- Home

- »

- Medical Devices

- »

-

mRNA Therapeutics Contract Development & Manufacturing Organization Market Report 2033GVR Report cover

![mRNA Therapeutics Contract Development & Manufacturing Organization Market Size, Share & Trends Report]()

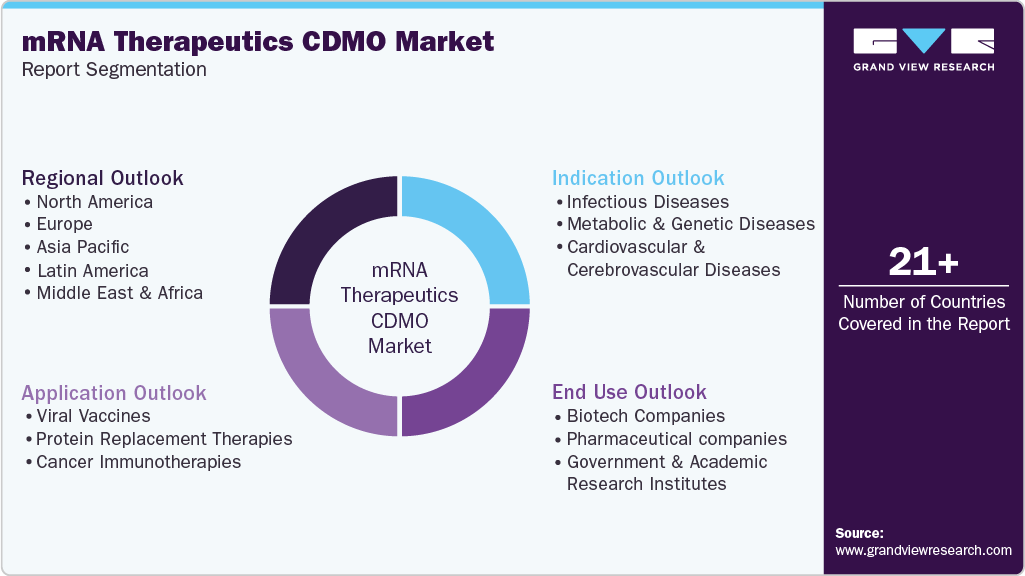

mRNA Therapeutics Contract Development & Manufacturing Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Metabolic & Genetic Diseases), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-083-7

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

mRNA Therapeutics Contract Development & Manufacturing Organization Market Summary

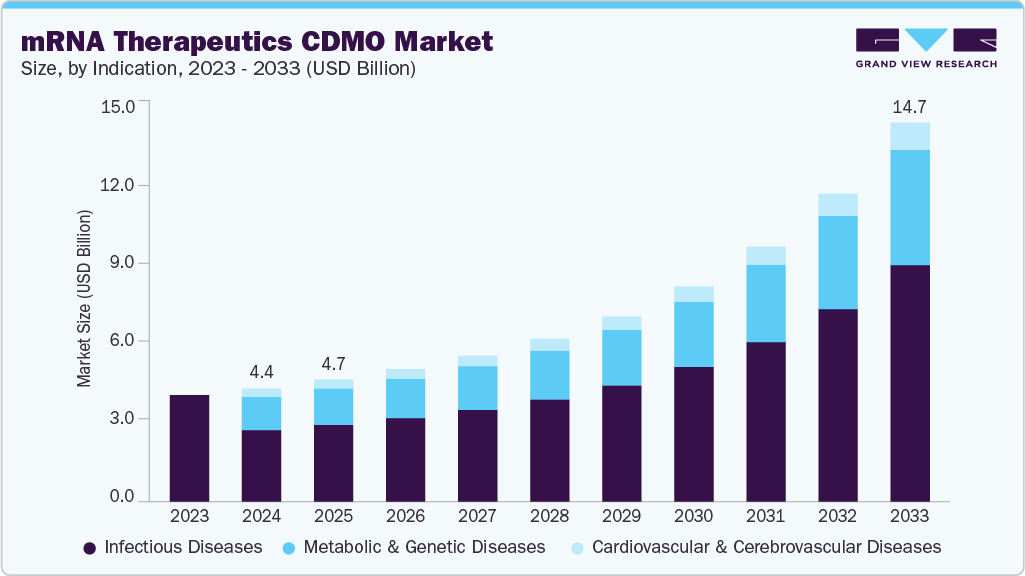

The global mRNA therapeutics contract development & manufacturing organization market size was estimated at USD 4.40 billion in 2024 and is projected to reach USD 14.75 billion by 2033, growing at a CAGR of 15.22% from 2025 to 2033. The market is driven by rising mRNA vaccine development, increasing burden of infectious diseases & cancer cases, shifting clinical requirements, and digitalization that has revolutionized vaccine development & other therapeutic applications.

