- Home

- »

- Biotechnology

- »

-

Next Generation Sequencing Market Size Report, 2030GVR Report cover

![Next Generation Sequencing Market Size, Share & Trends Report]()

Next Generation Sequencing Market Size, Share & Trends Analysis Report By Technology (Targeted Sequencing & Resequencing), By Product, By Application, By Workflow, By End-use, By Region And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-428-4

- Number of Pages: 300

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Next Generation Sequencing Market Trends

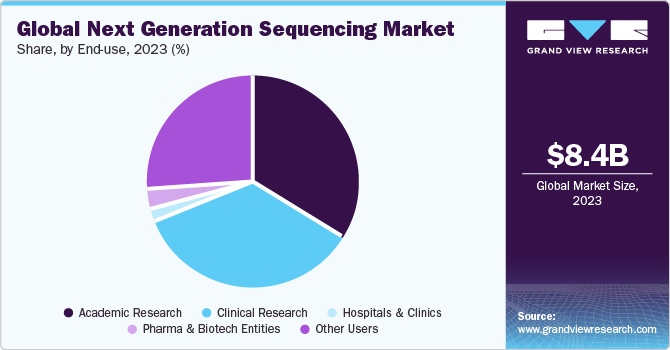

The global next generation sequencing market size was estimated at USD 8.40 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 21.7% 2024 to 2030. Next Generation Sequencing (NGS) refers to the huge DNA sequencing methods that aid in genomic discovery. Following the World Health Organization's (WHO) declaration of COVID-19 as a pandemic, a diverse group of recognized pharmaceutical and biotechnology companies, have decided to step forward in order to boost the global research efforts to develop test kits and vaccines.

Furthermore, major companies across the globe have increased their research and development capacities. This substantial focus on COVID-19 vaccine development offered a lucrative opportunity for the adoption of NGS during the pandemic period. For instance, a group of researchers in China utilized MinION Mk1C, a product by Oxford Nanopore Technologies (U.K.) for the sequencing of COVID-19 samples. In addition, factors such as extensive adoption of NGS technologies in clinical diagnostics due to rapid result time and faster processing are also projected to offer a favorable environment for market growth during the forecast period. For instance, in August 2020, Pediatrix Medical Group, GeneDx Inc., and OPKO Health signed an agreement to provide state-of-the-art, next generation gene-sequencing to enhance clinical diagnosis in uncommon disorders for newborn intensive care units.

Moreover, growing technological developments in NGS instruments and technologies are further likely to offer significant market growth over the coming years. For instance, in January 2020, the Intelligence Advanced Research Projects Activity in the U.S. awarded a grant of USD 23 million to the Harvard University, DNA Script, and Broad Institute. The institutes are conducting collaborative research to develop a novel technology that will combine enzymatic DNA synthesis and NGS into a single instrument.

To better understand the link between genetics and disease, several countries have invested in their own national population genome mapping projects. Furthermore, millions of genomes are being sequenced by government groups to progress research and discover better ways to identify and cure cancer, uncommon disorders, and other ailments. Efforts are being undertaken by the EU to improve the region’s large-scale genomic data with projects such as France’s French Plan for Genomic Medicine 2025 and the UK’s 100,000 Genomes Project. Such initiatives have resulted in the growth of NGS informatics services in the region.

Certain advantages offered by NGS such as cost-effectiveness, rapid and accurate sample analysis, and technological advancements are estimated to boost the adoption of NGS technologies during the forecast period. In addition, the development of genomics programs in a number of countries is projected to benefit the NGS market. The advent of next generation sequencing-based diagnoses, along with proactive government support, are also some of the key market growth factors.

The NGS market is experiencing lucrative growth, propelled by the increasing demand for testing and services worldwide. NGS testing has become instrumental in genomics research, clinical diagnostics, and personalized medicine, driving the expansion of the market. NGS data analysis, a critical component in deriving meaningful insights from vast genomic datasets, has witnessed a surge in demand, further fueling market growth.

As researchers and healthcare professionals seek comprehensive solutions, NGS services, including sequencing and data interpretation, are becoming necessary. The advent of NGS panels, designed for targeted sequencing of specific genomic regions, has revolutionized genetic analysis, offering cost-effective and efficient solutions for various applications. The synergy between advancements in NGS technologies and the increasing awareness of their potential across diverse sectors ensures a promising future for the NGS market, focusing on its pivotal role in shaping the future of genomics and precision medicine.

Top of Form

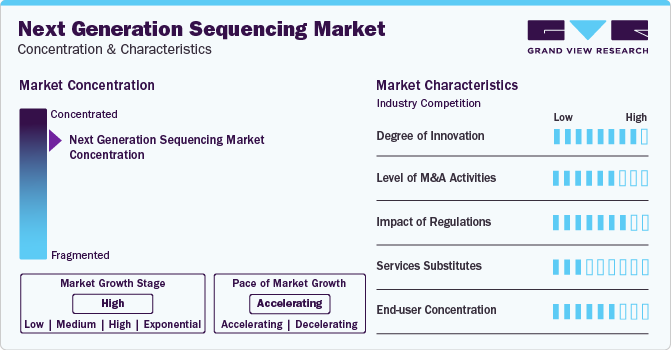

Market Concentration & Characteristics

Market growth for next generation sequencing market is high and pace is accelerating. One of the most important factors expected to have a significant impact on NGS is how much and to what extent the growth of personalized medicine would enhance the adoption of this technology in the next 7 years. The exponentially decreasing cost of sequencing whole genomes with subsequent technological advancements in precision medicine in a way replicates Moore’s law for semiconductors in the field of life sciences. NGS is anticipated to witness high demand for applications in clinical diagnostics over the forecast period.

