- Home

- »

- Power Generation & Storage

- »

-

Natural Gas Storage Market Size, Industry Report, 2030GVR Report cover

![Natural Gas Storage Market Size, Share & Trends Report]()

Natural Gas Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Aboveground, Underground (Depleted Gas Reservoir, Aquifer Reservoir, Salt Caverns)), By Region (North America, Asia Pacific, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-700-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Gas Storage Market Summary

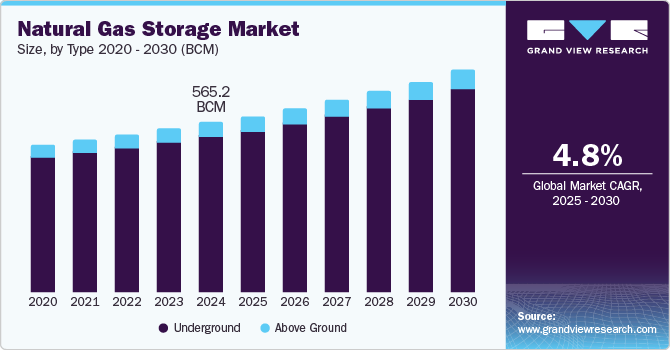

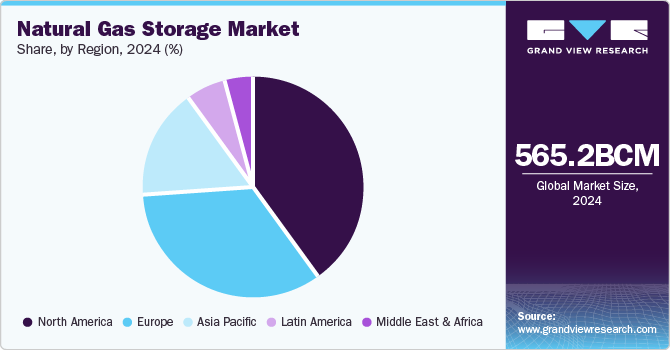

The global natural gas storage market size was estimated at 565.2 bcm in 2024 and is projected to reach 742.3 bcm by 2030, growing at a CAGR of 4.8% from 2025 to 2030. This growth is attributed to the increasing reliance on natural gas as a cleaner energy source and the rising demand for electricity generation.

Key Market Trends & Insights

- The North America natural gas storage market dominated the global market and accounted for the largest share of 40.2% in 2024.

- The U.S. dominated the North American market and accounted for the largest share in 2024.

- Based on type, the underground natural gas storage segment dominated the market and accounted for the largest share of 92.0% in 2024.

- Based on underground type, the depleted gas reservoir dominated the underground type segment and accounted for the largest share of 76.1% in 2024.

Market Size & Forecast

- 2024 Market Size: 565.2 BCM

- 2030 Projected Market Size: 742.3 BCM

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

In addition, the deregulation of the natural gas market has made storage essential for managing supply and demand fluctuations. Moreover, seasonal variations in consumption, particularly during winter, further necessitate robust storage capabilities to ensure energy security and accommodate growing industrial and residential needs.

Natural gas storage refers to the practice of reserving natural gas for future use, akin to maintaining a savings account. This process is essential for managing supply and demand fluctuations, particularly during peak usage periods in winter and summer. Typically, natural gas is stored underground in depleted reservoirs, aquifers, or salt caverns, allowing for efficient retrieval when needed.

Favorable government initiatives are significantly enhancing the market for natural gas stockpiling. Globally, governments are expanding tax incentives to encourage the adoption of liquefied natural gas (LNG) vehicles and infrastructure. In countries such as India and China, there is a concerted effort to finance the development of compressed natural gas (CNG) technologies. This includes providing loans and grants for constructing CNG fueling stations, which aim to reduce emissions and improve air quality and stimulate job creation within the economy.

Furthermore, the sports industry is witnessing a surge in the adoption of wearable technology integrated with real-time location systems (RTLS). This trend is driven by significant sports media and broadcasting investments, as organizations seek innovative methods to enhance engagement and performance analysis. RTLS technology allows for detailed tracking of athletes' performance across various sports, including basketball and football, thereby facilitating data-driven decision-making in competitive settings.