Key Market Trends & Insights

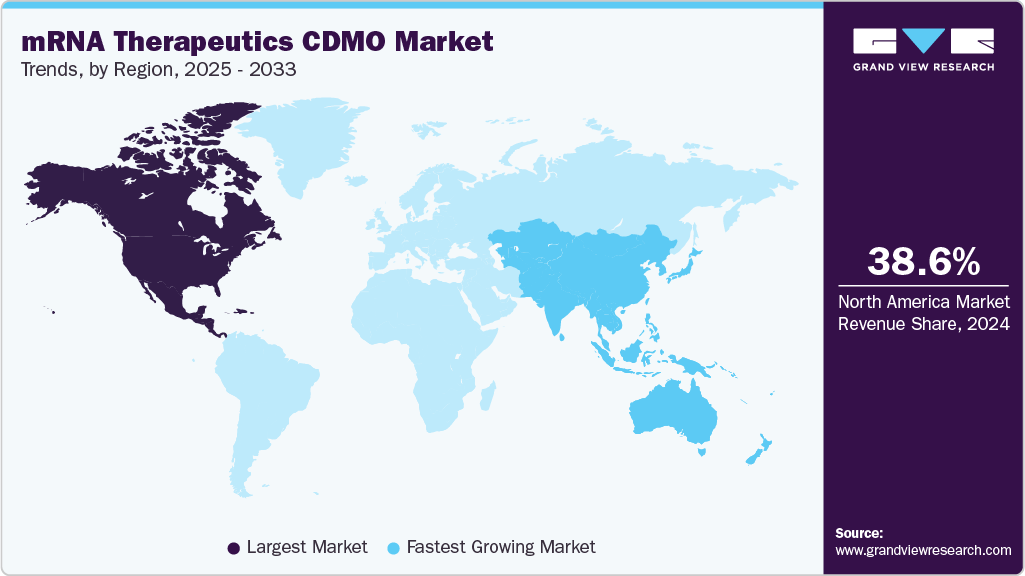

- North America mRNA therapeutics contract development & manufacturing organization market held the largest share of 38.61% of the global market in 2024.

- The mRNA therapeutics contract development & manufacturing organization in the U.S. is expected to grow significantly over the forecast period.

- Based on indication, the infectious diseases segment held the highest market share in 2024

- By application, the viral vaccines segment held the highest market share of 68.59% in 2024.

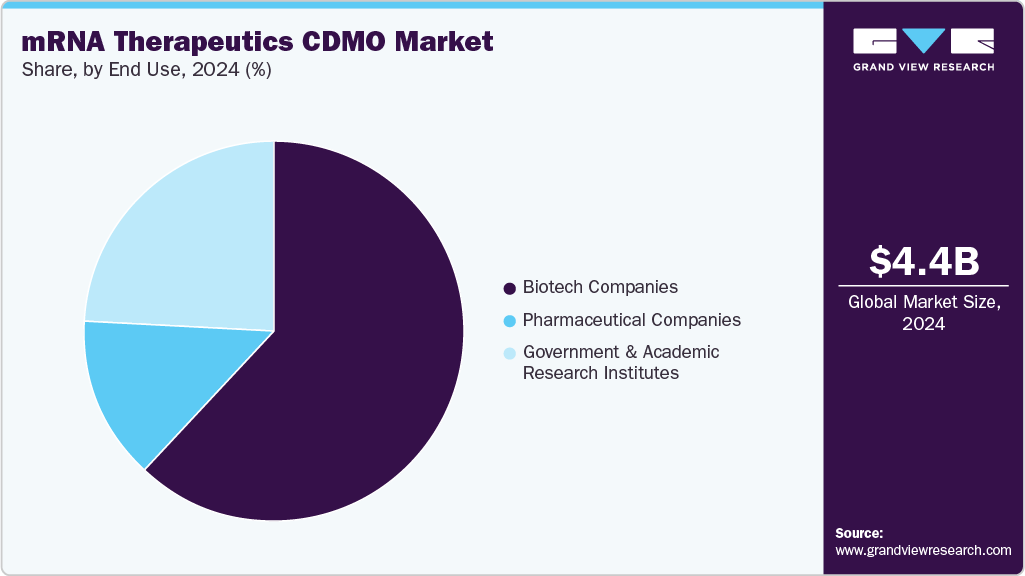

- Based on end use, the biotech companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.40 Billion

- 2033 Projected Market Size: USD 14.75 Billion

- CAGR (2025-2033): 15.22%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, mRNA therapeutics manufacturing is driven by growing investments & collaborations and an increasing number of global Contract Development & Manufacturing Organizations (CDMOs). Furthermore, research & development (R&D) activities and preclinical studies have increased the market requirements. The market is witnessing rising demand for services due to the growing use of mRNA technologies in vaccines. Amid the SARS-CoV-2 pandemic, mRNA-based vaccines demonstrated remarkable efficacy against the virus, and they were swiftly developed & distributed worldwide. The pioneering efforts of Pfizer-BioNTech and Moderna in creating these vaccines validated the mRNA platform and generated interest for its use in preventive & therapeutic applications.Besides, growing research initiatives focused on mRNA therapeutics are fueling new breakthroughs across a wide range of diseases, extending beyond vaccines to encompass cancer, genetic disorders, and rare conditions. In addition, growing success of mRNA-based COVID-19 vaccines, scientists are harnessing this technology for its rapid development capabilities, precise targeting, and flexible design. Moreover, rising innovations in delivery methods, including lipid nanoparticles and polymer-based systems, are improving tissue-specific expression and stability, which further supports the market growth. Also, the current studies aim to optimize mRNA translation efficiency, reduce immunogenicity, and facilitate repeat dosing.

These advancements are establishing mRNA as a versatile therapeutic approach, supported by increasing investment and expansion of research pipelines in both the biopharmaceutical sector and academic institutions. For instance, in April 2025, Wacker Biotech announced a partnership with RNAV8 Bio, an innovative company in mRNA engineering based in Boston. This collaboration aims to advance the development and manufacturing of mRNA-based advanced therapies for the biopharmaceutical sector.

