- Home

- »

- Homecare & Decor

- »

-

Music Tourism Market Size & Share, Industry Report, 2033GVR Report cover

![Music Tourism Market Size, Share & Trends Report]()

Music Tourism Market (2025 - 2033) Size, Share & Trends Analysis Report By Event (Concert, Festival, Others), By Age Group, By Expenditure, By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-557-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Music Tourism Market Summary

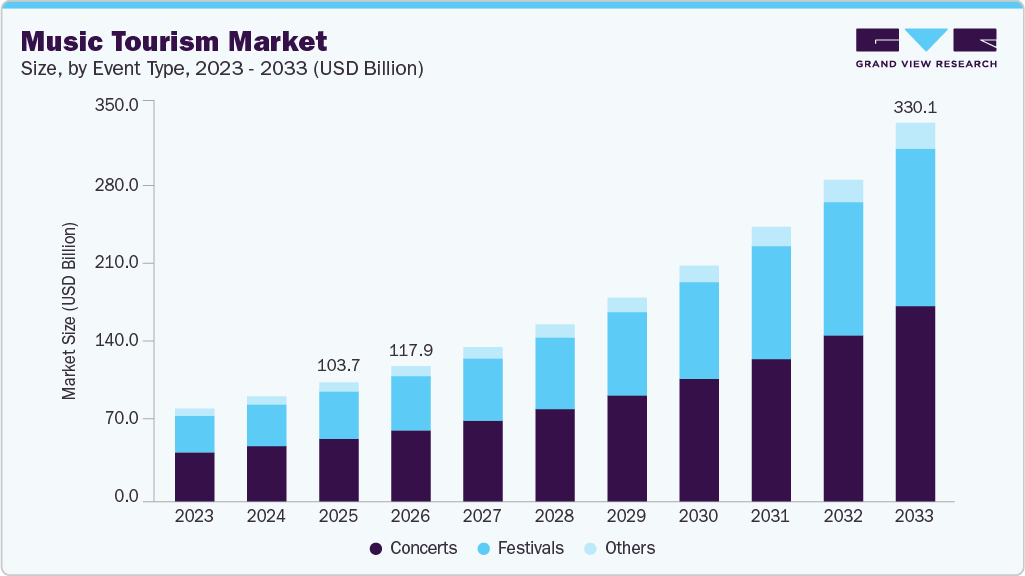

The global music tourism market size was estimated at USD 91.44 billion in 2024 and is projected to reach USD 330.12 billion by 2033, growing at a CAGR of 15.6% from 2025 to 2033. As travel becomes a central pillar of lifestyle spending rather than a discretionary break from routine, people are building journeys that reflect personal aspirations in the same way they now curate their homes or wellness habits.

Key Market Trends & Insights

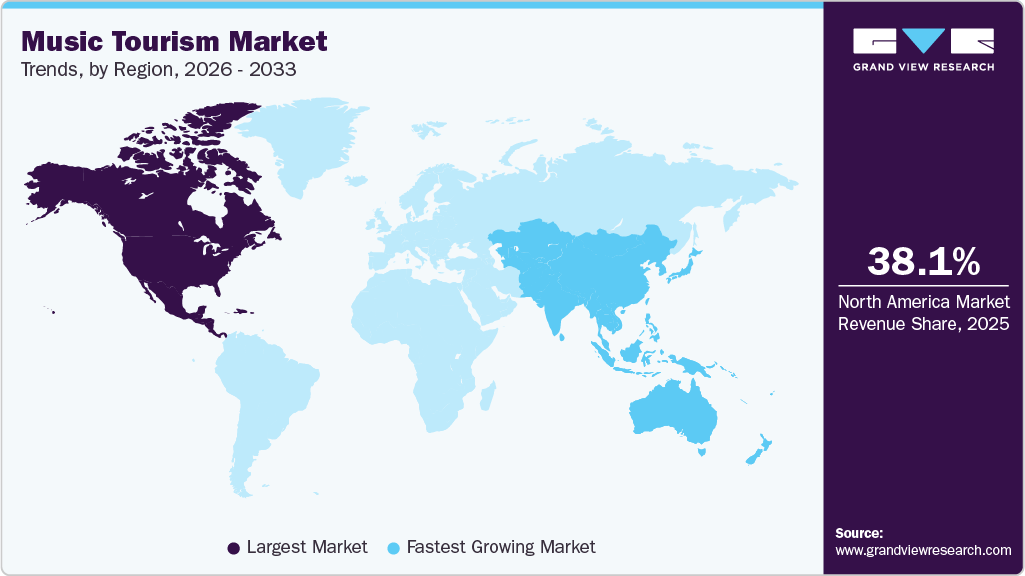

- North America led the market with a share of 38.5% in 2024.

