- Home

- »

- Sensors & Controls

- »

-

Navigation Lighting Market Size, Share, Industry Report 2033GVR Report cover

![Navigation Lighting Market Size, Share, & Trends Report]()

Navigation Lighting Market (2025 - 2033) Size, Share, & Trends Analysis Report By Type (Sidelights, Masthead Light), By Technology (LED, Solar), By Installation Type (Fixed, Portable), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-659-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Navigation Lighting Market Summary

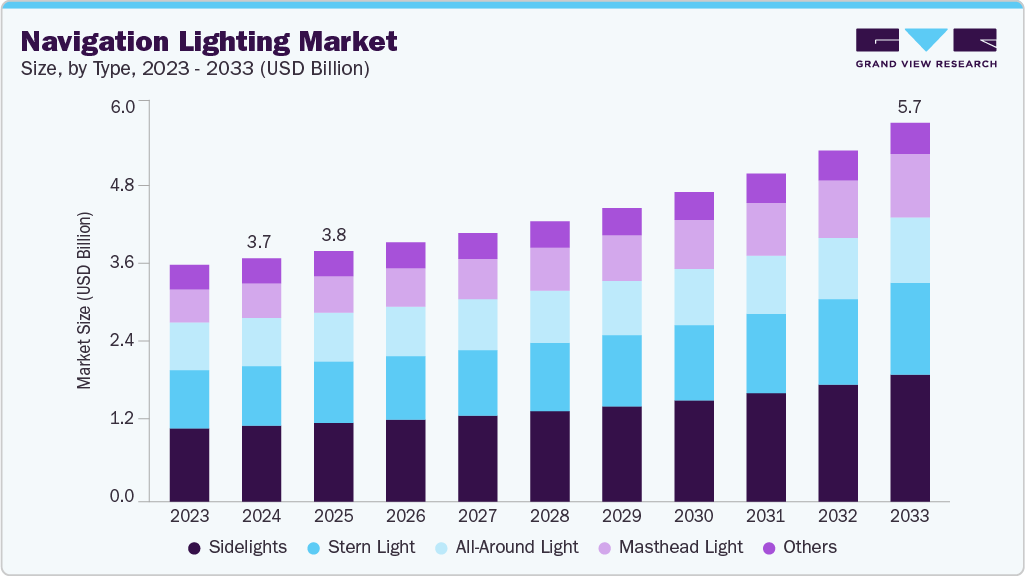

The global navigation lighting market size was estimated at USD 3.67 billion in 2024 and is projected to reach USD 5.74 billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The strict enforcement of international safety regulations governing the use of navigation lights in both the marine and aviation sectors is driving the navigation lighting market.

Key Market Trends & Insights

- Asia Pacific held 37.1% revenue share of the global navigation lighting market in 2024.

- In China, the global expansion of commercial and recreational marine and aviation sectors is accelerating the demand for navigation lighting systems.

- By type, sidelights segment held the largest revenue share of 31.3% in 2024.

- By technology, LED segment held the largest revenue share in 2024.

- By installation type, the fixed segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.67 Billion

- 2033 Projected Market Size: USD 5.74 Billion

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market in 2024

The increasing adoption of automation and autonomous systems across maritime and aviation domains fuels the demand for the navigation lighting market. Autonomous ships and drones require lighting systems that integrate with onboard sensors, communication modules, and collision avoidance systems. This creates opportunities for next-generation lighting systems equipped with data interfaces and self-monitoring capabilities. Manufacturers are focusing on developing intelligent lighting systems that can dynamically adjust intensity, report performance metrics, and integrate into broader control and monitoring networks, enhancing both safety and operational oversight.

The navigation lighting market is also benefiting from the defense sector's expanding investments in new-generation naval and aerial platforms. As nations invest in modernizing their military fleets, there is a parallel need for advanced lighting systems that meet tactical, stealth, and visibility requirements. Military aircraft and vessels often require specialized navigation lighting that supports infrared or NVG (night vision goggles) compatibility, enabling operations in covert or low-visibility scenarios without compromising the operator's situational awareness. Governments are not only upgrading existing fleets but also placing large orders for new platforms integrated with modular lighting systems that support multi-role and night-time operations. This focus on mission-critical performance in defense applications adds another layer of sophistication to the overall navigation lighting market, fueling R&D and high-value procurement contracts.