Opportunity Analysis

The mRNA therapeutics CDMOs are expected to witness growth opportunities due to the increasing number of pharmaceutical and biotech companies increasingly opting to outsource complex development and manufacturing processes. Besides, the success of mRNA vaccines during the COVID-19 pandemic has shown the platform’s potential, leading to a surge in R&D for mRNA-based therapies aimed at infectious diseases, cancer, and rare genetic conditions. However, the production of mRNA therapeutics necessitates specialized skills in areas such as plasmid DNA production, in vitro transcription, lipid nanoparticle (LNP) formulation, and aseptic fill-finish, which are domains where few companies possess comprehensive expertise. This factor has led to rising requirements for CDMOs that can offer integrated solutions across the entire mRNA value chain.

Moreover, emerging new opportunities such as scalable, modular GMP manufacturing, process development for innovative LNPs, and cold-chain logistics solutions. Besides, small and mid-sized biotechnology companies increasingly focus on early-stage mRNA innovation, which further drives the growing need for CDMOs due to their technical knowledge and regulatory-compliant infrastructure. Furthermore, the regional expansion of mRNA manufacturing beyond North America and Western Europe is creating new opportunities in Asia and other emerging markets. CDMOs that invest in flexible, digitally integrated facilities and develop proprietary mRNA/LNP platforms are likely to secure lasting partnerships and take advantage of the expanding mRNA therapeutic landscape.

Impact of U.S. Tariffs on the Global mRNA Therapeutics Contract Development & Manufacturing Organization Market

The impact of U.S. tariffs on pharmaceutical inputs and raw materials related to biologics has significantly impacted the mRNA therapeutics Contract Development & Manufacturing Organization (CDMO) sector. In the market, essential components, such as nucleotides, enzymes, and specialized lipids, are primarily sourced from China and Europe. This has led to price increases due to U.S. tariffs and higher input costs for CDMOs based in the U.S. In addition, the impact of the U.S. has put additional pressure on early-stage projects sensitive to margins and increased reliance on diversified or domestic supply chains. This factor has led CDMOs to reevaluate their sourcing strategies, focusing on suppliers from tariff-exempt countries or considering reshoring vital inputs to reduce risks and ensure consistent operations.

Moreover, tariffs have unexpectedly benefited certain U.S. CDMOs by making domestic manufacturing more appealing to biotech clients looking to sidestep cost fluctuations and geopolitical risks associated with overseas suppliers. Increased federal funding and a growing strategic interest in enhancing mRNA manufacturing resilience following the pandemic have further supported this trend. However, global supply chain challenges, along with the tariffs, have resulted in delays in equipment delivery and the scaling of facilities. Thus, CDMOs maintaining flexible procurement networks, regional manufacturing capabilities, and production efforts aligned with government initiatives are more likely to manage the volatility caused by tariffs and secure long-lasting strategic partnerships within the mRNA therapeutics industry.

