- Home

- »

- Clinical Diagnostics

- »

-

Multi Cancer Early Detection Market Size, Share Report 2030GVR Report cover

![Multi Cancer Early Detection Market Size, Share & Trends Report]()

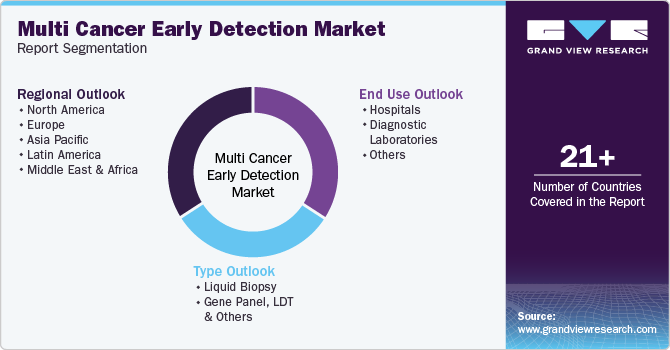

Multi Cancer Early Detection Market Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Gene Panel, LDT & Others), By End-use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-966-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Multi Cancer Early Detection Market Trends

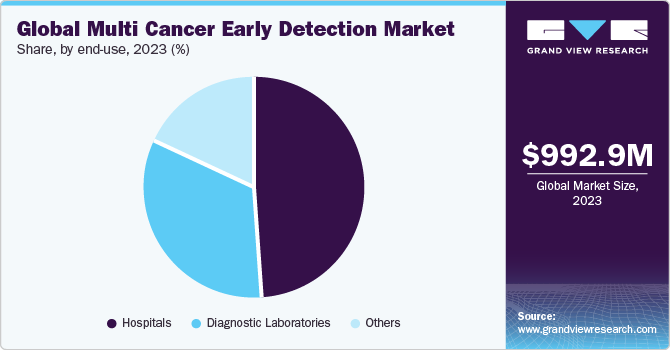

The global multi cancer early detection market size was estimated at USD 992.99 million in 2023 and is projected to grow at a CAGR of 16.61% from 2024 to 2030. A rise in the prevalence of multiple cancers and an increase in the need to provide efficient methods to detect them at early stages to enable timely and appropriate treatment are anticipated to drive the multi cancer early detection (MCED) market growth.For instance, according to the International Agency for Research on Cancer (IARC), over 20.7 million new cases were expected in 2023. Moreover, when cancer is detected early, that is, when it is localized before it has spread to other areas of the body, it can be treated most effectively & efficiently.

This propels the need for the development of effective diagnostics, which is further fueling market growth. Emerging biological & informational technologies, such as nanotechnology, big data analytics, Artificial Intelligence/Machine Learning (AI/ML), and genome sequencing, are enabling major advancements in diagnosis & therapy. The goal of MCED screening is to significantly increase the number of cancers for which screening methods are available and to enlarge the pool of people who are asymptomatic & can be diagnosed with the disease. When considering its effect on survival rates for certain cancer types, the significance of early detection is made even more apparent.

In comparison to women who are diagnosed with the most advanced stages of the illness, which account for around 15% of cases, over 90% of women with breast cancer at its earliest stages survive for a minimum of five years. In contrast to those who are identified with the most advanced stages of the disease, who have a 15% chance of surviving for at least a year, more than 80% of lung cancer patients will do so if they receive treatment at the earliest possible stage. Furthermore, awareness among people about early diagnosis & available treatment options and advancements in treatments have substantially improved patient outcomes.

According to the OECD in 2020, about 2.7 million people in the EU were expected to be diagnosed with some form of malignancy. Ireland, Belgium, Denmark, and the Netherlands are expected to show a higher incidence. Cancer is the second leading cause of mortality in Europe, after cardiovascular diseases. An estimated 1.3 million people died of cancer in 2020. Moreover, early detection is crucial for lowering mortality, especially through efficient screening programs. Overall, early detection increases patient survival rates by 5 to 10 times more than late cancer detection. The 5-year-specific survival rate is only 21% when cancer is discovered after it has spread, as opposed to 89% when it is found early & still localized.

