- Home

- »

- Biotechnology

- »

-

Next-generation Sequencing Services Market Report, 2033GVR Report cover

![Next-generation Sequencing Services Market Size, Share & Trends Report]()

Next-generation Sequencing Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Human Genome Sequencing, Gene Regulation Services), By Workflow, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-630-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Next-generation Sequencing Services Market Summary

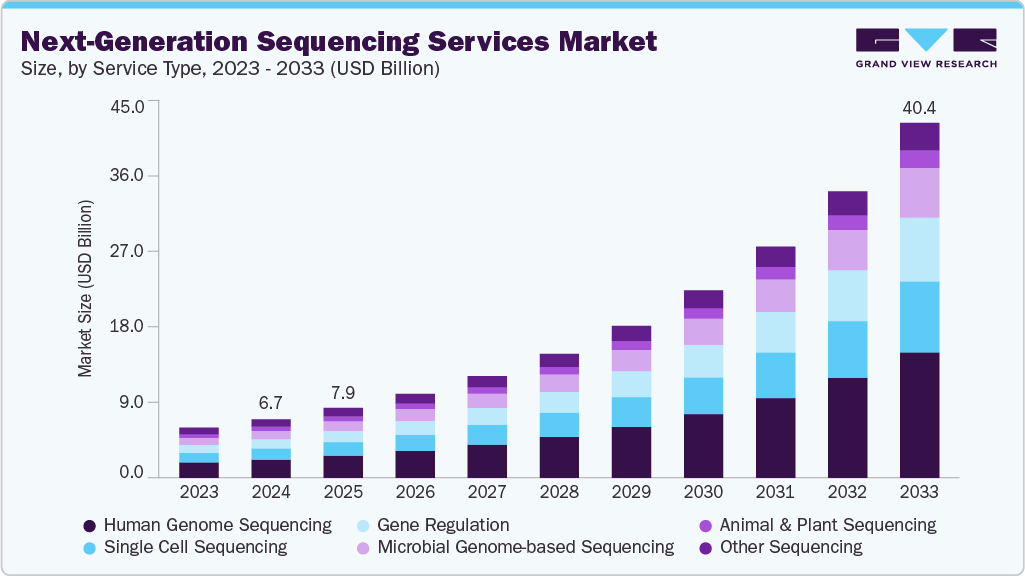

The global next-generation sequencing services market size was estimated at USD 6.66 billion in 2024 and is anticipated to reach USD 40.43 billion by 2033, expanding at a CAGR of 22.54% from 2025 to 2033. This growth is driven by the increasing demand for advanced genomic research, the rising prevalence of genetic disorders, and the growing adoption of precision medicine.

Key Market Trends & Insights

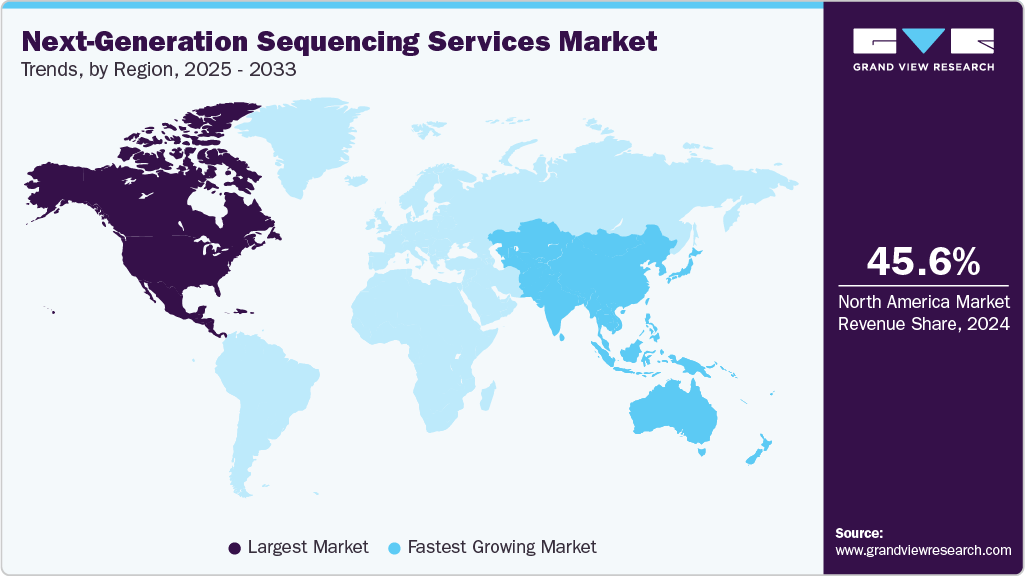

- The North America next-generation sequencing services market held the largest global revenue share of 45.56% in 2024.