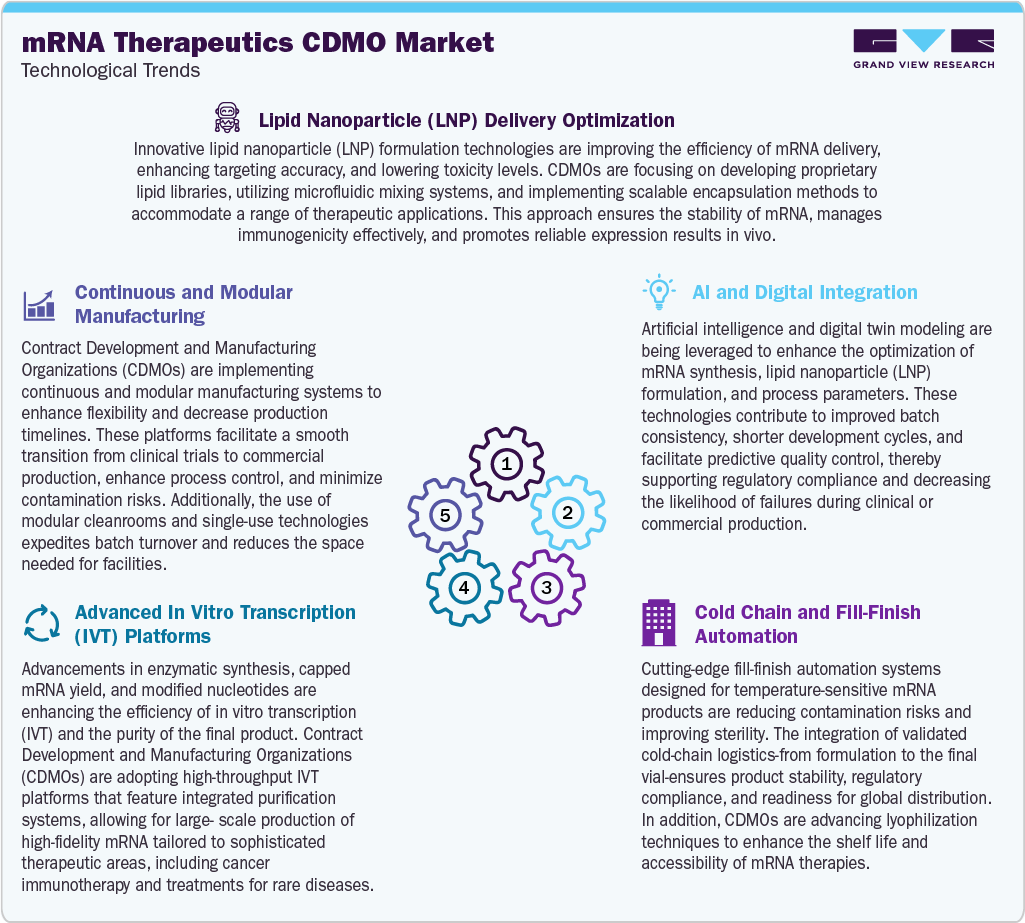

Technological Advancements

Recent advancements in mRNA therapeutic CDMO services transform drug development by facilitating faster, safer, and more scalable production methods. Besides, currently, it is supporting the optimization of Lipid Nanoparticle (LNP) delivery, where CDMOs are improving encapsulation efficiency through techniques such as microfluidic mixing, tailored lipid libraries, and scalable LNP synthesis platforms. These enhancements have led to a significant increase in delivery efficiency, with some clinical-stage programs reporting improvements exceeding 90%. Besides, the shift towards continuous and modular manufacturing further supports reducing production timelines by as much as 40%. It allows swift transitions from clinical to commercial production using versatile, plug-and-play cleanroom designs. Moreover, integrating AI and digital technologies enhances manufacturing processes, with AI-driven models cutting batch failure rates by 25% through real-time monitoring and predictive analytics.

In addition, advanced in vitro transcription (IVT), innovations like enzymatic capping, and optimized nucleotide sequences have led to higher yields and purity of mRNA, with platforms achieving transcription efficiencies above 95%. Furthermore, cold chain management and automated fill-finish processes support the preservation of mRNA stability. Also, CDMOs are adopting automated aseptic systems and integrated cold storage solutions, which minimize handling time and reduce product loss. These developments further support CDMOs as crucial partners in the efficient and reliable delivery of next-generation mRNA therapeutics.

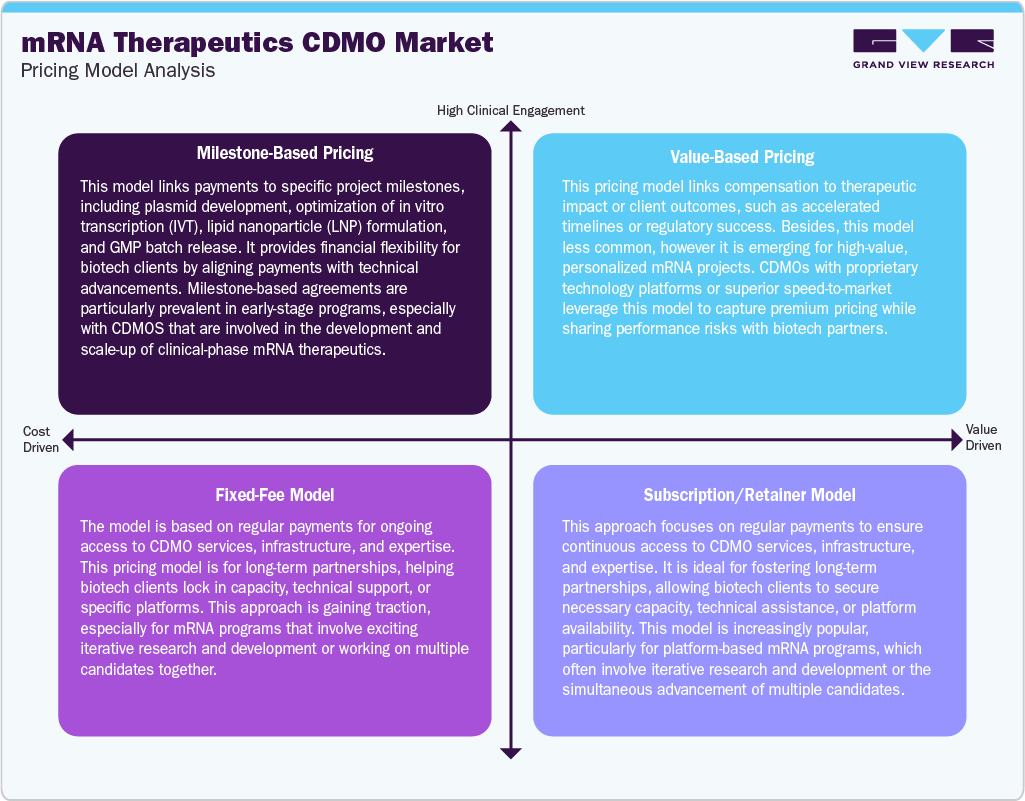

Pricing Model Analysis

mRNA therapeutics CDMOs are adapting to various pricing models to accommodate the varied needs of clients at different development stages. Milestone-based pricing is commonly adopted, particularly for early-phase projects, where payments are linked to specific deliverables such as plasmid DNA production, scaling up in vitro transcription (IVT), lipid nanoparticle (LNP) formulation, and batch release. This structure aligns payments with technical advancements and minimizes financial risks for clients.

In addition, the emerging value-based pricing model connects CDMO compensation to performance outcomes, such as accelerated development timelines or regulatory approvals, and is used selectively for high-value or personalized mRNA therapy initiatives. Besides, the fixed-fee pricing remains prevalent for clearly defined scopes, including pilot manufacturing, analytical development, and technology transfer, offering cost predictability and easing contract management. Furthermore, subscription or retainer models are becoming popular among biotechs working on platform-based mRNA pipelines, as they allow for ongoing access to CDMO infrastructure, technical expertise, or GMP suites. Such a pricing model fuels long-term collaboration and ensures capacity reservation in a competitive manufacturing environment.

