- Home

- »

- Pharmaceuticals

- »

-

Muscle Relaxant Drugs Market Size & Share Report, 2030GVR Report cover

![Muscle Relaxant Drugs Market Size, Share & Trends Report]()

Muscle Relaxant Drugs Market Size, Share & Trends Analysis Report By Drug Type (Skeletal Muscle Relaxant Drugs, Facial Muscle Relaxant Drugs), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-065-5

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Muscle Relaxant Drugs Market Size & Trends

The global muscle relaxant drugs market size was valued at USD 3.74 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.38% from 2023 to 2030. The term "muscle relaxant" is typically used to describe medications that relax the skeletal muscles by acting on the Central Nervous System (CNS). These medicines are frequently prescribed to reduce the discomfort and soreness associated with sprains, strains, or other kinds of muscular injuries. The global muscle relaxant drugs market is a highly competitive and fragmented market, with several key players vying for market share. The space is primarily driven by factors such as the growing prevalence of muscle pain and spasms and the increasing demand for effective treatment options, and rising strategic initiatives by key players.

The outbreak of the COVID-19 pandemic negatively affects the overall space due drop in adoption or muscle relaxant drugs. However, there is increase in the usage of some muscle relaxant drugs for pain management amid the pandemic. In addition, in July 2021,Hikma Pharmaceuticals PLC launched Succinylcholine Chloride Injection, USP 20mg/mL in the U.S. Succinylcholine Chloride Injection, USP is an important medicine used in the treatment of COVID-19 patients. In addition to general anesthesia, it is recommended for tracheal intubation assistance and skeletal muscle relaxation during mechanical ventilation or surgery.

According to a study of Global Burden of Disease (GBD) 2021 data, 1.71 billion individuals globally suffer from musculoskeletal diseases, such as osteoarthritis, rheumatoid arthritis, neck discomfort, low back pain, fractures, and other injuries. People of all ages are afflicted by musculoskeletal problems; however, the prevalence varies by age and diagnosis. With over 149 million years lived with disability (YLDs), or 17% of all YLDs worldwide, musculoskeletal diseases are the main cause of YLDs.

The need for muscle relaxants drugs is also being driven by the growing geriatric population, as this group is more vulnerable to illnesses including back pain, muscular tightness, and muscle spasms, especially those connected to injuries to the spine. As a result of this disease muscle relaxants are more in demand, which further drives market growth. For instance, 1 in 6 people worldwide will be 60 or older by 2030. The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. Between 2020 and 2050, the number of people 80 or older is projected to triple, reaching 426 million.

Additionally, strategic activities by key market players will offer lucrative opportunities over the forecast. For instance, in May 2023, the United States Food and Drug Administration (USFDA) granted final approval to Caplin Point Laboratories for its Abbreviated New Drug Route of Administration, Rocuronium Bromide Injection. A neuromuscular blocking medication called rocuronium bromide injection is recommended as a supplement to general anesthesia to speed up routine and rapid sequence tracheal intubation and to relax the skeletal muscles during procedures like surgery or mechanical breathing. In addition, in December 2021, Saol Therapeutics received U.S. FDA approval for Saol's LYVISPAH (baclofen) oral granules.

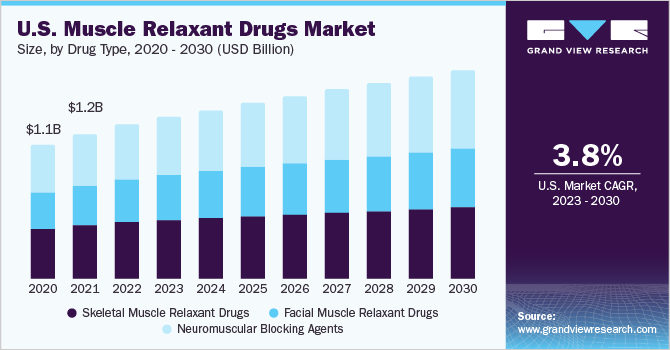

Drug Type Insights

The skeletal muscle relaxant drugs segment dominated the global industry in 2022 and captured the maximum share of more than 36.54% of the overall revenue.Skeletal muscle relaxants were once licensed for the short-term treatment of muscular spasms and back pain but are now used to treat chronic pain and other disorders without adequate research. Pain is the most frequent reason for people to seek medical attention. Low back discomfort is among the top five causes of office visits to a primary care physician.