Key strategies opted by the companies in the next generation sequencing market include increased spending on R&D, collaborations and product launches. For instance, in In February 2022, Invitae Corporation announced the launch of LiquidPlex Dx and FusionPlex Dx in Europe. It allows genomic profiling along with companion diagnostics used for solid tumor neoplasms. These are used on Illumina's Next Generation Sequencing platforms for IVD testing.

The NGS market has high impact of regulations. In the U.S., a clinical laboratory accreditation is required to be obtained by the CMS with certification in compliance with CLIA for conducting genetic & diagnostic tests, such as the New York State Department of Health and College of American Pathologists.

North America and Europe are witnessing rapid clinical developments in NGS methodologies for applications in oncology and infectious diseases. Presence of market leaders, such as Illumina, Roche, and Life Technologies, which are involved in the development of rapid and high-throughput sequencing capabilities, has contributed to the country’s market growth. These players are undertaking several strategic initiatives to strengthen their market presence in the country. For instance, in February 2022, Agilent Technologies, Inc. partnered with Element Biosciences, Inc. to integrate the latter’s AVITI System with Agilent’s SureSelect target enrichment panels for enhancing customer access to genomic tools.

Application Insights

The oncology segment held the highest market share of 27.70% in 2023. A gradually growing prevalence of cancer that warrants use of latest technology to enable oncologists better understand the mechanics of cancer and tumor cells and the application of NGS for DNA & RNA sequencing, epigenetics, and analyzing chromosomal abnormalities account for over three fourths of the global sequencing data are factors responsible for high market share. Companies like Myriad, through its myRisk product, offer genetic testing to identify people who may be at higher risk of developing certain cancers in the future. In January 2021, Merus N.V.; a clinical stage immuno-oncology company; collaborated with National Cancer Center, Japan and Erasmus University Medical Center, Netherlands to evaluate its HER2/3-targeting bispecific antibody in solid tumors.

Furthermore, the consumer genomics segment is anticipated to be the fastest-growing segment with a CAGR of 24.84% during the forecast period. Continuous introduction of new products by the key players is driving growth in the consumer genomics segment. Presence of companies such as 23andMe that are involved in the provision of the “Personal Genome Service” can be attributed to growth in the coming years. Moreover, Ancestry.com, Color Genomics, Cloud Health (which purchased a HiSeq X Ten), National Geographic and several Japanese consumer companies, as well as a nascent consumer business, Helix, which was launched by Illumina are expected to impact revenue generation in this segment. Rapid proliferation in genealogy, paternity testing, and personal health awareness is expected to drive the growth in the consumer genomics, as an application of NGS.

Product Insights

The consumables segment held the larger market share in 2023 and will continue to grow at a faster CAGR of 22.47% from 2024 to 2030. The larger share and exponential growth rate of this segment is mainly attributed to the recurrent usage and high demand of the consumables in the commercial as well as research applications of NGS. These consumables include sample preparation kits as well as kits for target enrichment. The adoption of NGS consumables has increased as most of the pharmaceutical companies and research institutes are utilizing NGS for several diagnostic applications and cancer research.

Another import factor contributing to the growth of the consumables market is the involvement of key companies in development of innovative products, focus on regulatory approvals, along with strategic initiatives to ensure the constant supply of consumables that can meet the increasing demand. These efforts also strengthen the company’s product portfolio, thus, maintaining the leading position in the market. For instance, in June 2022, PerkinElmer, Inc. launched three sample preparation kits for research purpose only, which include PG-Seq Rapid Kit v2, NEXTFLEX Small RNA-Seq Kit v4, and NEXTFLEX Rapid XP V2 DNA-Seq Kit. All these factors along with increasing R&D activities in the sequencing market will continue to boost the market growth.

Technology Insights

The targeted sequencing & resequencing segment held the highest market share in 2023. This segment is expected to witness growth in demand subsequent to the growth of whole genome sequencing, as the availability of a large amount of whole genome data will required to be analyzed at specific gene locations and isolated genetic expressions. There are many companies in the NGS market offering targeted sequencing services. Thus, this segment is expected to grow in tandem with WGS segment throughout the forecast period.

Illumina offers targeted resequencing with its gene panel and array finder, whereas Pacific Biosciences of California’s Sequel System with its SMRT technique allows targeted sequencing and accurate detection of variants. Targeted sequencing panels are expected to remain the workhorse for cancer molecular diagnostics and are projected to become the routine part of the heme malignancies and solid tumor.

Workflow Insights

The sequencing segment held the highest market share in 2023. NGS sequencing is the most important phase of the workflow and consequently accounts for the largest share of the market. These systems are able to provide accurate amount of liquid, which is important in NGS. Moreover, functions such as changing tubes and micro liter plates are also carried out by the system, which helps streamline workflow. The advantage of using robotic liquid handling system is that it enables researchers focus on analyzing the data rather than managing the process.

