- Home

- »

- Clinical Diagnostics

- »

-

Neglected Tropical Diseases Diagnosis Market Report, 2030GVR Report cover

![Neglected Tropical Diseases Diagnosis Market Size, Share & Trends Report]()

Neglected Tropical Diseases Diagnosis Market Size, Share & Trends Analysis Report By Disease (Dengue, Chikungunya, Rabies, Leprosy), By Diagnostic Method, By Service Type, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-319-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

NTD Diagnosis Market Size & Trends

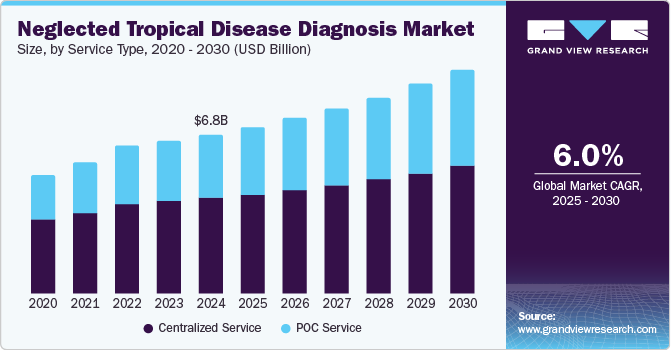

The global neglected tropical diseases diagnosis market size was estimated at USD 6.84 billion in 2024 and is projected to grow at a CAGR of 6.03% from 2025 to 2030. Growing awareness of NTDs and an increasing number of initiatives undertaken by the government are anticipated to fuel the market growth. For instance, the inclusion of NTDs in the Sustainable Development Goals (SDG), a United Nations Development Program, as a global target is anticipated to fuel market growth. Furthermore, various initiatives being undertaken by WHO, such as road map 2030 for the elimination of NTDs, are expected to drive market growth over the forecast period.

Due to the outbreak of the COVID-19 pandemic, the neglected tropical diseases (NTD) diagnosis market experienced a significant setback. WHO launched the Global Program to Eliminate Lymphatic Filariasis (GPELF) in 2000, which aims to stop the spread of infection and relieve the pain of those who have already been afflicted. However, according to the pulse survey conducted by WHO, as of early 2021, the neglected tropical disease program has faced disruptions in 44% of countries. Moreover, the high risk of transmission of SARS-CoV-2 infection has affected the public health approaches for NTDs. In countries with low health budgets, funds being shifted to tackle other diseases, and a shortage of funding from international partners and the foreign government has significantly impacted the market growth.

The NTD program has expanded its support to 31 countries in Asia, Latin America, and Africa. Besides, it has provided more than 2.6 billion treatments and leveraged more than USD 22.3 billion in donated medicines. Government organizations such as CDC and WHO collaborate with counties to improve existing public health services for NTDs. Moreover, in January 2021, the WHO introduced its roadmap for NTDs for the period 2021 to 2030. It is aimed to increase the prevention and control of neglected tropical diseases worldwide. Such initiatives undertaken by the government bodies are anticipated to drive the market growth over the forecast period.

Globally, several organizations initiated multiple programs that contribute to a rise in awareness about NTDs, including the Global NTD Program by the Centers for Disease Control and Prevention, Global NTD Programs by the World Health Organization, NTD Program by the United States Agency for International Development, the United States Global Health Initiative. The primary focus of all these programs is on controlling or eliminating NTDs. Similarly, the London Declaration was initiated to sustain, expand, and extend different programs to support & control guinea worm disease, leprosy, lymphatic filariasis, sleeping sickness, trachoma, schistosomiasis, and Chagas disease by 2020.

The increasing burden of Neglected Tropical Diseases (NTDs) is considered a major factor fueling the growth of the overall market over the forecast period. According to WHO estimates, more than 1.7 billion individuals- about one-fifth of the world’s population-mostly in lower-income and developing countries-required interventions for at least on NTD every year. Around 40% of the African region was affected by NTDs. These diseases are more prevalent among poor populations living in tropical environments and difficult-to-access areas. Countries such as Brazil, Yemen, India, Bangladesh, China, and some countries in Central & East Africa contribute the majority of NTD cases globally.