Furthermore, urbanization and the expansion of coastal infrastructure such as marinas, harbors, and small airports are contributing to the demand for fixed navigation lighting installations. As cities develop waterfronts for tourism, commerce, and logistics, there is a growing need for well-lit navigation routes, buoys, docks, and airstrips that remain safe and operational around the clock. These developments often include energy-autonomous lighting systems powered by solar panels or wind turbines that require minimal infrastructure and maintenance. The combination of expanding coastal economies and the need for 24/7 operational readiness in these zones has made fixed navigation lighting a growth segment within the broader market.

The integration of IoT (Internet of Things) and digital twins in transportation networks is also impacting how navigation lighting is conceptualized and implemented. In smart ports and airports, lighting systems are increasingly being connected to central control systems that can monitor their status, adjust brightness, and trigger alerts in case of malfunction. These intelligent systems contribute to predictive maintenance and operational efficiency, reducing downtime and enhancing safety. In many cases, navigation lights are becoming part of larger infrastructure automation strategies, supporting visibility and environmental monitoring, traffic flow analytics, and emergency response systems. This convergence of lighting technology with digital infrastructure underlines a shift from standalone products to integrated, data-driven solutions.

Type Insights

The sidelights segment dominated the navigation lighting market with a revenue share of 31.3% in 2024. A growing global fleet, spurred by rising international trade and maritime tourism, is contributing to the growth of this segment. As shipping companies expand their operations and cruise lines add new vessels to meet increasing passenger demand, the need for reliable and efficient navigation lighting, especially sidelights, rises in tandem. Furthermore, the expansion of domestic and regional shipping, particularly in developing economies across Asia, Africa, and Latin America, is generating significant demand for low-cost but durable sidelight systems.

The masthead light segment is projected to be the fastest-growing segment from 2025 to 2033. The trend of autonomous and remotely operated vessels is driving the growth of the masthead light segment. As unmanned surface vessels (USVs) and automated cargo ships begin trials and early installation types, they must still comply with COLREGs and be equipped with traditional navigation lights, including masthead lights, for visibility and to signal their movement patterns to manned vessels. This new application introduces additional requirements for integrating masthead lights with onboard automation systems, enabling remote monitoring, diagnostics, and fail-safes.

Technology Insights

LED segment dominated the navigation lighting market with a revenue share in 2024. The push for smart and connected navigation systems contributed to the segment's growth. LED technology enables greater flexibility in design and integration with digital control systems. Advanced LED navigation lights can be equipped with features such as automatic brightness adjustment based on ambient light, remote diagnostics, fault alerts, and integration into vessel or aircraft monitoring systems. These smart capabilities enhance operational efficiency and safety, especially in complex or automated environments like modern airports, seaports, and autonomous vehicle operations.

The solar segment is projected to be the fastest-growing segment from 2025 to 2033. The advancement of solar and battery technologies is also accelerating the growth of this market segment. Improvements in photovoltaic cell efficiency and the development of high-capacity, long-life lithium-ion batteries have significantly enhanced the reliability and performance of solar navigation lights. These systems can now store enough energy to function for several days without sunlight, ensuring consistent operation even during extended periods of cloud cover or inclement weather. In addition, rugged, corrosion-resistant enclosures and smart energy management systems allow solar navigation lights to perform reliably in extreme maritime environments and high-altitude locations.

Installation Type Insights

The fixed segment dominated the navigation lighting market in 2024. The growth of global trade and maritime activity drives the demand for fixed segments, especially as commercial shipping fleets expand and seaports become busier. Fixed navigation lights are standard equipment on cargo vessels, tankers, ferries, and other large vessels to meet international maritime laws and ensure nighttime navigation safety. Additionally, as new ports, terminals, and coastal infrastructure are developed, particularly in Asia-Pacific, the Middle East, and Africa, the need for fixed lighting systems installed on breakwaters, piers, and harbor entry points is also increasing.

The portable segment is projected to grow at a significant CAGR from 2025 to 2033. The rising popularity of recreational boating and small craft use, particularly in coastal regions and inland waterways, drives the segment’s growth. Small boats, kayaks, sailboats, and personal watercraft often lack the space or electrical systems to support fixed navigation lights. For these vessels, battery-operated or solar-powered portable lights provide an accessible and cost-effective solution for ensuring safety and regulatory compliance during night-time navigation or low-visibility conditions.

