- Home

- »

- Communication Services

- »

-

Nanosatellite And Microsatellite Market Size Report, 2030GVR Report cover

![Nanosatellite And Microsatellite Market Size, Share & Trends Report]()

Nanosatellite And Microsatellite Market (2025 - 2030) Size, Share & Trends Analysis Report By Mass (Nanosatellites, Microsatellites), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-230-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nanosatellite And Microsatellite Market Summary

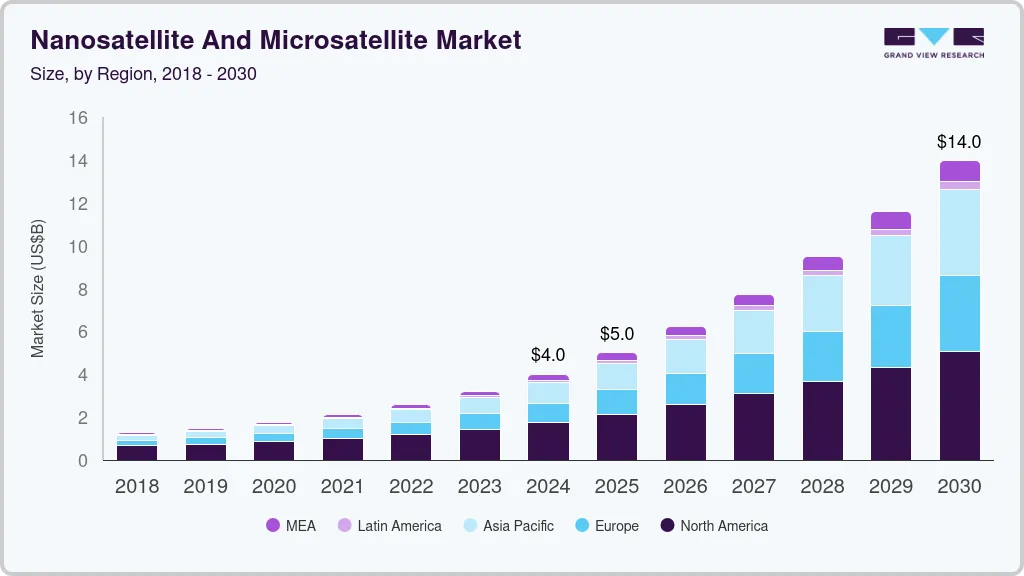

The global nanosatellite and microsatellite market size was estimated at USD 3,998.4 million in 2024 and is projected to reach USD 13,951.6 million by 2030, growing at a CAGR of 22.8% from 2025 to 2030. The market is primarily driven by the increasing demand for automation and digital transformation, which enhances operational efficiency and reduces costs for manufacturers.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, nanosatelllite (1-10kg) accounted for a revenue of USD 3,963.0 million in 2024.

- Nanosatelllite (1-10kg) is the most lucrative mass segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,998.4 Million

- 2030 Projected Market Size: USD 13,951.6 Million

- CAGR (2025-2030): 22.8%

- North America: Largest market in 2024

In addition, the growing emphasis on energy efficiency and sustainability, coupled with advancements in technologies such as IoT, AI, and robotics, is propelling the adoption of nanosatellite and microsatellite solutions across various industries. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies is also facilitating smarter decision-making and predictive maintenance, which is expected to present lucrative opportunities for the market in the coming years.

The increasing demand for automation and digital transformation across various industries, as companies seek to enhance operational efficiency and reduce costs. Governments worldwide are promoting initiatives that support the adoption of Industry 4.0 technologies, which include advanced manufacturing systems, robotics, and IoT solutions. In addition, the rise in energy costs and environmental regulations is pushing manufacturers to adopt sustainable practices, leading to a greater emphasis on energy efficiency and resource optimization in production processes.

The proliferation of Industry 4.0 is a significant trend in the market as it encourages the implementation of interconnected manufacturing systems that leverage real-time data for improved decision-making and efficiency. The adoption of industrial Internet of Things (IIoT) technologies is on the rise, enabling manufacturers to collect and analyze vast amounts of data to optimize operations. Furthermore, advancements in 5G technology are enhancing connectivity within factories, allowing for faster data transmission and more reliable communication between devices. Another notable trend is the growing use of collaborative robots (cobots), which work alongside human operators to increase productivity while ensuring safety in the workplace.

The integration of AI and machine learning into manufacturing processes enables predictive analytics that can significantly reduce downtime and improve maintenance schedules. In addition, the rise of cloud computing allows manufacturers to access data remotely and implement scalable solutions that can adapt to changing production demands. The development of advanced robotics is also transforming factories, with industrial robots becoming more versatile and capable of performing complex tasks alongside human workers. These technological innovations are enhancing productivity and driving down operational costs, making smart factories an attractive option for manufacturers seeking competitive advantages, thereby driving Nanosatellite and microsatellite industry expansion.