NGS Data Analysis is anticipated to be the fastest growing segment with a CAGR of 22.89%. A key factor contributing to the industry growth is the growing acceptance of sequencing platforms for clinical diagnosis due to a huge cost reduction of installation. Moreover, easy genomic and proteomic information availability is anticipated to create significant growth opportunities in this industry during the forecast period. Furthermore, the cost reduction of these sequencing technologies has resulted in increased adoption of NGS. In addition strategic activities by key market players will further offer lucrative opportunities in the review period. For instance, Illumina's BaseSpace Suite, aids in the analysis of sequencing data and the production of findings in a short amount of time. To expand its data analytic capabilities, the company has also purchased DRAGEN Bio-IT Platform (DRAGEN) and Edico Genome. Furthermore, Genomatix and DNAnexus, provide cloud-based solutions for the interpretation and management of enormous volumes of sequencing data.

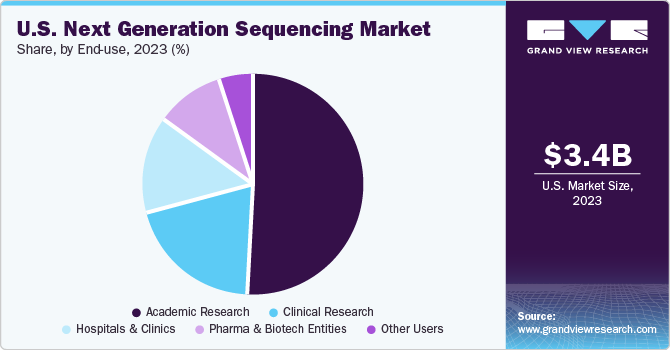

End use Insights

The academic research segment held the highest market share in 2023. Application of NGS solutions in research projects that are carried out in the universities and research centers can be attributed to the largest share of this segment in the market. Furthermore, scholarships offered for PhD projects in NGS are anticipated to drive demand for NGS products and services, thereby resulting in lucrative growth over the forecast period. Provision of on-site bioinformatics courses that include workshops on practical implementation of NGS sequencing and data analysis are also expected to boost revenue generated through academic research segment in the coming years.

Clinical research segment is anticipated to be the fastest growing segment with a CAGR of 22.92% during the forecast period. Owing to the use of NGS in cancer research and, more specifically, in discovery of new cancer-related genes, studying tumor heterogeneity, and identification of alterations that are contributive in tumorigenesis the segment is expected to witness significant growth through to 2030. In addition, availability of clinical research solutions through market entities such as Illumina, Thermo Fisher Scientific Corporation, and Agilent Technologies for the purpose of target enrichment & detection is anticipated to provide this segment with high growth opportunities over the forecast period.

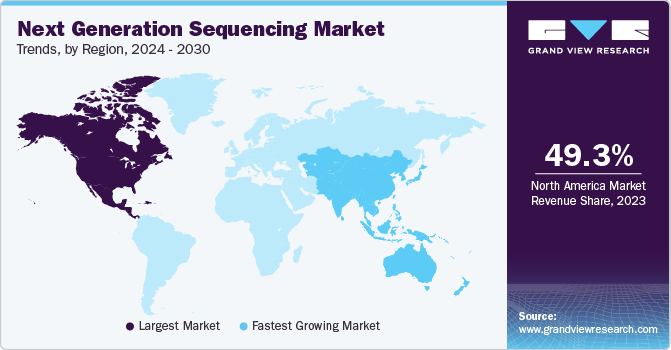

Regional Insights

North America dominated the NGS market with a share of 49.25% in 2023. The regional market is driven by the presence of multiple clinical laboratories that employ NGS to provide genetic testing services. Furthermore, due to the presence of high R&D investment, availability of technologically advanced healthcare research framework, the development of WGS in the region is also expected to serve as a critical factor for the growth of North America NGS market throughout the forecast period.

The Asia Pacific region is estimated to be the fastest-growing region owing to the presence of significant developments by China and Japan for technological integration of NGS methodologies, and the development of healthcare, R&D and clinical development frameworks of emerging economies such as India and Australia have poised the Asia Pacific NGS market to witness lucrative opportunities o growth throughout the forecast period.

UK Next Generation Sequencing Market

The UK next-generation sequencing market is expected to grow in tandem with the overall European market owing to increase in development of companion diagnostics and subsequent establishment of molecular diagnostic development facilities by key market players. Furthermore, ongoing strategic alliances between players in European and eastern markets are expected to fuel growth of next generation sequencing market during the forecast period in the region.

Key Companies & Market Share Insights

Major companies in the market are focusing on new product launches to cater the growing demand from various end users. Furthermore, emerging companies re involved into collaboration and partnerships with market leaders to increase their footprint in the competitive market space.

Key Next Generation Sequencing Companies:

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

Recent Developments

-

In December 2023, Oxford Nanopore launched TurBOT beta access in partnership with Tecan. The buyers are expected to recive the products in Q1 2024. TurBOT is a benchtop instrument offering efficient basecalling, data analysis, automated extraction, and library preparation of multiple samples in one single unit.

-

In December 2023, Illumina signed a memorandum of understanding with African Society for Laboratory Medicine to increase access to genomics within the African region to fight infectious diseases.

-

In December 2023, Illumina partnered with HaploX to provide locally manufactured sequencing instruments in China.

-

In November 2023, MedGenome and PacBio announced De Novo Genome Assembly and Annotation grant. Such research grants are expected to promote research and development activities within the industry.