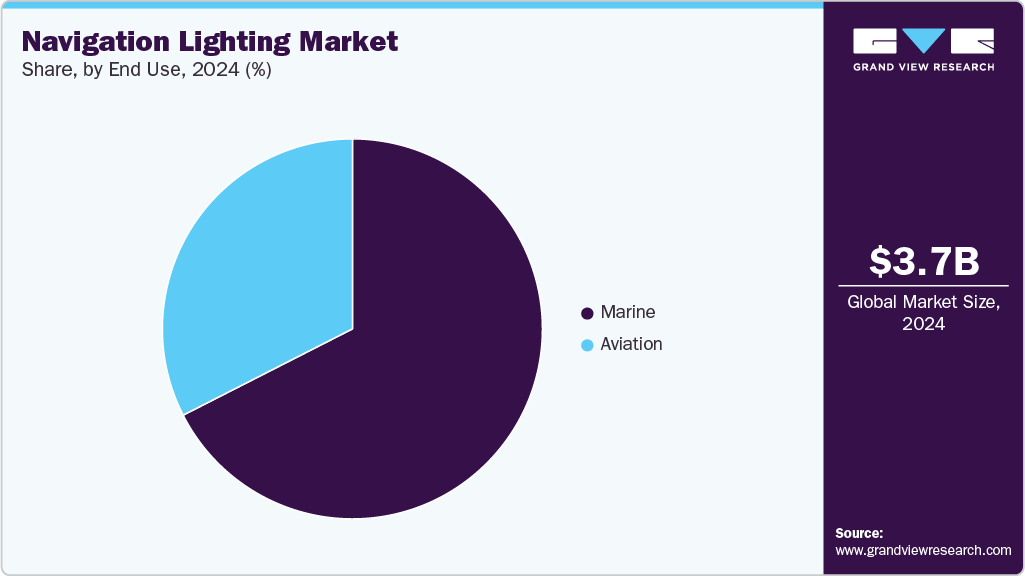

End Use Insights

The marine segment dominated the navigation lighting market in 2024. The growth of recreational boating and yachting, particularly in affluent regions such as the Mediterranean, Caribbean, and parts of Southeast Asia, drives the demand for the marine segment. Private vessel owners increasingly prioritize safety and aesthetics, creating a market for compact, stylish, and high-performance lighting systems. As more countries implement regulations requiring even small boats to carry functional navigation lights, particularly during night use or offshore trips, this segment is expanding rapidly.

The aviation segment is projected to be the fastest-growing segment from 2025 to 2033. Emerging aviation segments such as drones, electric vertical take-off and landing (eVTOL) aircraft, and urban air mobility (UAM) platforms are also driving the navigation lighting market growth. Regulatory authorities are starting to define visibility and safety standards for these new aircraft types, especially as they begin testing and limited commercial installation types in urban areas. Navigation lighting will be essential for ensuring airspace safety and integration with traditional aircraft, creating new niche markets for miniaturized, energy-efficient, and intelligent lighting systems tailored for these next-generation platforms.

Regional Insights

Asia Pacific navigation lighting market dominated the global market with a revenue share of 37.1% in 2024. Rapid infrastructure development, increasing maritime and aviation activity, and strong regulatory push from regional governments are driving the market growth. The region's economic expansion has led to heavy investments in transportation infrastructure, including new seaports, airports, inland waterways, and naval facilities. As these projects come online, the demand for advanced, compliant, and efficient navigation lighting systems has surged to ensure safety, visibility, and operational continuity in increasingly complex transport environments. Navigation lighting, both fixed and portable, has become a foundational requirement for meeting international safety standards and enabling seamless nighttime and low-visibility operations.

The navigation lighting market in China is projected to grow during the forecast period. China's substantial investment in port modernization and expansion as part of the Belt and Road Initiative (BRI) is driving the market growth. This infrastructure push has led to the installation of advanced navigation aids, including LED beacons, solar-powered buoys, and automated light towers across major ports and along newly developed inland waterways. These lighting systems are crucial for guiding vessels through complex routes, supporting 24/7 port logistics, and reducing the risk of marine accidents. Additionally, the increase in coastal tourism and recreational boating, particularly in regions such as Hainan and Guangdong, is generating new demand for compact and energy-efficient navigation lights for yachts, ferries, and leisure crafts.

