- Home

- »

- Conventional Energy

- »

-

Natural Gas Fired Electricity Generation Market Report, 2030GVR Report cover

![Natural Gas Fired Electricity Generation Market Size, Share & Trends Report]()

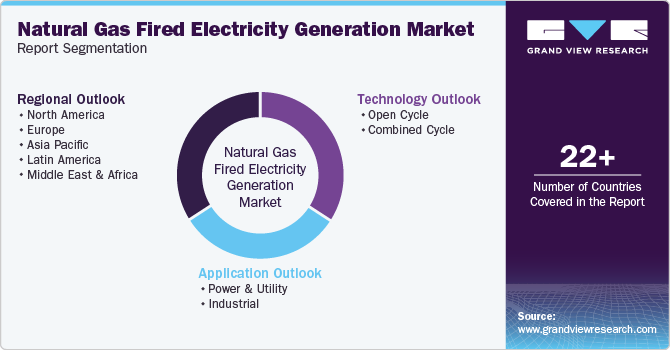

Natural Gas Fired Electricity Generation Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Open Cycle, Combined Cycle), By Application (Power & Utility, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-046-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Gas Fired Electricity Generation Market Summary

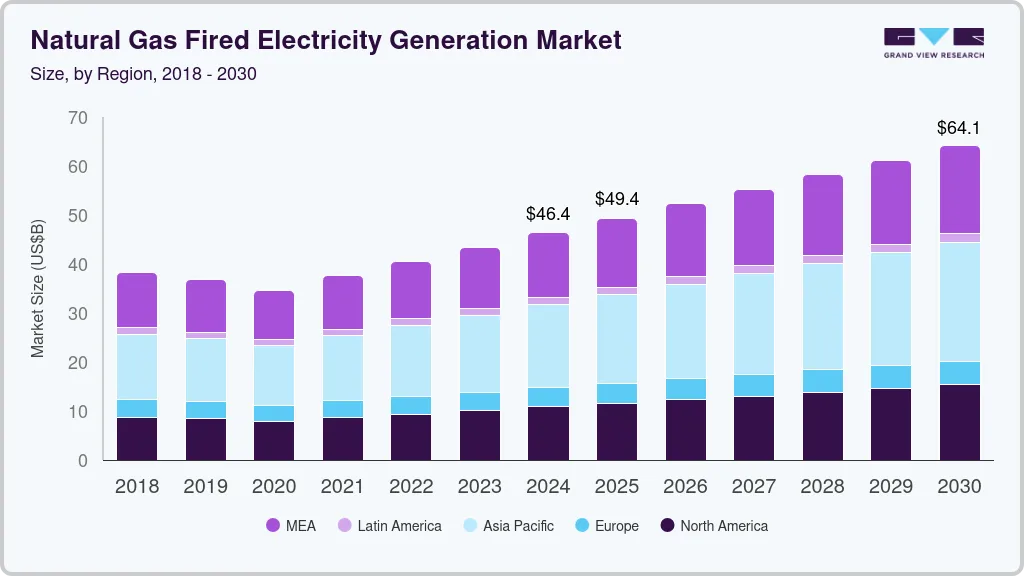

The global natural gas fired electricity generation market demand was 46.41 billion in 2024 and is projected to reach USD 64.12 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. This growth is attributed to the increased energy demand due to population growth and industrialization is a primary catalyst.

Key Market Trends & Insights

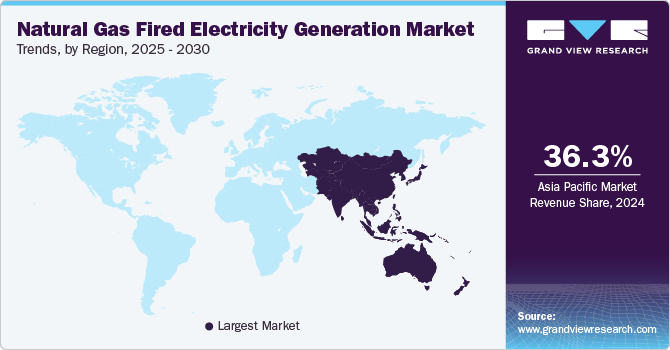

- The Asia Pacific natural gas fired electricity generation market dominated the global market and accounted for the largest revenue share of 36.3% in 2024.

- The natural gas fired electricity generation market in China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- By technology, the combined cycle segment led the market and accounted for the largest revenue share of 75.8% in 2024.

