- Home

- »

- Agrochemicals & Fertilizers

- »

-

Mulch Film Market Size And Share, Industry Report, 2030GVR Report cover

![Mulch Film Market Size, Share & Trends Report]()

Mulch Film Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Conventional, Biodegradable), By Crop (Fruits & Vegetables, Grains & Oilseeds, Flowers & Plants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-489-2

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mulch Film Market Summary

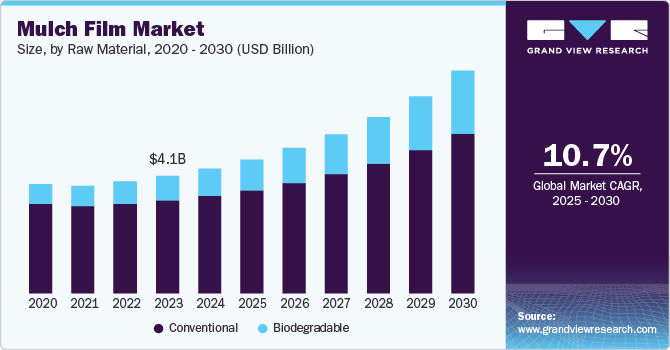

The global mulch film market size was estimated at USD 4,311.5 million in 2024 and is projected to reach USD 7,684.9 million by 2030, growing at a CAGR of 10.7% from 2025 to 2030. The mulch film industry is expected to experience substantial growth, as several farmers adopt these products to increase efficiency and output in food production.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Italy is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, conventional accounted for a revenue of USD 3,565.3 million in 2024.

- Biodegradable is the most lucrative raw material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,311.5 Million

- 2030 Projected Market Size: USD 7,684.9 Million

- CAGR (2025-2030): 10.7%

- Asia Pacific: Largest market in 2024

The market for mulch films is propelled by the growing need for improved crop yields, efficient water use, and effective weed management in agriculture. Advantages such as maintaining soil moisture, regulating temperature, and minimizing pesticide application improve the quality of crops and boost growth efficiency owing to the increasing sustainable farming practices and global food security issues.

Drivers, Opportunities & Restraints

Mulch films are used to cover soil, helping to retain moisture, control weeds, and regulate soil temperature, all of which contribute to higher crop productivity. As a result, the global mulch film industry is expected to experience substantial growth as more farmers adopt these products to increase efficiency and output in food production. The market is further promoted by the increasing focus on circular economic principles in agriculture, which emphasizes the reduction, reuse, and recycling of materials.

The mulch film industry is seeing opportunities for biodegradable and environmentally friendly alternatives in response to increasing environmental awareness and regulatory demands regarding plastic waste. The expansion of organic farming and sustainable agricultural practices, combined with innovations in bioplastics and recyclable materials, creates significant potential for the global growth of mulch film applications.

However, high installation costs are restraining the growth of the global mulch films market, especially for small and medium-sized farmers. While mulch films offer several benefits, including improved crop yields, better moisture retention, and weed control, the initial investment required for purchasing and installing these films can be substantial. For many farmers, especially in developing regions, these upfront costs can be prohibitive, limiting the adoption of mulch films despite their long-term benefits. As a result, the high initial investment acts as a barrier to market growth.

Raw Material Insights

Based on raw material, the market has been segmented into conventional and biodegradable. The conventional segment accounted for the largest revenue share of 78.12% in 2024. Conventional mulch films are more affordable compared to newer, biodegradable alternatives, which is expected to drive their adoption. The growing demand for durable, long-lasting, and cost-effective multi-cultural films is a key driver in the conventional mulch films segment.

The biodegradable segment is expected to grow at the fastest CAGR over the forecast period. The biodegradable mulch films market is rapidly expanding as sustainability becomes a key focus in agriculture. Unlike traditional plastic mulch films, which are made from non-renewable resources and often contribute to long-term environmental pollution, biodegradable mulch films are designed to break down naturally in the soil after use.

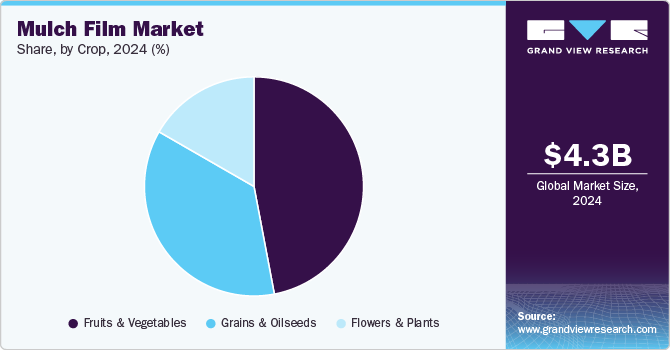

Crop Insights

Based on crop type, the mulch film industry has been segmented into Fruits & Vegetables, Grains & Oilseeds, and Flowers & Plants. The Fruits & Vegetables segment accounted for the largest revenue share of 47.02% in 2024. Mulch films play a crucial role in enhancing the growth conditions for fruits and vegetables by regulating soil temperature, maintaining moisture levels, and reducing weed growth. These benefits allow farmers to produce healthier crops with fewer chemical interventions, aligning with consumer preferences for natural and safe food products.

Moreover, Grains & Oilseeds crop type in the mulch film market plays a vital role in the rising consumption demand for mulch film. Mulch films are used in grain and oilseed cultivation to create optimal growing conditions. They help with soil moisture retention, weed suppression, and temperature regulation, which can significantly enhance crop growth and productivity.