- The next-generation sequencing services industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By service type, the human genome sequencing segment held the highest market share of 31.28% in 2024.

- By workflow, the sequencing segment held the highest market share in 2024.

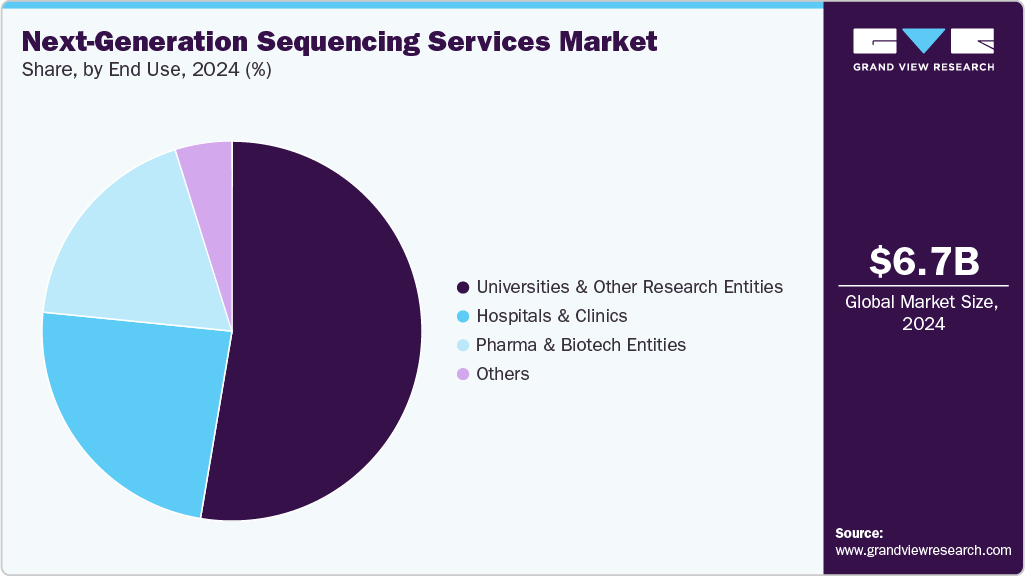

- By end use, the universities & other research entities segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.66 Billion

- 2033 Projected Market Size: USD 40.43 Billion

- CAGR (2025-2033): 22.54%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Increased Prevalence of Genetic and Chronic Diseases

One of the most significant drivers fueling demand in the next-generation sequencing (NGS) services industry is the rising global burden of genetic and chronic diseases. Conditions such as cancer, cardiovascular diseases, neurological disorders, and rare inherited syndromes are increasing in prevalence, prompting a heightened need for advanced diagnostic tools. Traditional diagnostic methods often fail to identify the underlying genetic causes of complex diseases, whereas NGS offers comprehensive genomic insights that enable early detection and precise diagnosis. For instance, according to data from the Centers for Disease Control and Prevention (CDC), 6 out of 10 Americans suffer from at least one chronic illness. At the same time, 4 out of 10 are affected by two or more chronic conditions. As healthcare systems worldwide shift toward preventive and precision medicine, the demand for robust, accurate, and scalable sequencing services continues to surge.

Clinical Trials- Genetic Disease Using Next-Generation Sequencing (NGS)

NCT Number

Conditions

Sponsor

Completion Date

NCT03962452

Rare Diseases|Genetic Predisposition

University Hospital Tuebingen

2025

NCT05216068

Chromosome Translocation|Genetic Disorders in Pregnancy|Recurrent Miscarriage

Chang Gung Memorial Hospital

2024

NCT03427593

Primary Immune-Deficiency (PID) Common Variable Immune Deficiency (CVID)