- The music tourism industry in the U.S. dominated the North American region in 2024 with a revenue share of 81.37%.

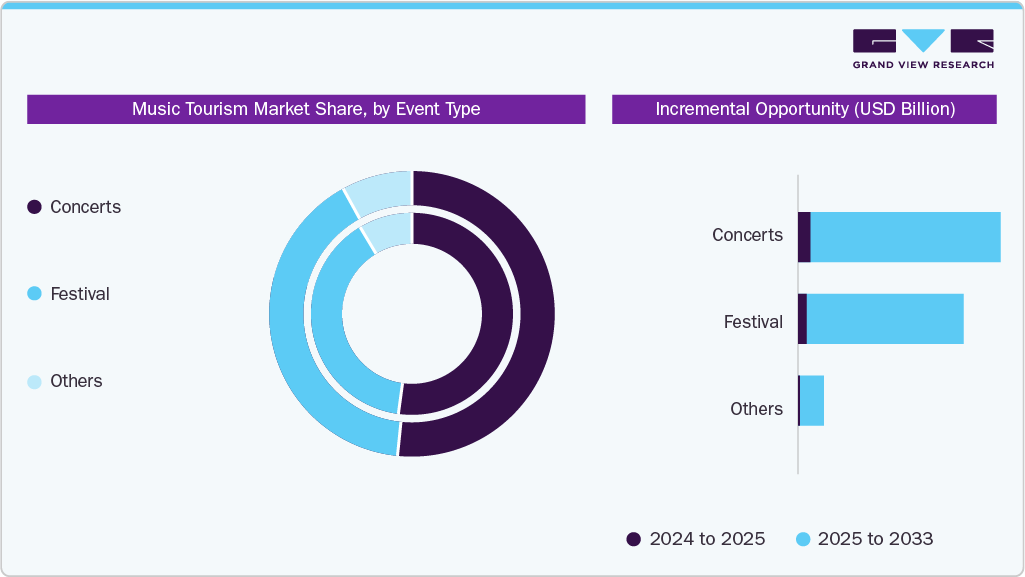

- By event, concerts led the market and accounted for a share of 52.7% in 2024.

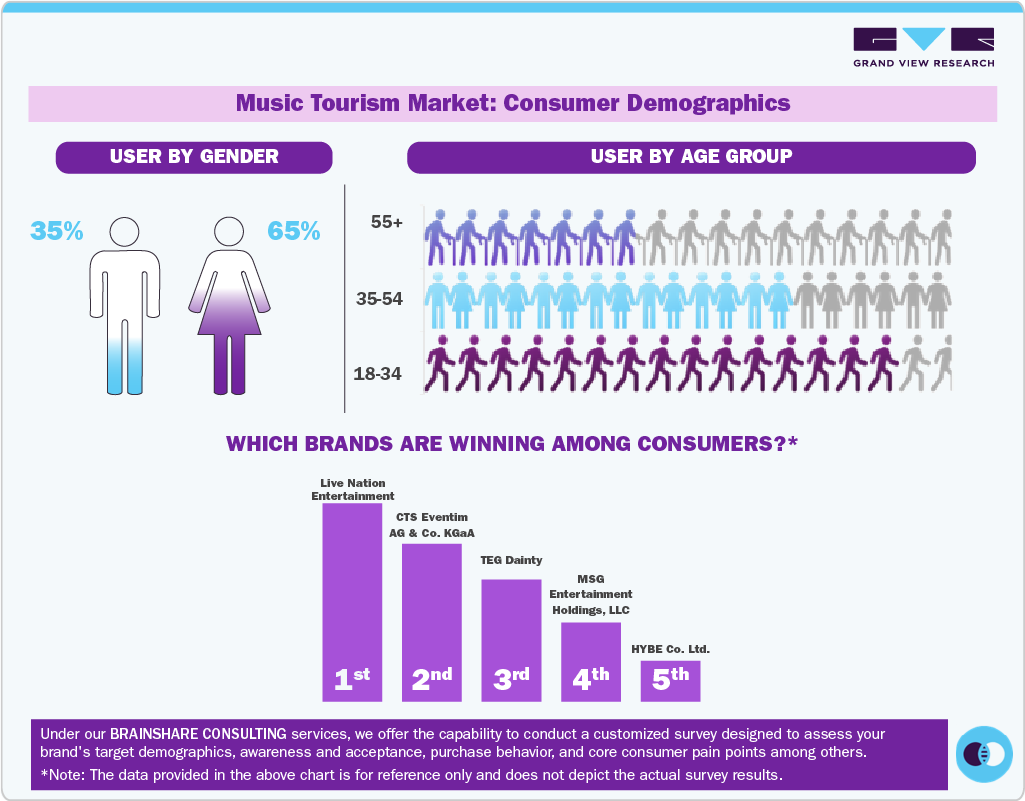

- By age group, the 18 to 34 years segment led the market and accounted for a share of 64.8% in 2024.

