- Home

- »

- Clothing, Footwear & Accessories

- »

-

Motorcycle Helmet Market Size, Share, Industry Report 2030GVR Report cover

![Motorcycle Helmet Market Size, Share & Trends Report]()

Motorcycle Helmet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Full-face Helmets, Open-face Helmets), By Price Range, By End-use (Commuters, Professional Riders), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-404-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Motorcycle Helmet Market Summary

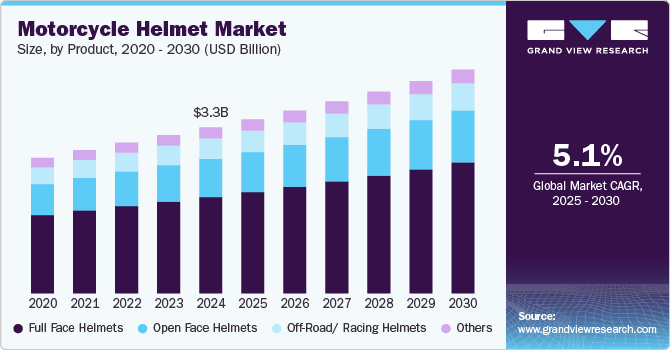

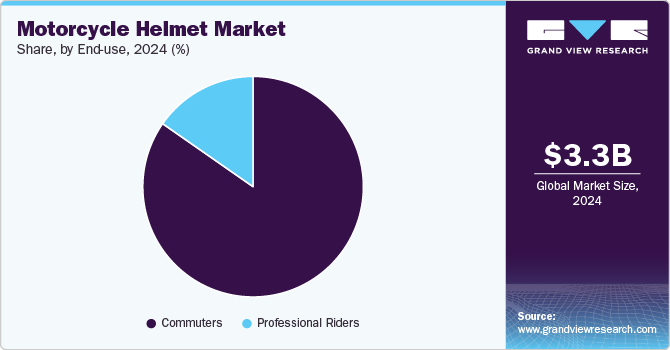

The global motorcycle helmet market size was estimated at USD 3.35 billion in 2024 and is projected to reach USD 4.52 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. The growth of the market is largely driven by increasing safety awareness among riders and the growing emphasis on protective gear.

Key Market Trends & Insights

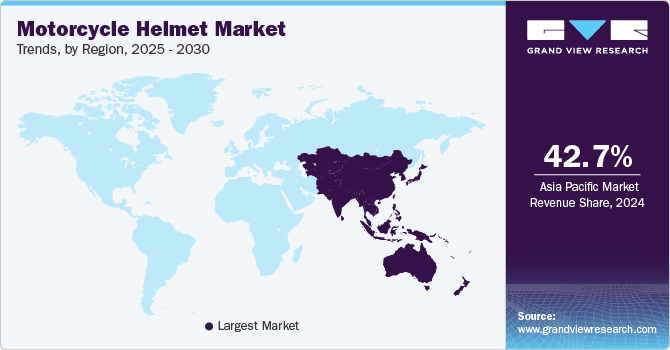

- The Asia Pacific motorcycle helmet industry accounted for a revenue share of 42.7% in 2024.

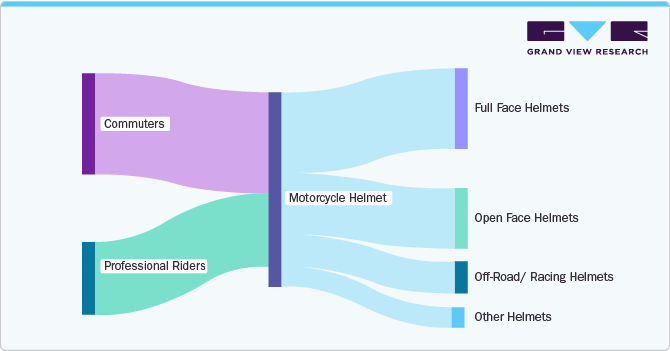

- Based on product, the full face helmets segment accounted for a revenue share of 58.1% in 2024.

- Based on distribution channel, the offline stores segment accounted for a revenue share of 78.5% in 2024.