The rise of sustainability concerns is influencing both operational practices and investment decisions. Manufacturers are increasingly adopting green technologies that minimize energy consumption and reduce waste throughout production processes. Smart factory solutions often incorporate energy-efficient systems that optimize resource use based on real-time data analysis. This shift towards sustainability is driven by regulatory pressures and consumer demand for environmentally friendly products. As companies strive to enhance their corporate social responsibility profiles, investments in sustainable manufacturing practices are expected to grow significantly, further supporting the expansion of the nanosatellite and microsatellite industry in the coming years.

Mass Insights

Based on mass, the nanosatellite segment led the market with the largest revenue share of 78.72% in 2024, owing to its growing deployment for various applications, particularly in Earth observation and communication. These small satellites are cost-effective and quicker to manufacture compared to their larger counterparts, making them increasingly attractive for both commercial and governmental entities. Their versatility allows for a wide range of uses, such as remote sensing, scientific research, and data collection, which has led to a surge in demand. In addition, advancements in technology and the decreasing costs of launches have further contributed to the popularity of nanosatellites, solidifying their position as a dominant segment in the market.

The microsatellite segment is projected to register at a significant CAGR of 19.6% from 2025 to 2030. This growth is attributed to the expanding capabilities of microsatellites, which can support more complex missions than their nanosatellite counterparts while still being relatively affordable. As organizations increasingly seek to enhance their satellite constellations for applications such as broadband communication, Earth observation, and scientific exploration, microsatellites are becoming essential tools. The ongoing trend towards miniaturization and the rising demand for high-performance satellite solutions are expected to drive robust growth in this segment, making it one of the fastest-growing areas within the nanosatellite and microsatellite industry.

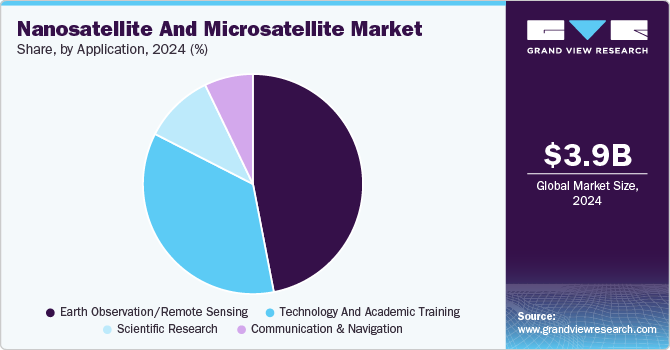

Application Insights

Based on application, the earth observation/remote sensing segment led the market with the largest revenue share of 46.96% in 2024, primarily owing to the increasing demand for high-resolution imaging and data collection capabilities offered by nanosatellites and microsatellites. These small satellites are particularly effective for monitoring agricultural fields, weather patterns, and environmental changes, providing critical information for disaster management and resource management. The capability of these satellites to deliver timely data at lower costs compared to traditional satellite systems has made them indispensable for various applications across sectors such as agriculture, urban planning, and defense.

The scientific research segment is anticipated to record at a significant CAGR from 2025 to 2030. This growth is largely driven by the increasing utilization of small satellites in academic and research institutions. These satellites enable researchers to conduct experiments in space, gather data on climate change, and explore new scientific frontiers with greater efficiency and lower costs. The rapid development cycles associated with nanosatellites and microsatellites allow for quicker deployment of research missions, facilitating ongoing studies in various scientific fields.

End-use Insights

Based on end use, the commercial segment led the market with the largest revenue share of 46.26% in 2024, driven by the increasing utilization of nanosatellites and microsatellites for various commercial applications, including telecommunications, navigation, and broadcasting. These small satellites offer a cost-effective solution for businesses looking to enhance their operational capabilities and expand their service offerings. The growing demand for real-time data collection and connectivity, particularly in the Internet of Things (IoT) space, has further fueled the adoption of these technologies.

The civil segment is anticipated to grow at a significant CAGR from 2025 to 2030, as governments and public institutions increasingly recognize the value of small satellites for various applications such as environmental monitoring, disaster management, and urban planning. The push for more efficient and effective public services is driving investments in satellite technologies that can provide critical data for decision-making processes. In addition, the growing emphasis on sustainability and smart city initiatives is expected to bolster demand for civil applications of nanosatellites and microsatellites.