India navigation lighting market is projected to grow during the forecast period. India’s growing defense and coast guard activities are also contributing to the market. The Indian Navy and Coast Guard are expanding their maritime presence with increased patrolling, surveillance, and modernization of naval bases. Navigation lighting plays a critical role in operational safety and strategic signaling, prompting the need for rugged, long-lasting, and energy-efficient lighting systems compatible with night-vision operations. Government initiatives further support this defense-driven demand focused on self-reliance in defense manufacturing, which includes the indigenization of critical equipment like advanced lighting systems.

Europe Navigation Lighting Market Trends

The navigation lighting market in Europe is expected to be the fastest-growing segment, with a CAGR of 6.7% over the forecast period. Europe’s inland waterways, including the Rhine, Danube, and Seine, play a vital role in regional freight transport and are another key factor driving the demand for the navigation lighting market. Governments across the region are working to revitalize these waterways as part of multimodal logistics chains, which require consistent and reliable lighting for safe vessel navigation. Projects funded through the EU and national programs are prioritizing low-maintenance, solar-powered navigation lights that can operate year-round and withstand fluctuating water levels and harsh weather conditions, particularly in Northern and Eastern Europe.

The UK navigation lighting market is projected to grow during the forecast period. The expansion of offshore wind energy installations around the British Isles also contributes to the navigation lighting market. These large-scale offshore renewable projects require specialized lighting systems for wind turbines, substations, and service vessels to ensure visibility, avoid collisions, and meet both civil and aviation safety codes. As offshore energy infrastructure grows, so does the demand for durable, weather-resistant lighting capable of operating in harsh marine environments and integrating with remote monitoring systems.

The navigation lighting market in Germany is projected to grow during the forecast period. The aviation segment is a major contributor to the navigation lighting market in Germany. The country’s international airports, such as Frankfurt, Munich, and Berlin Brandenburg, are critical aviation hubs for Europe and the world. These facilities demand advanced lighting systems for runways, taxiways, aprons, and approach paths to meet high traffic volumes and stringent safety requirements set by the European Union Aviation Safety Agency (EASA). As part of broader airport modernization initiatives, many facilities are replacing older lighting with smart LED-based systems that allow for energy efficiency, remote control, and adaptive brightness based on real-time weather and traffic conditions.

North America Navigation Lighting Market Trends

The North America navigation lighting market is expected to grow during the forecast period, driven by the region’s extensive maritime and aviation infrastructure, stringent safety regulations, and increasing emphasis on modernization and energy efficiency. As home to some of the world’s busiest ports, airports, and inland waterways, the U.S. and Canada rely heavily on advanced navigation lighting systems to ensure safe, continuous, and efficient operations across diverse environments and weather conditions. Government-backed infrastructure investment programs and a growing shift toward smart, energy-efficient technologies further amplify this demand.

The navigation lighting market in the U.S. is expected to grow during the forecast period. Tourism and recreational boating contribute to the demand for the navigation lighting market in the U.S., particularly in states with active coastal and lakefront economies, such as Florida, California, and Michigan. Marinas, yacht clubs, and municipal waterfronts increasingly invest in well-lit navigation systems to enhance visitor safety and meet regulatory standards. These facilities are adopting aesthetically designed, low-glare, and energy-efficient lighting that blends functional navigation with architectural appeal, reflecting a broader trend of integrating safety with user experience and environmental consciousness.

Key Navigation Lighting Company Insights

Some key companies operating in the market include Collins Aerospace and Perko Inc., among others.

-

Collins Aerospace, a subsidiary of RTX Corporation, is an aerospace and defense technology provider. The company designs robust LED navigation lights featuring a three-light configuration: a red forward light on the left wingtip, a green forward light on the right, and a rear white light color-coded to convey aircraft position and orientation in accordance with international aviation standards. These LED systems are engineered to withstand extreme operational stresses, including high temperatures, electromagnetic interference, vibration, and shock, ensuring long-lasting durability in challenging flight environments.

