergence of local players and the growing number of veterinary hospitals and clinics. Furthermore, the increasing adoption of pets, along with the awareness regarding their diseases and the availability of treatment alternatives, is further expected to boost market growth.

Key Companies & Market Share Insights

The main players in the monoclonal antibodies in the veterinary health market are competitive. Key companies deploy strategic initiatives, such as product development and launches, sales & marketing strategies to increase product awareness, regional expansion, and partnerships to strengthen their market share. For instance, in January 2022, Zoetis announced the U.S. FDA approval of Solensia, a product for pain management of osteoarthritis in cats.

Similarly, in January 2022, Boehringer Ingelheim International GmbH announced that it collaborated with MabGenesis, a privately-held biopharmaceutical company in Japan.This initiative aimed to develop monoclonal antibodies for canine diseases. In May 2023, Elanco announced its breakthrough treatment for deadly canine parvovirus diseases using monoclonal antibodies. This single intravenous dose treats the signs caused by parvovirus in sick dogs and puppies regardless of their vaccination status. Some prominent players in the global monoclonal antibodies in veterinary health market include:

-

Zoetis

-

Merck & Co, Inc.

-

Elanco

-

Boehringer Ingelheim GmbH

-

Indian Immunologicals Ltd

-

Virbac

Monoclonal Antibodies In Veterinary Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 800 million

Revenue forecast in 2030

USD 2.42 billion

Growth rate

CAGR of 17.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Animal type, application, end-user, region

Regions covered

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Zoetis; Merck & Co, Inc.; Elanco; Boehringer Ingelheim GmbH; Indian Immunologicals Ltd; Virbac

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

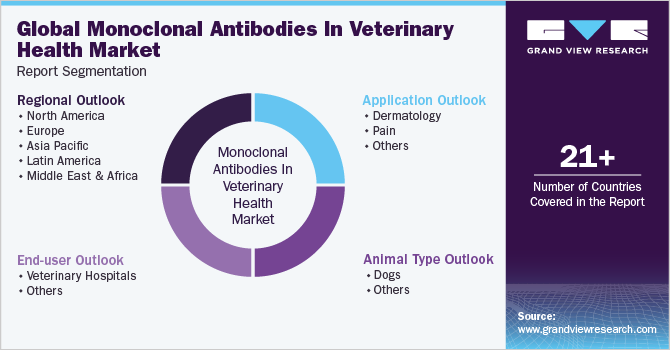

Global Monoclonal Antibodies In Veterinary Health Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global monoclonal antibodies in veterinary health market report based on animal type, application, end-user, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology

-

Pain

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Frequently Asked Questions About This Report

b. The global monoclonal antibodies in veterinary health market size was estimated at USD 700 mllion in 2022 and is expected to reach USD 800 million in 2023.

b. The global monoclonal antibodies in veterinary health market is expected to grow at a compound annual growth rate of 17.1% from 2023 to 2030 to reach USD 2.42 billion by 2030.

Which segment accounted for the largest monoclonal antibodies in the veterinary health market share?b. North America dominated the monoclonal antibodies in veterinary health market with a share of more than 40% in 2022. This is attributable to the various initiatives undertaken by the government and private sector coupled with the growing adoption of pet insurance.

b. Some key players operating in the monoclonal antibodies in veterinary health market include Zoetis; Merck & Co, Inc., Elanco, Boehringer Ingelheim GmbH, Indian Immunologicals Ltd, Virbac.

b. Key factors that are driving the market growth include increasing prevalence of atopic dermatitis along with the growing pet adoption rate, rising research & development expenditure by market players for the development of cancer therapeutics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."