University Hospital, Strasbourg, France

2019

NCT03548779

Epilepsy; Seizure|Neuromuscular Diseases Abnormality

University of North Carolina, Chapel Hill

2024

NCT06985160

Polymorphism, Genetic|Bacterial Infections|Infant

Ege University

2024

NCT04364828

COVID-19

University Hospital Tuebingen

2023

NCT04308603

Non-Immune Hydrops Fetalis

Hospices Civils de Lyon

2024

NCT05015868

Epilepsies, Partial|Epilepsy Intractable

IRCCS Eugenio Medea

2024

Source: Clinicaltrials.gov.in, Grand View Research

Rare genetic disorders, often undiagnosed due to their complexity and rarity, can now be effectively identified through whole-genome and exome sequencing provided by NGS services. For example, NGS can detect somatic mutations in cancer patients, facilitating the development of personalized treatment plans and improving patient outcomes. Moreover, as more individuals seek comprehensive genetic information to understand disease risks and inform their healthcare decisions, clinical laboratories, hospitals, and research institutions are increasingly becoming specialized NGS service providers. This trend is expected to intensify during the forecast period, positioning NGS services as an indispensable tool in the global fight against chronic and hereditary diseases.

Rising emphasis on quality control and safety

Technological advancements in next-generation sequencing (NGS) platforms have played a pivotal role in driving market demand by significantly improving sequencing speed, accuracy, and cost-efficiency. Over the past decade, innovations in sequencing chemistry, instrumentation, and bioinformatics have transformed NGS from a costly and time-consuming process into a faster and more affordable technology, making it accessible to a wide range of users. For instance, in November 2024, Avantor announced the distribution of Quantum-Si’s next-generation protein sequencing technology across the United States, enhancing access to advanced proteomics solutions in the region. These improvements have enhanced the quality and reliability of genomic data, expanding the potential applications of NGS across clinical diagnostics, drug discovery, agriculture, and environmental research.

The reduced costs and increased accessibility of NGS have lowered barriers for adoption among academic institutions, hospitals, biotechnology companies, and pharmaceutical firms. The availability of cloud-based data analysis platforms and user-friendly sequencing kits further democratizes access, enabling broader participation in genomic research and clinical applications. Moreover, ongoing technological progress fuels market growth by encouraging new entrants and expanding the user base, solidifying NGS as an indispensable tool in life sciences and precision medicine. For instance, in March 2025, SPT Labtech and SEQ-IT introduced an automated, miniaturized next-generation sequencing (NGS) workflow in Europe, enhancing cost efficiency and throughput in genomic diagnostics by reducing reagent volumes and labor.