-

Perko Inc. is a U.S. manufacturer specializing in marine hardware and lighting. Its lighting portfolio encompasses LED and incandescent sidelights, bi‑color units, all‑round, masthead, stern, and pole lights suitable for vessels both under and over 20 m. Perko’s lights bear certifications from the U.S. Coast Guard, ABYC, and NMMA, ensuring compliance with USCG 1 nm/2 nm/3 nm standards and A‑16 certification for small boats.

Hella Marine, and Fishmaster are some emerging market participants in the navigation lighting market.

-

Hella Marine is a specialist in marine-grade lighting technology. Its NaviLED range includes port/starboard lights, stern lights, tri‑color masthead fixtures, and all‑round/anchor lamps. These lights are engineered to be fully sealed (IP 67), UV‑resistant, vibration‑proof, and suitable for both vertical and horizontal mounting. LED variants provide two- to three‑nautical‑mile visibility, comply with COLREGS and USCG regulations, and draw less than 3.5 W, significantly less power than traditional bulbs.

-

Fishmaster is a U.S.-based marine accessory brand that specializes in high-performance lighting solutions tailored for boats and other aquatic vessels. The brand offers a selection of navigation fixtures, including vertical mount, fold-down masthead/all-round lights in 12″ and 24″ sizes, designed to comply with Coast Guard standards for nighttime and low-visibility navigation. These lights emphasize safety and visibility through bright, wide-range LED illumination and often include rotating or folding capabilities.

Key Navigation Lighting Companies:

The following are the leading companies in the navigation lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Accon Marine

- Attwood

- Collins Aerospace

- Fishmaster

- Hella Marine

- Livorsi Marine

- Lopolight ApS

- Lumitec LLC

- Marinebeam

- Perko Inc.

- Phoenix Products LLC

- Seaview Global

- TACO Marine

- TecNiq Inc

- T-H Marine Supplies

Recent Developments

-

In April 2025, Satair and Collins Aerospace signed the cabin interior parts distribution agreement. This strategic collaboration combines Satair’s strengths in inventory management, forecasting, and logistics with Collins Aerospace’s high-quality cabin interior products. The agreement covers a broad portfolio, including emergency supplemental oxygen systems, galley equipment for in-flight beverage service, and various lighting solutions for both cabin and exterior applications such as logo, wing, landing, navigation, emergency, anti-collision, and taxi lights.

-

In April 2024, Perko Inc. collaborated with DuraBrite to expand the reach of advanced LED technology across a broader spectrum of recreational and commercial vessels in the marine industry. This strategic alliance represents a significant advancement in marine lighting, aiming to raise industry standards by delivering products that provide exceptional performance, enhanced safety, and long-term reliability. By integrating DuraBrite’s patented innovations, such as cutting-edge thermal management, proprietary energy-efficient circuitry, and precision-engineered optical control.

Navigation Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.79 billion

Revenue forecast in 2033

USD 5.74 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, installation type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Seaview Global; Livorsi Marine; Perko Inc.; Collins Aerospace; Marinebeam; Phoenix Products LLC; Lopolight ApS; Lumitec LLC; Fishmaster; T-H Marine Supplies; TACO Marine; Hella Marine; Attwood; Accon Marine; TecNiq Inc

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Navigation Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global navigation lighting market report based on type, technology, installation type, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sidelights

-

Stern Light

-

All-Around Light

-

Masthead Light

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

LED

-

HID

-

Incandescent

-

Halogen

-

Solar

-

-

Installation Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fixed

-

Portable

-

Surface Mount

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Marine

-

Aviation

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global navigation lighting market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 3.79 billion in 2025.

b. The global navigation lighting market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach USD 5.74 billion by 2033.

b. The sidelights segment dominated the navigation lighting market with a market share of 31.3% in 2024. A growing global fleet, spurred by rising international trade and maritime tourism, is contributing to the growth of the sidelights segment.

b. Some key players operating in the market include Seaview Global, Livorsi Marine, Perko Inc., Collins Aerospace, Marinebeam, Phoenix Products LLC, Lopolight ApS, Lumitec LLC, Fishmaster, T-H Marine Supplies, TACO Marine, Hella Marine, Attwood, Accon Marine, TecNiq Inc.

b. Factors such the strict enforcement of international safety regulations governing the use of navigation lights in both marine and aviation sectors and global expansion of commercial and recreational marine and aviation sectors is driving the navigation lighting market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.