- Home

- »

- Sensors & Controls

- »

-

Motion Sensor Market Size And Share, Industry Report, 2030GVR Report cover

![Motion Sensor Market Size, Share & Trends Report]()

Motion Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Infrared, Ultrasonic, Microwave, Dual Technology, Tomographic, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-055-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Motion Sensor Market Size & Trends

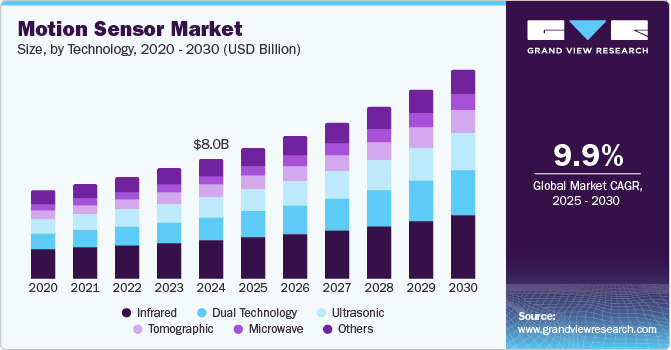

The global motion sensor market size was valued at USD 8.0 billion in 2024 and is projected to grow at a CAGR of 9.9% from 2025 to 2030. The surge in demand for automation across various sectors is significantly contributing to market expansion. Industries are increasingly adopting motion sensors for applications such as security systems, automated lighting, and HVAC controls, which enhance operational efficiency and reduce energy consumption. In addition, the proliferation of consumer electronics, particularly smartphones, wearables, and smart home devices, has further propelled the adoption of motion sensors, as these technologies often rely on motion detection for functionalities such as gesture recognition and activity tracking.

The integration of Internet of Things (IoT) technologies is transforming how motion sensors are utilized in smart homes and cities, enabling greater automation and connectivity. Furthermore, an aging population is driving demand for healthcare solutions that utilize motion sensors to monitor patient movements and ensure safety. The automotive sector is also emerging as a significant area for growth, with advancements in safety features such as collision avoidance systems and Advanced Driver-Assistance Systems (ADAS) relying heavily on motion sensing technologies. As these trends evolve, the motion sensor industry is expected to play a pivotal role in shaping innovative solutions that enhance user experience and safety across various applications.

Moreover, the increasing focus on smart city initiatives is also playing a crucial role in driving the motion sensor market. Governments and urban planners are investing in technologies that enhance urban living, improve public safety, and optimize resource management. Motion sensors are integral to various smart city applications, such as intelligent traffic management systems that monitor vehicle and pedestrian movement to reduce congestion and enhance safety. For instance, Darmstadt has implemented intelligent traffic sensors to alleviate rush hour congestion, showcasing an effective IoT application in smart cities. These sensors assess traffic conditions in real time, enabling adaptive signal changes that minimize wait times and enhance overall traffic flow.

Technology Insights

The infrared segment dominated the market with a revenue share of 32.4% in 2024. This dominance can be attributed to the versatile applications of infrared sensors across various industries, including security systems, home automation, and consumer electronics. Infrared sensors are particularly valued for their ability to detect heat signatures, making them ideal for motion detection in low-light conditions. In addition, the growing demand for smart home devices and advanced security solutions has further fueled the adoption of infrared technology, solidifying its position as a leading segment within the motion sensor industry.

The dual technology segment is projected to grow at the highest CAGR during the forecast period, driven by its unique advantages over single-technology sensors. Dual technology sensors combine two different sensing methods, Passive Infrared (PIR) and microwave detection, significantly enhancing their accuracy and reliability. This combination improves performance in various applications, including security systems and automated lighting controls. For instance, HomeMate’s motion sensors provide comprehensive motion detection capabilities that help maintain the security of homes. These sensors utilize advanced technologies, including PIR and microwave detection, to accurately identify motion within their designated areas.