- Based on end use, the commuters segment accounted for a revenue share of 84.6% in 2024.

- Based on price range, the motorcycle helmets priced up to USD 150 accounted for a revenue share of 50.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.35 Billion

- 2030 Projected Market Size: USD 4.52 Billion

- CAGR (2025-2030): 5.1%

- Asia Pacific: Largest market in 2024

With rising concerns over motorcycle-related accidents, both consumers and governments are prioritizing safety, leading to higher demand for helmets. In many regions, wearing a helmet has become a legal requirement, and stringent safety regulations are pushing riders to invest in quality headgear that meets safety standards. This focus on rider protection is one of the key factors fueling the market’s expansion.

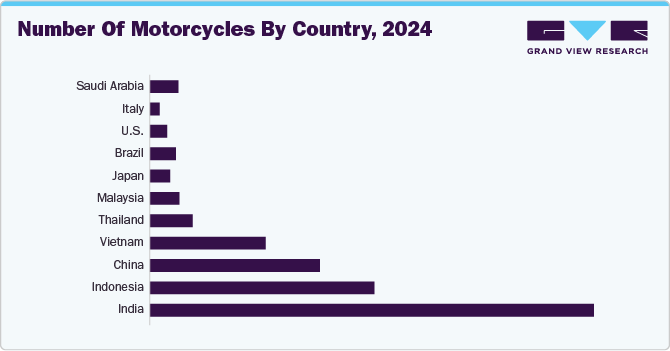

According to an article by ConsumerAffairs, published in March 2024, the number of on-road motorcycles registered in the U.S. has more than doubled from 4.3 million in 2002 to 8.8 million in 2023. In many of these countries, rapid urbanization, economic growth, and the need for cost-effective personal transportation have driven up motorcycle ownership. This surge is especially pronounced in densely populated regions, where motorcycles provide a practical solution for navigating congested streets. The chart below illustrates that India leads globally in the number of motorcycles, followed by Indonesia and China:

Technological advancements in helmet design and materials are also playing a significant role in the market's growth. Manufacturers are incorporating innovative features such as lightweight materials, advanced ventilation systems, and improved impact resistance, making helmets more comfortable and safer for riders. In addition, the integration of smart technologies, such as Bluetooth communication systems and enhanced aesthetics are attracting a broader range of consumers. These innovations not only improve safety but also cater to the modern rider's desire for functional, stylish, and tech-savvy gear, contributing to the continued expansion of the market.

For instance, at CES 2025, Intelligent Cranium Helmets unveiled the world’s smartest AI motorcycle helmet, designed to improve rider safety and reduce smartphone reliance. Featuring a 240-degree horizontal field of view, a front-facing action camera with 300-degree coverage, automatic crash detection, and a proximity alert system, it enhances safety by alerting emergency services and preventing lane drifting. The helmet also includes advanced Bluetooth connectivity, a heads-up display (HUD), and weighs 3.77 lbs, with plans to reduce its weight further, marking a major leap in motorcycle safety technology.

India, with a population of around 1.45 billion, has a reported helmet usage rate of approximately 60%. Thailand, on the other hand, has a population of roughly 70 million, with about 45% of its riders wearing helmets. While Thailand’s percentage of helmet users is not negligible, India’s higher adoption rate translates into a much larger absolute number of helmet wearers.

Several factors contribute to India’s relatively stronger emphasis on helmet usage. Stricter road safety regulations, which mandate helmet use for both riders and passengers, have been accompanied by more stringent enforcement, including regular checkpoints and spot fines. The rapid urbanization in many Indian cities, coupled with high traffic density, has heightened awareness of the importance of personal safety gear.

In contrast, while Thailand’s 45% usage rate indicates a reasonable level of compliance, efforts to improve helmet adoption could benefit from more consistent enforcement and expanded public awareness campaigns.

Consumer Insights

As urbanization continues to grow, particularly in developing countries, motorcycles have become an affordable and efficient mode of transportation. In congested cities with heavy traffic, motorcycles offer a quicker and more economical alternative to cars. With rising fuel prices and the increasing need for cost-effective commuting solutions, more people are turning to motorcycles, which in turn drives the demand for helmets, as they are required by law and essential for rider safety.

