- Home

- »

- Petrochemicals

- »

-

Needle Coke Market Size And Share, Industry Report, 2030GVR Report cover

![Needle Coke Market Size, Share & Trends Report]()

Needle Coke Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Super-Premium, Premium-Grade, Intermediate Grade), By Application (Electrode, Silicon Metals & Ferroalloys), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-492-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Needle Coke Market Size & Trends

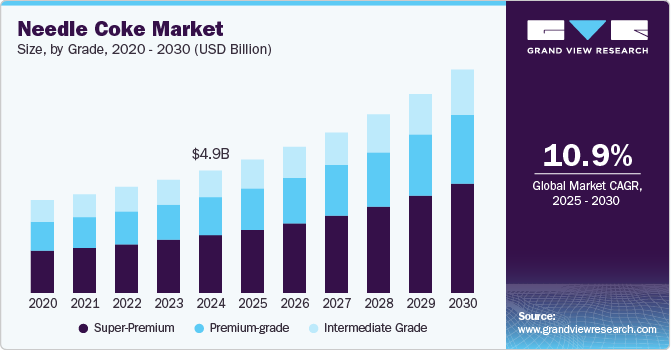

The global needle coke market size was valued at USD 4.93 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2030. There is increasing demand for needle coke in the production of graphite electrodes, which are essential for electric arc furnaces in the steelmaking process. In addition, the increasing demand for lithium-ion batteries in electric vehicles and energy storage systems, contribute to the growth of the market. Furthermore., technological advancements, strategic collaborations, and emerging markets also boost market opportunities.

This demand is being fueled by the expansion of the aluminum and steel sectors, driven primarily by infrastructural development, automotive manufacturing, and increased consumer goods demand. In addition, the market is positively impacted by the rise in strategic collaborations and emerging new markets, which act as market drivers and further boost beneficial opportunities for market growth.

The Asia-Pacific region, with countries such as China, Japan, South Korea, and India, is a major hub for steel production and electric arc furnace (EAF) steelmaking. Needle coke is a critical raw material for producing graphite electrodes used in EAFs. The expansion of steel production capacity in the Asia-Pacific countries has led to an increased demand for the market. In addition, the push for electric vehicles in the region has resulted in a surge in demand for lithium-ion batteries, which require needle coke-derived graphite as an anode material.

The global demand for products is also driven by the rising demand for graphite electrodes and lithium-ion batteries. Needle coke is a crucial raw material for the production of graphite electrodes used in EAFs and lithium-ion batteries. The increasing adoption of electric vehicles and the demand for clean energy are expected to further drive market growth and have a positive impact on the global market.

Grade Insights

The super-premium grade was valued at 46.9% in 2024, primarily driven by its highest purity levels, excellent crystalline structure, and optimal physical properties, such as a low coefficient of thermal expansion (CTE). These qualities make it ideal for high-performance applications such as graphite electrodes for electric arc furnaces in steel production and lithium-ion battery anodes. Furthermore, its low impurity levels ensure superior performance in extreme temperatures, supporting its increasing adoption in advanced technological applications.

Premium grade segment is expected to grow at a CAGR of 10.9% over the forecast period, owing to its higher quality compared to other grades. It is preferred in the production of high-quality graphite electrodes. Due to its low sulfur content, premium-grade product is commonly preferred in the steel industry. Furthermore, petroleum-based needle coke enhances wear and tear properties, making it suitable for various industrial uses. Moreover, the rising demand from the steel manufacturing industry and steel recycling also propels the market.