- By expenditure, travel-related expenditures led the market and accounted for a share of 59.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 91.44 Billion

- 2033 Projected Market Size: USD 330.12 Billion

- CAGR (2025-2033): 15.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The modern traveller is motivated by meaning, immersion, atmosphere, and a sense of belonging within a place rather than simply “visiting” it. This is visible in the return of long-stay demand and renewed interest in culturally grounded itineraries that feel like lived experiences rather than transactions.Global movement has already reflected this behavioural turn, with the latest update from UN Tourism confirming that international travel flows have not only recovered but are entering a new phase driven by purpose-led mobility rather than purely price-led volume. According to data from the UN World Tourism Organization, international tourist arrivals grew by approximately 5% in the first quarter of 2025 compared with the same period in 2024, surpassing pre-pandemic 2019 levels by around 3%. Travel is no longer viewed as a pause from life; it has become part of how people shape life itself.

Travelers increasingly look for experiences that extend the character of a destination into the textures of their accommodation, dining, and daily rhythm while abroad. Boutique hotels that combine contemporary design with locally rooted sensibilities are gaining influence across major cities as well as nature-based retreats, where aesthetics communicate cultural connection as much as comfort. The rise of “experience architecture” has pushed brands and tourism promoters to think beyond amenities and toward atmospheric storytelling, a trend reinforced by the Japan National Tourism Organization, which has formally emphasized craftsmanship, design sensibilities, and local cultural immersion as strategic pillars in its international positioning.

Brands and national tourism boards are adapting by becoming not just service providers but curators of identity-driven journeys. Airlines are packaging stopovers as mini-experiences rather than layovers, turning transit into narrative discovery. Hospitality groups are refining visual merchandising and destination storytelling, emphasizing emotional connection alongside stay quality.

Public agencies are also moving from static promotion to “experience creation,” such as coordinated heritage corridors, culinary trails, and city-break concepts intended to deepen cultural texture. In Europe, the Italian Ministry of Tourism has formalized this strategy by building its recent campaigns around lifestyle-led appreciation, using architecture, culinary heritage, and landscape to communicate depth rather than checklist tourism. Travel today competes on coherence and emotional resonance, not volume.