The European motorcycle market experienced robust growth in 2024, with new motorcycle registrations in the five largest markets-France, Germany, Italy, Spain, and the UK-reaching 1,155,640 units, marking a 10.1% increase compared to 2023. Among these, Italy led the market with 352,294 units registered, reflecting a 10% growth. Germany followed closely with 248,618 units, showing the highest increase at 16.3%. Spain recorded 229,685 registrations, growing by 14.2%, while France saw a modest 3.5% rise with 214,049 units. The UK had the lowest growth rate at 2.7%, with 110,994 registrations. However, ACEM Secretary General Antonio Perlot highlighted that a significant portion of this growth was driven by stock registrations in anticipation of the Euro5+ emissions standard, which took full effect on January 1, 2025.

Motorcycle helmets are considered essential safety gear by many motorcycle riders. Furthermore, many manufacturers of motorcycle helmets have been coming up with high-end features to encourage consumers to wear helmets. Few manufacturers are close to coming up with helmets featuring built-in Augmented Reality (AR) to display GPS maps and the speedometer on the helmet’s visor. In April 2024, Ather Energy introduced its Halo Smart Helmet series and Rizta family scooter at the 2024 Community Day event. The Halo helmet integrates Harman Kardon speakers, enabling handlebar-controlled music/call management and a ChitChat feature for clear rider-pillion communication. It offers a week-long battery, wireless charging via the Rizta scooter’s under-seat dock, and auto-WearDetect connectivity. The modular Halo Bit (₹5,000) upgrades existing half-face helmets with smart features.

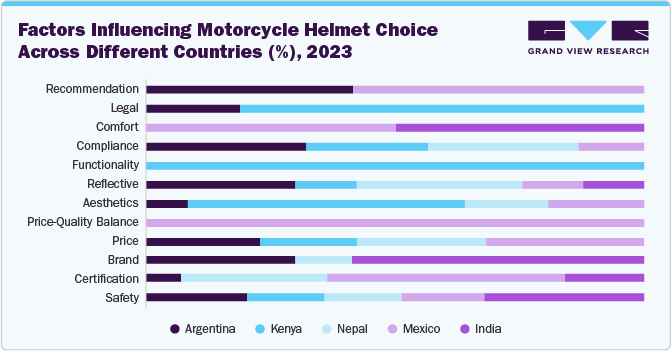

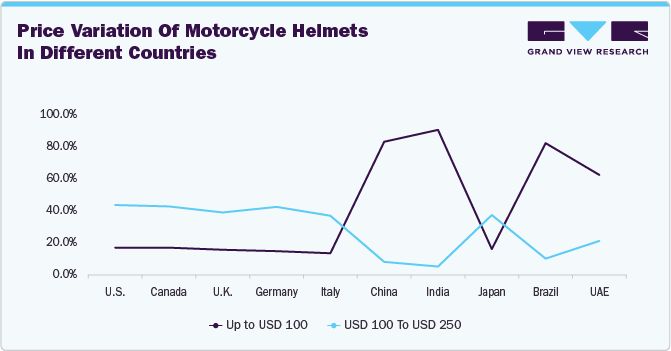

Several key factors influence motorcycle helmet purchases, including price, which can vary widely based on local production and consumer price sensitivity. Regulations and safety standards also play a critical role, as stricter enforcement often leads to higher adoption rates. Beyond compliance, brand reputation and quality certifications guide many buyers toward trusted manufacturers. In addition, comfort, style, and design affect consumer preferences, with riders increasingly seeking helmets that not only protect but also reflect personal taste.

