- Home

- »

- Beauty & Personal Care

- »

-

Nail Salon Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Nail Salon Market Size, Share & Trends Report]()

Nail Salon Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Manicure, Pedicure), By End-user (Men, Women), By Age Group (Below 18, 19 to 40), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-4-68040-088-5

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nail Salon Market Summary

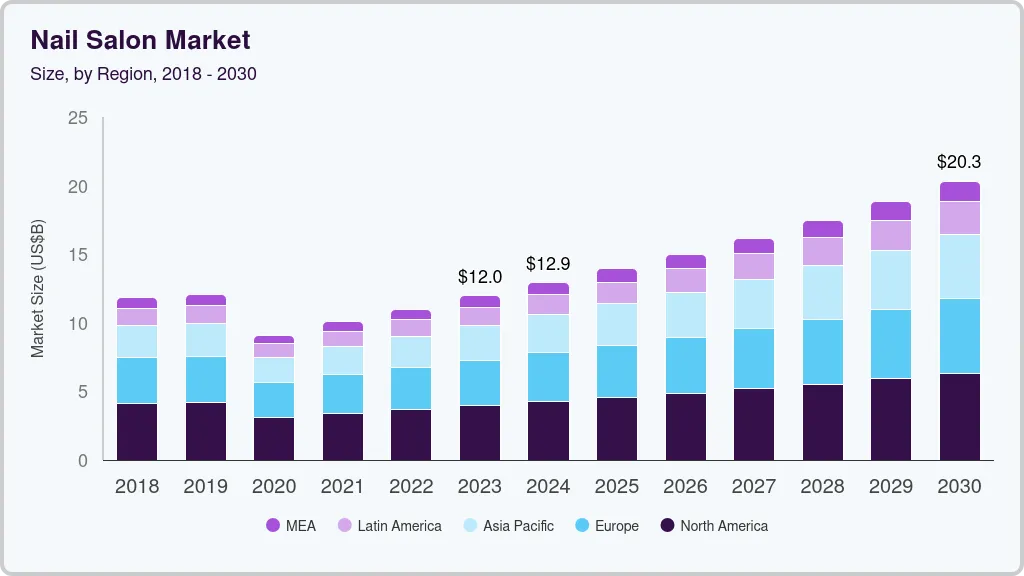

The global nail salon market size was valued at USD 11.96 billion in 2023 and is projected to reach USD 20.30 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. There has been a growing emphasis on personal appearance and grooming in recent years. People are more conscious about their overall appearance, including their nails. Nail salons provide a convenient and specialized service to cater to this demand.

Key Market Trends & Insights

- North America dominated the global market with a share of over 33% in 2022.

- By service, the manicure service segment dominated the market with a share of around 32% in 2022.

- By service, the UV gel overlays and extensions service is projected to register a CAGR of 9.5% from 2023 to 2030.

- By end user, the women segment dominated the market with a share of around 69% in 2022.

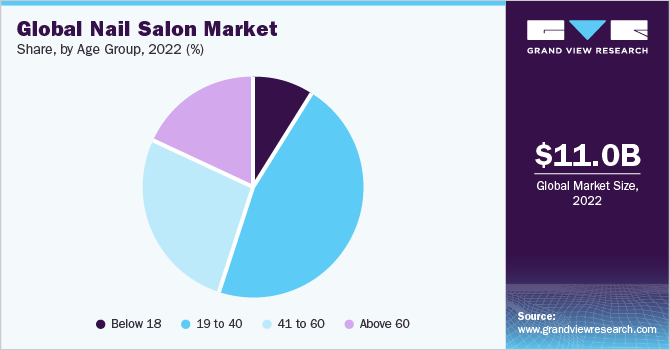

- By age group, the nail salons for the age group 19 to 40 years dominated the market with a share of over 46% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 11.96 Billion

- 2030 Projected Market Size: USD 20.30 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2022

The COVID-19 pandemic has significantly impacted the nail salon industry, bringing about several notable trends and changes. Nail salons have implemented rigorous safety measures to ensure the well-being of both customers and staff. These measures include mandatory mask-wearing, frequent sanitization of tools and surfaces, hand sanitizing stations, and social distancing measures within the salon.