Consumer Insights

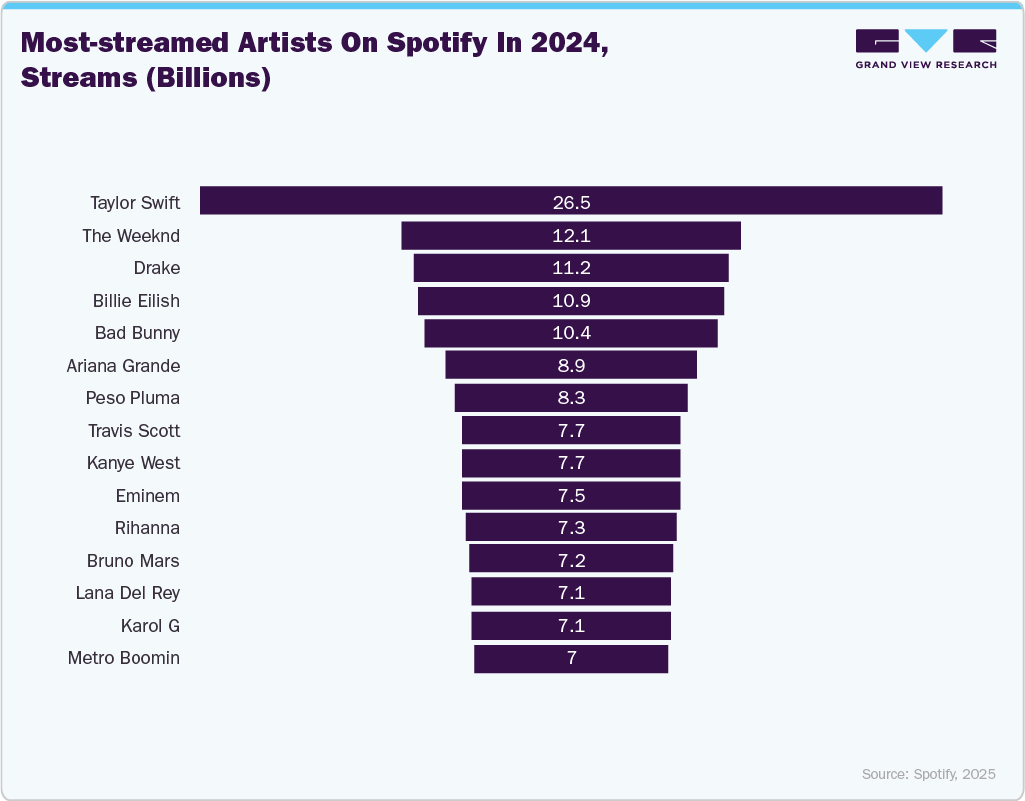

The rapid rise of digital fandom fostered through music streaming platforms has transformed how listeners engage with artists, increasingly converting online discovery into destination-led travel. As audiences build emotional attachment through Spotify, Apple Music, YouTube, and TikTok, the relationship no longer stops at listening; it evolves into a desire for physical proximity and live, shared experiences.

Streaming platforms thus act as the “first touchpoint” of fandom, while touring destinations become the real-world extension of that loyalty. This growing behavioral shift is now a major driver of music tourism, as fan journeys begin online but ultimately translate into flights, hotel bookings, and city visits built around live performances.

The social nature of fandom communities reinforces this move from virtual engagement to physical travel. The streaming environment is not only where fans discover music, but also where they find identity through shared culture, reposting concert clips or live-streamed performances that build anticipation for in-person attendance. According to the YouTube Culture & Trends Report 2023, 70% of Gen Z say online video is their primary gateway to experiencing live performances before attending them physically, illustrating how streaming is now the top-of-funnel driver for travel intent. As fandom becomes participatory, not passive, fans treat live events as moments of belonging, deciding to travel feels emotionally justified and socially validated, rather than discretionary leisure.

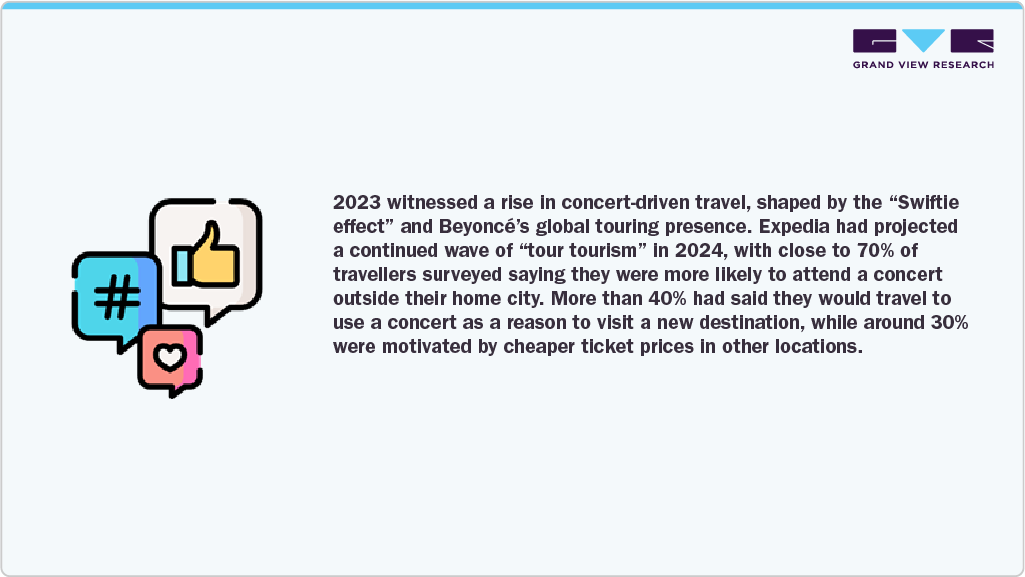

The tourism pull created by streaming-led fandom is now visible in booking behaviour across travel platforms. Cities experience measurable surges in travel interest the moment a globally streamed artist announces a tour stop. According to Expedia Traveler Trends 2024, published December 2023, Taylor Swift’s Eras Tour generated triple-digit increases in hotel and flight searches following city announcements, prompting the company to label 2024 “the year of Taylor Swift tourism.”

This pattern demonstrates a structural shift in tourism demand: the concert itself becomes the anchor for destination choice, while the city is selected secondary to the artist. Fans are no longer travelling for sightseeing alone; the live performance is the primary economic trigger, and hospitality spend, local excursions, retail purchases, and extended stays accumulate around the tour date rather than a traditional vacation itinerary.