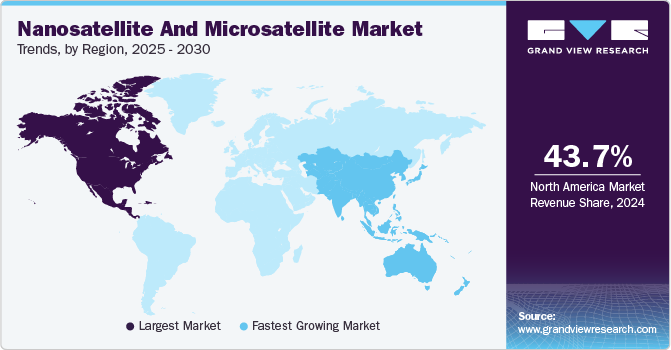

Regional Insights

North America dominated the nanosatellite and microsatellite market with the largest revenue share of 43.7% in 2024. This growth is driven by significant investments from both government and private sectors in advanced satellite technologies. The region is home to leading companies that are at the forefront of developing innovative satellite solutions for various applications, including Earth observation and communication services, which is further driving regional growth.

U.S. Nanosatellite And Microsatellite Market Trends

The nanosatellite and microsatellite market in the U.S. held a dominant position in North America in 2024. The U.S. government's commitment to enhancing its space capabilities further propels market growth as it allocates substantial budgets for satellite launches and research initiatives. In addition, the increasing demand for high-speed internet and data services across industries is fueling the adoption of small satellites,

Europe Nanosatellite And Microsatellite Market Trends

The nanosatellite and microsatellite market in Europe is expected to grow at a considerable CAGR of 25% from 2025 to 2030, driven by the rising demand for high-speed internet and advanced communication services. The European Space Agency (ESA) plays a crucial role by investing in satellite technology development, which enhances the region's capabilities in deploying small satellites for various applications. In addition, European countries are increasingly recognizing the strategic importance of small satellites for national security and scientific research, prompting greater collaboration between governments and private entities.

The UK nanosatellite and microsatellite market is expected to grow at a rapid CAGR during the forecast period, driven by a robust interest from both government and private sectors in advancing satellite technology for various applications. The UK Space Agency has been actively promoting initiatives to enhance the country’s space capabilities, including investments in small satellite projects that support Earth observation, telecommunications, and scientific research. This governmental support, combined with collaborations between universities and commercial entities, is fostering innovation in nanosatellite development.

The nanosatellite and microsatellite market in Germany held a substantial market share in Europe in 2024, fueled by strong industrial backing and a focus on technological advancements in space applications. The German Aerospace Center (DLR) plays a pivotal role in promoting research and development in satellite technologies, encouraging partnerships between academia and industry.

Asia-Pacific Nanosatellite And Microsatellite Market Trends

The nanosatellite and microsatellite market in the Asia-Pacific is expected to grow at the fastest CAGR of 26% from 2025 to 2030. The region's burgeoning economies and favorable government initiatives are facilitating collaborations between public agencies and private firms, driving the development of innovative satellite solutions. Furthermore, the increasing number of startups entering the market to address various needs-ranging from telecommunication to military surveillance-contributes to the dynamic expansion of the small satellite sector in APAC.

The Japan nanosatellite and microsatellite market is expected to grow at a rapid CAGR during the forecast period. The market is driven by government initiatives and private-sector innovation. The Japan Aerospace Exploration Agency (JAXA) is actively involved in developing small satellite technologies and facilitating partnerships with private companies to enhance launch capabilities at reduced costs.

The nanosatellite and microsatellite market in China held a substantial market share in 2024. China is heavily investing in space programs and satellite technologies, utilizing small satellites for diverse applications such as communication, Earth observation, and scientific research.

Key Nanosatellite And Microsatellite Company Insights

Some of the key players operating in the market include Sierra Nevada Corporation and The Boeing Company, among others.

-

Sierra Nevada Corporation (SNC) is an American aerospace and defense company that specializes in a wide array of technologies, including aircraft modification, space systems, and electronics. The company is particularly known for its Dream Chaser spacecraft, which is designed for cargo resupply missions to the International Space Station. The company has built a strong reputation for innovation and agility in delivering mission-critical solutions to government and commercial customers, emphasizing its commitment to advancing U.S. leadership in space and technology.

-

The Boeing Company designs and produces commercial airplanes, defense systems, satellites, and space exploration vehicles. The company operates through various segments, including Commercial Airplanes and Defense, Space & Security. Boeing is recognized for its engineering excellence and has played a pivotal role in numerous landmark projects such as the Space Launch System (SLS) and the International Space Station.

Some of the emerging market players in the nanosatellite and microsatellite industry include Spire Global, Inc. and Space Quest, Ltd., among others

-

Spire Global, Inc. is a provider of satellite data and analytics, specializing in the collection of global data through its constellation of nanosatellites. The company leverages its innovative technology to deliver high-quality data services to a diverse clientele, including governments, research institutions, and commercial enterprises. With a commitment to advancing the capabilities of small satellite technology, Spire continues to expand its global reach and enhance its data offerings.