Adhering to strict hygiene protocols has become a top priority for nail salons to instill confidence in customers. Post-COVID-19 pandemic many nail salons have shifted to appointment-only systems to manage customer flow and reduce overcrowding. This helps prevent long wait times for customers. Online booking platforms and mobile apps have become popular for scheduling appointments and managing salon capacity effectively.Moreover, millennials value self-expression and individuality. Nail salons offer a canvas for creative expression through unique nail designs, colors, and embellishments. Many millennials seek out nail technicians who can create customized and intricate nail art.

In addition, millennials are driving innovation in the nail industry by embracing vibrant acrylics, ombre accents, and novel techniques. Influential figures like Kylie Jenner, Nicki Minaj, Billie Eilish, and Cardi B have popularized acrylic nails, relying on skilled professionals to cater to their nail care needs. The internet, particularly the vast resources available online, serves as a valuable tool for discovering new and captivating nail designs. Millennials are active users of social media platforms like Instagram, where they share their experiences, including nail treatments and designs. This has created a trend-driven culture around nail art and has increased the popularity of nail salons.

Social media platforms, particularly TikTok, have emerged as significant influencers in the industry. TikTok’s short and concise video format aligns with millennial preferences, offering a seamless browsing experience for quick and easy access to a multitude of nail art tutorials. Furthermore, technology has played a significant role in shaping the nail salon industry. The availability of new and advanced nail care products, tools, and equipment has improved the quality of services and expanded the range of treatments offered. In addition, technological advancements in marketing, online presence, and customer engagement have helped salons reach a wider audience and provide a seamless customer experience, likely favoring the market growth.

Service Insights

The manicure service segment dominated the market with a share of around 32% in 2022. Manicures are often viewed as a form of self-care and relaxation. Many people enjoy the pampering experience of getting their nails done and consider it a treat or a way to unwind. The need for self-care and relaxation provides an ongoing demand for manicure services, as individuals prioritize regular visits to nail salons for a rejuvenating experience.

The UV gel overlays and extensions service is projected to register a CAGR of 9.5% from 2023 to 2030. By incorporating gel polish into their service offerings, salons can attract customers seeking a longer-lasting and low-maintenance manicure. The application and removal process of gel polish typically requires professional expertise and specialized equipment, creating a demand for salon services. Customers often prefer professional assistance to ensure precise application, proper curing, and safe removal of gel polish. This drives the demand for UV gel overlays and extensions among consumers.

End-user Insights

The women segment dominated the market with a share of around 69% in 2022. The frequency of women customer visits to nail salons goes beyond the mere provision of nail services and encompasses a holistic experience focused on relaxation and self-care. It serves as a ritualistic practice where they can momentarily step away from their hectic routines, unwind, and indulge in pampering. This emphasis on providing a comprehensive and rejuvenating experience caters to the growing demand for wellness-oriented services within the nail salon industry, enhancing customer satisfaction and fostering long-term loyalty.

The men end-usersegment is projected to register a CAGR of 8.7% from 2023 to 2030. Well-maintained nails can be regarded as a fashion-forward statement or an extension of one's personal brand. Men who prioritize their appearance and seek to express themselves through fashion may opt to visit nail salons to ensure their nails are stylishly maintained, complementing their overall aesthetic. According to an article in The Times of India on September 2020, Enrich, a unisex salon chain in India, stated that the female-to-male ratio has changed from 70:30 in 2019 to 60:40. Men are availing various services, such as pedicures and manicures.

Age Group Insights

Nail salons for the age group 19 to 40 years dominated the market with a share of over 46% in 2022. Individuals in this age group frequently attend special occasions like weddings, parties, or social events. Nail salons provide services, such as manicures, pedicures, and nail extensions, that can enhance their appearance for these events, complementing their outfits and overall style. According to a blog by NailCon in October 2022, GenZ (specifically of the age group 19 to 26 years) and millennials (specifically of the age range 27 to 40 years) spend more money on nail salon services.