-

In November 2023, Yourgene Health and PacBio announced collaboration in order to optimize the workflow of long read sequencing. PacBio approved LightBench instrument made by Yourgene Health for size selection of long DNA fragments

-

In September 2023, Integrated DNA Technologies (IDT) launched its xGen NGS products, including primers, adapters, and universal blockers for the Ultima Genomics UG 100 platform

Next Generation Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.16 billion

Revenue forecast in 2030

USD 33.15 billion

Growth rate

CAGR of 21.66% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, workflow, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Illumina; QIAGEN; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Next Generation Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the next generation sequencing market on the basis of technology, product, application, workflow, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

WGS

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing

-

DNA-based

-

RNA-based

-

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Sequencing

-

Data Analysis

-

-

Consumables

-

Sample Preparation

-

Target Enrichment

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Diagnostics and Screening

-

Oncology Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

Research Studies

-

-

Clinical Investigation

-

Infectious Diseases

-

Inherited Diseases

-

Idiopathic Diseases

-

Non-Communicable/Other Diseases

-

-

Reproductive Health

-

NIPT

-

Aneuploidy

-

Microdeletions

-

-

PGT

-

Newborn Genetic Screening

-

Single Gene Analysis

-

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Sequencing

-

NGS Library Preparation Kits

-

Semi-automated Library Preparation

-

Automated Library Preparation

-

-

Sequencing

-

NGS Data Analysis

-

NGS Primary Data Analysis

-

NGS Secondary Data Analysis

-

NGS Tertiary Data Analysis

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global next generation sequencing market size was estimated at USD 8.29 billion in 2023 and is expected to reach USD 9.90 billion in 2024.

b. The global next generation sequencing market is expected to grow at a compound annual growth rate of 21.12% from 2024 to 2030 to reach USD 31.26 billion by 2030.

b. North America dominated the NGS market with a share of 49.35% in 2023. This is attributable to the presence of major clinical laboratories that are using next-generation sequencing technology to perform genetic tests.

b. Some key players operating in the NGS market include Illumina, QIAGEN; Thermo Fisher Scientific Inc.; F Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; and Bio-Rad Laboratories, Inc.

b. Key factors that are driving the NGS market growth include exponentially decreasing costs for genetic sequencing, development of companion diagnostics and personalized medicine, rise in competition amongst prominent market entities, a rising clinical opportunity for NGS technology, technological advancements in cloud computing and data integration, growing healthcare expenditure, and increasing prevalence of cancer.

Table of Contents

Chapter 1. Next Generation Sequencing Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Regional Scope

1.3. Estimates and Forecast Timeline

1.4. Objective

1.5. Research Methodology

1.6. Information Procurement

1.6.1. Purchased Database

1.6.2. GVR’s Internal Database

1.6.3. Secondary Sources

1.6.4. Primary Research

1.7. Information or Data Analysis

1.7.1. Data Analysis Models

1.8. Market Formulation & Validation

1.9. Model Details

1.9.1. Commodity Flow Analysis

1.10. List of Secondary Sources

1.11. List of Abbreviations

Chapter 2. Next Generation Sequencing Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Next Generation Sequencing Market: Variables, Trends & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Trends and Outlook

3.4. Market Dynamics

3.4.1. Exponentially decreasing costs for genetic sequencing

3.4.2. Development of companion diagnostics and personalized medicine

3.4.3. Rise in competition among prominent market entities

3.4.4. Rising clinical opportunity for NGS technology

3.4.5. Technological advancements in cloud computing and data integration

3.4.6. Growing healthcare expenditure supporting development of effective diagnostic & therapeutic procedures for cancer

3.4.7. Increasing prevalence of cancer

3.5. Market Restraint Analysis

3.5.1. Lack of computational efficiency for data management

3.5.2. Non–value-based NGS reimbursement policy and regulation status

3.5.3. Challenges associated with NGS implementation.

3.6. Market Analysis Tools

3.6.1. SWOT Analysis; By Factor (Political & Legal, Economic and Technological)

3.6.2. Porter’s Five Forces Analysis

3.6.3. COVID-19 Impact Analysis

Chapter 4. Technology Business Analysis

4.1. Next Generation Sequencing Data Analysis Market: Technology Movement Analysis

4.2. Targeted sequencing & resequencing

4.2.1. Targeted Sequencing & Resequencing Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.2. DNA-based targeted sequencing & resequencing

4.2.2.1. DNA-based targeted sequencing & resequencing market estimates and forecast, 2018 - 2030 (USD Million)

4.2.3. RNA-based targeted sequencing & resequencing

4.2.3.1. RNA -based targeted sequencing & resequencing market estimates and forecast, 2018 - 2030 (USD Million)

4.3. Whole genome sequencing

4.3.1. Whole Genome Sequencing Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.4. Whole exome sequencing

4.4.1. Whole Exome Sequencing Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 5. Product Business Analysis

5.1. Next Generation Sequencing Data Analysis Market: Product Movement Analysis

5.2. Platforms

5.2.1. Platforms Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.2.2. Sequencing

5.2.2.1. Sequencing Platforms Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.2.3. Data Analysis

5.2.3.1. Data Analysis Platforms Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3. Consumables

5.3.1. Consumables Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3.2. Sample Preparation

5.3.2.1. Sample Preparation Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3.3. Target Enrichment

5.3.3.1. Target Enrichment Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3.4. Others

5.3.4.1. Others Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 6. Application Business Analysis

6.1. Next Generation Sequencing Data Analysis Market: Application Movement Analysis

6.2. Oncology

6.2.1. Oncology Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.2. Diagnostics & Screening

6.2.2.1. Diagnostics & Screening Market Estimates And Forecast, 2018 - 2030 (USD Million)

6.2.2.2. Oncology screening

6.2.2.2.1. Oncology Screening Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.2.2.2. Sporadic Cancer Screening Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.2.2.3. Inherited Cancer Screening Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.2.3. Companion diagnostics