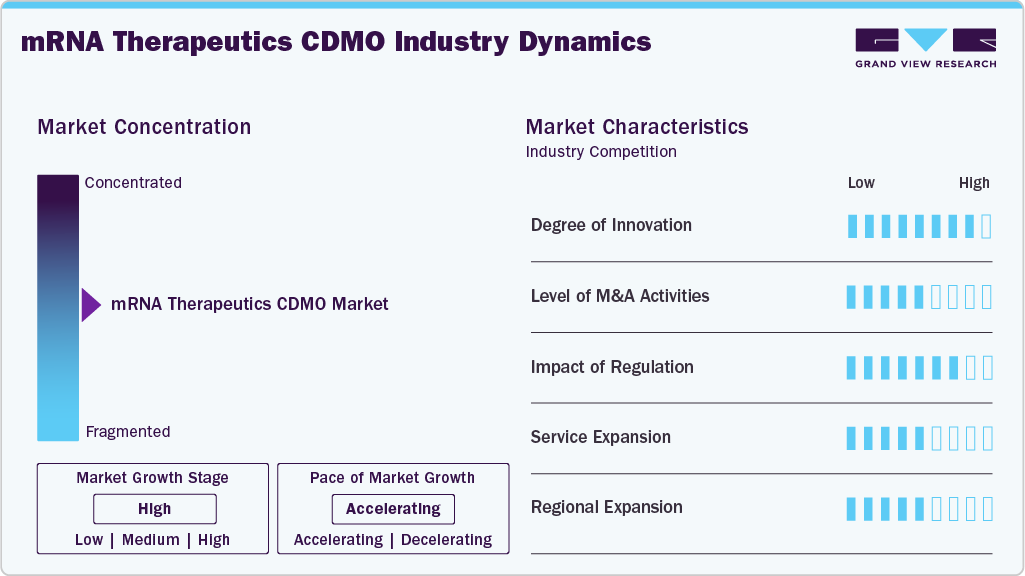

Market Concentration & Characteristics

The market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.The landscape of CDMOs for mRNA therapeutics is driven by significant innovation in areas such as lipid nanoparticle (LNP) delivery systems, continuous manufacturing, and modular cleanroom technologies. Besides, mRNA therapeutics CDMOs are adopting AI-driven process enhancements, single-use technologies, and scalable in vitro transcription (IVT) methods to address the increasing market needs. In addition, advancements made in thermostable formulations and personalized mRNA-based cancer therapies, leading to shorter timelines, lower costs, and enhanced product stability are expected to drive the innovations among early-stage biotech companies and mRNA drug developers aiming for commercial expansion.

Stringent regulatory standards are influencing the operations of mRNA CDMOs, which has led to increased focus on Good Manufacturing Practice (GMP) compliance, quality control of in vitro transcription reagents, and the traceability of raw materials. Regulatory bodies such as the FDA and EMA are rapidly adapting their frameworks to accommodate innovative mRNA-based therapies, with a strong emphasis on data integrity and the characterization of lipid nanoparticles (LNPs). While these measures enhance safety and efficacy, they also introduce added complexity and costs to CDMO operations. Organizations with regulatory expertise, robust documentation practices, and proactive engagement with regulatory agencies are better positioned to secure and retain projects.

M&A activity within the mRNA CDMO sector is currently moderate, however it is expected to witness rising activities driven by strategic consolidation, integration of platforms, and efforts to penetrate fast-growing biological markets. Besides, companies are acquiring businesses with proprietary lipid nanoparticle (LNP) technologies, advanced mRNA synthesis capabilities, or GMP-compliant facilities to quickly enhance their services and establish unique positions in this developing market.

mRNA contract development and manufacturing organizations (CDMOs) are broadening their services to encompass plasmid DNA production, tailored lipid nanoparticle (LNP) formulation, analytical development, and aseptic fill-finish capabilities. Besides, strong demand for comprehensive solutions that span from preclinical process development to large-scale commercial production, especially for personalized vaccines and treatments for rare diseases. In addition, there is increasing attention on integrated digital quality systems and cold-chain logistics.

CDMOs are increasingly focusing on regional expansion to localize mRNA manufacturing across North America, Europe, and the Asia-Pacific region. Companies based in the U.S. are directing investments towards biotech hubs, while their European region is enhancing production capabilities in countries such as Germany, Belgium, and Switzerland. Moreover, growth in the Asia-Pacific area is largely fueled by demand from Japan, South Korea, and Singapore. Furthermore, establishing facilities in these regions helps to mitigate geopolitical risks, bolster supply chain resilience, and aligns with governmental initiatives to strengthen biopharmaceutical sovereignty and enhance pandemic preparedness infrastructure.

Indication Insights

On the basis of indication, infectious diseases dominated the market in 2024. The prevalence of infectious diseases has long been a global health problem, and mRNA therapies have emerged as promising tools in combating these diseases. mRNA therapeutics promises growth regarding infectious diseases, and the market represents a dynamic & fast-growing segment with unique advantages and growth potential. The growing respiratory diseases have highlighted the need for rapid and flexible vaccine development. In addition, several pharmaceutical companies are enhancing their mRNA pipelines and collaborating with contract manufacturing companies to produce mRNA products, and such factors are expected to drive segment growth. For instance, in February 2024, ReCode Therapeutics mentioned that the first volunteer had been dosed in a Phase 1 clinical study of RCT2100. It is an inhaled investigational therapy based on mRNA for cystic fibrosis that is focused on 10-13% of patients with nonsense mutations who do not experience any side effects with approved CFTR modulators.