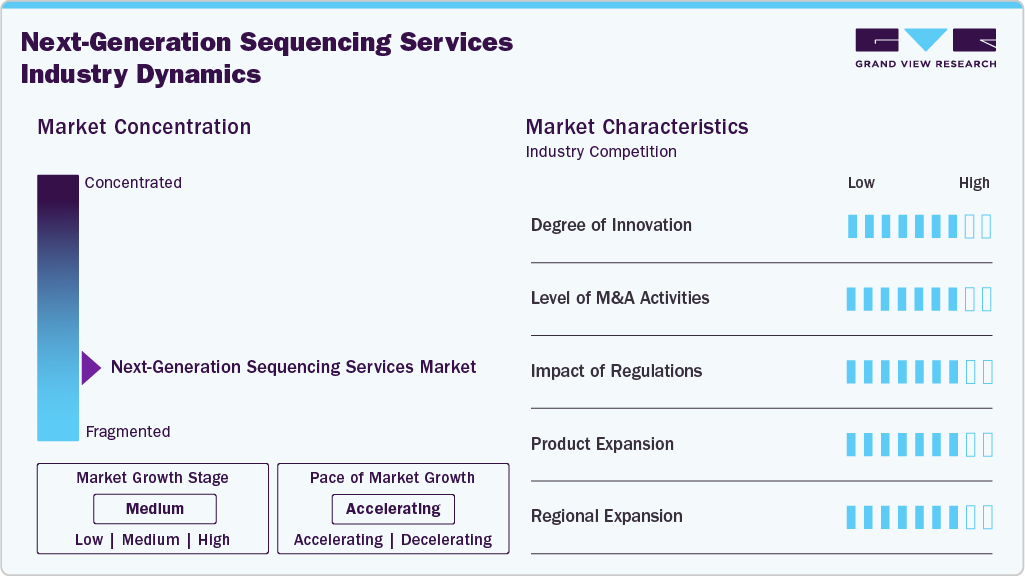

Market Concentration & Characteristics

The degree of innovation in the next-generation sequencing services market technologies is a key driver fueling market demand by continuously enhancing the capabilities, accuracy, and efficiency of the NGS services. For instance, in February 2025, Quantum-Si and leading researchers presented advancements in Next-Generation Protein Sequencing (NGPS) at the US HUPO 2025 conference in Philadelphia, Pennsylvania. These innovations enhance research outcomes and open new avenues in fields such as personalized medicine. As service providers continue to push the boundaries with advanced platforms and cutting-edge solutions, customers across academia, healthcare, and industry are increasingly adopting NGS services, driving sustained market growth.

A high level of mergers and acquisitions (M&A) activity within the next-generation sequencing services market drives demand by fostering consolidation, technological synergy, and global expansion. For instance, in May 2025, QIAGEN completed the acquisition of Genoox, an AI-driven genomics software provider, adding its Franklin cloud platform to QIAGEN’s Digital Insights portfolio and strengthening global clinical genomics capabilities. Such strategic deals often accelerate the integration of advanced platforms, bioinformatics tools, and AI-based analytics into service offerings, improving efficiency and value for end users. Moreover, M&A activities enable a broader geographic reach and increased customer access, especially in emerging markets, further boosting the adoption of NGS services across both clinical and research sectors.

Regulations play a critical role in shaping the growth and operational dynamics of the next-generation sequencing (NGS) services market. Strict regulatory frameworks ensure sequencing data's quality, safety, and accuracy, particularly in clinical and diagnostic applications. Compliance with standards set by bodies such as the FDA, EMA, and CLIA is essential for service providers offering tests used in patient care, which can increase the cost and complexity of service delivery. However, clear regulatory pathways also build trust among healthcare providers and patients, encouraging broader adoption. While regulation can act as a barrier to entry for smaller firms, it also drives innovation and standardization, ultimately supporting the long-term credibility and growth of the NGS services market.

Service expansion is a key driver of growth in the next-generation sequencing (NGS) services industry, as providers continually broaden their offerings to meet the diverse and evolving needs of researchers, clinicians, and pharmaceutical companies. Companies are expanding their customer base by offering services beyond standard sequencing to include data analysis, interpretation, cloud-based storage, and end-to-end workflow solutions. For instance, in May 2025, Summit Health internalized Genomic Testing Cooperative’s next-generation sequencing (NGS) DNA and RNA profiling services at its Woodland Park, New Jersey, USA lab, enabling inhouse tissue and liquid biopsy testing for solid tumors and hematologic neoplasms. This diversification enhances customer value and creates recurring revenue streams, positioning NGS service providers as comprehensive genomic solution partners and driving sustained market demand.

Regional expansion is a significant demand driver in the NGS services industry, as companies increasingly extend their presence into emerging markets and regions. With rising healthcare awareness, growing investment in genomics, and improving infrastructure in Asia-Pacific, Latin America, and the Middle East, NGS service providers are capitalizing on new growth opportunities outside traditional markets, such as North America and Europe. Establishing local laboratories, forming strategic partnerships with regional healthcare institutions, and adapting services to meet local regulatory and clinical needs help providers penetrate these markets more effectively. This geographic diversification increases market reach and accelerates the global adoption of NGS technologies, fueling long-term market expansion.

Service Type Insights

The human genome segment held the largest market share of 31.28% in 2024. Human genome sequencing services offer access to genomic information related to human genes, providing solutions for personalized medicine, biomarker discovery, cancer-associated gene information, and pharmacogenomics. For instance, GENEWIZ, Inc. utilizes sequencing platforms such as Illumina HiSeq X Ten and offers services related to genome sequencing, including the detection of germline variants, somatic variation, whole-genome resequencing, de novo genome assembly, and the discovery of structural variants, thereby fueling segment growth.

The gene regulation services segment is projected to increase at a considerable CAGR through the forecast period, because of growing demand for new genomic tools to study transcriptional and epigenetic mechanisms. Additionally, the increasing adoption of NGS, CRISPR-based functional genomics, and single-cell sequencing in oncology, immunology, and rare disease research will also contribute to the market growth.

