- Home

- »

- Agrochemicals & Fertilizers

- »

-

Natural Pyrethrin Market Size & Share, Industry Report 2033GVR Report cover

![Natural Pyrethrin Market Size, Share & Trends Report]()

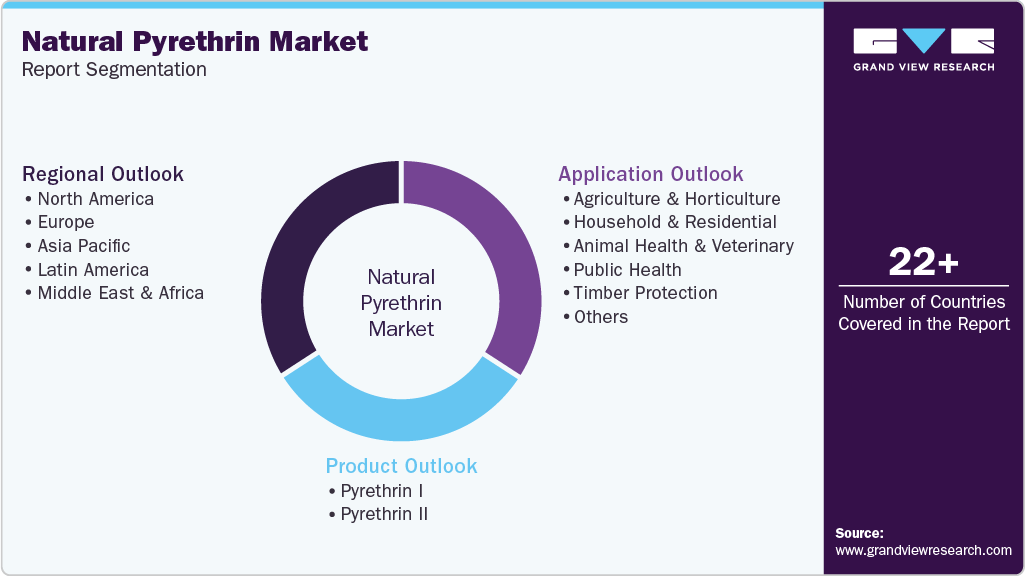

Natural Pyrethrin Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Pyrethrin I, Pyrethrin II), By Application (Agriculture & Horticulture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Pyrethrin Market Summary

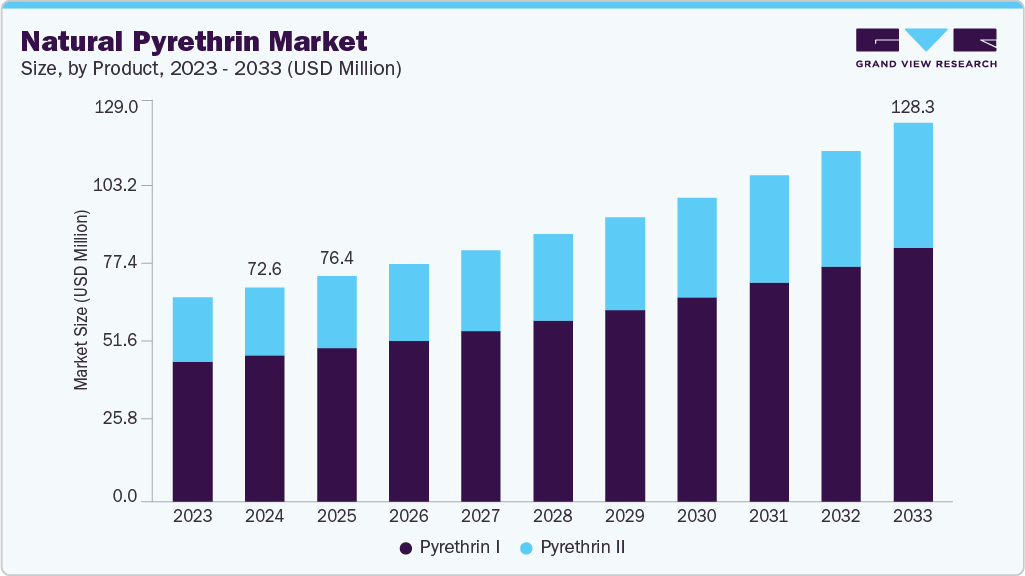

The global natural pyrethrin market size was estimated at USD 72.6 million in 2024 and is projected to reach USD 128.3 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The industry is expanding as stricter regulations on synthetic pesticides push industries toward safer, plant-based alternatives.