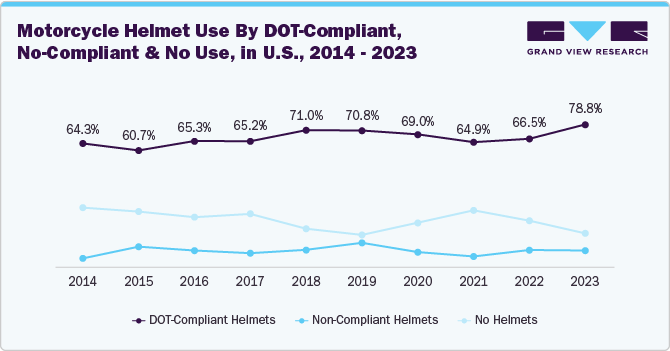

The strict safety regulations and government mandates play a crucial role in driving helmet sales. Many European countries enforce stringent helmet laws requiring riders to wear certified protective gear that meets standards such as the ECE (Economic Commission for Europe) certification. Law enforcement agencies and road safety campaigns have further contributed to raising awareness about the importance of helmet use, leading to higher compliance rates and an increase in premium helmet sales. Furthermore, in regions like North America, DOT (Department of Transportation) compliance is mandatory for motorcycle helmets, ensuring they meet specific safety standards for impact resistance, penetration protection, and retention system effectiveness, further reinforcing rider safety.

Regulations

Table 1 Motorcycle helmet regulations and qualifying standards in different countries, in 2023

Country

Regulation/Standard

Helmets That Qualify

U.S.

FMVSS 218 (DOT Standard)

Helmets with DOT certification

Canada

CAN/CSA D230

Helmets with CSA, DOT, or ECE 22.05/22.06 certification

Germany

ECE 22.05 or ECE 22.06 (EU Standard)

Helmets with ECE 22.05 or 22.06 certification

UK

UKCA or ECE 22.05/22.06

Helmets with UKCA or ECE 22.05/22.06 certification

France

ECE 22.05 or ECE 22.06 (EU Standard)

Helmets with ECE 22.05 or 22.06 certification

China

GB 811-2010

Helmets with GB certification

Japan

JIS T 8133:2015

Helmets with JIS certification

India

IS 4151:2015 (ISI Mark)

Helmets with ISI mark

Brazil

NBR 7471:2001

Helmets with NBR certification

UAE

GSO 39/2009

Helmets with GSO, ECE, or DOT certification

Source: U.S. Department of Transportation

The rise in motorcycle usage worldwide has led to heightened safety awareness among riders, driving a significant demand for high-quality helmets that meet stringent safety standards. As seen in the table above, countries like the U.S., Germany, and Japan enforce rigorous regulations such as DOT, ECE 22.06, and JIS T 8133, respectively, to ensure rider safety. In emerging markets like India and Brazil, the adoption of standards like IS 4151 and NBR 7471 reflects a growing emphasis on helmet quality. This global trend underscores the importance of compliance with local safety certifications, as riders increasingly prioritize helmets that not only meet legal requirements but also offer superior protection. The correlation between rising motorcycle usage and safety awareness highlights the critical role of standardized, high-quality helmets in reducing road accidents and saving lives.

Product Insights

Full face helmets accounted for a revenue share of 58.1% in 2024. The market for full-face motorcycle helmets is increasing due to growing safety awareness, regulatory changes, and shifting consumer preferences. Riders are prioritizing safety more than ever, leading to a surge in demand for helmets that provide full protection. Compared to open-face or half-helmets, full-face helmets offer superior head, jaw, and chin protection, significantly reducing the risk of severe injuries in accidents. In addition, governments worldwide are implementing stricter helmet laws and safety regulations, pushing more riders toward full-face options to comply with safety standards.

The open face helmets segment is expected to grow at a CAGR of 5.4% from 2025 to 2030. The market for open-face motorcycle helmets is experiencing significant growth, driven by evolving rider preferences, safety innovations, and changing urban commuting trends. These helmets are particularly popular among city riders, cruiser enthusiasts, and electric two-wheeler users who prioritize comfort and convenience over full-face protection. As motorcycles and scooters become an integral part of daily transportation, especially in densely populated urban areas, the demand for lightweight, breathable, and stylish helmets continues to rise.