Workflow Insights

The sequencing segment held the largest market share of 55.53% in 2024. This high share can be attributed to companies undertaking various scientific endeavors to boost the adoption of sequencing services. For instance, in June 2025, The Jackson Laboratory’s Advanced Precision Medicine Laboratory in Farmington, Connecticut, U.S., implemented an end-to-end Illumina‑powered NGS workflow automating in-house sample tracking, analysis, and variant interpretation. These companies offer a range of NGS services for a diverse array of sample types. The company generates publication-ready data to support the success of customer research programs across multiple domains, including agriculture, biomedical, and environmental science.

The data analysis service segment is projected to grow at a significant CAGR over the forecast period. Growth in the segment is also expected to be driven by the increasing adoption of cloud-based analytics, AI-enabled pipelines, and integrated multi-omics platforms, as well as the growing demand for personalized medicine and precision medicine-related research.

End Use Insights

The universities & other research entities segment led the next-generation sequencing services market with the largest share of 52.66% in 2024. Major factors that drive the adoption of NGS services by universities & other research entities include a rise in R&D funding, high demand for NGS services, and an increasing number of comparative and evolutionary genomic studies in universities. Additionally, an increase in the number of R&D activities and projects undertaken by universities and other research entities is expected to create lucrative growth opportunities for NGS service providers in the near future. Recently, in February 2022, the University of the West Indies (Mona campus) in Kingston, Jamaica, launched an in-house Next Generation Sequencing (NGS) service using a donated MiSeq system, collaborating with the University Hospital and the Ministry of Health & Wellness. It supports research across HIV/AIDS, biodiversity, antibiotic resistance, and pathogen monitoring, eliminating the need for overseas sequencing and supporting regional public health preparedness, fueling the demand for the segment in the NGS services industry.

The hospitals and clinics segment is expected to witness the fastest CAGR throughout the forecast period, driven by the increasing integration of next-generation sequencing (NGS) technologies into routine clinical workflows. The growing demand for precision diagnostics, particularly in oncology, the detection of rare diseases, and the management of infectious diseases, is prompting hospitals and clinics to adopt NGS-based testing solutions. For instance, the National Public Health Laboratory (NPHL) in Kathmandu, India, began offering in‑country next-generation sequencing (NGS) for breast cancer, allowing oncologists to process samples locally, halving patient costs and reducing turnaround time. This move accelerates diagnostic results, enabling earlier treatment, and positions NPHL to expand genomic testing to leukemia and other cancers. Such improvements in infrastructure, greater awareness of genomic medicine among healthcare professionals, and expanding reimbursement coverage for genetic testing further support the uptake of NGS services in clinical settings.

Regional Insights

The North America next-generation sequencing services market held the largest share of 45.56% in 2024, owing to factors such as a well-established informatics network, effective regulatory guidelines about approval and usage of genetic tests, and market leaders in the region. Moreover, strategic collaborations are further accelerating market development. For instance, in September 2024, AdvancedDx Biological Laboratories USA Inc. partnered with Complete Genomics to co-market a comprehensive NGS microbiology solution, including DeepChek assays and DNBSEQ platforms in the U.S., streamlining infectious disease genotyping workflows.

U.S Next-Generation Sequencing Services Market Trends

The U.S. next-generation sequencing services industry has experienced significant growth in recent years, driven by a strong foundation in genomic research, robust healthcare infrastructure, and substantial public and private investments in precision medicine. For instance, in June 2025, Avance Biosciences opened its Next-Generation Sequencing Center of Excellence in Houston, Texas, featuring advanced short-read and long-read sequencing platforms, as well as single-cell technologies, to support drug development and diagnostics. Moreover, the increasing number of FDA-approved genomic tests, rising demand for clinical diagnostics, and rapid adoption of personalized therapies are accelerating the integration of NGS in healthcare.

Europe Next-Generation Sequencing Services Market Trends

The Europe next-generation sequencing services industry is expected to grow steadily during the forecast period. Supportive regulatory frameworks, strong research funding, and a collaborative environment across academia and industry support market growth. For instance, in May 2025, n6 expanded its European presence by partnering with distributors across the Nordic region, Switzerland, and Central and Eastern Europe to simplify next-generation sequencing workflows and better support scientists. Countries such as the UK and Germany are leading the adoption of NGS in clinical and research settings. EU-wide initiatives promoting personalized medicine and cross-border data sharing further enhance the region’s capacity for large-scale genomic projects and population health studies.