6.2.2.3.1. Companion Diagnostics Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.2.4. Other Diagnostics

6.2.2.4.1. Other Diagnostics Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.2.3. Research Studies

6.2.3.1. Research Studies Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3. Clinical Investigation

6.3.1. Clinical Investigation Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3.2. Infectious Diseases

6.3.2.1. Infectious Diseases Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3.3. Idiopathic Diseases

6.3.3.1. Idiopathic Diseases Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3.4. Inherited Diseases

6.3.4.1. Inherited Diseases Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3.5. Non-communicable/other Diseases

6.3.5.1. Reproductive Health Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4. Reproductive Health

6.4.1. Clinical Investigation Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.2. NIPT

6.4.2.1. NIPT Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.2.2. Aneuploidy

6.4.2.2.1. Aneuploidy Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.2.3. Microdeletions

6.4.2.3.1. Microdeletions Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.3. PGT

6.4.3.1. PGT Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.4. Newborn Genetic Screening

6.4.4.1. Newborn Genetic Screening Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.4.5. Single Gene Analysis Market

6.4.5.1. Single Gene Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.5. HLA Typing/Immune System Monitoring

6.5.1. HLA Typing/Immune System Monitoring Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.6. Metagenomics, Epidemiology & Drug Development

6.6.1. Metagenomics, Epidemiology & Drug Development Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.7. Agrigenomics & Forensics

6.7.1. Agrigenomics & Forensics Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.8. Consumer Genomics

6.8.1. Consumer Genomics Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 7. Workflow Business Analysis

7.1. Next Generation Sequencing Data Analysis Market: Workflow Movement Analysis

7.2. Presequencing

7.2.1. Presequencing Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.2.1.1. NGS Library Preparation Kits

7.2.1.1.1. NGS Library Preparation Kits Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.2.1.2. Semiautomated Library Preparation

7.2.1.2.1. Semiautomated Library Preparation Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.2.1.3. Automated Library Preparation

7.2.1.3.1. Automated Library Preparation Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.3. Sequencing

7.3.1. Sequencing Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4. Data Analysis

7.4.1. Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.2. Primary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.2.1. Primary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.3. Secondary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.3.1. Secondary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.4. Tertiary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4.4.1. Tertiary Data Analysis Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 8. End - Use Business Analysis

8.1. Next Generation Sequencing Market: End - Use Movement Analysis

8.2. Academic Research

8.2.1. Academic Research Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3. Clinical Research

8.3.1. Clinical Research Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4. Hospitals & Clinics

8.4.1. Hospitals & Clinics Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.5. Pharmaceutical & Biotech Entities

8.5.1. Pharmaceutical & Biotech Entities Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.6. Other Users

8.6.1. Other Users Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 9. Regional Business Analysis

9.1. Next Generation Sequencing Market Share By Region, 2022 & 2030

9.2. North America

9.2.1. SWOT Analysis

9.2.2. North America next generation sequencing market, 2018 - 2030 (USD Million)

9.2.3. U.S.

9.2.3.1. Key country dynamics

9.2.3.2. U.S. next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.3.3. Target disease prevalence

9.2.3.4. Competitive scenario

9.2.3.5. Regulatory framework

9.2.3.6. Reimbursement scenario

9.2.4. Canada

9.2.4.1. Key country dynamics

9.2.4.2. Canada next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.4.3. Target disease prevalence

9.2.4.4. Competitive scenario

9.2.4.5. Regulatory framework

9.2.4.6. Reimbursement scenario

9.2.5. Europe

9.2.6. SWOT Analysis

9.2.7. Europe Next Generation Sequencing market, 2018 - 2030 (USD Million)

9.2.8. Germany

9.2.8.1. Key country dynamics

9.2.8.2. Germany next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.8.3. Target disease prevalence

9.2.8.4. Competitive scenario

9.2.8.5. Regulatory framework

9.2.8.6. Reimbursement scenario

9.2.9. UK

9.2.9.1. Key country dynamics

9.2.9.2. UK next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.9.3. Target disease prevalence

9.2.9.4. Competitive scenario

9.2.9.5. Regulatory framework

9.2.9.6. Reimbursement scenario

9.2.10. France

9.2.10.1. Key country dynamics

9.2.10.2. France next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.10.3. Target disease prevalence

9.2.10.4. Competitive scenario

9.2.10.5. Regulatory framework

9.2.10.6. Reimbursement scenario

9.2.11. Italy

9.2.11.1. Key country dynamics

9.2.11.2. Italy next generation sequencing (NGS) market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.11.3. Target disease prevalence

