- Home

- »

- Disinfectants & Preservatives

- »

-

Nitrogen Trifluoride And Fluorine Gas Market Report, 2030GVR Report cover

![Nitrogen Trifluoride And Fluorine Gas Market Size, Share, & Trends Report]()

Nitrogen Trifluoride And Fluorine Gas Market (2023 - 2030) Size, Share, & Trends Analysis By NF3 Application (Semiconductor Chips, Flat Panel Display, Solar Cells, Others), By F2 Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-241-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global nitrogen trifluoride and fluorine gas market size was valued at USD 1.27 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. Nitrogen Trifluoride (NF3) is an inorganic compound and has non-flammable, and toxic properties. NF3 is manufactured by the reaction of hydrochloric acid (HCL) and ammonia (NH3) and is primarily used in the cleaning of silicon wafers in semiconductor and solar energy applications. Fluorine Gas (F2) is produced either from fluorite (fluorspar) or fluorapatite.

Fluorine gas is used in uranium enrichment, switchgear, and electronic cleaning applications. Fluorine in the form of uranium hexafluoride (UF6) and sulfur hexafluoride (SF6) is used for uranium enrichment and as a dielectric medium for gas-insulated switchgear, respectively. Nuclear enrichment enables uranium for further processing in power generation and other applications. Increasing uranium production is expected to boost the demand for UF6 in nuclear power production, driving growth in the F2 demand.

NF3 is considered in place of other cleaning agents such as sulfur hexafluoride, and hexafluoroethane on account of its environmental effectiveness. Moreover, increasing solar power generation is expected to boost the NF3 demand for thin-film solar cells.

The growth in demand for LCDs is expected to boost the demand for NF3 over the forecast period. However, many manufacturers have started using F2 in place of NF3 to manufacture solar cells and LCDs owing to their environmentally friendly nature and low carbon footprint record. The increased use of F2 in uranium enrichment is expected to further augment its demand for nuclear production. In addition, the preference for gas insulated switchgears (GIS) over air insulated switchgears (AIS) is expected to propel the demand for F2 as a dielectric medium intended to be used in electrical applications.

Nitrogen Trifluoride (NF3) Application Insights

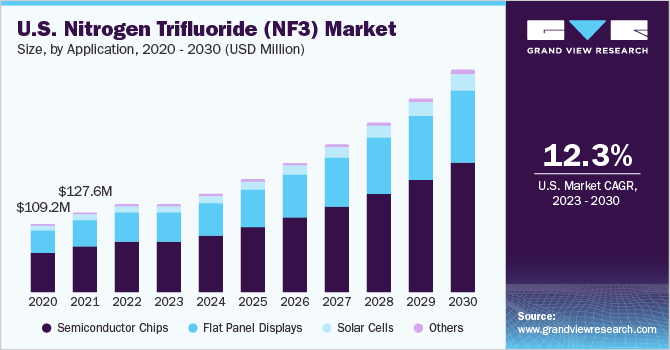

The semiconductor chips segment accounted for the largest revenue share of 57.5% in 2022. NF3 is majorly used in the manufacturing of semiconductor chips, flat panel displays, and solar cells, whereas, F2 is used in uranium enrichment, sulfur hexafluoride, and in electronic cleaning. Increasing demand for nitrogen trifluoride in semiconductor chips from the growing electronics industry worldwide is anticipated to pave opportunities for the material over the coming years. It is also used in the cleaning of PECVD (Plasma Enhanced Chemical Vapor Deposition) chambers. These PECVD chambers are used in the manufacturing of large volumes of flat panel displays. PECVDs are also used to manufacture flat panel displays for mobile digital cameras, camcorders, point-and-shoot cameras, phones, laptops, and pocket video cameras.