The global market for neglected tropical disease (NTD) diagnostics is experiencing significant growth, driven by innovations and an increased focus on combating diseases like dengue and chikungunya. bioMérieux, a leader in in vitro diagnostics, in May 2022 announced the CE marking of its VIDAS Anti-CHIKUNGUNYA IgM and IgG tests. Designed for use on the VIDAS range of immunoassay instruments, these automated tests provide reliable results for diagnosing Chikungunya virus (CHIKV) infections during both acute and chronic phases. The technology, based on methods developed by the Vaccine Research Center (VRC) at NIAID, ensures high performance and accuracy, aiding differentiation from similar febrile illnesses such as dengue and malaria. The tests' user-friendly features, like single-sample testing and automated "Load & Go" processes, make them accessible to laboratories of all sizes. In parallel, in September 2021, CoSara Diagnostics, a joint venture of Co-Diagnostics, Inc., secured clearance from India’s Central Drugs Standard Control Organization (CDSCO) to manufacture and sell Saragene dengue and chikungunya RT-PCR test kits. These kits leverage patented CoPrimer™ technology for the qualitative detection of mosquito-borne viruses.

With diseases like dengue now affecting up to 400 million people annually and chikungunya causing significant disability and socioeconomic impact, the demand for accurate, scalable diagnostics is critical. By addressing these needs, companies like bioMérieux and Co-Diagnostics are playing a vital role in improving disease management and public health in regions most affected by NTDs.

Disease Insights

Based on disease, soil-transmitted helminthiases dominated the market with 9.88% in 2024, owing to the increasing prevalence and high adoption of diagnostic tests. Moreover, the low false-positive rate of molecular diagnostics provides a competitive advantage over conventional and rapid tests. Furthermore, according to the WHO, as of January 2022, more than 1.5 billion people are infected with soil-transmitted helminth infections worldwide. The Kato-Katz technique is the WHO gold standard that is widely used to diagnose the intensity of STHs. Besides, neglected tropical diseases such as dengue, chikungunya, lymphatic filariasis, foodborne trematode infections, and others also held a significant share of the global market.

The dracunculiasis segment is estimated to exhibit the fastest CAGR of 5.51% over the forecast period. In April 2024, Researchers at Georgia Institute of Technology (Georgia Tech) partnered with The Carter Center to support efforts to eradicate dracunculiasis (Guinea worm disease, GWD) using mathematical modeling and analytics. GWD, caused by the parasite Dracunculus medinensis, currently has no diagnostic test, vaccine, or treatment. Eradication strategies focus on community surveillance, health education, water source treatment, and behavior changes like filtering drinking water and preventing contamination by infected humans and dogs. Georgia Tech researchers developed an agent-based simulation model to evaluate the impact of a diagnostic test for pre-patent infections in dogs, a potential “game changer” highlighted by WHO for accelerating global eradication efforts.

Diagnostics Method Insights

The conventional method segment dominated the market in 2024 with a revenue share of 49.00%, which can be attributed to high usage rates. Conventional diagnostic methods are based on microscopic & macroscopic identification of pathogens through gram stain, pathogen culturing, biochemical methods, and serology tests. Relatively higher availability of conventional methods, compared to modern techniques, across a large number of labs and clinics is a key factor that has enabled this segment to dominate the market. However, these tests exhibit certain limitations relating to speed, timeline, and accuracy. Furthermore, rapid technological advances are compelling end users to opt for molecular/modern methods over conventional methods.

Moreover, the molecular/modern method segment is anticipated to experience the fastest CAGR over the forecast period. An increase in R&D for molecular diagnostic techniques coupled with a rise in demand for point-of-care products is expected to boost the market growth at a CAGR of 5.04% by 2030. American Leprosy Missions (ALM) has launched an innovative project to develop molecular diagnostics for detecting five skin-neglected tropical diseases (NTDs): leprosy, Buruli ulcer, yaws, cutaneous leishmaniasis, and mycetoma. Supported by the Anesvad and Raoul Follereau Foundations, this initiative aims to create a multiplex assay that simplifies the simultaneous detection of these diseases, which require similar diagnostic and management approaches. Collaborating with Biomeme, Inc., ALM leverages advanced qPCR technology, including a mobile thermocycler and smartphone integration. This portable setup enables rapid DNA and RNA detection, delivering results in 30–45 minutes without the need for electricity or complex logistics. Building on prior successes, ALM has already developed assays for Buruli ulcer and leprosy, which are undergoing prequalification and evaluation phases. The new multiplex assay is poised to address diagnostic challenges in low-resource settings, significantly reducing delays and costs while advancing global efforts to eliminate skin NTDs.