On the other hand, the metabolic & genetic diseases segment is expected to witness growth at a CAGR of 15.54% over the forecast period. mRNA therapy is rapidly expanding, with several companies and scientific institutions developing mRNA-based treatments for diverse diseases, including metabolic & genetic diseases. This has increased the demand for CDMO services that produce these treatments. Furthermore, collaboration among companies for developing and adopting novel technologies is expected to significantly impact the market in the coming years. For instance, in June 2024, Moderna, Inc. announced that the U.S. FDA recognized mRNA-3705 as part of its pilot program for Support of Clinical Trials Advancing Rare Disease Therapeutics. This investigational treatment is aimed at addressing methylmalonic acidemia caused by methylmalonic-CoA mutase deficiency. Furthermore, the company reported that its investigational mRNA therapy for MMA has been chosen by the U.S. FDA for the START pilot program. This potential of Moderna's innovative mRNA technology extends beyond vaccines and addresses the significant and unmet medical needs associated with MMA.

Application Insights

On the basis of application, the viral vaccines segment accounted for the largest share in 2024. The demand in the segment can be attributed to the growing innovations of mRNA-based vaccines to control the spread of the COVID-19 virus, established technology, and the wide applicability of viral vaccines. Furthermore, expanding the mRNA vaccine pipeline is expected to drive market growth in the coming decade. The development of mRNA vaccines to treat various infectious diseases is also increasing. Companies have begun including vaccinations for various diseases, such as influenza, Zika, and Cytomegalovirus (CMV), in their pipelines along with COVID-19. This trend indicates the versatility of mRNA vaccines. For instance, in February 2024, CordenPharma International launched new Lipid NanoParticle (LNP) starter kits for the formulation of mRNA-based therapeutics like mRNA vaccines or gene therapies. These kits are designed to create and optimize LNPs for mRNA delivery among researchers.

In addition, cancer immunotherapies are anticipated to grow as the fastest-growing segment during the forecast period. Cancer immunotherapies, including mRNA-based approaches, are showing significant promise and attracting considerable attention in oncology. mRNA cancer vaccines represent a potent and adaptable approach to immunotherapy. The primary advantage of mRNA cancer immunotherapies is their potent immunogenicity, which triggers strong cell-mediated and humoral immune responses, thus contributing to market growth. These vaccines can encode and produce Tumor-Associated Antigens (TAA), Tumor-Specific Antigens (TSA), and related cytokines. This unique attribute enables mRNA vaccines to stimulate humoral and cellular immune responses. Moreover, personalized mRNA vaccines open a new way for precision cancer therapy. These personalized mRNA cancer vaccines, engineered to encode specific cancer antigens, can be manufactured using advanced Next-generation Sequencing (NGS) technology. Diverse computational methods are also available to predict neoantigens and their interaction with Human Leukocyte Antigen (HLA) for presentation.

End Use Insights

On the basis of end-use, the biotech companies segment dominated the market, accounting for a revenue share of 62.34%. This segment is driven by an increasing trend of outsourcing end-to-end services, especially among small and mid-sized biotechnology companies that lack expertise in mRNA development. Furthermore, the research & development (R&D) budget allocated to mRNA development has increased considerably, boosting segment growth over the forecast period. The growing number of nucleic acid therapeutics in the pipeline and the rising trend of outsourcing in biotechnology companies are expected to drive segment growth over the forecast period. Furthermore, collaboration between biotechnology companies and CDMOs is expected to drive the segment. For instance, in January 2024, Oxford Nanopore Technologies Plc and Lonza announced a collaboration for cGMP validation and to commercialize a novel test to determine quality attributes of mRNA products by sequencing both the DNA template & mRNA. Such factors are expected to drive the market over the estimated time period.

On the other hand, the government & academic research institutessegment is expected to grow significantly during the forecast period. This is due to the rising investment by government bodies to develop novel therapies for chronic diseases and increasing interest in healthcare innovation. For instance, in August 2024, A patient with lung cancer at University College London Hospitals noted that they are among the first to receive an innovative mRNA-based vaccine aimed at activating the immune system to target cancer cells specifically. The BioNTech immunotherapy (BNT116) is currently being investigated worldwide in a trial for lung cancer. The NIHR UCLH Clinical Research Facility serves as the primary research site for this study.

Regional Insights

North America mRNA therapeutics contract development & manufacturing organization market dominated with a share of 38.61% in 2024.The market is driven by established contract development & manufacturing organizations (CDMOs), increasing clinical trials, and a growing prevalence of infectious diseases, respiratory diseases, and cardiovascular & cerebrovascular diseases in North America.

In addition, in the region, the U.S. is the biggest market for mRNA therapeutics contract development & manufacturing, as several biopharmaceuticals and pharmaceutical companies prefer outsourcing their preclinical trials to CDMOs based in the U.S. Increased investments in R&D by market players, government support, rising number of clinical trials is expected to drive the market growth. For instance, in February 2024, Arcturus Therapeutics and CSL announced the results of a follow-up on the ARCT-154 booster dose Phase 3 study. It was the first sa-mRNA COVID-19 vaccine approved globally and can be administered at one-sixth the dose of Comirnaty (5 μg vs 30 μg). Such factors are expected to contribute to market growth.

U.S. mRNA Therapeutics Contract Development & Manufacturing Organization Market Trends

The mRNA therapeutics contract development & manufacturing organization market in the U.S. held the largest share in 2024, as many pharmaceutical and life sciences companies are present in this country. Growing interest in clinical trials and the benefits of live biotherapeutics in treating rare diseases is driving the development of new & novel drugs. Moreover, a well-established regulatory framework provides new opportunities for companies to develop and manufacture products with wide applications & target populations and improved knowledge of the importance of mRNA in terms of therapeutics.