Moreover, global appetite for music-led travel has strengthened in parallel with the full recovery of international mobility. According to UN Tourism’s World Tourism Barometer in January 2025, global arrivals surpassed 2019 levels through 2024 and continued to rise into early 2025, confirming that long-haul discretionary cultural tourism has fully normalized. At the same time, IATA’s World Air Transport Statistics Update in July 2024 reported the highest global average load factor on record, indicating strong willingness among consumers to allocate travel budgets to experience-centric motivations. This broader travel recovery is not simply a backdrop; it is the enabling condition that is allowing music tourism volumes to scale again at pace.

Live music has moved from being a secondary activity to becoming a primary reason for travel. For instance, Australia’s state of Victoria reported that among 89 contemporary music festivals held in regional zones, more than half (51%) of the 405,380 attendees in 2019 came from outside those host communities, underscoring that travelling specifically for a music event is increasingly part of the trip design. This shift suggests travellers are choosing the performance first and then building the larger itinerary around it, a pattern likely to ripple through other established music destinations.

Music travel spending is increasingly concentrated around major tours, flagship venues, and destination festivals rather than spread evenly throughout the year. According to UK Music’s Hometown Glory 2024 report, large-scale touring activity in 2023-2024 attracted around 23.5 million music tourists and generated USD 3.2 billion in direct economic impact.

These headline tours act as primary demand triggers, creating sharp spikes in visitation tied to specific events instead of traditional seasonal patterns. As a result, travel demand is aligning more closely with artist schedules than with tourism calendars, a shift that is reshaping how destinations plan capacity, manage pricing, and coordinate hospitality services.

Event Insights

Music tourism in concerts held the largest share in the music tourism industry, accounting for a share of 52.7% in 2024. As audiences become more willing to spend on leisure and premium experiences like VIP passes, concerts have emerged as major cultural and social touchpoints. At the same time, the globalization of music through platforms such as Spotify, YouTube, and TikTok has enabled artists to reach international audiences and cultivate cross-border fan bases, expanding touring opportunities worldwide. For many artists, concerts now serve as powerful branding tools, integral to album promotion, fan engagement, and merchandising, transforming global tours by major acts like Taylor Swift, Ed Sheeran, and BTS into large-scale entertainment spectacles that enhance profitability and international visibility.

Music tourism in festivals is anticipated to witness a CAGR of 16.2% from 2025 to 2033. Music festivals are evolving into immersive travel experiences rather than standalone music events. Increasingly hosted in scenic and culturally rich locations, these festivals blend entertainment with exploration, offering attendees curated packages that include accommodation, transport, and access to local attractions. With nearly 77% of festival fans willing to travel for such events, organizers are capitalizing on this trend by integrating cultural tourism, encouraging deeper local engagement, and transforming festivals into must-visit travel destinations that drive higher ticket demand.

Expenditure Insights

Travel-related expenditure held the largest share, accounting for a share of around 59.8% in 2024. For many attendees, travel costs such as transportation, accommodation, and local commuting often equal or exceed the ticket price. Consumers consider distance from home, airfare, hotel rates, and the convenience of reaching the venue before committing to attend. When travel expenses rise, potential festivalgoers may limit attendance to nearby events or reduce the number of festivals they visit yearly. This is especially true for younger audiences or budget-conscious travelers who balance the desire for unique experiences with financial constraints.

Event expenditure is anticipated to witness a CAGR of 15.2% from 2025 to 2033. For most attendees, event-related expenses, including ticket prices, food and beverages, merchandise, parking, and accommodations near the venue, represent a substantial portion of their total spending. Consumers carefully assess whether the experience justifies the cost. A 2024 survey shows that 44% of festival-goers are attending fewer festivals in 2024 due to rising ticket prices, and 49% of respondents refuse to pay over £200 for a festival ticket. This highlights consumers' sensitivity to pricing and its impact on their participation decisions. For example, a higher ticket price may be acceptable if it offers better amenities like VIP seating, exclusive artist access, or premium sound quality. On the other hand, hidden costs or overpriced food and merchandise can negatively impact perceptions of value.