9.2.11.4. Competitive scenario

9.2.11.5. Regulatory framework

9.2.11.6. Reimbursement scenario

9.2.12. Spain

9.2.12.1. Key country dynamics

9.2.12.2. Spain next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.12.3. Target disease prevalence

9.2.12.4. Competitive scenario

9.2.12.5. Regulatory framework

9.2.12.6. Reimbursement scenario

9.2.13. Denmark

9.2.13.1. Key country dynamics

9.2.13.2. Denmark next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.13.3. Target disease prevalence

9.2.13.4. Competitive scenario

9.2.13.5. Regulatory framework

9.2.13.6. Reimbursement scenario

9.2.14. Sweden

9.2.14.1. Key country dynamics

9.2.14.2. Sweden next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.14.3. Target disease prevalence

9.2.14.4. Competitive scenario

9.2.14.5. Regulatory framework

9.2.14.6. Reimbursement scenario

9.2.15. Norway

9.2.15.1. Key country dynamics

9.2.15.2. Norway next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.15.3. Target disease prevalence

9.2.15.4. Competitive scenario

9.2.15.5. Regulatory framework

9.2.15.6. Reimbursement scenario

9.3. Asia Pacific

9.3.1. SWOT Analysis

9.3.2. Asia Pacific next generation sequencing market, 2018 - 2030 (USD Million)

9.3.3. Japan

9.3.3.1. Key country dynamics

9.3.3.2. Japan next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.3.3. Target disease prevalence

9.3.3.4. Competitive scenario

9.3.3.5. Regulatory framework

9.3.3.6. Reimbursement scenario

9.3.4. China

9.3.4.1. Key country dynamics

9.3.4.2. China next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.4.3. Target disease prevalence

9.3.4.4. Competitive scenario

9.3.4.5. Regulatory framework

9.3.4.6. Reimbursement scenario

9.3.5. India

9.3.5.1. Key country dynamics

9.3.5.2. India next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.5.3. Target disease prevalence

9.3.5.4. Competitive scenario

9.3.5.5. Regulatory framework

9.3.5.6. Reimbursement scenario

9.3.6. South Korea

9.3.6.1. Key country dynamics

9.3.6.2. South Korea next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.6.3. Target disease prevalence

9.3.6.4. Competitive scenario

9.3.6.5. Regulatory framework

9.3.6.6. Reimbursement scenario

9.3.7. Australia

9.3.7.1. Key country dynamics

9.3.7.2. Australia next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.7.3. Target disease prevalence

9.3.7.4. Competitive scenario

9.3.7.5. Regulatory framework

9.3.7.6. Reimbursement scenario

9.3.8. Thailand

9.3.8.1. Key country dynamics

9.3.8.2. Thailand next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.8.3. Target disease prevalence

9.3.8.4. Competitive scenario

9.3.8.5. Regulatory framework

9.3.8.6. Reimbursement scenario

9.4. Latin America

9.4.1. SWOT Analysis

9.4.2. Latin America next generation sequencing market, 2018 - 2030 (USD Million)

9.4.3. Brazil

9.4.3.1. Key country dynamics

9.4.3.2. Brazil next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.3.3. Target disease prevalence

9.4.3.4. Competitive scenario

9.4.3.5. Regulatory framework

9.4.3.6. Reimbursement scenario

9.4.4. Mexico

9.4.4.1. Key country dynamics

9.4.4.2. Mexico next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.4.3. Target disease prevalence

9.4.4.4. Competitive scenario

9.4.4.5. Regulatory framework

9.4.4.6. Reimbursement scenario

9.4.5. Argentina

9.4.5.1. Key country dynamics

9.4.5.2. Argentina next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.5.3. Target disease prevalence

9.4.5.4. Competitive scenario

9.4.5.5. Regulatory framework

9.4.5.6. Reimbursement scenario

9.5. MEA

9.5.1. SWOT Analysis

9.5.2. MEA next generation sequencing market, 2018 - 2030 (USD Million)

9.5.3. South Africa

9.5.3.1. Key country dynamics

9.5.3.2. South Africa next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.3.3. Target disease prevalence

9.5.3.4. Competitive scenario

9.5.3.5. Regulatory framework

9.5.3.6. Reimbursement scenario

9.5.4. Saudi Arabia

9.5.4.1. Key country dynamics

9.5.4.2. Saudi Arabia next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.4.3. Target disease prevalence

9.5.4.4. Competitive scenario

9.5.4.5. Regulatory framework

9.5.4.6. Reimbursement scenario

9.5.5. UAE

9.5.5.1. Key country dynamics

9.5.5.2. UAE next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.5.3. Target disease prevalence

9.5.5.4. Competitive scenario

9.5.5.5. Regulatory framework

9.5.5.6. Reimbursement scenario

9.5.6. Kuwait

9.5.6.1. Key country dynamics

9.5.6.2. Kuwait next generation sequencing market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.6.3. Target disease prevalence

9.5.6.4. Competitive scenario

9.5.6.5. Regulatory framework

9.5.6.6. Reimbursement scenario

Chapter 10. Competitive Landscape

10.1. Participant’s Overview

10.2. Company Categorization

10.3. Financial Performance

10.4. Product Benchmarking

10.5. Company Market Share Analysis

10.6. Strategy Mapping

10.6.1. THERMO FISHER SCIENTIFIC, INC.

10.6.1.1. Overview

10.6.1.2. Life Technologies Corporation

10.6.1.2.1. Overview

10.6.1.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.1.4. Product Benchmarking

10.6.1.5. Strategic Initiatives

10.6.2. QIAGEN N.V

10.6.2.1. Overview

10.6.2.2. CLC Bio

10.6.2.2.1. Overview

10.6.2.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.2.4. Product Benchmarking