The UK next-generation sequencing services market is expected to grow over the forecast period. The UK is a key player in the Europe NGS services market, benefiting from strong government support and initiatives such as the Genomics England project. The NHS’s growing emphasis on integrating genomics into routine care, particularly for cancer and rare diseases, is boosting demand for NGS services. A highly collaborative research environment and advanced data infrastructure also contribute to the UK’s leadership in population-scale sequencing efforts. For instance, in May 2024, Azenta Life Sciences opened a new Genomics Laboratory in Oxford, UK, offering advanced next-generation sequencing services to support research in diabetes, infectious diseases, and Alzheimer’s, with streamlined sample collection and expert bioinformatics support.

The next-generation sequencing services market in Germany is expected to grow over the forecast period, supported by its highly developed healthcare system and substantial investment in biomedical research. Government-led initiatives and increasing acceptance of NGS-based diagnostics among clinicians enhance market penetration. The presence of several biotechnology hubs and academic research institutions further accelerates the demand for both clinical and research-based sequencing services. For instance, in March 2025, Labor Dr. Wisplinghoff, one of Germany's largest medical laboratories, partnered with the Genomic Testing Cooperative (GTC) to introduce advanced Next-Generation Sequencing (NGS) DNA/RNA tests for solid tumors and hematologic neoplasms. This collaboration introduced advanced NGS DNA/RNA tests targeting solid tumors and hematologic neoplasms, underscoring Germany's commitment to advancing precision oncology through cutting-edge genomic solutions.

Asia Pacific Next-Generation Sequencing Services Market Trends

Asia Pacific is expected to witness the fastest CAGR of 24.07% over the forecast period, driven by rising healthcare investments, expanding research infrastructure, and a growing burden of chronic and genetic diseases. Countries such as China, Japan, and India are driving advancements in genomics, while emerging economies are increasingly investing in precision medicine. For instance, in June 2024, the Armed Forces Medical College (AFMC) in Pune, India, inaugurated a Genome Sequencing Lab featuring advanced Next-Generation Sequencing systems, including the NextSeq 2000 and MiniSeq, to support cutting-edge genomic research and diagnostics, and further facilitate market expansion.

The China next-generation sequencing services market is expected to grow over the forecast period. China is emerging as a major player in the global market, driven by extensive government funding in genomics, rapid technological advancement, and a large patient base. The expansion of precision medicine initiatives and the growing demand for early disease detection are driving the adoption of NGS services. Domestic companies are also forming strategic partnerships with global technology providers to enhance service capabilities and compete on a global scale. For instance, in June 2025, Gene Solutions and Shenzhen USK Bioscience formed a strategic partnership to launch a cutting-edge next-generation sequencing laboratory in southern China. The collaboration aims to enhance early cancer detection and molecular residual disease monitoring using AI-powered technologies, combining Gene Solutions’ NGS expertise with USKBio’s diagnostic capabilities to advance personalized oncology care in the country.

The next-generation sequencing services market in Japan is expected to witness significant growth over the forecast period, driven by strong government initiatives in genomic medicine and aging population healthcare needs. Programs like the Center for Cancer Genomics and Advanced Therapeutics (C-CAT) enable the integration of NGS into cancer care and personalized treatment pathways. For instance, in January 2025, Taiwan's Advanced Genomics partnered with Cancer Precision Medicine to launch the GALEAS Bladder test in Japan. This non-invasive NGS-based screening detects bladder cancer with high accuracy and will be exclusively offered by Cancer Precision Medicine to medical and research institutions. This non-invasive, NGS-based screening tool detects bladder cancer with high accuracy. Cancer Precision Medicine will exclusively provide it to medical and research institutions, marking a major advancement in cancer diagnostics and NGS technology within the country.

MEA Next-Generation Sequencing Services Market Trends

The MEA region is an emerging market for next-generation sequencing services, due to rising healthcare modernization and increased awareness of genetic disorders. Countries like Kuwait and the UAE are investing in genomic research and forming international partnerships to bring advanced sequencing technologies to the region. Limited local expertise and infrastructure currently pose challenges, which are gradually addressed through strategic collaborations and policy support.