Canada mRNA therapeutics CDMO market is driven by a rising number of clinical trials, and the growing burden of various diseases is driving the market growth. Furthermore, pharmaceutical companies and CDMOs are increasing their focus on the development of new products. For instance, in January 2025, Esphera SynBio mentioned a groundbreaking project focused on improving the effectiveness of mRNA vaccines. The company is utilizing its unique technology to develop mRNA vaccines that enable patient cells to produce specialized nanomedicines upon administration. This initiative is backed by the CQDM Quantum Leap program, which promotes collaborations between Canadian firms and international biopharmaceutical entities. These factors are expected to enhance market growth in Canada during the projected period.

Europe mRNA Therapeutics Contract Development & Manufacturing Organization Market Trends

The mRNA therapeutics contract development & manufacturing organization market in Europe is expected to grow significantly. Due to the COVID-19 pandemic, vaccine developers entered into strategic agreements with contract development and manufacturing service providers to meet the urgent global demand for mRNA-based vaccines, which led to significant growth in the outsourcing industry. Moreover, manufacturing mRNA therapeutics is complex, cost-intensive, and requires skilled professionals. Thus, several small- to medium-sized companies rely on CDMO to produce mRNA-synthesized products to innovate new mRNA therapeutics.

Germany mRNA therapeutics CDMO market held the highest share in 2024. The country’s growth is driven presence of a substantial number of providers offering mRNA therapeutics and rising initiatives undertaken to expand the mRNA therapeutics. For instance, in June 2024, Wacker announced the launch of a new mRNA competence center at its biotech facility in Germany. This state-of-the-art facility allows for large-scale production of active ingredients derived from mRNA, including vaccines for COVID-19. The company has invested over USD 115.55 million (€100 million) into the project, which has created more than 100 jobs in Halle. Furthermore, this expansion contributes to the German government's pandemic preparedness strategy, ensuring a swift supply of vaccines as needed.

The mRNA therapeutics CDMO market in the UK is driven by leading outsourcing companies that are increasing their financing to strengthen their mRNA synthesis infrastructure and support market growth. Besides, increasing government initiatives to support mRNA therapeutics development and accelerate clinical trials for mRNA immune therapies are driving the mRNA therapeutics contract development and manufacturing market. For instance, in February 2024, Imperial College Healthcare NHS Trust announced dosing the first participant in the UK with experimental mRNA therapy, mRNA-4359, in a Phase I/II clinical trial to treat solid tumors, including lung cancer and melanoma. Such innovations are expected to support the market growth over the estimated time period.

Asia Pacific mRNA Therapeutics Contract Development & Manufacturing Organization Market Trends

The mRNA therapeutics contract development & manufacturing organization market in Asia Pacific is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to various factors, such as increasing investments in biotechnology, government initiatives, and an expanding range of clinical trials in countries such as Japan, South Korea, China, and Singapore. In addition, the rising number of CDMOs is enhancing their capabilities in areas like plasmid DNA production, in vitro transcription (IVT), lipid nanoparticle (LNP) formulation, and aseptic fill-finish processes. Besides, collaborations with global biopharma companies and localized manufacturing efforts are facilitating technology transfer and minimizing reliance on Western supply chains. Moreover, the region offers a range of advantages such as cost-effectiveness, a skilled workforce, and improved regulatory alignment, which further support market growth.

China mRNA therapeutics CDMO market is driven by a rising number of biopharmaceutical companies, both within China and internationally, that are increasingly turning to CDMOs for mRNA drug development and manufacturing services. In addition, robust government support, a growing biotech ecosystem, and increasing domestic demand for cutting-edge therapies are expected to support market growth. Besides, CDMOs allow these companies to leverage specialized expertise and state-of-the-art facilities without the need for substantial in-house investments. State-of-the-art facilities equipped with cutting-edge technology have been established to meet the growing demand. Moreover, companies are focusing on developing comprehensive capabilities, partnerships with global biopharma companies and local innovators, which further support the market growth.

The mRNA therapeutics contract development & manufacturing organization market in Japan is driven by growing initiatives to set up drug discovery infrastructure in Japan, rising investments by private & public sectors, and strategic initiatives such as mergers & acquisitions by key companies are among the key factors fueling the market growth in the country. For instance, Daiichi Sankyo announced that it has received approval for the manufacturing & marketing of DAICHIRONA for Intramuscular Injection, a monovalent mRNA vaccine against the novel coronavirus infectious disease (COVID-19), in Japan for the prevention of infectious disease caused by SARS-CoV-2 (booster vaccination).

India mRNA therapeutics contract development & manufacturing organization market is driven by a large pool of skilled scientists, researchers, and professionals in biotechnology & pharmaceuticals. This skilled workforce is appealing to companies looking for outsourcing partners. In addition, India’s cost structure and relatively lower labor costs compared to Western countries make it an attractive destination for outsourcing mRNA development and manufacturing. This cost advantage is especially significant for startups and small- to medium-sized biotech companies.

Latin America mRNA Therapeutics Contract Development & Manufacturing Organization Market Trends

The mRNA therapeutics contract development & manufacturing organization market in Latin America is experiencing significant growth driven by growing breakthroughs in human health, influenced by the need to combat a wide range of incurable diseases. In addition, the support received from government bodies to carry out various mRNA therapeutics-related training for executing various clinical trials is impelling the growth of the market in the region. Moreover, the rising demand for CDMOs, growing investments in R&D, and increasing support for new innovations are expected to drive the growth of the Latin America mRNA therapeutics CDMO market.