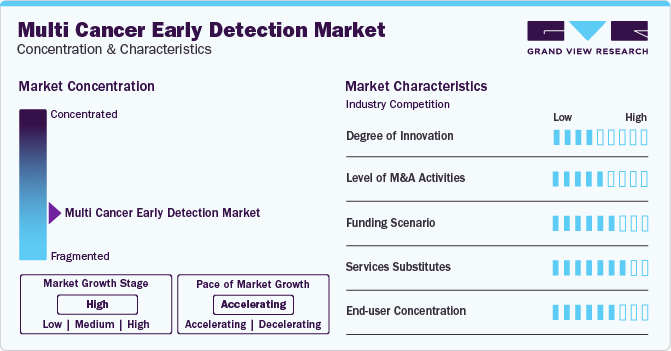

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as advancements in nanotechnology, big data analytics, AI/ML, and genome sequencing. The market is growing at a fast pace in Asian nations, and governments support these tests to enhance screening rates. Multiple collaborators are being witnessed in the Asian markets with AI platforms as well as screening tests

The MCED market is also characterized by a high level of partnership and collaboration activities by leading players. It is one of the most adopted strategies by companies to enhance early commercialization of their products and improve product availability

Increasing funding by various research organizations to develop early-stage cancer screening techniques is fueling market growth. Public & private organizations are constantly focusing on investments, propelling the need for developing newer technologies to meet the rising demand for cancer diagnosis. An exponential rise in prevalence globally creates a significant demand for rapid diagnostic tests. According to the WHO, cancer is a leading cause of death worldwide and resulted in around 10 million deaths in 2020 or one in every six deaths globally

Conventional diagnostic techniques are the key alternatives to multicancer diagnosis, and as MCED tests are relatively new in the market, customers prefer conventional tests over them. However, with the growing adoption of new technologies, the acceptance of MCED tests is expected to increase

End-user concentration is a significant factor in the MCED market. Hospitals are preferred for care due to the availability of various services under one roof. The biggest benefit of hospitals conducting multicancer diagnosis is that they can offer results for tests even in emergencies. Since MCEDs are being increasingly adopted, their acceptance has increased in hospitals

Type Insights

The gene panel, LDT, & others segment led the market and accounted for a share of 97.08% in 2023. The growth of the segment is attributed to the non-requirement of FDA approval for the utilization of LDT in diagnostic laboratories. For instance, in May 2022, Guardant Health launched Shield, an LDT blood test, for the detection of early signs of colorectal cancer in the adult population aged above 45 years. Comparing panel-based tests to BRCA1/2 genetic testing can help determine the inherited risk of breast and ovarian cancers. The clinical value and yield of panel-based testing are higher for hereditary risk of other malignancies, such as pheochromocytoma-paraganglioma and colon cancer. However, the landscape of genetic testing for detection of risk of cancer has changed because of next-generation or massively parallel sequencing, which makes it important to understand the clinical validity and utility of these tests.

The liquid biopsy segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment is attributed to the increasing number of players receiving funding from investors for the development of new tests. Liquid biopsy is an advanced testing technology for the detection of tumor-related genetic alterations. It has also been used to stratify tumors to enable appropriate treatment through precision oncology. For instance, in January 2023, Guardant Health received FDA approval for Guardant360 CDx, its liquid biopsy assay, as a companion diagnostic for the diagnosis of ESR1 mutant breast cancer. These recent advancements, innovations, and expansions in the industry promote the use of liquid biopsy, driving market growth.

End-use Insights

The hospitals end-use segment led the market with a share of 48.44% in 2023. This is attributed to the growing preference of hospitals for care due to the availability of various services under one roof. The biggest benefit of hospitals conducting multicancer diagnosis is that they can offer results for tests even in emergencies.Developments in hospital laboratories are crucial to address the evolving needs of patients, and more hospitals are aiming to provide a wide range of services within their settings. For instance, in July 2022, Mercy Hospital system formed a collaboration with GRAIL, LLC. for the launch of Grail’s Galleri MCED test, which enables the detection of more than 50 different types of cancers at an early stage with the motive of increasing cancer detection and improving public health.

