- Home

- »

- Next Generation Technologies

- »

-

Network Access Control Market Size & Share Report, 2030GVR Report cover

![Network Access Control Market Size, Share & Trends Report]()

Network Access Control Market (2023 - 2030) Size, Share & Trends Analysis Report By Type, By Enterprise Size, By Deployment, By Vertical, By Region, And Segment Forecasts

- Report ID: 978-1-68038-721-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global network access control market size was evaluated at USD 2.51 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.2% from 2023 to 2030. The growing incidents of non-corporate devices hampering corporate networks and breaching privacy laws require businesses to invest additional costs and attention to ensure network security. Network access control ensures a higher level of authentication, authorization, and compliance policies to permit access across the users’ network. It also allows users to instantly block devices, users, and endpoints from making unwanted connections. Thus, it offers advanced protection against data security breaches, helps restrict malicious activities, safeguard critical information, and offers higher visibility on the security posture of connected devices. These factors are expected to bode well for the market.

The recent trends such as hybrid work culture, bring your own devices, and remote working scenarios are increasing the dependency of users’ devices on business networks and are the key factors driving the market’s growth across various industries such as BFSI, IT & Telecommunication, healthcare, government, and manufacturing.

Further, the rising use of technology-enabled devices such as the Internet of Things (IoT) is being rapidly utilized by businesses, leading to potential threats of offering access to unwanted and malicious applications and devices. Thus, organizations that remain protected against cybercrimes, data theft, and malware are adopting network access control systems and solutions that help them regain control over their network, authorize and deny access, and monitor the security postures of organizational devices.

The rising access to third-party and non-employed resources further drives the need for the NAC solution. It helps reduce the costs and time associated with authorizing and authenticating networks and devices and enables users to determine whether the devices are compliant enough. In recent years, cybercriminals have adopted highly sophisticated campaigns to exploit vulnerabilities across various industries such as BFSI, IT, and government organizations.

The rising technology advancements across network access control solutions are helping users to detect unusual activities and suspicious network breaches while enabling them to isolate and quarantine critical devices from the network. Thus, it helps in protecting users against potential damages the key factor expected to drive the demand.

The growing adoption of web applications, IoT devices, and industrial software across verticals such as BFSI, Government, IT & telecommunication contains highly confidential information related to customers, vendors, and employees. These organizations follow strict security regulatory compliance, authentication, and verification guidelines and spend significant amounts to deploy network access control solutions.

For instance, in June 2023, Fortinet, a security and networking solutions provider, announced that 11 renowned managed security service providers initiated the adopted Fortinet’s’ Secure SD-WAN solution named as solutions by KT Corporation; STCClaro Empresas, Kyndryl, InfiniVAN, Inc., Globe Business, 11:11 Systems, SPTel, Sify Technologies, Neurosoft S.A., and Tata Teleservices to offer enhanced user experience and drive better business outcomes without compromising on security positioning.

Key companies in the market are taking various strategic initiatives, such as new product launches, partnerships, and mergers and acquisitions, to offer advanced solutions and service offerings. For instance, in February 2023, Cisco announced a series of innovations in cloud-managed networking to help customers simplify their IT operations with advanced and powerful cloud management tools enabling simplified dashboard operation, flexible network intelligence, and sophisticated IoT applications to visualize and secure industrial assets.

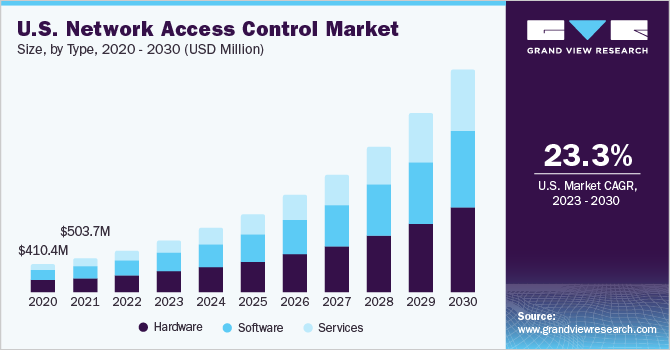

Type Insights

The hardware segment accounted for the largest market share of 42.63% in 2022. The hardware solutions and devices consist of firewalls, routers, switches, controllers, and others designed to deliver high-performance capability and dynamic network security functionalities. These advanced NAC hardware solutions provide endpoint security, network security, web-based application security, and identity and access management, enabling superior visibility and representation of real-time threats across the users’ network are the key factors expected to drive the growth of the segment.