Service Type Insights

Centralized service was the largest segment in terms of market share of 59.93% in 2024 owing to high procedure volume and wide presence of ancillary support in terms of infrastructure and manpower. However, the PoC segment is likely to be the fastest-growing segment over the forecast period. Rising demand for bedside patient care due to the booming home healthcare market, technological advancements, and increasing market penetration are among the major factors driving the segment growth.

Furthermore, POC services provide quick results, allowing immediate diagnosis and better patient outcomes. Moreover, in May 2022, Anitoa Systems, a medical technology company, introduced a portable RT-PCR test for dengue virus detection, expanding its Maverick line of RT-PCR devices. This multiplex test identifies multiple target genes associated with severe dengue symptoms, enabling early and precise diagnosis. Established in 2013, Anitoa focuses on developing diagnostic solutions for neglected tropical diseases, addressing the unique challenges of low-resource settings. The portable Maverick platform is designed to provide advanced molecular diagnostics with minimal infrastructure, supporting efforts to combat tropical diseases through accessible and efficient testing.

End-use Insights

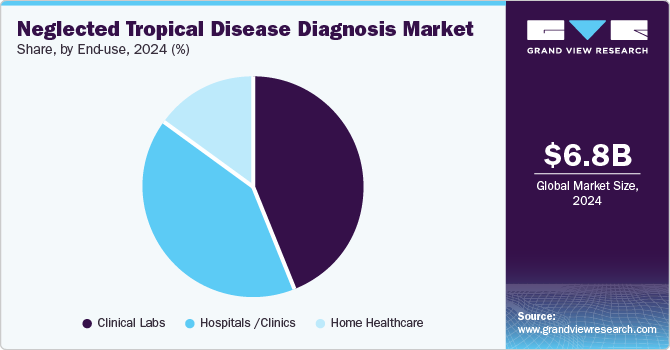

The clinical laboratory segment held the largest market share of 44.16% in terms of revenue owing to high market penetration & procedure volumes and a large number of laboratories in emerging & underdeveloped markets. Moreover, an increase in the number of initiatives undertaken by the government to provide various services, such as reimbursement for diagnostic tests, is another major factor anticipated to drive the market. However, the home healthcare segment is expected to grow at the fastest CAGR owing to the increasing adoption of point-of-care testing services.

The home healthcare segment is expected to grow at the fastest CAGR of 6.49% in 2024. The home healthcare segment is emerging as the fastest-growing segment in the market, addressing challenges in low-resource settings. Portable diagnostic tools like RT-PCR devices and molecular assays are revolutionizing early detection by enabling point-of-care testing in remote areas. These advancements reduce reliance on centralized labs, making testing more accessible and timely. By leveraging user-friendly, field-ready technologies, the home healthcare segment supports faster diagnosis and management of diseases like dengue, leprosy, and Buruli ulcer, ultimately contributing to global efforts for NTD elimination.

Regional Insights

The North America Neglected Tropical Diseases (NTD) Diagnosis Market is driven by increased awareness and funding for tropical diseases, including Chagas disease and leishmaniasis. Advanced diagnostic technologies, such as molecular and serological assays, are gaining traction due to their high accuracy and efficiency. Government and non-governmental organizations are investing in research and development for improved diagnostic tools. Additionally, the rise in travel-related and immigrant-associated cases is boosting the demand for accessible and rapid diagnostics across the region.

U.S. Neglected Tropical Diseases Diagnosis Market Trends

The U.S. Neglected Tropical Diseases (NTD) Diagnosis Market is witnessing growth due to rising awareness of tropical diseases, particularly in immigrant and travel-associated populations. Advances in diagnostic methods, such as PCR-based assays and rapid serological tests, are enhancing detection accuracy and efficiency. Increased funding from government initiatives and organizations like the CDC supports research and diagnostics for diseases like Chagas and West Nile virus. Additionally, collaborations between public health agencies and diagnostic companies are fostering innovation and market expansion.