- By application, the Power & utility segment dominated the global natural gas-fired electricity generation industry and accounted for the largest revenue share of 73.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 46.41 Billion

- 2030 Projected Market Size: USD 64.12 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

In addition, environmental concerns regarding carbon emissions from coal-fired plants have led to a shift towards cleaner natural gas options. Furthermore, the technological advantages of natural gas, such as flexibility and efficiency in power generation, also contribute significantly to its rising adoption in the energy sector. Natural gas fired electricity generation refers to the process of producing electricity using natural gas as a primary fuel source. This market is experiencing substantial growth, primarily due to the rising global demand for electricity driven by population growth and economic development. As nations develop, especially in regions with limited access to electricity, natural gas technology emerges as a viable solution. Its efficiency and cost-effectiveness make it an attractive option compared to traditional coal-fired power plants, which are more polluting.The increasing global focus on reducing carbon emissions has further accelerated the shift towards natural gas, as it is less harmful to the environment than coal or oil. The International Energy Agency has noted that electricity consumption is expected to rise significantly, influenced by factors such as population growth, economic development, and the increasing adoption of electric vehicles. In addition, the demand for air conditioning units also contributes to this trend, alongside the replacement of outdated coal plants with cleaner alternatives.

Furthermore, technological innovations play a crucial role in enhancing the appeal of natural gas-fired power plants. Advances in combustion technologies have led to improved efficiency and reduced fuel consumption, making these plants more competitive against other energy sources. Moreover, developments in materials and plant design have resulted in greater reliability and durability.

Technology Insights

The combined cycle segment led the market and accounted for the largest revenue share of 75.8% in 2024. This growth is attributed to its high efficiency and cost-effectiveness. By utilizing both gas and steam turbines, combined cycle plants can generate significantly more electricity from the same amount of fuel compared to traditional methods. In addition, this technology not only reduces fuel consumption but also lowers emissions, making it an environmentally friendly option. Furthermore, advancements in turbine design have further enhanced operational efficiency, driving increased adoption in various regions.

Open cycle segment is expected to grow at a CAGR of 5.7% over the forecast period, due to its simplicity and quick start-up capabilities. Open cycle gas turbines are easier to install and operate, making them suitable for meeting peak demand or providing backup power. In addition, their ability to generate electricity rapidly without extensive infrastructure makes them attractive in regions with fluctuating energy needs.

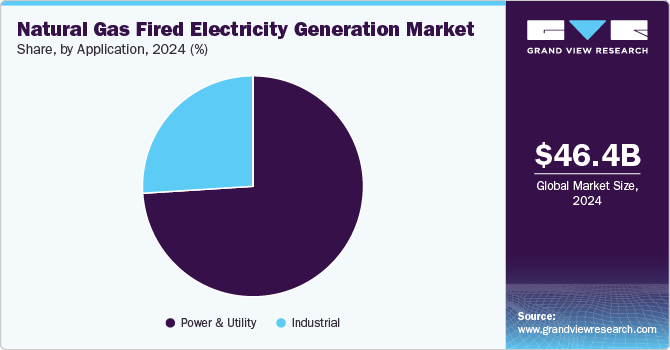

Application Insights

Power & utility segment dominated the global natural gas-fired electricity generation industry and accounted for the largest revenue share of 73.9% in 2024, primarily driven by the rising demand for reliable and cleaner energy sources. As countries aim to reduce carbon emissions, natural gas is increasingly favored over coal for baseload power generation. In addition, the development of large-capacity power projects and supportive government regulations further enhance this trend, making natural gas a key player in transitioning to sustainable energy systems.

The Industrial sector is expected to grow at a CAGR of 5.3% from 2025 to 2030, owing to the expanding industrial operations and the need for efficient power generation. In addition, industries such as cement, steel, and chemicals are adopting natural gas-fired electricity generation for their energy needs, particularly for captive power plants. This shift is supported by government initiatives aimed at bolstering manufacturing while reducing environmental impact. Furthermore, frequent power outages in certain regions have heightened the demand for reliable natural gas solutions, further propelling this segment's growth.

Regional Insights

The Asia Pacific natural gas fired electricity generation market dominated the global market and accounted for the largest revenue share of 36.3% in 2024. This growth is attributed to the increasing energy demands and a shift towards cleaner energy sources. In addition, countries in this region are focusing on reducing their reliance on coal due to environmental concerns, leading to greater investments in natural gas infrastructure. Furthermore, the development of large-scale gas-fired power projects and supportive government policies further enhance the attractiveness of natural gas as a primary energy source, particularly in rapidly industrializing nations.

China Natural Gas Fired Electricity Generation Market Trends

The natural gas fired electricity generation market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by the government’s commitment to reducing carbon emissions and transitioning towards cleaner energy. As one of the largest consumers of coal, China is actively decommissioning outdated coal plants and replacing them with natural gas facilities. Furthermore, the increasing demand for electricity, especially in urban areas, coupled with advancements in natural gas extraction technologies, positions China as a key player in expanding its natural gas infrastructure to support sustainable growth.