The solar cells segment is expected to grow at the fastest CAGR of 9.6% over the forecast period. Nitrogen trifluoride is principally used in cleaning applications for a range of electronic applications such as semiconductor chips, flat panel displays, solar cells, and more. Further, with increasing dependency on digitalized platforms and automated services globally, the demand for flat panel displays has increased over the past decade. Demand for laptops, desktops for commercial and private utility, LCD, and LED television sets, are anticipated to drive the demand for NF3.

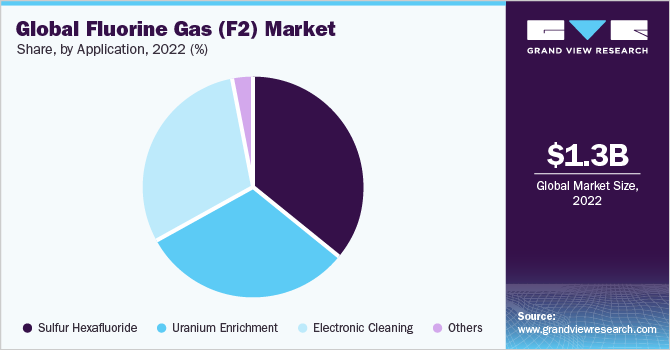

Fluorine Gas (F2) Application Insights

The sulfur hexafluoride segment accounted for the largest revenue share of 36.5% in 2022. Sulfur hexafluoride also known as SF6 is majorly used in electronic applications as a dielectric medium. The other uses of SF6 include contrast agents for tracer compounds, ultrasound imaging, and casing medium for magnesium production.

The electronic cleaning segment is expected to register the fastest CAGR of 7.6% over the forecast period. Growing semiconductor industry is a key driving factor for the market. Semiconductors are an essential component of the electronics industry, which is utilized to power multiple digital devices globally. Increased research & development activities related to the development of the semiconductor industry and application markets have led to a surge in demand for various electronic cleaning formulations. East Asia is the major hub for semiconductor manufacturers due to factors such as rising mobile communications, burgeoning economy, as well as growth in cloud computing across the region.

Regional Insights

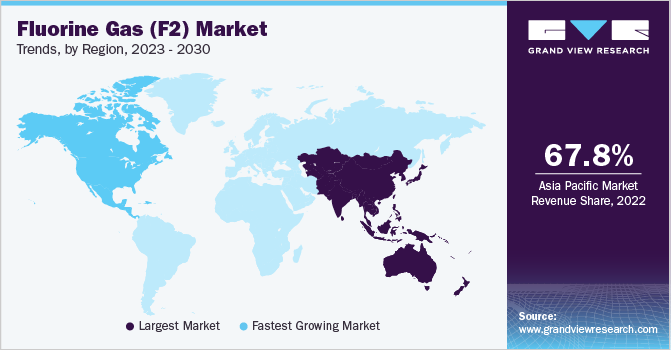

Asia Pacific dominated the market and accounted for the largest revenue share of 67.8% in 2022. In Asia Pacific the NF3 and F2 gas are majorly used to manufacture semiconductor chips and as a dielectric medium respectively. The growth of the semiconductor industry in South Korea, China, and Japan is expected to drive the NF3 market. F2 gas demand is expected to increase due to the increase in production of flat panel displays in emerging markets such as China. According to the report published by the Semiconductor Industry Association (SIA) in 2022, semiconductor chip sales from Chinese companies were on the rise.

North America is expected to grow at the fastest CAGR of 11.3% over the forecast period. Growth in electronics manufacturing, renewable energy technologies such as solar cells, growing demand for data centers, and phase out of the use of Sulphur hexafluoride (SF6), a potent greenhouse gas, are some of the important factors driving the NF3 demand in North America.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The following are some of the major participants in the global nitrogen trifluoride and fluorine gas market:

-

Mitsui Chemicals Inc

-

American Gas Group

-

Central Glass Co. Ltd

-

Formosa Plastics Corporation

-

Kanto Denka Kogyo Co. Ltd

-

SK Materials

-

Foosung Co. Ltd

-

HYOSUNG

-

Linde plc

-

Navin Fluorine International Limited

-

OCI COMPANY Ltd.