Nail salon for the age group below 18 years is estimated to grow with the fastest CAGR of 10.2% over the forecast period. Nail salons catering to teenagers often create a welcoming and age-appropriate ambiance. They may have vibrant decor, trendy music, and a friendly staff that understands the preferences and tastes of teenagers, ensuring a comfortable and enjoyable experience. For instance, Revive Nails & Massage Therapy based in the U.S. offers manicures and pedicures specifically for children at an average price of USD 14 and USD 15 respectively.

Regional Insights

North America dominated the global market with a share of over 33% in 2022. The expansion of nail salon franchises plays a significant role in fueling theU.S. market growth. In the wake of the pandemic, nail salon brands established in the past decade are strategically focusing on franchise expansion, while upholding their dedication to maintaining high standards of cleanliness and using chemical-free processes. Prose Nails, for example, just opened its 27th facility in Sandy Springs, Georgia.Asia Pacific is expected to grow at a CAGR of 9.4% from 2023 to 2030.

There has been an increase in the number of male customers visiting nail salons in the Asia Pacific region. Men are embracing nail care as part of their grooming routine and seeking professional services for nail maintenance and styling. The Indian market has seen significant growth and evolving preferences in recent years. BBlunt, a nail salon company in India, reported to note a significant change in consumer trends as the frequency of visit of male customers were more post-pandemic lockdown. The ratio of female customers to male customers in BBlunt changed from 70:30 to 55:45 for services, such as haircuts, manicures, and pedicures.

Key Companies & Market Share Insights

The market exhibits a mix of established players and emerging entrants. Key industry players are recognizing the rising trend of nail salons and intensifying their efforts to capture this market opportunity. To safeguard their market share, these players are diversifying their service offerings to cater to evolving customer preferences and demands.For instance:

-

In June 2022, John Barrett partnered with a luxury condo building 53 West 53 in Manhattan. The partnership aims to create easy access and treated it as a priority for the people of the building for a complete wellness center through pre-appointments

-

In December 2021, MiniLuxe, a Boston-based nail salon chain, accomplished an important milestone by finalizing the largest Capital Pool Company (CPC) offering in TSX history, demonstrating the market's trust in its dedication to healthy workplace conditions and delivering quality service at a premium

Some of the key players operating in the global nail salon market include:

-

Revive Nails & Massage Therapy

-

Alluring Nails & Tanning

-

Milano Nail Spa The Height

-

Soho Beauty & Nail Boutique

-

J and J Nails & Spa

-

Hana Nail

-

Shian Nails

-

Nailaholics

-

LOTUS NAILBAR & SPA

-

ZAZAZOO Nail Salon

Nail Salon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.96 billion

Revenue forecast in 2030

USD 20.30 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-user, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Africa; Brazil

Key companies profiled

Revive Nails & Massage Therapy; Alluring Nails & Tanning; Milano Nail Spa The Height; Soho Beauty & Nail Boutique; J and J Nails & Spa; Hana Nail; Shian Nails; Nailaholics; LOTUS NAILBAR & SPA; ZAZAZOO Nail Salon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nail Salon Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global nail salon market report based on service, end-user, age group, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manicure

-

Pedicure

-

Fiberglass & Silk Wraps

-

UV Gel Overlays And Extensions

-

Acrylic Overlays And Extensions

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 18

-

19 to 40

-

41 to 60

-

Above 60

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nail salon market was estimated at USD 11.00 billion in 2022 and is expected to reach USD 11.96 billion in 2023.

b. The global nail salon market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 20.30 billion by 2030.

b. North America dominated the nail salon market with a share of around 34% in 2022. Factors such as trends in nail fashion, customer preferences for quality and cleanliness, and innovations in nail care techniques influence the dynamics and growth of the nail salon service market.

b. Some of the key players operating in the nail salon market include Revive Nails & Massage Therapy; Alluring Nails & Tanning; Milano Nail Spa The Height; Soho Beauty & Nail Boutique; J and J Nails & Spa; Hana Nail; Shian Nails; Nailaholics; LOTUS NAILBAR & SPA; ZAZAZOO Nail Salon

b. Key factors that are driving the nail salon market growth include individuals seeking to enhance the appearance and health of their nails, as well as those looking for a relaxing and pampering experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.