North America Natural Gas Fired Electricity Generation Market Trends

North America natural gas fired electricity generation market is expected to grow at a CAGR of 5.8% over the forecast period, owing to the abundance of shale gas resources. The region's shift towards cleaner energy sources is supported by favorable regulations aimed at reducing carbon emissions from power generation. Furthermore, technological advancements in natural gas extraction and processing have made it more cost-effective, encouraging utilities to invest in gas-fired power plants. Moreover, this trend is further bolstered by the increasing need for reliable electricity supply amidst fluctuating energy demands.

The natural gas fired electricity generation market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by significant advancements in extraction technologies and an abundant supply of natural gas. Furthermore, the country has shifted its focus from coal to natural gas as a cleaner alternative for electricity generation, driven by both environmental regulations and economic factors. As a result, many coal-fired plants are being retired or converted to natural gas, enhancing the overall efficiency and sustainability of the power generation sector.

Europe Natural Gas Fired Electricity Generation Market Trends

Europe natural gas fired electricity generation market is expected to grow significantly over the forecast period due to its broader strategy to achieve climate goals. The region's commitment to reducing greenhouse gas emissions has led many countries to phase out coal and invest in cleaner alternatives such as natural gas. Furthermore, increasing interconnections between national grids facilitate the integration of renewable energy sources alongside natural gas, making it a crucial component of Europe’s energy mix as it seeks to enhance energy security and sustainability.

The growth of the natural gas fired electricity generation market in Russia is expected to be driven by its vast reserves of natural gas and strategic initiatives aimed at expanding domestic consumption. In addition, the Russian government is promoting the use of natural gas for power generation as part of its energy strategy, which includes modernizing existing infrastructure and developing new projects. Furthermore, this focus not only aims to meet domestic electricity needs but also positions Russia as a key exporter of natural gas to neighboring countries, reinforcing its influence in the global energy market.

Key Natural Gas Fired Electricity Generation Company Insights

Key players in the global natural gas fired electricity generation industry include General Electric, Siemens AG, Ansaldo Energia S.P.A., and others. These companies are employing various strategies to enhance their market presence. These include forming strategic alliances and partnerships to leverage shared expertise and resources. In addition, companies are focusing on mergers and acquisitions to expand their operational capabilities and market share. Furthermore, players are diversifying their service offerings to encompass comprehensive solutions for natural gas power generation.

-

General Electric (GE) provides a diverse range of products, including aero derivative gas turbines, reciprocating engines, and combined cycle systems. The company operates primarily in the power generation segment, focusing on delivering efficient and reliable energy solutions for utilities and industrial applications.

-

Kawasaki Heavy Industries, Ltd. manufactures a variety of products, including gas turbines designed for power generation and cogeneration applications. Operating within the energy sector, the company focuses on providing high-efficiency solutions that cater to both utility and industrial markets.

Key Natural Gas Fired Electricity Generation Companies:

The following are the leading companies in the natural gas fired electricity generation market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- Siemens AG

- Mitsubishi Hitachi Power Systems, Ltd.

- Kawasaki Heavy Industries, Ltd.

- Ansaldo Energia S.P.A.

- Bharat Heavy Electricals Limited

- Opra Turbines B.V.

- Man Energy Solutions

- Centrax Gas Turbines

Recent Developments

-

In January 2024, GE Vernova and IHI Corporation have initiated the next phase of their collaboration to develop a gas turbine combustion system capable of burning 100% ammonia, potentially transforming natural gas fired electricity generation. This joint development agreement, signed on January 24, 2024, aims to retrofit existing F-class turbines for ammonia use by 2030. The project includes extensive combustion testing in Japan, focusing on reducing nitrogen oxide emissions while enhancing the viability of ammonia as a low-carbon fuel alternative in power generation.

-

In December 2024, SSE and Siemens Energy have announced a partnership "Mission H2 Power," aimed at advancing gas turbine technology to operate on 100% hydrogen. This initiative supports the decarbonization of SSE’s Keadby 2 Power Station, which currently utilizes natural gas. The collaboration was expected to develop a combustion system for Siemens’ SGT5-9000HL turbine, ensuring flexibility to run on both hydrogen and natural gas. This project is crucial for the UK's transition to a cleaner energy system, enhancing energy security and reducing reliance on fossil fuels.

Natural Gas Fired Electricity Generation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.38 billion

Revenue forecast in 2030

USD 64.12 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Volume in MW, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, and region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., China, India, Japan, Thailand, Russia, Saudi Arabia, and Iraq

Key companies profiled

General Electric; Siemens AG; Mitsubishi Hitachi Power Systems, Ltd.; Kawasaki Heavy Industries, Ltd.; Ansaldo Energia S.P.A.; Bharat Heavy Electricals Limited’; Opra Turbines B.V.; Man Energy Solutions; Centrax Gas Turbines.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Gas Fired Electricity Generation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global natural gas fired electricity generation market report based on technology, application, and region.

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Open Cycle

-

Combined Cycle

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Industrial

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

-

Latin America

-

Middle East and Africa

-

Saudi Arabia

-

Iraq

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.