- Home

- »

- Plastics, Polymers & Resins

- »

-

Multi-med Adherence Packaging Market Size Report, 2030GVR Report cover

![Multi-med Adherence Packaging Market Size, Share & Trends Report]()

Multi-med Adherence Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Aluminum), By Packaging Type (Pouches, Blister Packs, Strips), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-427-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

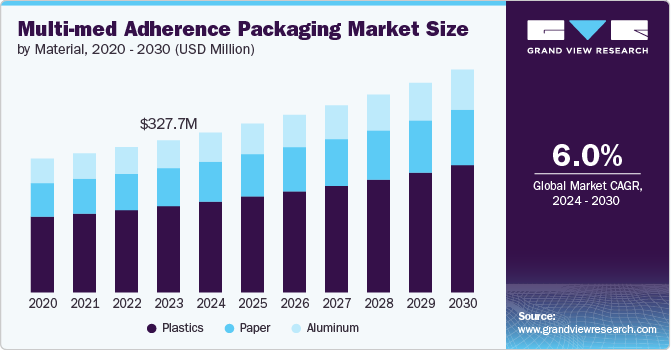

The global multi-med adherence packaging market size was valued at USD 327.73 million in 2023 and is expected to expand at a CAGR of 6.0% from 2024 to 2030. The global industry is experiencing significant growth due to the rising demand for effective medication management solutions, particularly among the aging population and those with chronic conditions. The increased awareness about the importance of medication adherence to prevent hospital readmissions and improve patient outcomes is a major driver.

Technological advancements in packaging materials and design, such as intelligent blister packs and pouches with integrated tracking systems, are also contributing to market expansion. Additionally, the growing focus on sustainability and environmental concerns is pushing manufacturers to innovate with eco-friendly materials, creating new opportunities for growth. For instance, in recent years, there have been product launches featuring recyclable plastics and paper-based materials that cater to both consumer demands for convenience and environmental responsibility.

Market Concentration & Characteristics

Major multi-med adherence packaging manufacturing companies operating in the market include Medicine-On-Time, LLC, Parata Systems, LLC, Omnicell, Inc., AARDEX Group, Jones Healthcare Group, Cardinal Health, MCKESSON CORPORATION, and Baxter. The multi-med adherence packaging market is largely fragmented. While there are a few dominant players, the market is characterized by a multitude of smaller, specialized companies offering a variety of products and services.

Regulations play a significant role in the multi-med adherence packaging market. Regulatory bodies worldwide impose stringent guidelines to ensure patient safety, product quality, and adherence to prescribed medication regimens.

Material Insights

Based on material, the industry is segmented into paper, plastics, and aluminum. Among these, plastics emerged dominant in 2023 with a revenue share of over 56.0% and are expected to exhibit the fastest CAGR from 2024 to 2030. Their versatility, durability, and cost-effectiveness make them the material of choice for multi-med adherence packaging, particularly for blister packs and pouches. Recent advancements in biodegradable and recyclable plastics are further driving their adoption.

The paper segment is gaining traction due to its eco-friendly nature, especially in regions with stringent environmental regulations. Aluminum is used in specialized applications where moisture and light barriers are critical, though its market share is comparatively smaller.

Packaging Type Insights

Based on packaging type, market is segmented into strips, blister packs, and pouches. Among these, blister packs emerged as the dominant packaging type segment in 2023. It is also expected to demonstrate the fastest CAGR over the forecast period. The structured design of blister packs makes it easy for patients to track their medication usage, enhancing adherence. Additionally, blister packs provide a safeguard against tampering, ensuring the medication's integrity and patient safety.

Pouches are expected to grow with a significant CAGR over the forecast period. Pouches offer a user-friendly approach to medication management, featuring clear labeling and easy-to-open packaging. Additionally, their production can be more economical than other packaging options, making them a practical choice for pharmaceutical companies aiming to reduce costs without compromising quality or patient convenience.

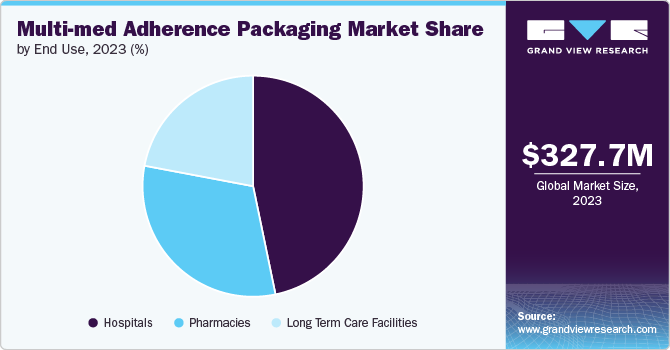

End Use Insights

Based on end-use, the market is segmented into hospitals, pharmacies, and long-term care facilities. Among these, hospitals emerged as the dominant segment in 2023 and accounted for a share of over 46.0%. Hospitals, serving a diverse patient population, frequently face the challenge of managing complex medication regimens. Effective medication management systems are crucial to ensure all patients receive their medications accurately.

Pharmacies also represent a significant segment, as they increasingly adopt adherence packaging solutions to support patient care and compliance. Long-term care facilities are another key end-use segment, with adherence packaging helping to manage the complex medication regimens often required in these settings.