Neuromuscular blocking agents are anticipated to expand at the fastest CAGR of 4.97% during the study period. Since neuromuscular blocking drugs can speed up speedy endotracheal intubation, ease surgical operations, and aid in mechanical ventilation by relaxing skeletal muscles, they are frequently used as muscle relaxants. In surgical operations, neuromuscular blocking drugs are frequently used. The rising number of operations propels the demand for neuromuscular blocking medications, causing this market segment to expand. For instance, more than 24,000 active orthopedic surgeons practice in the U.S. In 2021 alone, there were around 1.0 million knee and hip arthroplasties, according to Definitive Healthcare's PhysicianView, which records more than 2 million physicians. Since neuromuscular blocking medications are frequently given during anesthesia to enhance surgical conditions, the growing number of surgical procedures is increasing the adoption of neuromuscular blocking agents.

Rout of Administration Insights

The oral segment dominated the muscle relaxant drugs market with a share of 51.21% in 2022. The most popular method of medicine administration is oral. Due to its benefits, including non-invasiveness, patient compliance, and ease of medication delivery, it is the most favoured method. Additionally, the introduction of products with oral formulations helps the market grow. For instance, Azurity Pharmaceuticals received FDA clearance in February 2022 for Fleqsuvy (baclofen oral suspension), which is used to treat spasticity brought on by multiple sclerosis and when it is associated with spinal cord injuries or disorders.

The injectable segment is anticipated to be the fastest-growing segment of the muscle relaxant drugs market with a CAGR of 4.42% during the forecast period. Key players in the market are moving towards the development of novel products. For instance, in September 2020, the US USFDA granted Zydus Cadila permission to commercialize Cisatracurium Besylate Injection USP in the strength of 20 mg (base)/10 mL (2 mg/mL) multiple-dose vial. This muscle relaxant is administered before to general anesthesia. Additionally, Botox has been widely known for more than 25 years and is the brand of muscle-relaxing injection that is most frequently utilized. The best-known use of muscle-relaxing injections in anti-aging medicine is to lessen forehead and eyelid wrinkles and lines.

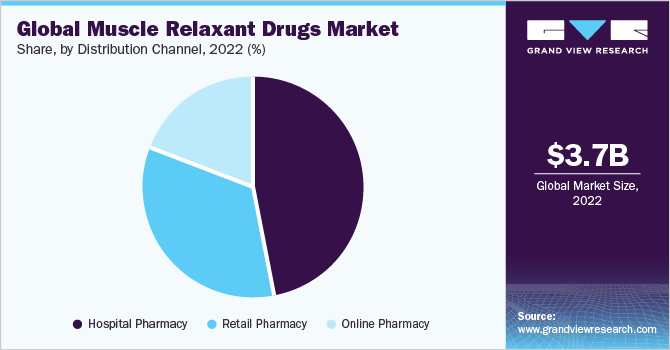

Distribution Channel Insights

The hospital pharmacy segment captured the highest revenue share of 46.76% in the muscle relaxant drugs market in 2022 and is expected to expand at a fastest CAGR over the forecast period. The major factors responsible for the dominance are growing awareness and increasing clinical & hospital visits. In addition, growing geriatric population is a key factor driving the segment growth. This is attributed to the fact that elderly individuals are often admitted to hospitals for different chronic diseases for which they receive medications.

Retail pharmacy is expected to be the second largest distribution channel in 2022. Additionally, online pharmacies are gaining prominence over the foreseeable future due to certain benefits associated with it such as convenience, comfort, and flexibility. These websites also offer wide range of options to compare and an in-depth drug information useful for the patients.

Regional Insights

North America dominated the overall muscle relaxant drugs market with a share of 37.56% in 2022. This major share can be attributed to the rise in investment by government, increasing incidence of chronic diseases, and the presence of high-quality infrastructure in North America region.