The Kuwait next-generation sequencing services market represents a growing segment within the MEA region, driven by increasing interest in genetic testing and personalized healthcare. Government efforts to modernize the healthcare sector, combined with rising awareness of rare and hereditary diseases, support the adoption of NGS services. While the market is still in the early stages, partnerships with international genomics firms and investments in medical infrastructure are expected to drive future growth.

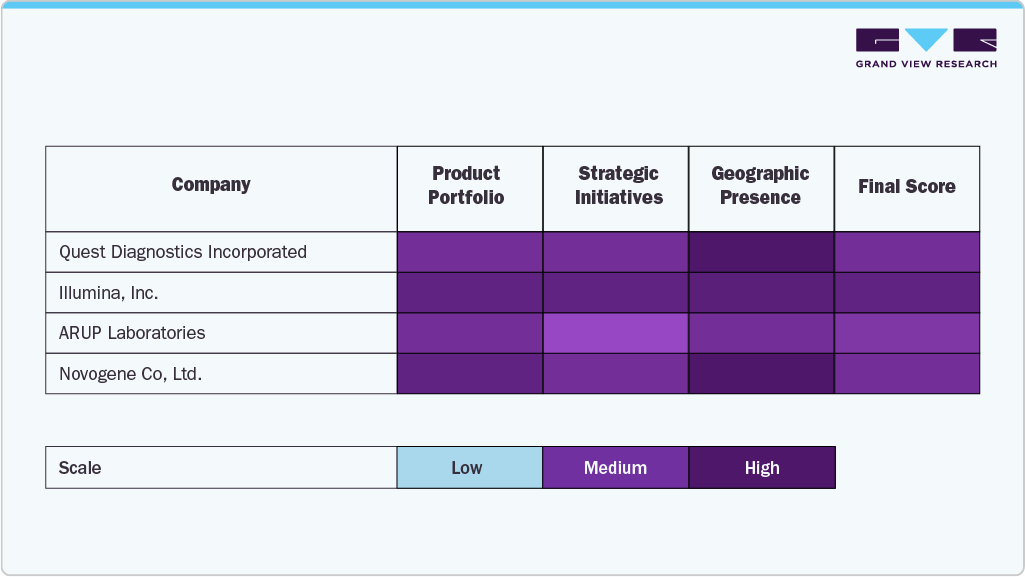

Key Next-Generation Sequencing Services Company Insights

The next-generation sequencing (NGS) services industry is a rapidly advancing segment within the global genomics and biotechnology industry, driven by the increasing demand for high-throughput, accurate, and cost-effective sequencing solutions across clinical, research, and pharmaceutical applications. Leading companies such as Illumina, Inc., Thermo Fisher Scientific, Quest Diagnostics Incorporated, ARUP Laboratories, Novogene Co., Ltd., Azenta Life Sciences (GENEWIZ), PacBio, BGI (Beijing Genomics Institute), Gene by Gene Ltd., Lucigen Corporation, Applied Biological Materials, Inc. (abm), NanoString Technologies, and Veritas have established themselves as key players by offering comprehensive NGS services tailored to applications in oncology, rare disease diagnostics, reproductive health, and infectious disease research.

These organizations have strengthened their market presence through the use of cutting-edge technology, deep genomic expertise, and extensive global service networks. Their offerings span a wide range of sequencing platforms and services, including whole-genome sequencing, exome sequencing, transcriptome analysis, targeted gene panels, and metagenomics, supported by robust bioinformatics and data interpretation tools.

Continuous investment in R&D, regulatory compliance, and strategic partnerships with hospitals, research institutions, and biopharma companies has positioned these companies at the forefront of precision medicine. As the demand for personalized healthcare and data-driven drug development increases, the NGS services market continues to evolve, focusing on innovation, scalability, and global accessibility.

Key Next-Generation Sequencing Services Companies:

The following are the leading companies in the next-generation sequencing services market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- BGI Genomics

- Eurofins Genomics

- GENEWIZ

- Macrogen Inc.

- QIAGEN N.V.

- Agilent Technologies Inc.

- Revvity, Inc.