Type Insights

Underground natural gas storage dominated the market and accounted for the largest share of 92.0% in 2024, owing to its capacity to store large volumes of gas for extended periods. This type of storage is crucial for balancing seasonal fluctuations in energy demand, particularly in regions with high natural gas consumption. In addition, underground facilities, such as depleted reservoirs and salt caverns, provide efficient means to manage excess supply during low-demand periods and ensure availability during peak usage. Furthermore, advancements in technology and infrastructure have enhanced the operational efficiency of these storage systems, making them more attractive for meeting the dynamic energy needs of various sectors, including industrial and residential applications.

The above-ground natural gas storage segment is expected to grow at a CAGR of 4.2% from 2025 to 2030. Its flexibility and lower operational costs drive this growth. Above-ground facilities, such as LNG storage tanks, allow for rapid access to stored gas, which is beneficial during sudden spikes in demand. In addition, the increasing adoption of LNG as a cleaner fuel option across various industries also propels this segment forward. Furthermore, regulatory support and investments in infrastructure are encouraging the development of above-ground storage solutions that can be easily integrated into existing energy systems.

Underground Type Insights

The depleted gas reservoir segment dominated the underground type segment and accounted for the largest share of 76.1% in 2024, driven by its established infrastructure and cost-effectiveness for natural gas storage. In addition, these reservoirs, which have already been tapped for fossil fuel extraction, provide a ready-made solution for storing natural gas, benefiting from the existing wells and facilities. Furthermore, their geological characteristics allow for efficient gas storage, with the ability to maintain pressure levels that facilitate gas retrieval. Moreover, the growing demand for energy security and the transition to cleaner energy sources drive investments in these reservoirs, making them a viable option for meeting fluctuating energy needs.

Salt caverns are expected to grow at a CAGR of 11.0% over the forecast period, owing to their unique structural properties and operational advantages. Salt formations' high integrity and strength make them ideal for creating caverns that can withstand significant pressure changes without risk of collapse. Furthermore, this type of storage allows for rapid injection and gas withdrawal, making it particularly useful for balancing supply and demand fluctuations. Moreover, salt caverns support high storage efficiencies and lower operational costs, which appeal to an increasingly competitive energy market.

Regional Insights

The North America natural gas storage market dominated the global market and accounted for the largest share of 40.2% in 2024. This growth is attributed to the region's extensive infrastructure and high production levels. In addition, the region dominates this market, accounting for a significant share due to the operation of over 400 underground storage sites. Furthermore, increasing demand for natural gas, particularly for heating and industrial applications, enhances the need for reliable storage solutions.

U.S. Natural Gas Storage Market Trends

The natural gas storage market in the U.S. dominated the North American market and accounted for the largest share in 2024, driven by robust production capabilities and a well-established network of storage facilities. In addition, the country’s transition towards cleaner energy sources has led to increased investments in natural gas infrastructure, including depleted reservoirs and salt caverns. Furthermore, the growing emphasis on energy security and the need to balance supply with fluctuating demand further drive the expansion of storage capacity. Moreover, technological advancements in monitoring and managing storage systems are enhancing operational efficiency, making U.S. natural gas storage a vital component of the energy landscape.

Asia Pacific Natural Gas Storage Market Trends

The Asia Pacific natural gas storage market is expected to grow at a CAGR of 5.8% over the forecast period, owing to rapid economic development and urbanization. In addition, countries in this region are increasingly shifting towards natural gas to reduce coal dependency and improve air quality. Furthermore, investments in infrastructure, including regasification terminals and distribution networks, are essential to support this growth and ensure that natural gas can meet rising energy demands.

The natural gas storage market in China led the Asia Pacific market and accounted for the largest share in 2024, driven by government initiatives aimed at increasing the share of natural gas. This shift is driven by concerns over air quality and a commitment to reducing greenhouse gas emissions. Investments in domestic production and infrastructure development are crucial for meeting the anticipated surge in demand. In addition, as China continues to urbanize and industrialize, the need for efficient natural gas storage solutions becomes increasingly important for maintaining energy security.