Key Market Trends & Insights

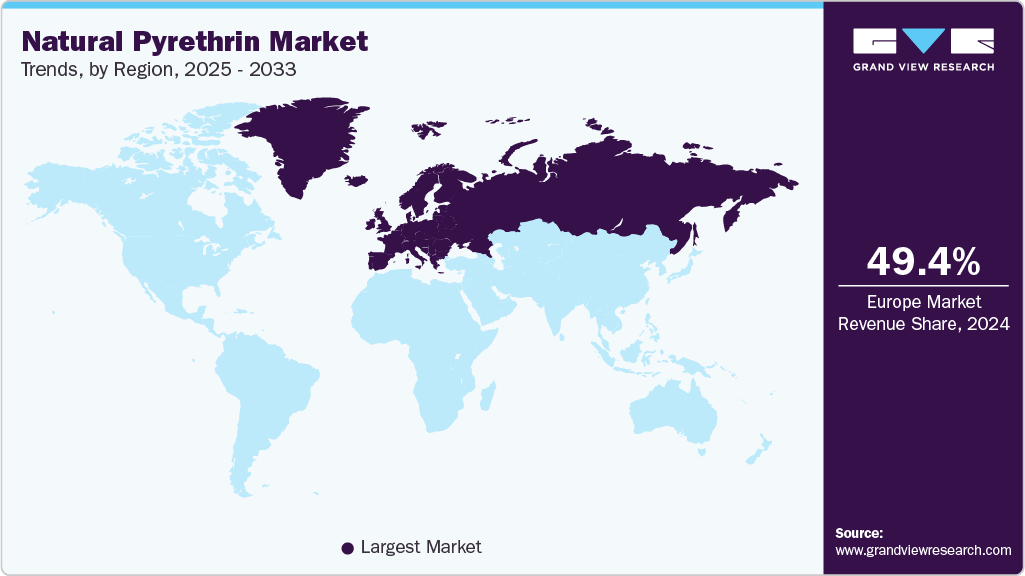

- Europe dominated the natural pyrethrin market with the largest revenue share of 49.4% in 2024.

- Germanyaccounted for a robust share of 26.8% in 2024.

- By product, the Pyrethrin I segment dominated the market and accounted for the largest revenue share of 68.1% in 2024.

- By application, the household & residentialsegment is expected to grow at the fastest CAGR of 7.1% in terms of revenue from 2025 to 2033

Market Size & Forecast

- 2024 Market Size: USD 72.6 Million

- 2033 Projected Market Size: USD 128.3 Million

- CAGR (2025-2033): 6.7%

Pyrethrin’s natural origin and lower toxicity make it well-suited to evolving safety and compliance standards. Manufacturers are adapting product portfolios to meet the rising demand for eco-friendly formulations. These shifts collectively strengthen market growth across both household and industrial applications.

Increasing incidences of mosquito- and insect-borne diseases are prompting governments and public health agencies to expand pest control programs. Natural pyrethrin is preferred for these initiatives due to its rapid knockdown effect and safer environmental profile. Household insect sprays and repellents are also witnessing strong uptake as consumers prioritize health protection. This trend is creating sustained demand across both urban and semi-urban markets.

Growing pet ownership and increasing focus on safe flea-and-tick control products are creating strong opportunities for pyrethrin-based formulations. Its natural origin and rapid action make it a preferred ingredient in shampoos, sprays, and spot-on treatments. Manufacturers can capitalize on this by developing premium, plant-based veterinary solutions.