Regional Insights

The North America Mulch Film is experiencing steady growth, driven by the well-developed financial infrastructure, coupled with government support and private sector funding, which provides agricultural businesses with the necessary resources to adopt advanced farming technologies, including mulch film.

U.S. Mulch Film Market Trends

The U.S. is a significant country in this market driven by the increasing adoption of smart farming practices. U.S. farmers are leveraging technology to enhance productivity and efficiency in crop cultivation. Advanced technologies such as precision agriculture, automated irrigation systems, and climate-smart farming tools have made it easier to monitor soil health, optimize water usage, and control weed growth.

Asia Pacific Mulch Film Market Trends

Asia Pacific dominated the global mulch film market and accounted for the largest revenue share of 46.14% in 2024. The Asia Pacific region’s rapidly growing population is one of the primary drivers behind the rising demand for mulch films in agriculture. As the population expands, there is an increasing need for higher food production to meet the demand for sustenance.

The China mulch film market is expected to grow rapidly in the coming years. With the government prioritizing food security and rural development, mulch films have become an essential tool for farmers to increase efficiency and meet the rising food demand caused by China's growing population.

Europe Mulch Film Market Trends

The Europe mulch film market is witnessing steady growth, driven by the region's demographic changes and urbanization. The push for higher productivity and efficiency in agriculture has increased the adoption of mulch films, which helps improve soil quality, conserve water, and enhance crop yields.

Key Mulch Film Company Insights

The mulch film industry is highly competitive, with several key players dominating the landscape. Major companies include BASF SE, Kingfa Sci & Tech Co Ltd, BioBag International AS, Yibiyuan Water-Saving Equipment Technology Co., Ltd., RKW SE, and Polystar Plastics Ltd, among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Mulch Film Companies:

The following are the leading companies in the mulch film market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Kingfa Sci & Tech Co Ltd

- BioBag International AS

- Yibiyuan Water-Saving Equipment Technology Co., Ltd.

- RKW SE

- Polystar Plastics Ltd

- Armando Alvarez

- Al-Pack Enterprises Ltd.

- Novamont S.p.A.

- AB Rani Plast OY

- Berry Global Inc.

- Napco National

- Tilak Polypack

- Intergro, Inc.

- Shalimar Group

- Solplast (Armando Alvarez Group)

- GEROVIT

Recent Developments

-

In June 2024, NUREL SA achieved the TÜV OK biodegradable SOIL certification for its biopolymers used in agricultural mulching. This certification ensures that its products will completely biodegrade in soil without harming the environment. Additionally, NUREL holds the DIN CERTCO certification in line with the EN 17033 standard, which outlines the requirements for biodegradable mulch films.

-

In October 2023, BioBag International AS introduced a new biodegradable mulch film, BioAgri, designed for agricultural purposes. This innovation addresses the significant disposal issues associated with traditional plastic mulch films, which are widely used in Australian farming, around 200,000 kilometers annually. The BioAgri film is made from a bioplastic material called MATER-BI and is fully biodegradable when tilled into the soil at the end of the growing season. This eliminates the need for costly removal processes and helps maintain soil quality. The Australasian Bioplastics Association has also verified that BioAgri meets ISO 23517:2021 standards.

-

In October 2023, Mondi plc, a prominent packaging and paper company, announced a collaboration with Cotesi S.A., a producer of agricultural materials, to launch a new sustainable product called Advantage Kraft Mulch. This innovative mulch film was designed to replace traditional plastic mulch films used in farming, which contribute significantly to plastic waste. Advantage Kraft Mulch is made entirely from 100% kraft paper sourced responsibly from wood and is certified as industrially compostable. It provides similar protective benefits to plastic mulch, such as shielding crops from weeds, soil erosion, and harsh weather conditions. Field trials have also shown that it effectively inhibits weed growth and decomposes naturally after harvest, adding organic matter back into the soil without leaving any waste behind.

Mulch Film Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.62 billion

Revenue forecast in 2030

USD 7.68 billion

Growth rate

CAGR of 10.7% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Raw material, crop, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

BASF SE; Kingfa Sci & Tech Co Ltd; BioBag International AS; Yibiyuan Water-Saving Equipment Technology Co., Ltd.; RKW SE; Polystar Plastics Ltd; Armando Alvarez; Al-Pack Enterprises Ltd.; Novamont S.p.A.; AB Rani Plast OY; Berry Global Inc.; Napco National; Tilak Polypack; Intergro, Inc.; Shalimar Group; Solplast (Armando Alvarez Group); GEROVIT

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Lead Acid Battery Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global mulch film market report on the basis of raw material, crop and region:

-

Raw Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Conventional

-

LDPE and LLDPE

-

HPDE

-

EVA

-

-

Biodegradable

-

Thermoplastic Starch (TPS)

-

Starch Blended with Polylactic Acid (PLA)

-

Starch Blended with Polyhydroxyalkanoate (PHA)

-

Others

-

-

-

Crop Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Fruits & Vegetables

-

Grains & Oilseeds

-

Flowers & Plants

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mulch film market size was estimated at USD 4.31 billion in 2024 and is expected to reach USD 4.62 billion in 2025.

b. The global mulch film market is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2030, reaching USD 7.68 billion by 2030.

b. Conventional packaging was the dominant raw material segment in the mulch film market in 2024, accounting for a revenue share of over 78.12%.

b. Some key players operating in the mulch film market include BASF SE; Kingfa Sci & Tech Co Ltd; BioBag International AS; Yibiyuan Water-Saving Equipment Technology Co., Ltd.; RKW SE; and Polystar Plastics Ltd, among others

b. The mulch films market is expected to experience substantial growth, as several farmers adopt these products to increase efficiency and output in food production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.