Europe Natural Gas Storage Market Trends

Europe natural gas storage market is expected to witness substantial growth over the forecast period, driven by countries seeking to enhance energy security amid geopolitical uncertainties. In addition, the region's reliance on imported natural gas necessitates robust storage capabilities to manage supply disruptions and seasonal demand variations. Investments in underground facilities, such as depleted reservoirs and salt caverns, are critical for ensuring a stable natural gas supply during peak periods. Furthermore, European policies promoting renewable energy integration drive demand for flexible storage solutions that accommodate varying energy sources.

The growth of the natural gas storage market in Germany is attributed to a commitment to transitioning towards a low-carbon economy. As part of its energy transition strategy (Energiewende), Germany is increasing its reliance on natural gas as a transitional fuel while phasing out coal and nuclear power. In addition, this shift necessitates enhanced storage capacity to manage fluctuations in supply and ensure reliability during periods of high demand. Furthermore, investments in infrastructure improvements are essential for integrating renewable energy sources into the existing grid while maintaining adequate backup supplies from natural gas storage facilities.

Key Natural Gas Storage Company Insights

Key companies in the global natural gas storage industry include McDermott International, Inc., NAFTA A.S., TransCanada Corp., and others. These companies adopt various strategies to enhance their competitive edge. These strategies include investing in advanced technologies for efficient storage solutions, optimizing existing infrastructure, and expanding storage capacity to meet rising demand. Furthermore, companies focus on forming strategic partnerships and collaborations to enhance service offerings and improve market reach.

-

TransCanada Corp. specializes in unregulated natural gas storage, offering services that include supply security, operational balancing, and risk management for various clients, such as utilities and producers. Operating primarily in the underground storage segment, the company energy leverages its strategically located facilities to meet the growing demand for natural gas while ensuring reliable service and operational efficiency.

-

Royal Vopak N.V. operates in the energy and chemicals sectors, focusing on providing safe and efficient storage solutions for its customers. The company manages above-ground facilities that cater to the needs of the LNG market. By enhancing its service offerings and expanding its terminal network, it aims to support the increasing demand for natural gas as a cleaner energy source worldwide.

Key Natural Gas Storage Companies:

The following are the leading companies in the natural gas storage market. These companies collectively hold the largest market share and dictate industry trends.

- McDermott International, Inc.

- NAFTA A.S.

- TransCanada Corp.

- Royal Vopak N.V.

- Chart Industries

- Uniper

- Sempra

- Enbridge, Inc.

- Gazprom

- Martin Midstream Partners L.P.

Recent Developments

-

In June 2024, Aramco and Sempra announced a non-binding Heads of Agreement for a 20-year LNG offtake agreement from the Port Arthur LNG Phase 2 development project. This deal includes a commitment of 5 million tonnes per annum and Aramco’s 25% equity participation in the project. Both companies aim to enhance global energy security and reduce carbon emissions through this strategic partnership, which is expected to facilitate the distribution of U.S. natural gas worldwide.

-

In June 2024, Vopak and Gasunie initiated a market consultation to explore the future use of the EemsEnergyTerminal in Eemshaven, Netherlands, focusing on liquefied natural gas (LNG), hydrogen, and CO2. This effort aims to extend the terminal's operation beyond its initial five-year contract, enhancing energy security amid reduced Russian gas supplies. The consultation will assess market interest in LNG imports post-2027 and investigate conditions for hydrogen development and carbon capture, supporting the transition to a sustainable energy system.

Natural Gas Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

587.7 BCM

Revenue forecast in 2030

742.3 BCM

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in BCM, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; Australia; Germany; UK; France; Italy; Ukraine; Brazil; Argentina; UAE; South Africa

Key companies profiled

McDermott International, Inc.; NAFTA A.S.; TransCanada Corp.; Royal Vopak N.V.; Sempra; Chart Industries; Uniper; Enbridge, Inc.; Gazprom; Martin Midstream Partners L.P.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Gas Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global natural gas storage market report based on type and region.

-

Type Outlook (Volume, BCM, 2018 - 2030)

-

Underground

-

Depleted gas Reservoir

-

Aquifer Reservoir

-

Salt Caverns

-

-

Above Ground

-

-

Regional Outlook (Volume, BCM, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

Italy

-

Ukraine

-

-

Asia Pacific

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.