- Twist Bioscience

Recent Developments

-

In June 2025, Novogene launched Novogene Korea Limited, a wholly-owned subsidiary in Seoul, to offer rapid, high-quality multi-omics and next-generation sequencing services tailored to South Korea’s research ecosystem, which supports cancer genomics, microbiome, precision medicine, agriculture, and more.

-

In March 2025, Genalive, a joint venture between China’s BGI Genomics and Saudi partners, secured a contract from Saudi Arabia’s NUPCO to deliver 930,000 genetic tests (NGS, WES, WGS, NIPT, hereditary cancer screening) across 83 hospitals over three years, bolstering the nation’s precision medicine strategy under Vision 2030.

-

In March 2025, ARUP Laboratories became the world’s first to apply AI-driven screening across the full ova-and-parasite testing workflow, including both trichrome and wet-mount slides, resulting in significantly higher sensitivity, doubled positivity rates, faster turnaround, and reduced human error in gastrointestinal parasite detection.

-

In November 2023, Quest Diagnostics (USA) and Scipher Medicine launched a multi-faceted collaboration leveraging Quest's RNA extraction and next-generation sequencing capabilities to scale access to PrismRA, a blood-based molecular classifier for predicting rheumatoid arthritis patients' responses to TNF‑inhibitor therapy, supported by thousands of U.S. specimen collection sites and streamlined logistics.

Next-Generation Sequencing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.95 billion

Revenue forecast in 2033

USD 40.43 billion

Growth rate

CAGR of 22.54% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, workflow, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Switzerland; India; China; Japan; Australia; South Korea; Thailand; Singapore; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Illumina, Inc.; Thermo Fisher Scientific Inc.; BGI Genomics; Eurofins Genomics; GENEWIZ; Macrogen Inc.; QIAGEN N.V.; Agilent Technologies Inc.; Revvity, Inc.; Twist Bioscience

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

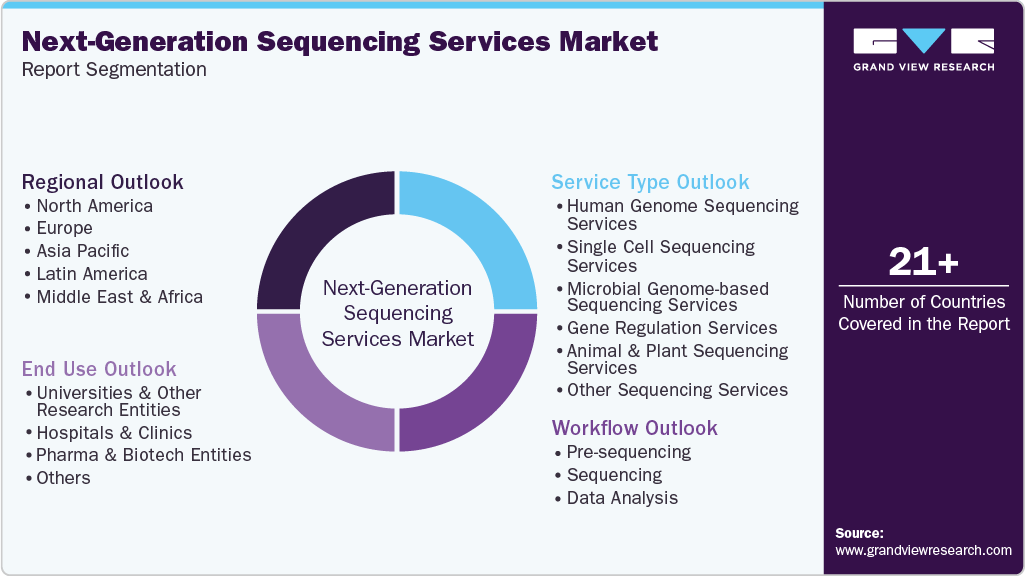

Global Next-Generation Sequencing Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the next-generation sequencing services market on the basis of service type, workflow, end use, and region:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Human Genome Sequencing Services

-

Single Cell Sequencing Services

-

Microbial Genome-based Sequencing Services

-

Gene Regulation Services

-

Small RNA Sequencing

-

ChIP Sequencing

-

Other Gene Regulation-based Services

-

-

Animal & Plant Sequencing Services

-

Other Sequencing Services

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Universities & Other Research Entities

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.