Brazil mRNA therapeutics contract development & manufacturing organization market is driven by rising cost-effectiveness, high prevalence of diseases, and ease of patient recruitment. Besides, growing for mRNA vaccines, there is a rising number of trials being conducted in this region, which is expected to drive market growth during the forecast period. In addition, increasing R&D capabilities and initiatives among global companies are likely to attract investments from pharmaceutical & biotech companies. This is expected to boost market growth during the forecast period.

MEA mRNA Therapeutics Contract Development & Manufacturing Organization Market Trends

Middle Eastern countries such as South Africa, Saudi Arabia, the United Arab Emirates (UAE), and Kuwait are prospering economies. The mRNA therapeutics contract development & manufacturing organization (CDMO) in the MEA region is likely to grow steadily in the coming years. The increasing burden of diseases and the demand for various mRNA therapeutics are major factors contributing to the growth of the market. Besides, the growing number of clinical trials is anticipated to boost market growth.

South Africa mRNA therapeutics contract development & manufacturing organization market is driven by investing in end-to-end capabilities, including plasmid DNA production, in vitro transcription, LNP formulation, and aseptic fill-finish. Moreover, expanded sterile manufacturing capacity and growing CDMOs services demand are expected to support the market over the estimated time period.

Key mRNA Therapeutics Contract Development & Manufacturing Companies Insights

Key players operating in the mRNA therapeutics contract development & manufacturing organization market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key mRNA Therapeutics Contract Development & Manufacturing Companies:

The following are the leading companies in the mRNA therapeutics contract development & manufacturing organization market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher (Aldevron)

- Biomay AG

- Bio-Synthesis, Inc.

- eTheRNA

- Kaneka Eurogentec S.A.

- TriLink BioTechnologies

- ApexBio Technology

- BioNTech SE

- Biocina

- Lonza

- Recipharm AB

- Novo Holdings (Catalent, Inc.)

- Samsung Biologics

Recent Developments

-

In May 2025, Aldevron announced the production of personalized CRISPR gene editing therapy aimed at treating urea cycle disorder in infants. Besides the given absence of existing cures for UCDs, the Children’s Hospital of Philadelphia & the University of Pennsylvania mention a partnership with Aldevron and IDT, both subsidiaries of Danaher Corporation, to create a novel mRNA-based CRISPR treatment within six months, three times quicker than the usual timeline for gene editing drug development.

-

In November 2024, SyVento Biotech mentioned the launch of a new mRNA manufacturing facility in Poland, spanning more than 7,000 m². The facility includes laboratory and production areas, office spaces, and shared facilities. This development represents a key advancement in SyVento's growth and strengthens its position as a leader in the European mRNA manufacturing sector.

-

In January 2024, Oxford Nanopore Technologies plc and Lonza company announced a collaboration for cGMP validation and to commercialize a novel test in order to determine quality attributes of mRNA products by sequencing both the DNA template & mRNA.

mRNA Therapeutics Contract Development & Manufacturing Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.75 billion

Revenue forecast in 2033

USD 14.75 billion

Growth Rate

CAGR of 15.22% from 2025 to 2033

Historical Year

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Danaher (Aldevron), Biomay AG; Bio-Synthesis, Inc.; eTheRNA; Kaneka Eurogentec S.A.; TriLink BioTechnologies; ApexBio Technology; BioNTech SE; Biocina; Lonza; Recipharm AB; Novo Holdings (Catalent, Inc.); Samsung Biologics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mRNA Therapeutics Contract Development & Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mRNA therapeutics contract development & manufacturing organization market report based on indication, application, end use, and region.

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Diseases

-

Metabolic & Genetic Diseases

-

Cardiovascular & Cerebrovascular Diseases

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Viral Vaccines

-

Protein Replacement Therapies

-

Cancer Immunotherapies

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotech Companies

-

Pharmaceutical companies

-

Government & Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mRNA therapeutics contract development & manufacturing market size was estimated at USD 4.40 billion in 2024 and is expected to reach USD 4.75 billion in 2025.

b. The global mRNA Therapeutics CDMO market is expected to grow at a compound annual growth rate (CAGR) of 15.22% from 2025 to 2033 to reach USD 14.75 billion by 2033.

b. The biotech companies dominated the market in 2024 with a market share of 62.34%. This segment is driven by an increasing trend of outsourcing end-to-end services, especially among small and midsized biotechnology companies that lack expertise in mRNA development. Furthermore, the research & development (R&D) budget allocated to mRNA development has increased considerably, boosting segment growth over the forecast period.

b. Some key players operating in the mRNA therapeutics contract development & manufacturing market includeDanaher (Aldevron), Biomay AG, Bio-Synthesis, Inc., eTheRNA, Kaneka Eurogentec S.A., TriLink BioTechnologies, ApexBio Technology, BioNTech SE, Biocina, Lonza, Recipharm AB, Novo Holdings (Catalent, Inc.), and Samsung Biologics among others.

b. Key factors driving the mRNA therapeutics contract development & manufacturing market growth are the rising mRNA vaccine development, increasing burden of infectious diseases & cancer cases, shifting clinical requirements, and digitalization that have revolutionized vaccine development & other therapeutic applications.In addition, mRNA therapeutics manufacturing is driven by growing investments & collaborations and an increasing number of global CDMOs, which further supports the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.