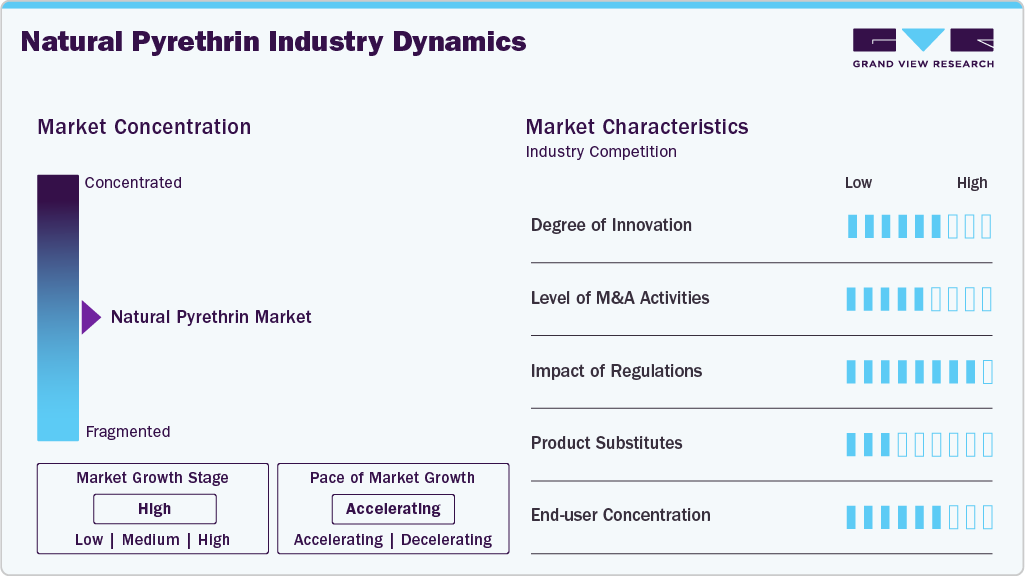

Market Concentration & Characteristics

The market is moderately concentrated, dominated by a few established producers with strong control over pyrethrum cultivation and extraction. Limited production regions and high entry barriers-such as sourcing, processing capabilities, and regulatory requirements-reinforce the position of vertically integrated players. This concentration results in a supply-sensitive market structure.

The market is defined by consistent demand from household insecticides, agriculture, pet care, and public health applications. Product differentiation centers on purity, formulation efficiency, and compliance with organic standards. Supply availability often fluctuates with crop yields and climate conditions, influencing pricing trends. The overall environment increasingly favors natural, low-toxicity pest-control solutions.

Product Insights

The Pyrethrin I segment dominated the product segment with a revenue share of 68.1% in 2024, due to its high insecticidal efficacy and wide adoption across household, agricultural, and public-health applications. Its consistent performance and established regulatory acceptance make it the preferred choice for formulators seeking reliable pest-control solutions. Leading manufacturers leverage Pyrethrin I in diverse product lines, ensuring stable demand and reinforcing its market leadership.

The Pyrethrin II is the fastest-growing segment with a CAGR of 7.1% during the forecast period, driven by increasing demand for formulations with enhanced knockdown efficiency and low-residue profiles. Its rapid adoption in modern eco-friendly insecticides reflects growing consumer preference for sustainable and safe pest-control solutions.

Application Insights

Agriculture & Horticulture dominated the application segment with a revenue share of 46.7% in 2024, driven by widespread adoption of eco-friendly and low-residue insecticides. Pyrethrin’s effectiveness against key crop pests and compliance with organic farming standards make it a preferred choice among growers. Manufacturers are increasingly integrating Pyrethrin-based solutions into large-scale agricultural applications, ensuring stable demand and reinforcing the segment’s leadership.

The household & residential segment is expected to depict the fastest CAGR of 7.1% over the forecast period, fueled by rising consumer awareness of safe and non-toxic pest-control solutions. Demand for convenient, ready-to-use pyrethrin-based sprays and aerosols is expanding rapidly across urban and semi-urban households. This trend encourages manufacturers to innovate in formulation and packaging, driving accelerated adoption and segment growth.

Regional Insights

“China registered the fastest CAGR of 8.3%, in terms of revenue, during the review period”

The natural pyrethrin industry in the Asia Pacific has gained impetus from the rising awareness of safe pest-control practices and expanding agricultural activities. The trend has driven the adoption of natural pyrethrin as a cleaner alternative to conventional insecticides. Growing urban populations further amplify demand for effective household pest solutions.

The China natural pyrethrin industry is witnessing tightening national regulations and a growing push for safer agricultural inputs. The move has accelerated the shift toward natural pyrethrin, supported by the rising consumer focus on low-residue pesticide solutions. Domestic producers are increasingly incorporating natural ingredients to enhance their market competitiveness.

Europe Natural Pyrethrin Market Trends

The natural pyrethrin industry in Europe dominated the market with the largest revenue share of 49.4% in 2024. Stringent environmental and safety regulations are accelerating the transition toward natural, plant-derived insecticides, positioning pyrethrin as a compliant and preferred option across regulated pest-management sectors. The regulatory landscape continues to incentivize natural inputs over synthetic alternatives.

Germany accounted for a robust share of 26.8% in 2024 and has gained momentum from strong adherence to sustainability standards and preference for bio-based ingredients, thereby reinforcing the adoption of natural pyrethrin across agriculture, home care, and garden applications. The country’s advanced regulatory framework continues to favor natural formulations.

North America Natural Pyrethrin Market Trends

The natural pyrethrin industry in North America is driven by strong consumer preference for safe, non-toxic pest-control solutions, prompting manufacturers and retailers to expand natural insecticide portfolios. This shift is reinforcing pyrethrin’s position in mainstream household and commercial applications.