10.6.2.5. Strategic Initiatives

10.6.3. Illumina, Inc.

10.6.3.1. Overview

10.6.3.2. Edico Genome

10.6.3.2.1. Overview

10.6.3.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.3.4. Product Benchmarking

10.6.3.5. Strategic Initiatives

10.6.4. F. Hoffmann-La Roche Ltd

10.6.4.1. Overview

10.6.4.2. Foundation Medicine

10.6.4.2.1. Overview

10.6.4.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.4.4. Product Benchmarking

10.6.4.5. Strategic Initiatives

10.6.5. Agilent Technologies, Inc.

10.6.5.1. Overview

10.6.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.5.3. Product Benchmarking

10.6.5.4. Strategic Initiatives

10.6.6. Bio-Rad Laboratories, Inc.

10.6.6.1. Overview

10.6.6.2. GnuBio

10.6.6.2.1. Overview

10.6.6.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.6.4. Product Benchmarking

10.6.6.5. Strategic Initiatives

10.6.7. PierianDx

10.6.7.1. Overview

10.6.7.2. Tute Genomics

10.6.7.2.1. GnuBio

10.6.7.2.2. Knome, Inc

10.7.7.2.2.1 COMPANY OVERVIEW

10.6.7.3. Product Benchmarking

10.6.7.4. Strategic Initiatives

10.6.8. Oxford Nanopore Technologies Plc

10.6.8.1. Overview

10.6.8.2. Product Benchmarking

10.6.8.3. Strategic Initiatives

10.6.9. Partek Incorporated

10.6.9.1. Overview

10.6.9.2. Product Benchmarking

10.6.9.3. Strategic Initiatives

10.6.10. Eurofins Scientific

10.6.10.1. Overview

10.6.10.2. Eurofins GATC Biotech GmbH

10.6.10.2.1. Overview

10.6.10.3.

10.6.10.4. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.10.5. Product Benchmarking

10.6.10.6. Strategic Initiatives

10.6.11. DNASTAR, Inc.

10.6.11.1. Overview

10.6.11.2. Product Benchmarking

10.6.11.3. Strategic Initiatives

10.6.12. SOPHIA GENETICS

10.6.12.1. Overview

10.6.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.12.3. Product Benchmarking

10.6.12.4. Strategic Initiatives

10.6.13. Fabric Genomics, Inc.

10.6.13.1. Overview

10.6.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.13.3. Product Benchmarking

10.6.13.4. Strategic Initiatives

10.6.14. Laboratory Corporation of America

10.6.14.1. Overview

10.6.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.14.3. Product Benchmarking

10.6.14.4. Strategic Initiatives

10.6.15. SYAPSE, INC.

10.6.15.1. Overview

10.6.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.15.3. Product Benchmarking

10.6.15.4. Strategic Initiatives

10.6.16. IQVIA

10.6.16.1. Overview

10.6.16.2. Q² Solutions

10.6.16.2.1. Overview

10.6.16.3. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.16.4. Product Benchmarking

10.6.16.5. Strategic Initiatives

10.6.17. Personalis, Inc

10.6.17.1. Overview

10.6.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.17.3. Product Benchmarking

10.6.17.4. Strategic Initiatives

10.6.18. 10x Genomics

10.6.18.1. Overview

10.6.18.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.18.3. Product Benchmarking

10.6.18.4. Strategic Initiatives

10.6.19. DNAnexus, Inc

10.6.19.1. Overview

10.6.19.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.19.3. Product Benchmarking

10.6.19.4. Strategic Initiatives

10.6.20. CENTOGENE N.V

10.6.20.1. Overview

10.6.20.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.20.3. Product Benchmarking

10.6.20.4. Strategic Initiatives

10.6.21. Invitae Corporation

10.6.21.1. Overview

10.6.21.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.21.3. Product Benchmarking

10.6.21.4. Strategic Initiatives

10.6.22. GeneDx, LLC

10.6.22.1. Overview

10.6.22.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.6.22.3. Product Benchmarking

10.6.22.4. Strategic Initiatives

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. Country share estimation

Table 4. Healthcare expenditure, 2022

Table 5. NGS top platforms

Table 6. Base pairs sequenced using WGS, WES, and targeted sequencing & resequencing