-

SpaceQuest Ltd. focuses on the design, development, and operation of microsatellites and spacecraft components, providing innovative solutions for remote monitoring and tracking applications. The company operates a fleet of low-earth orbiting satellites that serve various clients, including NASA and the U.S. Air Force. With a strong emphasis on commercial satellite services and advanced technology development, the company continues to play an integral role in the evolving landscape of nanosatellite and microsatellite operations.

Key Nanosatellite And Microsatellite Companies:

The following are the leading companies in the nanosatellite and microsatellite market. These companies collectively hold the largest market share and dictate industry trends.

- Dauria Aerospace

- GomSpace

- Innovative Solutions in Space (ISIS)

- Sierra Nevada Corporation (SNC)

- Spire Global, Inc.

- SpaceQuest Ltd.

- Surrey Satellite Technology Limited (SSTL)

- The Boeing Company

- Tyvak Inc.

- Vector Launch, Inc

Recent Developments

-

In November 2024, the UK Ministry of Defense (MOD) signed a contract with Surrey Satellite Technology Limited (SSTL) for the Juno satellite program. This initiative aims to enhance the UK's capabilities in Earth observation and satellite communications. The Juno satellites will be designed to provide critical data for military operations, including intelligence, surveillance, and reconnaissance.

-

In August 2024, Sierra Nevada Corporation (SNC) announced significant advancements in its Vindler commercial radio frequency (RF) satellite constellation through a new partnership with Muon Space. This collaboration aims to develop and deliver three additional satellites that will enhance the capabilities of the existing Vindlér constellation, which is designed to detect and geo-locate objects based on targeted RF emissions.

-

In August 2024, Surrey Satellite Technology Limited (SSTL) announced its participation in the Small Satellite Conference 2024. This event showed SSTL's advancements in small satellite technology and its contributions to various space missions. SSTL plans to highlight its innovative satellite solutions, including capabilities for Earth observation and communications.

Nanosatellite And Microsatellite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,002.0 million

Revenue forecast in 2030

USD 13,951.5 million

Growth rate

CAGR of 22.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mass, application, end-use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Dauria Aerospace; GomSpace; Innovative Solutions in Space (ISIS); Sierra Nevada Corporation (SNC); Spire Global, Inc.; SpaceQuest Ltd.; Surrey Satellite Technology Limited (SSTL); The Boeing Company; Tyvak Inc.; Vector Launch, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

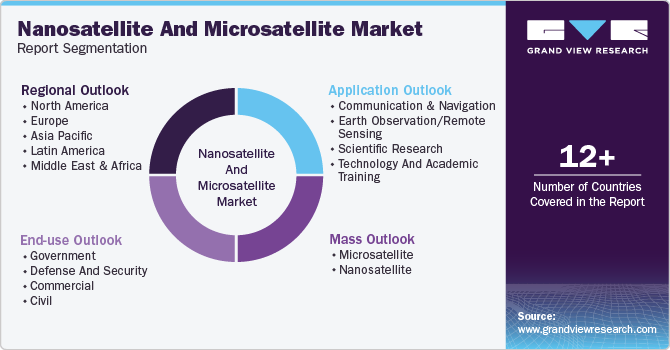

Global Nanosatellite And Microsatellite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nanosatellite and microsatellite market report based on mass, application, end-use, and region:

-

Mass Outlook (Revenue, USD Million, 2018 - 2030)

-

Microsatellite

-

Nanosatellite

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication & Navigation

-

Earth Observation/Remote Sensing

-

Scientific Research

-

Technology and Academic Training

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Defense and Security

-

Commercial

-

Civil

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nanosatellite and microsatellite market was estimated at USD 3,998.4 million in 2024 and is expected to reach USD 5,002.0 million in 2025.

b. The global nanosatellite and microsatellite market is expected to grow at a compound annual growth rate of 22.8% from 2025 to 2030 to reach USD 13,951.5 million by 2030.

b. The nanosatellites segment dominated the global nanosatellite and microsatellite market with a share of over 78% in 2024. This is attributable to the growing deployment of nanosatellites for earth observation missions.

b. Some of the key players in the global nanosatellite and microsatellite market include Innovative Solutions In Space, Sierra Nevada Corporation, Dauria Aerospace, GomSpace Group AB, and SpaceQuest Ltd.

b. Key factors that are driving the nanosatellite and microsatellite market growth include an increase in the demand for miniaturized satellites in commercial and defense & military segments and lower manufacturing cost and time as compared to larger satellites

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.