Price Range Insights

Motorcycle helmets priced up to USD 150 accounted for a revenue share of 50.3% in 2024. The market for motorcycle helmets priced up to USD 150 is increasing due to a combination of safety regulations, technological advancements, and shifting consumer preferences. Riders are becoming more safety-conscious, driving demand for premium helmets that offer superior protection, impact resistance, and compliance with stringent safety certifications such as DOT, ECE, and Snell.

Motorcycle helmets priced between USD 150 to USD 250 are expected to grow at a CAGR of 3.8% from 2025 to 2030, owing to the rise in commuter motorcycling and entry-level riding, particularly in urban areas. Many budget-conscious riders, including new motorcyclists, prefer helmets in this range as they offer a balance between affordability and essential safety features. Manufacturers are also enhancing helmet technology in this segment, incorporating improved ventilation, anti-fog visors, lightweight materials, and Bluetooth compatibility, making these helmets more appealing.

Moreover, the expansion of online sales and discount retailing has made it easier for consumers to purchase mid-range helmets with premium-like features at competitive prices. Growing brand trust in mid-tier manufacturers, such as HJC, Bell, and Scorpion, has further fueled demand, as riders seek cost-effective yet reliable helmets for daily commuting and recreational riding.

Distribution Channel Insights

Sales through offline stores accounted for a revenue share of 78.5% in 2024. Motorcycle helmets are mostly purchased offline due to several key factors related to safety, fit, and consumer preference. Unlike other riding gear, helmets require a precise fit to ensure maximum protection and comfort, which is difficult to assess when shopping online. In physical stores, customers can try on different models, check for proper sizing, and get expert guidance from sales representatives, reducing the risk of buying an ill-fitting or uncomfortable helmet. In addition, many riders prefer to physically inspect the helmet's build quality, padding, and visor functionality before making a purchase.

Sales of motorcycle helmets through online channels are expected to grow at a CAGR of 5.8% from 2025 to 2030. Online retailers often offer competitive pricing, discounts, and exclusive deals, making helmets more affordable compared to traditional brick-and-mortar stores. Many websites also provide detailed product descriptions, size guides, and user reviews, helping buyers make informed decisions. In addition, augmented reality (AR) and virtual try-on features have enhanced the online shopping experience by allowing consumers to visualize how a helmet will fit before purchasing.

The rise of direct-to-consumer (DTC) brands and manufacturer websites has also contributed to online sales growth. These websites enable brands to engage directly with customers, offer customization options, and provide personalized recommendations. Fast and reliable shipping, easy returns, and flexible payment options further enhance the appeal of online helmet shopping.

End-use Insights

Motorcycle helmets for commuters accounted for a revenue share of 84.6% in 2024. Comfort and convenience play a crucial role in helmet adoption among commuters. Manufacturers are developing lightweight, well-ventilated, and noise-reducing helmets with features such as anti-fog visors, Bluetooth connectivity for hands-free communication, and quick-release straps, making them more appealing for daily riders. In addition, advancements in materials, such as polycarbonate shells and multi-density foam liners, provide better protection while keeping helmets affordable for budget-conscious commuters. The growing awareness of road safety and head injuries has also driven demand for commuter helmets. Riders are increasingly prioritizing helmets with better impact absorption and enhanced visibility features, such as reflective elements and integrated LED lights.

Motorcycle helmets for professional riders are expected to grow at a CAGR of 3.7% from 2025 to 2030. The market for motorcycle helmets among professional riders is increasing due to heightened safety awareness, advancements in helmet technology, and growing participation in professional motorsports and long-distance touring. Professional riders, including racers, stunt performers, and adventure motorcyclists, require helmets that offer superior protection, aerodynamics, and comfort, driving demand for high-performance models with advanced safety certifications such as Snell, FIM, and ECE 22.06.