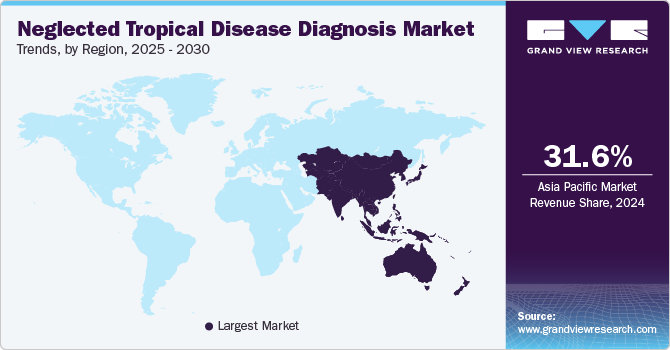

Asia Pacific Neglected Tropical Diseases Diagnosis Market Trends

Asia Pacific neglected tropical diseases diagnosis market held a 31.57% share of the global market in 2024 due to the high disease burden of NTDs, increased healthcare expenditure, rapid technological advancements, proactive government initiatives, and a rise in customer awareness about using PCR tests in diagnosing NTDs.

China's neglected tropical diseases (NTDs) diagnostics market is witnessing significant growth, driven by government initiatives and advancements in healthcare technology. Rising awareness about NTDs like schistosomiasis, dengue, and leprosy has boosted demand for accurate and portable diagnostic tools. Innovations such as molecular assays and rapid test kits are addressing diagnostic challenges in endemic regions, improving early detection and disease management. China's focus on integrating digital health solutions and mobile diagnostics is further enhancing accessibility, while collaborations with global health organizations are strengthening efforts to combat NTDs effectively.

India's neglected tropical diseases (NTDs) diagnostics market is expanding due to the high prevalence of diseases like leprosy, lymphatic filariasis, and kala-azar. Government programs like the National Vector Borne Disease Control Programme (NVBDCP) and initiatives from international organizations are driving efforts to improve diagnostics and disease surveillance. Innovations such as portable molecular diagnostic tools and cost-effective rapid test kits are enhancing early detection, particularly in rural areas. Increased public health funding, awareness campaigns, and collaborations with technology providers are further propelling advancements in India’s NTD diagnostics landscape.

Indonesia's neglected tropical diseases (NTDs) diagnostics market is growing, driven by the prevalence of diseases like lymphatic filariasis, dengue, and soil-transmitted helminths. Efforts by the government and global health organizations to strengthen healthcare infrastructure are boosting demand for accurate and scalable diagnostic solutions. Portable rapid test kits and molecular diagnostics are gaining traction, particularly in remote and resource-limited areas. Public-private partnerships, increased awareness campaigns, and integration of diagnostic technologies into national health programs are key factors propelling market growth and improving NTD detection and management in Indonesia.

Latin America Neglected Tropical Diseases Diagnosis Market Trends

Latin America neglected tropical diseases diagnosis market is expected to show the fastest growth at a CAGR of 6.89% during the projected period due to increased IVD product penetration and the high disease burden of NTDs in developing countries in the region.In addition, an increase in government spending, the presence of skilled healthcare professionals, and a rise in the focus of multinational diagnostic companies on the development of advanced & novel IVD products are among the factors likely to drive market growth in Latin America. However, low awareness about the prevention & treatment of infectious diseases in underdeveloped areas and the lack of favorable reimbursement policies are some of the key factors restraining market growth.

Brazil's neglected tropical diseases (NTDs) diagnostics market is expanding due to the significant burden of diseases like dengue, Chagas disease, leishmaniasis, and schistosomiasis. Government initiatives under the Unified Health System (SUS) and partnerships with international health organizations are driving improvements in diagnostics. Advancements in molecular diagnostics, such as RT-PCR and multiplex assays, are enhancing early detection and disease monitoring. In addition, portable and cost-effective diagnostic tools are being deployed in remote and underserved regions. Increased investments in public health infrastructure and research are further accelerating the growth of NTD diagnostics in Brazil.

Argentina’s neglected tropical diseases (NTDs) diagnostics market is anticipated to grow over the forecast period. Recently, Argentina proposed reform in its healthcare system, stating that the controlling power of private pavers should be with the government. This may lead to affordable pricing of tests for the common population, leading to an increase in the demand for IVD instruments and reagents.

Key Neglected Tropical Diseases Diagnosis Company Insights

Some of the key market players include Abbott,Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, ZeptoMetrix, and InBios International, Inc. These players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors.

