- Home

- »

- Pharmaceuticals

- »

-

Morocco Medical Cannabis Market, Industry Report, 2030GVR Report cover

![Morocco Medical Cannabis Market Size, Share & Trends Report]()

Morocco Medical Cannabis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flower, Oil & Tinctures) And By Application (Chronic Pain, Tourette’s, Arthritis, Diabetes, Glaucoma, Migraines), And Segment Forecasts

- Report ID: GVR-4-68040-081-9

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

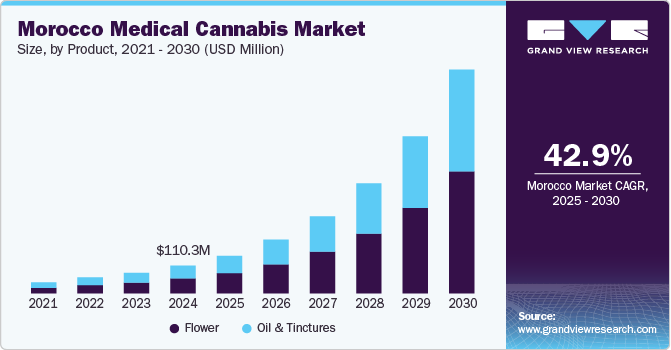

The Morocco medical cannabis market size was estimated at USD 110.3 million in 2024 and is expected to grow at a CAGR of 42.9% from 2025 to 2030. The growth of the industry in the country is driven by several factors, including the increasing legalization of medical marijuana in the country, the growing demand for alternative treatments for chronic diseases, and the country's longstanding reputation as a major producer of cannabis. In addition, the Moroccan government has undertaken steps to regulate and legalize its cultivation, encouraging investment and growth in the industry. For instance, in May 2021, the Moroccan Parliament adopted Bill 13-21 to regulate the cannabis plant for industrial and medical purposes.

With the recent legalization of medical cannabis in the country, there has been a growing interest in establishing a legal cannabis market. Morocco's reputation for cannabis has made it an attractive destination for tourists. According to High Times and South China Morning Post, Morocco is increasingly becoming a hotspot for marijuana tourism, with traditional hashish cafes, cannabis plantations, and markets being popular attractions. The country's cannabis industry has been estimated to be worth billions of dollars and legalizing it for recreational use could bring in substantial tax revenue and create job opportunities.

A significant driver of the legal cannabis market in Morocco is the growing need for medical marijuana, particularly for treating chronic ailments such as cancer, epilepsy, multiple sclerosis, and chronic pain. Research has shown that cannabis effectively treats various medical conditions. As more countries legalize medical marijuana, the global demand for the drug continues to grow. In addition, Morocco's favorable climate and low labor costs make it an attractive location for cannabis cultivation. The country has a long history of growing cannabis, and many farmers have vast experience in cultivation. For instance, according to the National Agency for the Regulation of Activities relating to Cannabis (ANRAC), after the legalization of cannabis cultivation and export for industrial and medical uses, Morocco's first legal cannabis harvest was 294 metric tons in 2023. Thus, Morocco is well-placed to become the leading producer of medical marijuana for export to other countries.

Legalizing medical marijuana in Morocco drives the legal cannabis market by eliminating the black market for illegal cannabis products. The government regulates the production, distribution, and sale of cannabis products, ensuring that consumers have access to safe and regulated products, which improve public health and safety. Furthermore, legalization provides business opportunities for the cannabis industry in the country. For instance, in March 2023, Bio Cannat, the first Moroccan cooperative licensed to export and market cannabis and its products for medical and industrial purposes, began constructing its first laboratory.

Furthermore, the use of medical marijuana has quickly gained popularity in Morocco after its recent legalization. Treatment with medical marijuana benefits people suffering from chronic illnesses and pains associated with cancer, arthritis, Alzheimer's disease, Parkinson's disease, depression, anxiety, and epilepsy. As a result, the widespread application of medical marijuana has contributed to its increased adoption for treating various chronic conditions.

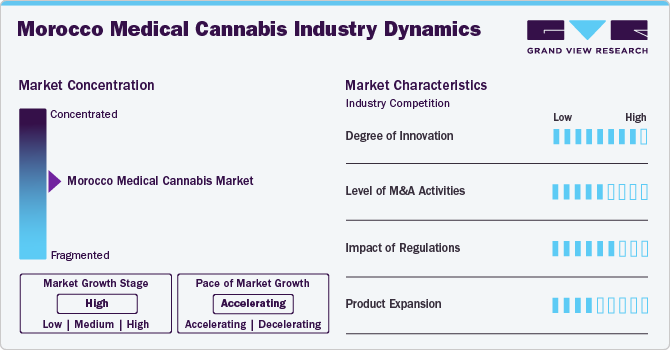

Market Concentration & Characteristics

The Morocco medical cannabis market is characterized by a high degree of innovation owing to the rising legalization of cannabis, rising demand for cannabis-infused products, and growing awareness among people regarding the medicinal benefits of cannabis, increasing R&D activities on the use of cannabis and its medicinal properties.

Morocco medical cannabis market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position.