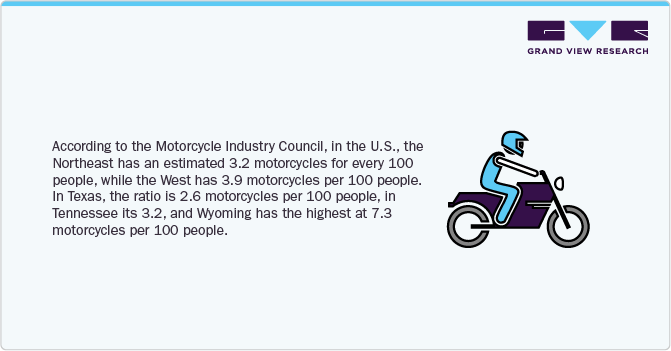

Regional Insights

The North America motorcycle helmet market is expected to grow at a CAGR of 3.2% from 2025 to 2030. Motorcycling is becoming more popular in the U.S. and Canada for several reasons. Many riders are drawn to the recreational appeal of motorcycling, which offers a sense of freedom and adventure. Events like the Sturgis Motorcycle Rally in South Dakota, which attracts nearly half a million participants annually, highlight the enthusiasm for motorcycle culture. In addition, economic factors play a role, as motorcycles are generally more fuel-efficient and cost-effective compared to cars. In congested urban areas, motorcycles provide a practical solution for navigating traffic and reducing commuting time.

U.S. Motorcycle Helmet Market Trends

The motorcycle helmet industry in the U.S. is expected to grow at a CAGR of 2.3% from 2025 to 2030. Increasing demand for luxury motorcycles and the growing popularity of motorcycle events and championships are the key factors expected to create good growth opportunities for helmet manufacturers. In 2022, approximately 9.6 million motorcycles were registered, with California leading with over 802,500 registrations. Certain states, such as Montana, have particularly high motorcycle ownership rates, with 6,312.25 registrations per 100,000 people. The rising popularity of motorcycles as a cost-effective and enjoyable mode of transportation is a key factor contributing to the demand for helmets.

Asia Pacific Motorcycle Helmet Market Trends

The Asia Pacific motorcycle helmet industry accounted for a revenue share of 42.7% in 2024. As the number of motorcycle owners continues to rise each year in the Asia Pacific region, so too does the incidence of fatalities associated with motorcycle accidents. In response, governments across the region have increasingly mandated the use of helmets as a crucial safety measure. This policy initiative is designed to significantly reduce the risk of head injuries and fatalities, underscoring a broader commitment to improving road safety standards amid rapid motorization.

The India motorcycle helmet industry is expected to grow at a CAGR of 8.9% from 2025 to 2030. The increasing urban population, traffic congestion, and demand for affordable mobility solutions have contributed to this surge. To enhance road safety, the Indian government has implemented stringent helmet regulations. The Motor Vehicles Act of 1988 mandates that all riders and pillion passengers above four years of age wear protective headgear. In India, the majority of helmets fall under the sub-USD 100 range primarily due to the country’s strong price sensitivity and large lower-to-middle-income consumer base. Many Indian riders seek affordable helmets that meet basic safety standards without incurring a significant financial burden. In addition, robust local manufacturing and the presence of numerous domestic brands help keep production costs-and therefore retail prices-relatively low. While premium, higher-priced helmets exist, they command a much smaller share of the market, reflecting the broad demand for cost-effective products in a price-conscious economy.

China motorcycle helmet market has implemented significant regulations for motorcycle and electric bicycle helmets in recent years, with major updates coming into effect in 2023-2024. The key regulations governing motorcycle helmets in China include GB 811-2022, a mandatory national standard for "motorcycle and electric bicycle passenger helmets" that replaced the older GB 811-2010 standard on July 1, 2023. This standard determines the basic structure, categories, specifications, technical requirements, test methods, and marking requirements for motorcycle helmets.

Europe Motorcycle Helmet Market Trends

The Europe motorcycle helmet industry is expected to grow at a CAGR of 3.0% from 2025 to 2030. Countries such as Italy, France, and Spain have a long-standing motorcycling tradition, with legendary brands like Ducati, Moto Guzzi, and BMW Motorrad shaping the industry. The influence of motorsports, including MotoGP and World Superbike Championships, has further fueled interest in motorcycling, encouraging enthusiasts to invest in high-quality helmets inspired by professional riders. The European motorcycle industry experienced robust growth in 2024, with new motorcycle registrations in the five largest markets-France, Germany, Italy, Spain, and the UK-reaching 1,155,640 units, marking a 10.1% increase compared to 2023. Among these, Italy led the market with 352,294 units registered, reflecting a 10% growth. Germany followed closely with 248,618 units, showing the highest increase at 16.3%. Spain recorded 229,685 registrations, growing by 14.2%, while France saw a modest 3.5% rise with 214,049 units. The UK had the lowest growth rate at 2.7%, with 110,994 registrations.