Table 7. Clonal amplification products in the market

Table 8. North America next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 9. North America next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 10. North America next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 11. North America next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 12. North America NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 13. North America NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 14. North America next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 15. North America next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 16. North America targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 17. North America next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 18. North America NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 19. North America NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 20. North America next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 21. U.S. next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 22. U.S. next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 23. U.S. next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 24. U.S. next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 25. U.S. NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 26. U.S. NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 27. U.S. next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 28. U.S. next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 29. U.S. targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 30. U.S. next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 31. U.S. NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 32. U.S. NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 33. U.S. next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 34. Canada next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 35. Canada next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 36. Canada next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 37. Canada next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 38. Canada NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 39. Canada NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 40. Canada next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 41. Canada next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 42. Canada targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 43. Canada next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 44. Canada NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 45. Canada NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 46. Canada next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 47. Europe next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 48. Europe next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 49. Europe next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 50. Europe next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 51. Europe NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 52. Europe NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 53. Europe next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 54. Europe next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 55. Europe targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 56. Europe next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 57. Europe NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 58. Europe NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 59. Europe next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 60. Germany next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 61. Germany next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 62. Germany next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 63. Germany next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 64. Germany NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 65. Germany NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 66. Germany next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 67. Germany next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 68. Germany targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 69. Germany next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 70. Germany NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 71. Germany NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 72. Germany next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 73. U.K. next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 74. U.K. next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 75. U.K. next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 76. U.K. next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 77. U.K. NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 78. U.K. NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 79. U.K. next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 80. U.K. next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 81. U.K. targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 82. U.K. next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 83. U.K. NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 84. U.K. NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 85. U.K. next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 86. Spain next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 87. Spain next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 88. Spain next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 89. Spain next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 90. Spain NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 91. Spain NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 92. Spain next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 93. Spain next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 94. Spain targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 95. Spain next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 96. Spain NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 97. Spain NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 98. Spain next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 99. France next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 100. France next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 101. France next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 102. France next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 103. France NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 104. France NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 105. France next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 106. France next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 107. France targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 108. France next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 109. France NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 110. France NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 111. France next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 112. Italy next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 113. Italy next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 114. Italy next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 115. Italy next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 116. Italy NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 117. Italy NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 118. Italy next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 119. Italy next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 120. Italy targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 121. Italy next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 122. Italy NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 123. Italy NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 124. Italy next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 125. Italy next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 126. Denmark next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 127. Denmark next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 128. Denmark next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 129. Denmark next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 130. Denmark NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 131. Denmark NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 132. Denmark next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 133. Denmark next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 134. Denmark targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 135. Denmark next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 136. Denmark NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 137. Denmark NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 138. Denmark next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 139. Norway next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 140. Norway next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 141. Norway next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 142. Norway next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 143. Norway NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 144. Norway NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 145. Norway next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 146. Norway next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 147. Norway targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 148. Norway next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 149. Norway NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 150. Norway NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 151. Norway next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 152. Sweden next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 153. Sweden next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 154. Sweden next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 155. Sweden next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 156. Sweden NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 157. Sweden NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 158. Sweden next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 159. Sweden next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 160. Sweden targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 161. Sweden next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 162. Sweden NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 163. Sweden NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 164. Sweden next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 165. Asia Pacific next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 166. Asia Pacific next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 167. Asia Pacific next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 168. Asia Pacific next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 169. Asia Pacific NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 170. Asia Pacific NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 171. Asia Pacific next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 172. Asia Pacific next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 173. Asia Pacific targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 174. Asia Pacific next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 175. Asia Pacific NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 176. Asia Pacific NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 177. Asia Pacific next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 178. Japan next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 179. Japan next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 180. Japan next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 181. Japan next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 182. Japan NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 183. Japan NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 184. Japan next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 185. Japan next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 186. Japan targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 187. Japan next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 188. Japan NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 189. Japan NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 190. Japan next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 191. China next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 192. China next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 193. China next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 194. China next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 195. China NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 196. China NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 197. China next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 198. China next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 199. China targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 200. China next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 201. China NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 202. China NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 203. China next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 204. India next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 205. India next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 206. India next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 207. India next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 208. India NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 209. India NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 210. India next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 211. India next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 212. India targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 213. India next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 214. India NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 215. India NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 216. India next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 217. South Korea next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 218. South Korea next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 219. South Korea next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 220. South Korea next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 221. South Korea NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 222. South Korea NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 223. South Korea next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 224. South Korea next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 225. South Korea targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 226. South Korea next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 227. South Korea NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 228. South Korea NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 229. South Korea next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 230. Australia next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 231. Australia next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 232. Australia next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 233. Australia next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 234. Australia NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 235. Australia NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 236. Australia next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 237. Australia next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 238. Australia targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 239. Australia next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 240. Australia NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 241. Australia NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 242. Australia next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 243. Thailand next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 244. Thailand next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 245. Thailand next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 246. Thailand next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 247. Thailand NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 248. Thailand NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 249. Thailand next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 250. Thailand next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 251. Thailand targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 252. Thailand next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 253. Thailand NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 254. Thailand NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 255. Thailand next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 256. Latin America next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 257. Latin America next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 258. Latin America next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 259. Latin America next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 260. Latin America NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 261. Latin America NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 262. Latin America next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 263. Latin America next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 264. Latin America targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 265. Latin America next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 266. Latin America NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 267. Latin America NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 268. Latin America next generation sequencing market estimates & forecasts, by end-use, 2018 - 2030 (USD Million)

Table 269. Brazil next generation sequencing market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 270. Brazil next generation sequencing for oncology market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 271. Brazil next generation sequencing for oncology diagnostics & screening market, by application, 2018 - 2030 (USD Million)

Table 272. Brazil next generation sequencing for oncology screening market, by application, 2018 - 2030 (USD Million)

Table 273. Brazil NGS clinical investigation market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 274. Brazil NGS reproductive health market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Table 275. Brazil next generation sequencing NIPT market, by application, 2018 - 2030 (USD Million)

Table 276. Brazil next generation sequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 277. Brazil targeted sequencing/resequencing market estimates & forecasts, by technology, 2018 - 2030 (USD Million)

Table 278. Brazil next generation sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 279. Brazil NGS pre-sequencing market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)

Table 280. Brazil NGS data analysis market estimates & forecasts, by workflow, 2018 - 2030 (USD Million)