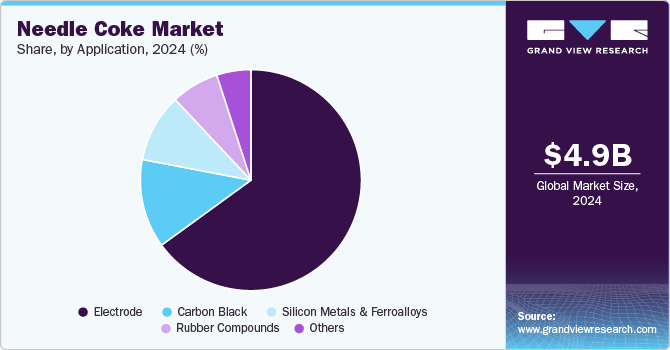

Application Insights

The electrode application segment led the market and accounted for the largest revenue share of 65.1% in 2024, primarily driven by the increasing use of electric arc furnaces (EAF) in steel production and the rising demand for energy-efficient steelmaking. In addition, graphite electrodes, crucial for EAFs, rely on needle coke due to its high thermal and electrical conductivity and low impurity levels. Furthermore, infrastructure development and industrialization globally further boost steel production, increasing the demand for high-quality graphite electrodes and, consequently, needle coke.

The Silicon Metals & Ferroalloys is expected to grow at a CAGR of 10.9% from 2025 to 2030, owing to the need for high-quality materials in the manufacturing process. The excellent thermal conductivity and heat resistance of graphite make it a preferred choice for heating elements in electric arc furnaces used in the production of silicon metals and ferroalloys. Furthermore, Needle coke is indispensable in these applications for achieving efficient and cost-effective processes.

Regional Insights

Asia Pacific needle coke market dominated the global market and accounted for the largest revenue share of 63.5% in 2024. The Asia-Pacific region, with countries such as China, Japan, South Korea, and India, is a major hub for steel production and electric arc furnace (EAF) steelmaking. Needle coke is a critical raw material for producing graphite electrodes used in EAFs. Furthermore, the need for high-quality coke in manufacturing electrodes for electric arc furnaces and lithium-ion batteries likely further boosts the market. General business expansion and modernization across APAC,

China Needle Coke Market Trends

The needle coke market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the country's substantial steel production. As a top steel-producing nation, China likely needs a lot of needle coke as a raw material for electrodes in electric steel furnaces. In addition, the country's economic growth, industrialization, and urbanization may have led to an increase in steel production, likely driving the demand for needle coke.

Latin America Needle Coke Market Trends

Latin America needle coke market is expected to grow at a CAGR of 10.6% over the forecast period, owing to the growth of the steel industry. Needle coke is used in the production of graphite electrodes, which are essential for electric arc furnaces used in steel production. In addition, the rising demand for lithium-ion batteries, driven by the growing popularity of electric vehicles and portable electronic devices, is expected to contribute to the demand product in the region.

North America Needle Coke Market Trends

The needle coke market in the North America is expected to grow significantly over the forecast period, driven by factors such as technological advancements, strategic partnerships, and emerging marketplaces. However, challenges such as the high production cost of needle coke and stringent environmental regulations may impact the market.

The U.S. needle coke market dominated the North American market with the highest revenue share in 2024, driven by the increasing demand for lithium-ion batteries, due to EV expansion and renewable energy storage. Needle coke's properties make it important for graphite anodes in these batteries. In addition, the push toward decarbonization and sustainable energy solutions has possibly led to investments in EV production and energy storage technologies, potentially creating strong needle coke demand.

Europe Needle Coke Market Trends

The needle coke market in Europe is expected to be driven by the demand from the steel and automotive sectors. Needle coke is used in the production of graphite electrodes, which are essential for electric arc furnaces used in steel production. The automotive industry also utilizes needle coke in the manufacturing of lithium-ion batteries for electric vehicles. Furthermore, the presence of manufacturing facilities in countries such as Germany indicates the importance of the market in the country.

Key Needle Coke Company Insights

Key players in the needle coke industry include Graphite India Limited (GIL), IOCL, Phillips 66, and China National Petroleum Corporation, among others. These players enhance their market presence through strategies such as partnerships, agreements, and collaborations. In addition, they focus on technological advancements to improve product quality and meet the growing demand from the electric vehicle battery and steel manufacturing sectors.