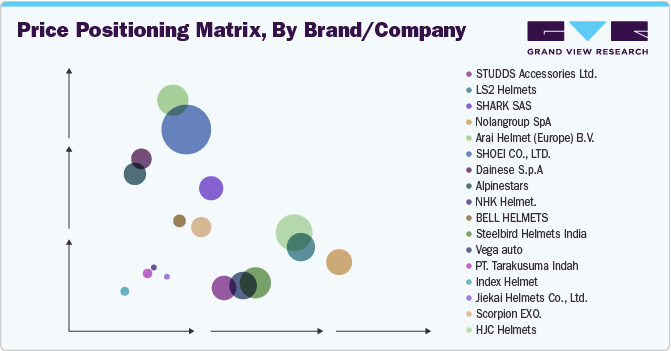

Key Motorcycle Helmet Company Insights

Motorcycle helmet manufacturers are increasingly incorporating smart technology to enhance rider safety and convenience. Advanced helmets now feature Bluetooth connectivity, integrated communication systems, and voice command compatibility, allowing riders to navigate, make calls, and access real-time updates hands-free. In addition, brands are focusing on customization by offering interchangeable visors, aerodynamic designs, and a variety of color and graphic options to suit individual preferences. Modular helmet designs are also gaining popularity, enabling riders to upgrade specific components like ventilation systems or communication modules without replacing the entire helmet, ensuring both durability and adaptability.

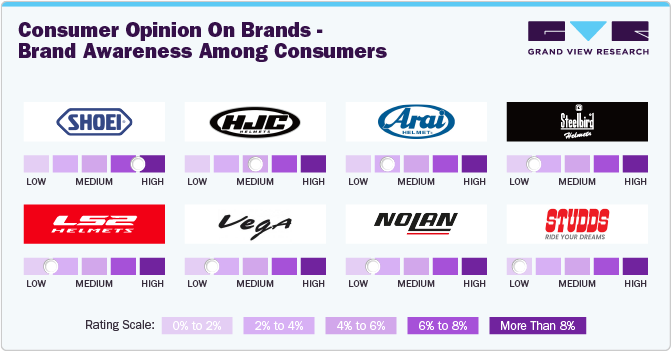

The graph above illustrates the leading helmet brands preferred by consumers, along with their respective ratings. It provides a clear insight into the brands that consumers prioritize when selecting helmets, considering key factors such as safety, convenience, and overall performance.

Key Motorcycle Helmet Companies:

The following are the leading companies in the motorcycle helmet market. These companies collectively hold the largest market share and dictate industry trends.

- STUDDS Accessories Ltd.

- ls2helmets.com

- SHARK SAS

- Nolangroup SpA

- Arai Helmet (Europe) B.V.

- SHOEI CO., LTD.

- Dainese S.p.A

- Alpinestars

- NHK Helmet.

- BELL HELMETS

- Steelbird Helmets India

- Vega auto

- PT. Tarakusuma Indah

- Index Helmet

- Jiekai Helmets Co., Ltd.

- Scorpion EXO

- HJC Helmetsi

Recent Developments

-

In February 2025, HJC unveiled a new Replica Quartararo version based on the RPHA 12 helmet, featuring a more subtle white, grey, and black design while retaining Fabio Quartararo's essential graphics and the Monster Energy logo. The RPHA 12, recognizable for its lineage with the RPHA series and its transition to the ECE 22.06 standard, showcased a new multi-fiber shell made using HJC's PIM EVO process. It boasted improvements in aerodynamics, aeroacoustics, comfort, ventilation, and safety and featured a new screen and turntables, advanced ventilation, and a completely new interior for enhanced support and comfort.