Regional Insights

North America multi-med adherence packaging market dominated the global industry in 2023 and accounted for a revenue share of over 33.0%. This is driven by advanced healthcare infrastructure and high awareness of medication adherence. The region's dominance in global pharmaceutical manufacturing further solidifies its leading position in the market.

U.S. Multi-med Adherence Packaging Market Trends

The multi-med adherence packaging market of the U.S. is the largest market in the North American region, benefiting from strong healthcare policies and the presence of major industry players. Canada follows, with a growing focus on sustainable packaging solutions. Mexico is expected to exhibit the fastest-growing CAGR in North America due to increasing healthcare investments and rising awareness about medication adherence

Asia Pacific Multi-med Adherence Packaging Market Trends

The multi-med adherence packaging market in Asia Pacific is expected to grow with the fastest CAGR. The rapid growth of multi-med adherence packaging industry in this region is attributed to the expanding elderly population, rising disposable incomes, and increasing awareness about the importance of medication adherence.

China multi-med adherence packaging market is expanding at a high rate, driven by population growth and a well-developed manufacturing base for both pharmaceuticals and packaging materials. This leads to a convenient supply chain and potentially lower production costs compared to other countries in the region.

Europe Multi-Med Adherence Packaging Market Trends

The multi-med adherence packaging market in Europe is growing due to the aging population, and the associated need for complex medication regimens is increasing the demand for multi-med adherence packaging solutions. By providing visual reminders and simplifying medication routines, these products can help mitigate the significant financial burden of medication non-adherence

The multi-med adherence packaging market in Germany leads the European multi-med adherence packaging industry, supported by a robust healthcare system and stringent regulations that promote the use of adherence packaging.

Key Multi-med Adherence Packaging Company Insights

The multi-med adherence packaging market is characterized by intense competition among leading pharmaceutical packaging firms, healthcare technology companies, and numerous smaller players. As key players seek to expand their product offerings and geographic reach, consolidation through mergers and acquisitions is on the rise. Additionally, the entry of new players with innovative product launches is further intensifying the competitive landscape.

-

In March 2023, Berry Global Inc., introduced the Digi-Cap, a digital child-resistant closure designed for clinical trials, drug development, research, and academic studies. By tracking patient usage data, the Digi-Cap can help improve medicine adherence and provide insights into medication effectiveness. Embedded with a microprocessor, the closure records patient openings and stores usage history. Additionally, it continuously monitors and logs temperature storage levels, offering valuable data for research and development.

-

In February 2024, Jones Healthcare Group launched FlexRx Gen 2 and FlexRx Reseal, two medication adherence solutions designed to boost pharmacy efficiency. FlexRx Gen 2 features an enhanced design for easier medication handling, while FlexRx Reseal enables pharmacies to reseal medications. Both products are intended to streamline pharmacy workflows and better serve patients.

Key Multi-med Adherence Packaging Companies:

The following are the leading companies in the multi-med adherence packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Omnicell, Inc.

- Manrex Ltd.

- Parata Systems, LLC

- AARDEX Group

- Aptar CSP Technologies, Inc.

- Jones Healthcare Group

- MCKESSON CORPORATION

- Euclid Medical Products

- Baxter

- Medicine-On-Time, LLC

- BD

- Euclid Medical Products

- AmerisourceBergen Corporation

- Synergy Medical

- Cardinal Health

Multi-Med Adherence Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 344.54 million

Revenue forecast in 2030

USD 490.04 million

Growth rate

CAGR of 6.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, packaging type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Medicine-On-Time, LLC; Parata Systems, LLC; Omnicell, Inc.; AARDEX Group; Jones Healthcare Group; Cardinal Health; MCKESSON CORPORATION; Baxter; BD; Euclid Medical Products; Aptar CSP Technologies, Inc.; AmerisourceBergen Corporation; Synergy Medical; Manrex Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-Med Adherence Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi-med adherence packaging market report on the basis of material, packaging type, end use, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Aluminum

-

-

Packaging Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Blister Packs

-

Strips

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Pharmacies

-

Long-term Care Facilities

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi-med adherence packaging market size was estimated at USD 327.73 million in 2023 and is expected to reach USD 344.54 million in 2024.

b. The global multi-med adherence packaging market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030, reaching USD 490.04 million by 2030.

b. Plastics accounted for the largest share of over 56.0% in multi-med adherence packaging market. Plastic materials offer a high degree of versatility, allowing manufacturers to create a wide range of packaging types, from blister packs to pouches, that can be tailored to meet specific medication adherence needs.

b. Key players in the market include Medicine-On-Time, LLC; Parata Systems, LLC; Omnicell, Inc.; AARDEX Group; Jones Healthcare Group; Cardinal Health; MCKESSON CORPORATION; Baxter; BD; Euclid Medical Products; Aptar CSP Technologies, Inc.; AmerisourceBergen Corporation; Synergy Medical; and Manrex Ltd.

b. The global increase in the aging population is one of the most significant drivers of the multi-med adherence packaging market. Also, there is a growing awareness among healthcare providers, caregivers, and patients about the benefits of multi-med adherence packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.