The services segment is anticipated to grow at a CAGR of 30.3% during the forecast period. Network access control services include deployment, customer support, maintenance, training, and consultation services. The rising demand for network access control solutions, devices, and infrastructures is expected to support the service segments for a more extended period owing to the regular need for support and maintenance, license renewal, and customer support requirements are the primary factors expected to drive the growth of the segment.

Deployment Insights

The cloud-based segment accounted for a market share of 51.98% in 2022. Cloud-based network access control is primarily defined as subscription models. It enables organizations to access and utilize advanced network security offerings from the cloud infrastructure. It offers organizations a cost-effective and flexible way of monitoring and ensuring network security based on usage, demand, and buying capabilities. Thus, the underlined factors are expected to drive the growth of the cloud-based network access control segment during the forecast period.

The on-premise segment is expected to grow at a CAGR of 25.5% over the forecast period. On-premise network access control offers in-house solution offerings where the organizations can run and maintain their network’s security with higher flexibility in the usage as per their focus areas, organizational demand, and changing business requirements, along with offering complete control on the use and management. These factors are expected to drive the segment’s growth in the network access control market.

Enterprise Size Insights

The large enterprise segment accounted for a revenue share of 54.49% in 2022. The rising incidences of cyberattacks, data theft, and security breaches due to the rapid use of technologies, connected devices, remote work cultures, and the use of unsecured networks to share data are the key factors attracting cybercriminals toward large organizations such as banking and financial institutions, IT companies, healthcare institutes, and government organizations. Thus, ensuring the safety of organizational networks and connected devices is becoming highly important among large organizations.

The SMEs segment is expected to grow at the highest CAGR of 27.8% during the forecast period. Small and medium enterprises are emerging as the easiest and most valuable target for cybercriminals due to the lack of adoption of security solutions, accessible to-comprisable networks, and lack of technological knowledge and infrastructures. The growing technological advancements in the network security industry offering reliable and cost-effective solutions are the key factors expected to drive the adoption of network access control software and hardware solutions in the SME segment.

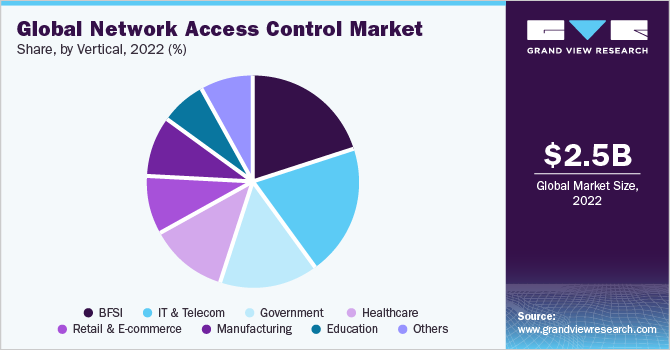

Vertical Insights

The BFSI segment accounted for the largest revenue share of 20.15% in 2022. The financial and banking industries constantly witness higher risks of data theft, cybersecurity breaches, device compromission, and network hijackings. Meanwhile, these industries are expanding their IT spending at an unprecedented pace to keep up with the latest technologies, IoT devices, and web-based applications making them highly vulnerable and accessible to security breaches. Thus, the demand for zero-trust, network security, and access monitoring and control solutions is rapidly growing for banking and financial services organizations.