Booking Mode Insights

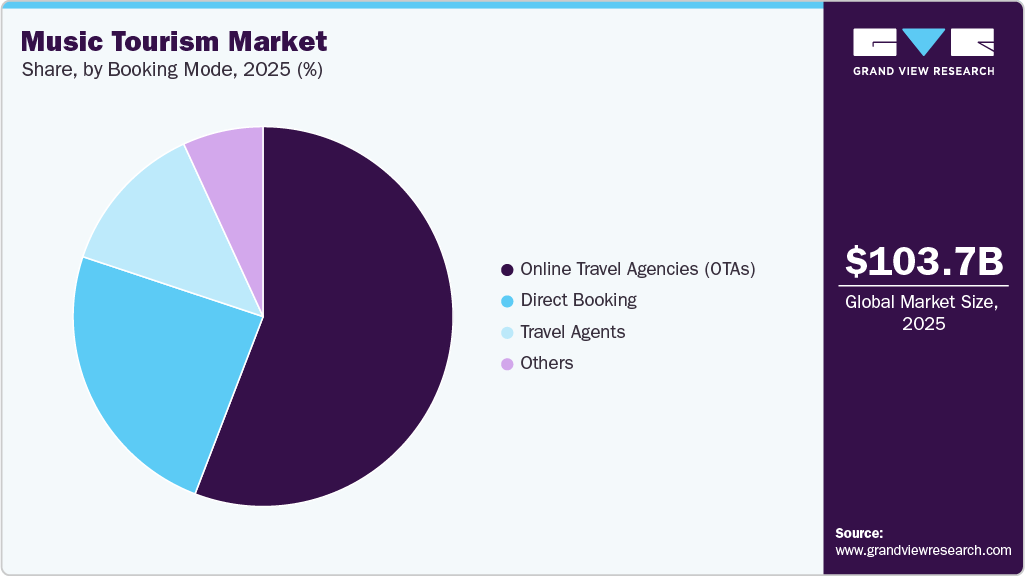

Online travel agencies held the largest share, accounting for a share of around 55.4% in 2024. Online travel agencies (OTAs) provide unmatched convenience by bringing together all essential travel services, such as event tickets, accommodation, flights, and local transport, on a single platform. This eliminates the need to visit multiple websites or coordinate separate bookings, which can be time-consuming and confusing, especially for large events. Using OTAs like Trip.com, Expedia, or Booking.com, festivalgoers can organize their entire trip in one seamless transaction. These platforms have also started offering specialized festival or concert packages, making it easier for domestic and international travelers to plan their itineraries efficiently. For busy consumers, this one-stop solution transforms a potentially stressful process into a smooth, time-saving experience.

Travel agents are anticipated to witness a CAGR of 16.4% from 2025 to 2033. Travel agents bring valuable expertise and local knowledge to music festival and concert travel. Their familiarity with event venues, transportation systems, and nearby attractions allows them to craft smooth and enjoyable itineraries for travelers. They guide consumers on the best routes, local customs, safety precautions, and the ideal time to arrive at the festival grounds. For international attendees unfamiliar with a destination’s logistics or language, this expertise ensures a hassle-free experience. It allows them to focus on enjoying the music and atmosphere rather than worrying about planning details.

Age Group Insights

Music tourism for 18 to 34-year-olds held the largest share in the music tourism industry, accounting for a share of around 64.8% in 2024. Generation Z and Millennials are reshaping music festival attendance through their strong preference for travel and nature-infused experiences. According to a study by AAA and Bread Financial, 65% of Gen Z and 58% of Millennials have traveled or plan to travel more than 50 miles for live events in the next year, compared to only 43% of Gen X and 27% of Baby Boomers. Similarly, 53% of Gen Z attendees are willing to fly to attend a music festival, showing how festivals have evolved into key travel experiences.

This is further supported by regional data, with 64% of those under 24 willing to take a flight to see their favorite artist live-particularly strong among Italians, where 46% are ready to take a short flight and 15% would fly across the world for a show.

Music tourism for 34 to 54-year-olds is anticipated to witness a CAGR of 17.6% from 2025 to 2033. Adults aged 34 to 54 are often drawn to music festivals and concerts because these events help them reconnect with the music of their past. Many in this group grew up during the golden eras of the 1980s, 1990s, and early 2000s, when iconic artists and genres defined popular culture. Attending concerts featuring these artists triggers nostalgia and emotional connection, allowing them to relive memories associated with their youth and personal milestones. This sense of nostalgia provides emotional satisfaction and reinforces their identity, making live performances deeply meaningful rather than just entertaining.

Regional Insights

The North American music tourism industry accounted for a share of around 38.5% in 2024. The growth of the North American music tourism industry is fueled by a vibrant live entertainment culture, strong consumer spending power, and a growing preference for experience-driven travel.