-

Graphite India Limited (GIL) is a manufacturer of Graphite Electrodes as well as Carbon and Graphite Specialty products. The company's manufacturing facilities are spread across six plants in India, and it also has a 100% owned subsidiary in Nuremberg, Germany, called Graphite COVA GmbH. The company participate in the needle coke market, where needle coke demand is reportedly being driven by its use in lithium-ion batteries.

-

Sumitomo Chemical operaties in different regions, serving customers worldwide and operates in areas such as animal nutrition, crop health solutions, environmental health solutions, and more. Sumitomo Chemical Europe N.V./S.A. conducts business in Belgium and manufactures industrial chemical products. The company is involved in needle coke production, a material used in graphite electrodes for electric arc furnaces.

Key Needle Coke Companies:

The following are the leading companies in the needle coke market. These companies collectively hold the largest market share and dictate industry trends.

- Phillips 66

- Asbury Carbon Inc.

- Seadrift Coke L.P.

- Sumitomo Chemical Company

- Mitsubishi Chemical Corp.

- JXTG Nippon Oil & Energy Corp.

- Indian Oil Corporation Limited

- Graftech International

- Sojitz Ject Corp.

- C-Chem Co., Ltd.

- Baosteel Group

Recent Developments

-

In January 2025, Chevron Lummus Global and TAQAT announced a new license and engineering agreement for the production of needle coke and synthetic materials. This collaboration aims to enhance needle coke production capabilities, which are essential for industries such as steel manufacturing and battery production. The agreement is a significant step toward meeting the growing demand for high-quality needle coke, reinforcing both companies' commitment to advancing technologies in the energy and materials sectors.

-

In November 2023, HEGLTD announced its strategic initiatives to enhance operations in critical sectors, including the needle coke market. The company emphasized its commitment to expanding its influence in high-demand industries such as steel production and energy, where needle coke plays a key role. They detailed ongoing advancements in technology and sustainability efforts aimed at meeting the evolving needs of these markets. HEGLTD’s efforts align with global trends toward increased demand for high-quality materials, especially needle coke, in various applications.

-

In April 2023, GrafTech International Ltd. announced the opening of a new sales office in Dubai as part of its strategic expansion. This move is aimed at strengthening GrafTech's presence in the Middle East and supporting the growing demand for needle coke in the region. The company highlighted its commitment to enhancing customer relationships and providing high-quality needle coke products used in steel production and other critical industries. This expansion is a key step in GrafTech's global growth strategy.

Needle Coke Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.35 billion

Revenue forecast in 2030

USD 9.00 billion

Growth Rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, Italy, France, UK, China, India, Japan, South Korea, Brazil, and Qatar

Key companies profiled

Phillips 66; Asbury Carbon Inc.; Seadrift Coke L.P.; Sumitomo Chemical Company; Mitsubishi Chemical Corp.; JXTG Nippon Oil & Energy Corp.; Indian Oil Corporation Limited; Graftech International; Sojitz Ject Corp.; C-Chem Co., Ltd; Baosteel Group

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

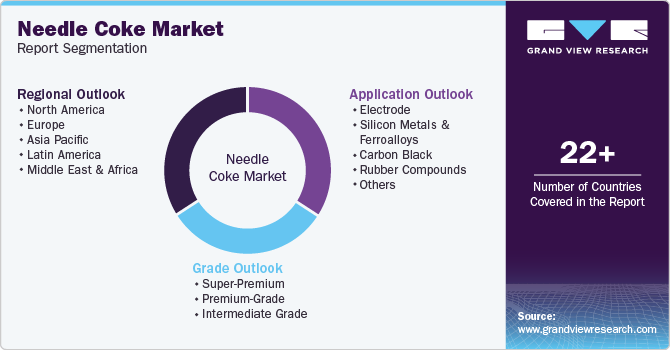

Global Needle Coke Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global needle coke market report based on grade, application, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Super-Premium

-

Premium-Grade

-

Intermediate Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrode

-

Silicon Metals & Ferroalloys

-

Carbon Black

-

Rubber Compounds

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.