Key Neglected Tropical Diseases Diagnosis Companies:

The following are the leading companies in the neglected tropical diseases diagnosis market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Abbott

- Thermo Fisher Scientific Inc.

- ZeptoMetrix

- InBios International, Inc.

- Genome Diagnostics Pvt. Ltd.

- Omega Diagnostics Group PLC

- Coris BioConcept

- DiaSys Diagnostic Systems GmbH

- Oscar Medicare Pvt Ltd.

View a comprehensive list of companies in the Neglected Tropical Diseases Diagnosis Market

Recent Developments

-

In June 2023, GenWorks Health, a Bengaluru-based startup, launched innovative in vitro diagnostics (IVD) solutions, including rapid test kits for detecting dengue and malaria. These tests aim to support the prevention, diagnosis, and treatment of seasonal epidemics, reducing their overall impact. The iScreen Malaria Card Antigen (Pf/Pv) is a key offering, utilizing lateral flow immunoassay technology for the qualitative detection of Plasmodium falciparum (via histidine-rich protein-2, Pf HRP-2) and Plasmodium vivax (via lactate dehydrogenase, pLDH) in human blood. Boasting 98.5% sensitivity and 95% specificity, it enhances accuracy and accessibility in malaria diagnosis, particularly in resource-limited settings.

-

In August 2024, J Mitra & Company introduced India's first self-test kit for dengue, the Dengue NS1 Antigen self-test kit. This innovative home-testing solution allows for the early detection of dengue by identifying the NS1 antigen from the first day of symptom onset. The kit empowers individuals with a quick and convenient diagnostic tool, reducing delays in seeking medical attention. This proactive approach is expected to enhance early intervention, improve patient outcomes, and play a significant role in managing dengue outbreaks across India.

Neglected Tropical Diseases Diagnosis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.16 billion

Revenue forecast in 2030

USD 9.59 billion

Growth rate

CAGR of 6.03% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, diagnostic method, service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, China, India, Indonesia, Malaysia, Brazil, Colombia, Venezuela, Nigeria

Key companies profiled

F. Hoffmann-La Roche Ltd, Abbott, Thermo Fisher Scientific Inc., ZeptoMetrix, InBios International, Inc., Genome Diagnostics Pvt. Ltd., Omega Diagnostics Group PLC, Coris BioConcept, DiaSys Diagnostic Systems GmbH, Oscar Medicare Pvt Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neglected Tropical Diseases Diagnosis Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global neglected tropical disease diagnosis market report based on disease, diagnostic method, service type, end use, and regions.

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Dengue

-

Chikungunya

-

Rabies

-

Leprosy

-

Buruli Ulcer

-

Yaws

-

Lymphatic Filariasis

-

Taeniasis/Cysticercosis

-

Foodborne Trematodiases

-

Echinococcosis

-

Chagas Disease (American Trypanosomiasis)

-

Dracunculiasis

-

African Trypanosomiasis

-

Soil-transmitted Helminth Infections

-

Onchocerciasis

-

Schistosomiasis

-

Scabies and Other Ectoparasites

-

Snakebite Envenoming

-

Leishmaniasis

-

-

Diagnostic Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Method

-

Molecular/Modern Method

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Centralized Service

-

POC Service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Labs

-

Hospitals /Clinics

-

Home Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Asia Pacific

-

China

-

India

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Colombia

-

Venezuela

-

-

Middle East and Africa (MEA)

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global neglected tropical diseases diagnosis market size was estimated at USD 6.84 billion in 2024 and is expected to reach USD 7.16 billion in 2025

b. The global neglected tropical diseases diagnosis market is expected to grow at a compound annual growth rate of 6.03% from 2025 to 2030 and is expected to reach USD 9.59 billion by 2030.

b. The soil-transmitted helminthiases segment is expected to dominate the neglected tropical diseases diagnosis market with a share of 9.90% in 2024 due to the increasing prevalence and high adoption of diagnostic tests.

b. Some key players operating in the neglected tropical diseases diagnosis market include Abbott, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, and InBios International, Inc. among others.

b. The increasing burden of neglected tropical diseases, growing awareness of NTDs, and an increasing number of initiatives undertaken by the governments are the major factors driving the neglected tropical diseases diagnosis market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."