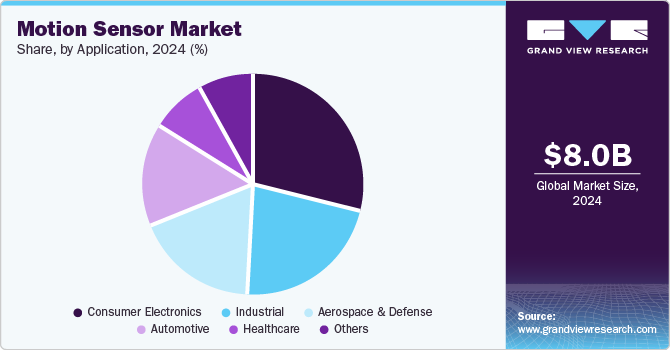

Application Insights

The consumer electronics segment dominated the market with the largest share in 2024. This strong performance is primarily driven by the increasing integration of motion sensors in a wide range of devices, including smartphones, smart TVs, and home automation systems. Features such as gesture recognition, screen orientation, and motion-controlled gaming have become essential for enhancing user experience. For instance, modern smartphones, such as the latest iPhone models, utilize multiple sensors, including accelerometers and gyroscopes, to enhance user experience through features such as screen orientation and motion-based gaming. In addition, the rising popularity of wearable devices, such as fitness trackers and smartwatches, further contributes to this segment's growth, as consumers seek innovative technologies that improve convenience and functionality in their daily lives.

The industrial segment is expected to grow at the highest CAGR over the forecast period, fueled by a growing emphasis on automation and efficiency in various industrial applications. Industries are increasingly adopting motion sensors for equipment monitoring, optimizing workflows, and enhancing safety protocols. The motion sensor industry is witnessing a surge in demand for advanced sensing technologies that can improve operational efficiency and reduce downtime. As industries continue to invest in smart technologies and IoT integration, the industrial segment is positioned for significant growth, reflecting a broader trend towards automation and intelligent systems across sectors.

Regional Insights

The North America motion sensor market is experiencing significant growth, driven by technological advancements and increasing adoption across various sectors. The region benefits from a strong emphasis on smart home technologies, including security systems and automated lighting, which are becoming increasingly prevalent among consumers. In addition, major automotive manufacturers in the U.S. have spurred demand for motion sensors in Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles.

U.S. Motion Sensor Market Trends

The U.S. motion sensor market dominated the regional market in 2024, primarily due to its robust technological infrastructure and high consumer demand for smart devices. The integration of motion sensors into everyday products, such as smartphones and smart home appliances, has significantly enhanced user experience through features such as gesture recognition and automated controls. Furthermore, the country’s advanced healthcare sector is increasingly utilizing motion sensors for patient monitoring and safety applications.

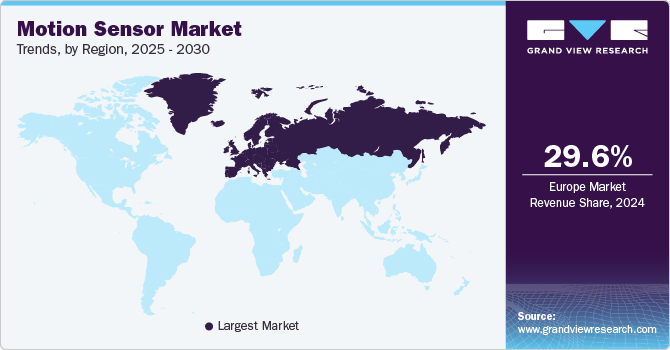

Europe Motion Sensor Market Trends

Europe motion sensor market dominated the global market with a revenue share of 29.6% in 2024, which can be attributed to the region's strong focus on energy efficiency and sustainability. European countries such as the UK, Germany, and France are investing heavily in smart city initiatives that leverage motion sensors for traffic management, public safety, and environmental monitoring. The regulatory framework promoting energy-saving technologies also supports the growth of motion sensors in various applications, ranging from residential to industrial settings.

Germany motion sensor market dominated the regional market in 2024, owing to its advanced manufacturing capabilities and strong automotive industry. The country is at the forefront of integrating motion sensing technologies into automotive applications, particularly in safety features such as collision avoidance systems. In addition, Germany's emphasis on Industry 4.0 initiatives is driving demand for motion sensors in automation and robotics, enhancing operational efficiency across various sectors. This combination of factors positions Germany as a dominant force within the European motion sensor industry.