To improve the economic standing of farmers who have been relying on cannabis cultivation as their primary source of income, the Moroccan government has introduced recent legislation that legalizes medical marijuana production in designated areas. The law recommends the formation of cooperatives that sign contracts with manufacturers, protect farmers' rights, promote sustainable agriculture practices, and facilitate the acquisition of quality seeds. Thus, such favorable regulations for cannabis in Morocco propel the market growth.

Several market players are expanding their business by launching new solutions in the market to expand their product portfolio. Furthermore, companies are expanding their business by entering new business regions and launching new products to strengthen their market position and capture larger market share.

Product Insights

By product, the flower segment held the largest market share in 2024 and is expected to grow at the fastest CAGR of 43.2% over the forecast period. Dried cannabis flowers are used for smoking and obtaining the medical benefits of cannabis. Traditionally, they have been used to alleviate chronic pain, limit the growth of cancer, and slow down the progression of Alzheimer’s disease. Moreover, smoking cannabis is much more economical than purchasing oral products or tinctures; thus, most people prefer smoking. In addition, the onset of action posts the smoking of cannabis is rapid. Such factors fuel the segment growth.

The oils & tinctures segment is expected to grow at a significant CAGR over the forecast period. The increasing number of patients requiring treatment for conditions such as epilepsy, PTSD, autism, chronic pain, muscle spasms resulting from multiple sclerosis, Parkinson's disease, and convulsions are expected to drive the demand for the oils & tinctures segment. Oils and tinctures provide convenient and discreet consumption methods, aligning with the growing demand for these products in domestic and international markets. In addition, regulatory changes and the economic opportunities presented by the industry contribute to the expansion of the oil and tincture segment, positioning Morocco as a key player in this rapidly evolving market. For instance, RIAD ZITOUN, a provider and manufacturer of beauty & wellness products, offers Pure Moroccan Cannabis Seed Oil, a nutritious oil for skin & hair.

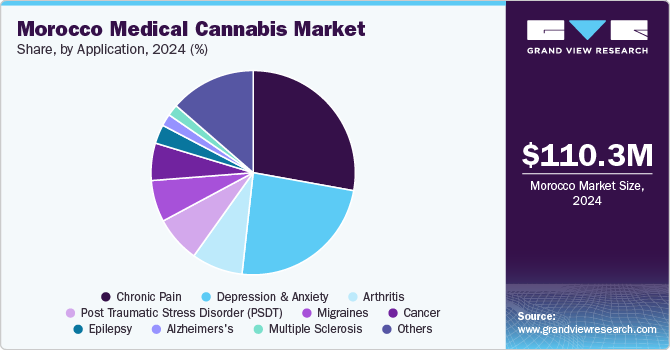

Application Insights

By application, the chronic pain held largest market share of 23.9% in 2024. The growth of the segment is attributed to research indicating the beneficial effects of marijuana in mitigating pain and the significant incidence of chronic pain. There is a shift from traditional treatment options for the use of medical cannabis in pain management due to the positive effects and cost-effectiveness provided by cannabis-based products in the country. Furthermore, cannabis has provided patients with long-term pain relief without significant adverse side effects. The co-administration of cannabis and opioids has been found to enhance pain relief. Many patients with chronic pain and other conditions have been found to taper or eliminate their prescription pain medications following the use of cannabis.

The Tourette's syndrome segment is expected to grow at the fastest CAGR over the forecast period, owing to an increasing number of patients exploring the potential benefits of marijuana-based treatments. With the growing acceptance and legalization of medical marijuana, patients in Morocco are seeking alternative and complementary treatments, leading to a rise in demand for these products specifically tailored for managing Tourette's syndrome. The expanding availability of these products and the potential improvements in the quality of life they offer make the Tourette's syndrome segment a significant focus within the market.

Key Morocco Medical Cannabis Company Insights

Key participants in the Morocco medical cannabis market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Morocco Medical Cannabis Companies:

- Bio Cannat

- PharmaCielo.com.

- RIAD ZITOUN

Recent Developments

-

In June 2024, Morocco introduced the sale of legal cannabis-based cosmetic products and dietary supplements in pharmacies.

Morocco Medical Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 148.4 million

Revenue forecast in 2030

USD 885.6 million

Growth rate

CAGR of 42.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Key companies profiled

Bio Cannat; PharmaCielo.com.; RIAD ZITOUN

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Morocco Medical Cannabis Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Morocco medical cannabis market based on product and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flower

-

Oil & Tinctures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder

-

Parkinson's

-

Tourette’s

-

Frequently Asked Questions About This Report

b. The Morocco medical cannabis market size was valued at USD 110.3 million in 2024 and is expected to reach USD 148.4 million in 2025.

b. The Morocco medical cannabis market size was valued at USD 110.3 million in 2024 and is expected to grow at a compound annual growth rate of 42.9% from 2025 to 2030 to reach USD 885.6 million in 2030.

b. The flower segment held the majority of the market share of 53.8% in 2024 owing to increasing number of patients requiring treatment for conditions such as epilepsy, PTSD, autism, chronic pain, muscle spasms resulting from multiple sclerosis, Parkinson's disease, and convulsions.

b. Some of the prominent players in the Morocco medical cannabis market include Bio Cannat, and PharmaCielo Ltd.

b. The market is driven by several factors, including the increasing legalization of medical marijuana globally, the growing demand for alternative treatments for chronic diseases, and the country's longstanding reputation as a major producer of cannabis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.