The IT and telecommunication segment is anticipated to grow at a CAGR of 30.3% during the forecast period. IT and Telecommunication industries are experiencing a rapid surge in cyberattacks and data security breaches owing to the higher availability of customer data, sharing of critical information through large networks, higher use of digital technologies, and rise in application of connected devices. Further, the growing security concerns and rising awareness among organizations are expected to drive the demand for network access control solutions in the IT and telecommunication segment.

Regional Insights

North America accounted for a major revenue share of 34.19% in 2022. North America's network access control market is expected to witness growth opportunities due to the rising demand for network security solutions among major end-use industries such as healthcare, Government, Education, IT and Telecom, and BFSI. Cybercriminals and data thefts are constantly targeting the following industries in the region to gain access to critical organizational networks and devices containing exorbitant personal and organizational data. These factors are expected to drive the regional market growth.

Asia Pacific is expected to emerge as the fastest-growing regional market with a CAGR of 30.0% during the forecast period. The rapid adoption of advanced technologies such as IoT in various end-use industries such as IT and Telecom, BFSI, healthcare, manufacturing, retail, and others, along with the growing security compliances and regulatory policies to protect customer data BFSI and IT sectors is driving the demand for NAC solutions. Further, the rapidly growing industrial infrastructure, large customer base in the region, and rising awareness among organizations toward adopting network security and access control solutions are expected to strengthen the adoption of network access control in the Asia Pacific region.

Key Companies & Market Share Insights

The key players are utilizing a variety of inorganic growth strategies, such as mergers, partnerships, and acquisitions to broaden their software offering. In February 2023, Fortinet, a cybersecurity solution and service provider, announced FortiSP5, built with the latest ASIC technology, taking significant leaps in ensuring secured distributed networks. The FortiSP5 offers highly efficient and reliable computing at a lower cost and less power consumption. Further, it enables secure infrastructure across campus, branches, edge computing, 5G, operational technologies, and others. Some prominent players in the global network access control market include:

-

Cisco

-

SAP Access Control

-

Sophos

-

Fortinet

-

Huawei

-

Extreme Networks

-

Check Point Software Technology

-

Microsoft Corporation

-

Hewlett Packard Enterprises (HPE)

-

Juniper Networks, Inc.

-

IBM Corporation

-

Broadcom, Inc.

-

ManageEngine

-

VMware

-

Forescout Technologies

-

Aruba ClearPass

Network Access Control Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.19 billion

Revenue forecast in 2030

USD 17.14 billion

Growth Rate

CAGR of 27.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Cisco; AP Access Control; Sophos; Fortinet; Huawei; Extreme Networks; Check Point Software Technology; Microsoft Corporation; Hewlett Packard Enterprises (HPE); Juniper Networks, Inc.; IBM Corporation; Broadcom, Inc.; ManageEngine; VMware; Forescout Technologies; Aruba ClearPass

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Access Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global network access control market report based on type, deployment, enterprise size, vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Government

-

Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global network access control market size was estimated at USD 2.51 billion in 2022 and is expected to reach USD 3.19 billion in 2023.

b. The global network access control market is expected to grow at a compound annual growth rate of 27.2% from 2023 to 2030 to reach USD 17.14 billion by 2030.

b. The BFSI segment accounted for the largest market share of 20.15% in 2022. The financial and banking industries constantly witness higher risks of data theft, cybersecurity breaches, device compromission, and network hijackings. Meanwhile, these industries are expanding their IT spending at an unprecedented pace to keep up with the latest technologies, IoT devices, and web-based applications making them highly vulnerable and accessible to security breaches.

b. Some key players operating in the network access control market include Cisco, AP Access Control, Sophos, Fortinet, Huawei, Extreme Networks, Check Point Software Technology, Microsoft Corporation, Hewlett Packard Enterprises (HPE), Juniper Networks, Inc., IBM Corporation, Broadcom, Inc., ManageEngine, VMware, Forescout Technologies, and Aruba ClearPass.

b. The recent trends such as hybrid work culture, bring your own devices, and remote working scenarios are increasing the dependency of users’ devices on business networks and are the key factors driving the growth of network access control across various industries end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.