U.S. Natural Pyrethrin Market Trends

The U.S. natural pyrethrin industry has observed heightened concerns about chemical exposure in residential and institutional environments, thereby driving strong demand for pyrethrin-based products as brands prioritize green-label innovation. Retailers are broadening natural product offerings to align with shifting consumer expectations.

Latin America Natural Pyrethrin Market Trends

The natural pyrethrin industry in Latin America is witnessing an uptick with high pest pressures driven by tropical climatic conditions. It has boosted reliance on natural insecticides like pyrethrin that offer safer performance across agricultural and household use. Export-focused growers are also adopting pyrethrin to align with global quality standards.

Middle East & Africa Natural Pyrethrin Market Trends

The natural pyrethrin industry in the Middle East & Africa has observed an intensified vector-control requirement due to widespread mosquito challenges that are generating strong demand for natural pyrethrin, especially within public health programs. Government-backed sanitation initiatives are further supporting market uptake.

Key Natural Pyrethrin Company Insights

BASF SE and Sumitomo Chemical Co., Ltd. dominate the Natural Pyrethrin Market by leveraging advanced formulation expertise, strong global distribution, and integrated supply capabilities. Their scale, innovation strength, and established market presence solidify their competitive leadership.

-

BASF SE maintains a strong position in the natural pyrethrin market through its advanced formulation capabilities and established crop protection portfolio. The company’s global distribution strength and steady investments in sustainable pest-control technologies support consistent market growth. Its strategic focus on compliant, high-performance bio-based solutions strengthens customer confidence and commercial reach.

-

Sumitomo Chemical leverages its R&D capabilities and long-standing presence in bio-insecticidal ingredients to sustain relevance in the natural pyrethrin market. The company benefits from an integrated supply chain and strong regulatory alignment across key regions. Its commitment to eco-efficient pest management and diversified customer reach enables consistent growth opportunities in this segment.

Key Natural Pyrethrin Companies:

The following are the leading companies in the natural pyrethrin market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Endura S.p.A.

- Botanical Resources Australia

- AgroPy Ltd.

- Horizon Sopyrwa

- KAPI Limited

- Neudorff

- The Pyrethrum Processing Company of Kenya Ltd (PPCK)

Recent Developments

-

23 May 2024 - BASF SE launched its SUWEIDA natural pyrethrin aerosol in China, using plant-derived pyrethrin sourced from Yuxi, Yunnan. The product provides rapid household pest control with low residue and enhanced safety, reinforcing BASF’s commitment to expanding eco-friendly pest management solutions in the consumer market.

-

05 December 2023 - Rovensa Next announced the launch of tec-fort, the first 100 % natural-pyrethrin bioinsecticide granted phytosanitary registration in Peru. Developed using advanced Promicell micro-encapsulation technology, the product provides growers with enhanced control over pests such as thrips and whiteflies, while maintaining low residue and organic-compliant credentials.

Global Natural Pyrethrin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 76.4 million

Revenue forecast in 2033

USD 128.3 million

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Sumitomo Chemical Co., Ltd.; Endura S.p.A.; Botanical Resources Australia; AgroPy Ltd.; Horizon Sopyrwa; KAPI Limited; Neudorff; The Pyrethrum Processing Company of Kenya Ltd (PPCK)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Pyrethrin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global natural pyrethrin market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pyrethrin I

-

Pyrethrin II

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agriculture & Horticulture

-

Household & Residential

-

Animal Health & Veterinary

-

Public Health

-

Timber Protection

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural pyrethrin market size was estimated at USD 72.6 million in 2024 and is expected to reach USD 76.4 million in 2025.

b. The global natural pyrethrin market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 128.3 million by 2030.

b. Europe dominated the natural pyrethrin market with largest revenue share of 49.4% in 2024. Stringent environmental and safety regulations are accelerating the transition toward natural, plant-derived insecticides, positioning pyrethrin as a compliant and preferred option across regulated pest-management sectors.

b. Some key players operating in the natural pyrethrin market include BASF SE, Sumitomo Chemical Co., Ltd., Endura S.p.A., Botanical Resources Australia, AgroPy Ltd., Horizon Sopyrwa, KAPI Limited, Neudorff, The Pyrethrum Processing Company of Kenya Ltd (PPCK).

b. The Natural Pyrethrin Market is expanding as stricter regulations on synthetic pesticides push industries toward safer, plant-based alternatives. Pyrethrin’s natural origin and lower toxicity make it well-suited to evolving safety and compliance standards. Manufacturers are adapting product portfolios to meet rising demand for eco-friendly formulations. These shifts are collectively strengthening market growth across household and industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.