Asia Pacific is estimated to witness the fastest growth due to rising demand for therapeutics in the region. Furthermore, increasing R&D investment by governments and rapid infrastructural development are the other factors that are boosting regional growth. In addition, strategic activities by key market players of expand their presence in the region also drives the growth of the muscle relaxant drugs market in the study period. For instance, in November 2022, Eisai Co., Ltd. entered into an agreement to separate its rights for muscle relaxant drug Myonal in Asia to a subsidiary of DKSH Holding Ltd. The company believes that this agreement will fast-track the pursuit of the marketing in the Asia and Latin America Region. According to the terms of the deal, Eisai will continue to manufacture the products and distribute them in nations including Japan, China, and South Korea.

Key Companies & Market Share Insights

Major players in muscle relaxant drugs market are executing numerous strategies including novel product launches, partnerships, collaborations, mergers and acquisitions and geographical expansion to expand their market presence. For instance, in June 2022 Amneal Pharmaceuticals, Inc. launched a baclofen oral granules specialty product, LYVISPAH, approved by the U.S. FDA for treating spasticity associated to multiple sclerosis and other spinal cord disorders. Some of the prominent players in the global muscle relaxant drugs market include:

-

Amneal Pharmaceuticals LLC

-

Ipsen Biopharmaceuticals, Inc.

-

Merz Pharmaceuticals, LLC.

-

Par Pharmaceutical

-

Endo Pharmaceuticals

-

Vertical Pharmaceuticals

-

Mallinckrodt

-

SteriMax

-

Eisai Co., Ltd.

-

Metacel Pharmaceuticals, LLC.

-

Teva Pharmaceuticals USA, Inc.

Muscle Relaxant Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.94 billion

Revenue forecast in 2030

USD 5.28 billion

Growth rate

CAGR of 4.38% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Amneal Pharmaceuticals LLC, Ipsen Biopharmaceuticals, Inc., Merz Pharmaceuticals, LLC., Par Pharmaceutical, Endo Pharmaceuticals, Vertical Pharmaceuticals, Mallinckrodt, SteriMax, Eisai Co., Ltd, Metacel Pharmaceuticals, LLC. , Teva Pharmaceuticals USA, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

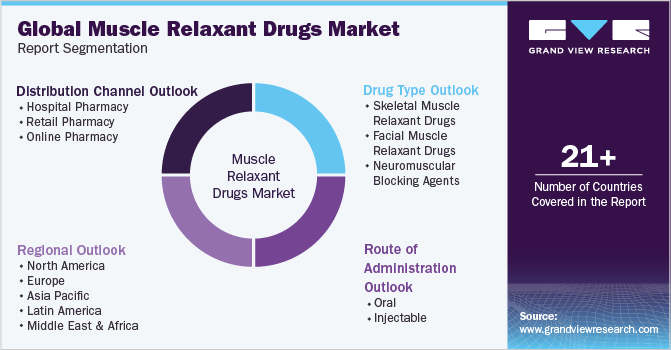

Global Muscle Relaxant Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global muscle relaxant drugs market report on the basis of drug type, route of administration, distribution channel, and region:

-

Drug type Outlook (Revenue, USD Million, 2018 - 2030)

-

Skeletal Muscle Relaxant Drugs

-

Facial Muscle Relaxant Drugs

-

Neuromuscular Blocking Agents

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global muscle relaxant drugs market size was estimated at USD 3.74 billion in 2022 and is expected to reach USD 3.94 billion in 2023.

b. The global muscle relaxant drugs market is expected to grow at a compound annual growth rate of 4.38% from 2022 to 2030 to reach USD 5.28 billion by 2030.

b. North America dominated the market for muscle relaxant drugs and accounted for the largest revenue share in 2022

b. Some of the key market players include Amneal Pharmaceuticals LLC, Ipsen Biopharmaceuticals, Inc., Merz Pharmaceuticals, LLC., Par Pharmaceutical, Endo Pharmaceuticals, Vertical Pharmaceuticals, Mallinckrodt, SteriMax, Eisai Co., Ltd, Metacel Pharmaceuticals, LLC., Teva Pharmaceuticals USA, Inc. and others.

b. The muscle relaxant drugs market is primarily driven by factors such as the growing prevalence of muscle pain & spasms, and rising strategic initiatives by key players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."