-

In December 2024, Scorpion launched the EXO-JNR Air, a children's motorcycle helmet designed to provide young riders with a blend of safety, comfort, and style. The helmet features a lightweight polycarbonate shell, ECE 22.06 certification, advanced technologies such as the AirFit inflatable cheek pad system for a personalized fit, and the KwikWick C inner liner to keep riders cool and dry. Additionally, it includes a Pinlock-ready visor to prevent fogging and the Ellip-Tec mechanism for quick, tool-free visor changes.

-

In November 2024, Triumph Motorcycles partnered with Arai to launch a new range of co-branded, high-specification helmets. The collaboration resulted in four models: the sporty Quantic, the adventurous Tour X-5, the modern classic Concept-XE, and the off-road MX-V Evo. These helmets, available in sizes XS to XL, combined Arai's renowned performance in protection, comfort, and ease of wear with Triumph's style and elegance. The co-branded helmets were set to be available in dealerships across Italy and the UK starting in the Summer of 2025.

-

In November 2024, AXOR Helmets, a subsidiary of Vega Auto, made a notable debut at EICMA in Milan, attracting influencers, celebrities, and motorcycle enthusiasts worldwide. The company's booth showcased its range of high-quality helmets, with the Brutale helmet standing out due to its aerodynamic design and focus on rider stability. Renowned Indian influencers and Bollywood celebrities, including John Abraham, visited the AXOR booth, contributing to the brand's growing domestic and international influence.

-

In February 2024, GoPro Inc. announced its plans to acquire Forcite Helmets, an Australian company known for its tech-enabled motorcycle helmets. The acquisition aims to integrate Forcite's technology into GoPro's future products to enhance the performance and safety of various helmets. GoPro envisioned launching its first tech-enabled motorcycle helmet, utilizing Forcite's technology, by 2025 and considered implementing "tech-as-a-service subscription plans," similar to its existing camera and video models, which would offer riders benefits such as unlimited cloud storage, total camera replacement, discounts, quick app access, and exclusive deals for a monthly fee.

Motorcycle Helmet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.52 billion

Revenue forecast in 2030

USD 4.52 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy;, Spain; Benelux; Nordics; China; Japan; India; Australia & New Zealand; South Korea; Southeast Asia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

STUDDS Accessories Ltd.; ls2helmets.com; SHARK SAS; Nolangroup SpA; Arai Helmet (Europe) B.V.; SHOEI CO., LTD.; Dainese S.p.A; Alpinestars; NHK Helmet; BELL HELMETS; Steelbird Helmets India; Vega Auto; PT. Tarakusuma Indah; Index Helmet; Jiekai Helmets Co., Ltd.; Scorpion EXO; HJC Helmets

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Motorcycle Helmet Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motorcycle helmet market report based on product, price range, end-use, distribution channel, and region.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Full Face Helmets

-

Open Face Helmets

-

Off-road/ Racing Helmets

-

Others

-

-

Price Range Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Up to USD 150

-

USD 150 to USD 250

-

USD 250 to USD 500

-

USD 500 to USD 1,000

-

Above USD 1,000

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Commuters

-

Professional Riders

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Nordics

-

Benelux

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global motorcycle helmet market size was estimated at USD 3.35 billion in 2024 and is expected to reach USD 3.52 billion in 2025.

b. The global motorcycle helmet market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 4.52 billion by 2030.

b. Key factors that are driving the market growth include increasing number of motorbike and sports bike enthusiasts and rising concerns regarding road traffic injuries.

b. Full face helmets dominated the motorcycle market with a share of 58.1% in 2024.The market for full-face motorcycle helmets is increasing due to growing safety awareness, regulatory changes, and shifting consumer preferences. Riders are prioritizing safety more than ever, leading to a surge in demand for helmets that provide full protection.

b. Some key players operating in the motorcycle market include STUDDS Accessories Ltd., ls2helmets.com, SHARK SAS, Nolangroup SpA, Arai Helmet (Europe) B.V. and others

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.