U.S. Music Tourism Market Trends

The music tourism industry in the U.S. dominated the North American region in 2024 with a revenue share of 81.37%. Iconic festivals such as Coachella, Lollapalooza, and Bonnaroo attract domestic and international visitors seeking immersive cultural and musical experiences. This surge is further supported by Americans’ willingness to invest in premium event experiences; many are prepared to pay extra for better seats, exclusive access, and merchandise.

Europe Music Tourism Market Trends

The music tourism industry in Europe is expected to grow at a CAGR of 14.9% from 2025 to 2033. Across Europe, the live music landscape is being reshaped by audiences seeking deeper, more meaningful, and experience-driven events. Rather than attending multiple small festivals, fans prioritize fewer but higher-quality experiences combining music, atmosphere, and destination appeal.

Festivals now compete not only through their lineups but also through immersive production, location design, and side attractions such as art installations, wellness zones, and curated food markets. This shift reflects a broader consumer trend toward experiential spending, where emotional connection and memorable moments outweigh price sensitivity. As a result, major festivals are positioning themselves as cultural destinations, integrating music, travel, and lifestyle to attract local and international audiences.

Asia Pacific Music Tourism Market Trends

The Asia Pacific music tourism industry accounted for a share of around 21.8% in 2024. The rise of regional pop, indie talent, and localized live event lineups is reshaping the Asia-Pacific music landscape. Genres like K-pop, J-pop, C-pop, Mandopop, and Thai pop are gaining strong traction across markets like Australia, New Zealand, and Southeast Asia, reflecting a growing cultural shift toward regionally inspired sounds and diverse audience preferences. According to a 2025 Mumbrella study, 90% of Asia-Pop fans actively engage with these genres. Notably, 98% listen to music in languages other than English, with over 60% stating they prefer non-English music despite English being the primary language spoken at home. The study also highlights that one in three fans consumes over 15 hours of Asian pop per week, and that 35% of the Asia-Pop audience falls within the 27-48 age group, showing that the trend extends well beyond Gen Z.

Central & South America Music Tourism Market Trends

The Central & South America music tourism industry is expected to grow at a CAGR of 16.7% from 2025 to 2033. In 2025, Central and South America are witnessing a significant surge in live-music activity, with cities such as Bogotá, Mexico City, Buenos Aires, and São Paulo emerging as regional concert capitals. According to a 2025 El País article, Bogotá has “consolidated itself as a new epicenter of concerts in Latin America,” driven by improved infrastructure, large-scale venues, and greater engagement from international promoters. Major global festival brands such as Lollapalooza and Ultra continue to expand into Latin markets, signaling the region’s importance in the worldwide touring ecosystem. Audiences across Latin America have shown a post-pandemic appetite for live events, pushing attendance numbers into the tens of thousands and making the live-entertainment sector one of the fastest-growing cultural industries in the region.

Middle East & Africa Music Tourism Market Trends

The Middle East and Africa music tourism industry is expected to grow at a CAGR of 16.0% from 2025 to 2033. Across Sub-Saharan Africa, live music and festivals are experiencing a strong post-pandemic revival, supported by rapid urbanization, a growing middle class, and an increasingly vibrant youth demographic. As local promoters and international brands recognize the continent's untapped potential for large-scale events, major markets such as Nigeria, Kenya, South Africa, and Ghana are leading this resurgence. According to the survey, rising disposable income, improved digital connectivity, and the popularity of Afrobeat and Amapiano have fueled demand for live performances and festivals. Cities like Lagos, Nairobi, and Johannesburg are transforming into regional music hubs, hosting high-profile events such as Afro Nation Ghana and Ultra South Africa.