The diagnostic laboratories segment is projected to witness a significant growth rate over the forecast period. The segment growth is attributed to the increased awareness of personalized medicine, technological advancements, and rise in demand for affordable services. Another major factor expected to drive the segment growth is the increase in government initiatives to provide various facilities, such as compensation for diagnostic tests.Moreover, many healthcare institutions are working with laboratories to incorporate different clinical tests. For instance, in June 2023,-Baylor-Scott-& White-Research Institute in collaboration with Exact Sciences Corporation announced the launch of the MCED program to intercept more cancers in Texas.

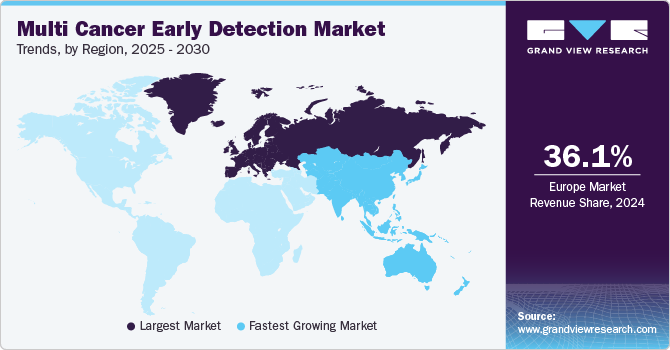

Regional Insights

The North America multi cancer early detection market accounted for a share of 34.39% in 2023 owing to high cancer prevalence, rapid technological advancements, and the presence of various supportive government initiatives in the region. It is led by the U.S. owing to major investments and the local presence of several biotechnology companies developing novel MCED tests. Various organizations, such as the American Society of Clinical Oncology (ASCO), support the implementation of early detection products, which is likely to boost revenue in this market.Key players in the market are continuously focusing on developing novel products that offer high efficacy and effectiveness for the detection of multiple cancers. For instance, in November 2023, GRAIL, LLC announced the initiation of the REACH (Real-world Evidence to Advance Multi-Cancer Early Detection Health Equity) study to evaluate the clinical impact of the Galleri, MCED test on the Medicare population.

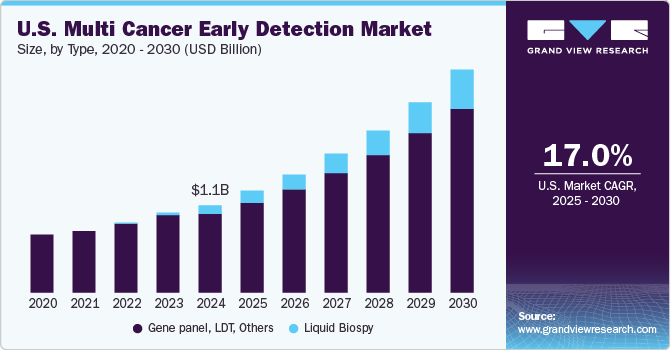

U.S. Multi Cancer Early Detection Market Trends

The multi cancer early detection market in the U.S. is expected to grow over the forecast period. Owing to high cancer prevalence in the country, there is rapid adoption of cancer diagnostic tests.

Europe Multi Cancer Early Detection Market Trends

The Europe multi cancer early detection market was identified as a lucrative regional marketdue to the presence of developed economies, such as Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to significantly boost clinical research prospects in the region.

The multi cancer early detection market in the UK is expected to grow over the forecast period due to the presence of sophisticated healthcare infrastructure, collaborations between key market players, and continuous novel product launches.

The France multi cancer early detection market is expected to grow over the forecast periodowing to high cancer prevalence and an increasing burden of chronic diseases on the healthcare industry.

The multi cancer early detection market in Germany is expected to grow over the forecast period due to intense competition between various biotechnology companies.

Asia Pacific Multi Cancer Early Detection Market Trends

Asia Pacific multi cancer early detection market is anticipated to witness the fastest CAGR over the forecast period due to a significantly improving healthcare infrastructure, a growing population, and a rising number of local companies entering the market. Asia Pacific has a large population and a high prevalence of cancer. According to Global Cancer Statistics 2020, nearly half of the global cases and around 58.3% of cancer deaths were estimated to occur in Asia.Moreover, cancer has drawn more attention as a result of demographic shifts brought on by urbanization, aging populations, and economic expansion.However, low affordability, poor infrastructure, and lack of trained professionals are expected to hinder market growth.