Recent Development

-

In February 2021, according to the Korea International Trade Association data report, Hyosung Chemical, the world’s second-largest manufacturer of NF3, with a 4,550-ton manufacturing capacity, increased its export in global chip and display industries. It shipped roughly 4,000 tons of NF3 in 2020 as compared to 3,000 tons in 2019.

-

In June 2022, SK Materials Co. a South Korean NF3-producing company, and the Showa Denko K.K. a Japanese chemical firm decided to work together to look for commercial prospects in the U.S. semiconductor materials industry. The two companies planned to build a facility in the U.S. to manufacture the high-purity gas to meet the growing demand in the North America region. This initiative is expected to increase the company’s market share in the North American region.

Nitrogen Trifluoride And Fluorine Gas Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.25 billion

Revenue forecast in 2030

USD 2.49 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018- 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilo Tons & Revenue in USD million/billion and CAGR From 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; South East China; Argentina; Brazil; South Africa; Saudi Arabia.

Key companies profiled

Mitsui Chemicals Inc.; American Gas Group; Central Glass Co. Ltd; Formosa Plastics Corporation; Kanto Denka Kogyo Co. Ltd.; SK Materials; Ltd.; Foosung Co. Ltd.; HYOSUNG; Linde plc; Navin Fluorine International Limited; OCI COMPANY Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrogen Trifluoride And Fluorine Gas Market Report Segmentation

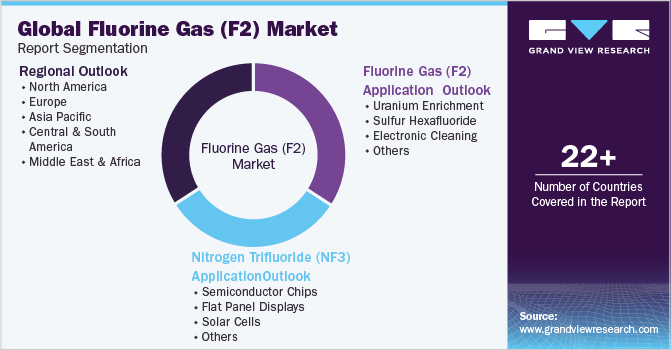

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nitrogen trifluoride and fluorine gas market based on application, and region:

-

Nitrogen Trifluoride (NF3) Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Semiconductor Chips

-

Flat Panel Displays

-

Solar Cells

-

Others

-

-

Fluorine Gas (F2) Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Uranium Enrichment

-

Sulfur Hexafluoride

-

Electronic Cleaning

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South East Asia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nitrogen trifluoride and fluorine gas market size was estimated at USD 1.27 billion in 2022 and is expected to reach USD 1.25 billion in 2030.

b. The global nitrogen trifluoride and fluorine gas market is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 2.49 billion by 2030.

b. Asia Pacific dominated the nitrogen trifluoride and fluorine gas market with a share of 67.77% in 2022. This is attributable to the growing electronics industry in the region.

b. Companies in the Nitrogen Trifluoride (NF3) & Fluorine Gas (F2) market include Mitsui Chemicals Inc, American Gas Group, Central Glass Co. Ltd, Formosa Plastics, Kanto Denka Kogyo Co. Ltd, Ulsan Chemical Company Limited, Foosung Co. Ltd, Hyosung, Linde Group, Navin Fluorine India and OCI Materials Co.

b. Global nitrogen trifluoride and fluorine markets are anticipated to grow due to increasing demand of the products from end-use markets. Increasing demand for nitrogen trifluoride in semiconductor chips from the growing electronics industry worldwide is anticipated to pave opportunities for the material over the coming years. Further, high electronic production across countries of Asia Pacific such as China, India, South Korea, India and more have accelerated demand for nitrogen fluoride in semiconductor applications across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.