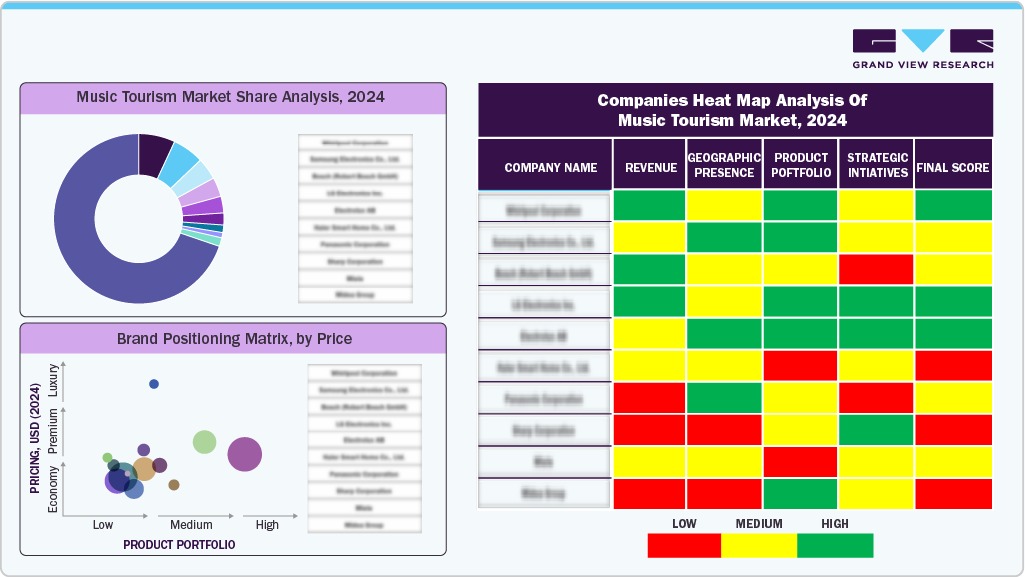

Key Music Tourism Company Insights

The music tourism industry remains highly competitive, with organizers and brands expanding their reach through both digital engagement platforms and on-ground experiential formats. Companies are investing heavily in advanced event curation, crowd experience technologies, and immersive production elements to elevate fan engagement and differentiate large-scale festivals and concerts. Growing traveler interest in culturally rich, experience-led journeys-combined with rising global demand for live performances, destination festivals, and heritage music events-is further accelerating market momentum. Additionally, the shift toward sustainable event operations, eco-friendly venue practices, and locally rooted cultural programming continues to reinforce strong, long-term growth prospects for music tourism.

Key Music Tourism Companies:

The following are the leading companies in the music tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Anschutz Entertainment Group, Inc.

- Glastonbury Festival Events Limited

- We Are One World BV

- Superstruct Entertainment Limited

- iMe Entertainment Group

- CTS EVENTIM AG & Co. KGaA

- Live Nation Entertainment

- HYBE Co., Ltd.

- MSG Entertainment Holdings, LLC

- DF Concerts Limited

- TEG Dainty

Recent Developments

-

In April 2025, Hans Zimmer Presents launched “The World of Hans Zimmer - A New Dimension,” a 24-city North American arena tour to launch on September 5, 2025, in Sunrise, Florida. Curated and musically directed by Zimmer, the tour features newly arranged perage group ances of his legendary film scores, perage grouped by a full live orchestra under the baton of multiple‑Grammy‑nominated conductor Matt Dunkley, alongside virtuoso soloists and choir, synchronized with immersive film visuals.

-

In March 2025, KQ Entertainment, the South Korean label behind rising K-pop powerhouse ATEEZ, entered into a multi-year strategic partnership with global live entertainment giant AEG Presents. The deal grants AEG Presents full oversight of ATEEZ’s worldwide tour production following their highly successful North American and European legs, including sold‑out stadium shows at Citi Field, BMO Stadium, Globe Life Field, and a milestone perage groupance at Paris’s La Défense Arena. This collaboration aims to deepen K-pop’s global reach, pairing KQ’s artist development strengths with AEG’s production and promotional expertise.

-

In October 2024, Stevie Wonder announced a special 10‑date U.S. tour this fall titled “Sing Your Song! As We Fix Our Nation’s Broken Heart,” strategically timed to coincide with the 2024 presidential election. The tour will begin in Pittsburgh and span key battleground states, including perage groupances in New York’s Madison Square Garden, Detroit, Milwaukee, and Minneapolis, and will end in Grand Rapids

Music Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 103.68 billion

Revenue Forecast in 2033

USD 330.12 billion

Growth rate

CAGR of 15.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event, age group, expenditure, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa; UAE

Key companies profiled

Anschutz Entertainment Group, Inc.; Glastonbury Festival Events Limited; We Are One World BV; Superstruct Entertainment Limited; iMe Entertainment Group; CTS EVENTIM AG & Co. KGaA; Live Nation Entertainment; HYBE Co., Ltd.; MSG Entertainment Holdings, LLC; DF Concerts Limited; TEG Dainty

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Music Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global music tourism market report by event, age group, expenditure, booking mode, and region:

-

Event Outlook (Revenue, USD Million, 2021 - 2033)

-

Concerts

-

Festivals

-

Other

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 18 Years

-

18 to 34 Years

-

34 to 54 Years

-

55 Years and Above

-

-

Expenditure Outlook (Revenue, USD Million, 2021 - 2033)

-

Event Expenditure

-

Travel-Related Expenditure

-

-

Booking Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Booking

-

Travel Agents

-

Online Travel Agencies (OTAs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.