The multi cancer early detection market in China is expected to grow over the forecast period. The government has undertaken various initiatives, such as free cervical cancer screening campaigns for women of all ages and collaborations with nonprofit organizations to improve accessibility of tests.

The Japan multi cancer early detection market is expected to grow over the forecast period owing to high government spending to curb cancer prevalence. Increase in cancer prevalence can be attributed to rapid growth in the geriatric population.

Latin America Multi Cancer Early Detection Market Trends

The multi cancer early detection market in Latin America was identified as a lucrative region in this industryowing to the increased prevalence of various types of cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries.

The Brazil multi cancer early detection market is expected to grow over the forecast period. Cancer incidence in the country is high, which has led to increased usage of various novel cancer screening tools such as liquid biopsy and gene panel testing.

MEA Multi Cancer Early Detection Market Trends

The MEA multi cancer early detection market holds major growth opportunities, as the majority of the market is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African economies.

The multi cancer early detection market in Saudi Arabia is expected to grow over the forecast. The growth of this market can primarily be attributed to the increasing involvement of the government and rising awareness about the benefits of noninvasive diagnostic procedures.

Key Multi Cancer Early Detection Company Insights

Some of the key players operating in the MCED market include Illumina, Inc., Exact Sciences Corporation, FOUNDATION MEDICINE, INC., and Guardant Health.These players are adopting various expansion strategies to increase product outreach and enhance the availability of their products in diverse geographical areas.

ADELA, Inc., ClearNote Health, and SeekIn are some of the emerging market participants in the multi cancer early detection (MCED) market. Emerging companies focus on receiving funding or grants from governments and investors to focus on R&D and develop novel technology to enter the market.

Key Multi Cancer Early Detection Companies:

The following are the leading companies in the multi cancer early detection market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc. (GRAIL, LLC)

- Exact Sciences Corp.

- Foundation Medicine, Inc.

- AnchorDx

- Guardant Health

- Burning Rock Biotech Ltd.

- GENECAST

- Beijing Lyman Juntai International Medical Technology Development Co.

- Freenome Holdings, Inc.

- Elypta AB

Recent Developments

-

In September 2023, Point32Health and GRAIL, LLC announced the expansion of their pilot to offer Galleri, an MCED test developed by GRAIL

-

In May 2023, Lucence Health Inc. announced the launch of LucenceINSIGHT, an MCED blood test in the U.S.

-

In January 2023, Geneseeq Technology, Inc. received CE marking for its MCED tests for use in solid tumor patients

Multi Cancer Early Detection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.15 billion

Revenue forecast in 2030

USD 2.89 billion

Growth rate

CAGR of 16.61% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Illumina, Inc. (GRAIL, LLC); Exact Sciences Corp.; Foundation Medicine, Inc.; AnchorDx; Guardant Health; Burning Rock Biotech Ltd.; GENECAST; Beijing Lyman Juntai International Medical Technology Development Co.; Freenome Holdings, Inc.; Elypta AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi Cancer Early Detection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global multi cancer early detection market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Biopsy

-

Gene Panel, LDT & Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global multi cancer early detection market size was estimated at USD 992.99 million in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The global multi cancer early detection market is expected to grow at a compound annual growth rate of 16.61% from 2024 to 2030 to reach USD 2.89 billion by 2030.

b. North America multi cancer early detection market accounted for 34.39% share of the global market in 2023. This high share is owing to high cancer prevalence, rapid technological advancements, and growing number of supportive government initiatives.

b. Key players operating in the multi cancer early detection market are Grail, LLC, Illumina, Inc., Exact Sciences Corporation., Foundation Medicine, Inc., AnchorDx, Guardant Health, Inc., Burning Rock Biotech Limited, GENECAST, Laboratory for Advanced Medicine, Inc., Singlera Genomics Inc.

b. Key drivers driving the multi cancer early detection market are increasing prevalence of cancer, extensive R&D for the development of MCED and need to develop diagnostic options that can detect cancer at an early stage.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."