Asia Pacific Motion Sensor Market Trends

The Asia Pacific motion sensor market is anticipated to grow at the highest CAGR during the forecast period, fueled by rapid urbanization and increasing adoption of smart technologies. Countries in this region, such as China, India, and Japan, are investing significantly in smart city projects incorporating motion sensors for various applications, including traffic management and public safety. The growing consumer electronics sector also drives the demand for motion sensors in devices such as smartphones and wearables.

The China motion sensor market dominated the regional market in 2024. The country's rapid technological advancements have led to an increasing integration of motion sensors in consumer electronics, automotive applications, and industrial automation. In addition, government initiatives promoting smart city development further drive the demand for innovative sensing solutions. As China continues to invest in technology and infrastructure, it remains a critical player shaping the future of the motion sensor industry within the region.

Key Motion Sensor Company Insights

The motion sensor market is growing rapidly, driven by several innovative companies. Honeywell provides a variety of motion detectors, including advanced passive infrared sensors. Murata Manufacturing focuses on innovative sensor solutions for automotive and industrial applications, while NXP Semiconductors specializes in secure connectivity and smart sensing technologies. Robert Bosch GmbH offers a diverse range of sensors, particularly for automotive applications, enhancing safety and automation through precise motion detection.

-

Honeywell International Inc. is a technology and manufacturing company that provides advanced motion detection solutions. In the motion sensor market, Honeywell offers a comprehensive range of products, including PIR sensors and dual-technology sensors that combine PIR with microwave technology for enhanced accuracy. These sensors are designed to minimize false alarms while maximizing detection range, making them suitable for both residential security systems and commercial applications.

-

Robert Bosch GmbH is an engineering and technology company that plays a significant role in the motion sensor market. Bosch specializes in high-performance sensors tailored for automotive applications, including stability control systems and ADAS. Its motion sensors are designed to provide precise data for vehicle dynamics, enhancing safety features such as anti-lock braking and traction control. In addition, Bosch develops Micro-Electro-Mechanical Systems (MEMS) sensors that are compact and highly sensitive, making them ideal for various industrial applications.

Key Motion Sensor Companies:

The following are the leading companies in the motion sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Robert Bosch GmbH

- Sensinova India

- STMicroelectronics

- TE Connectivity

- TDK Corporation

- KEMET Corporation

- Analog Devices, Inc.

Recent Development

-

In April 2024, Aqara announced the launch of the Motion and Light Sensor P2, its latest generation motion sensor designed with the Thread protocol and compliant with the Matter standard. This native Matter connectivity ensures exceptional compatibility across various smart home platforms, including Amazon Alexa, Apple Home, Google Home, and Samsung SmartThings. With Matter's local networking features, the P2 sensor provides improved responsiveness and reliability to users.

-

In March 2024, Sentech, Inc. announced the acquisition of the assets of Xensor, LLC, a provider of advanced position measurement sensor solutions. This acquisition strengthened Sentech’s industrial portfolio by integrating Xensor’s expertise in various magnetic position technologies, including Hall Effect and proximity sensors. By combining these capabilities, Sentech aims to enhance its offerings and solidify its position in the sensor technology market.

Motion Sensor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.72 billion

Revenue forecast in 2030

USD 13.99 billion

Growth rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

Honeywell International Inc.; Murata Manufacturing Co., Ltd.; NXP Semiconductors; Robert Bosch GmbH; Sensinova India; STMicroelectronics; TE Connectivity; TDK Corporation; KEMET Corporation; Analog Devices, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

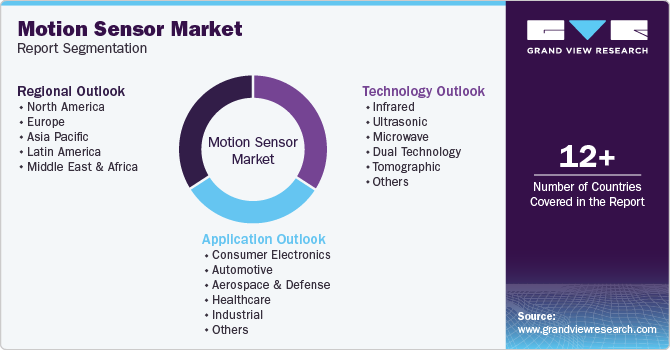

Global Motion Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motion sensor market report based on technology, application, and region:

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Infrared

-

Ultrasonic

-

Microwave

-

Dual Technology

-

Tomographic

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.