- Home

- »

- Electronic Security

- »

-

Night Vision Device Market Size And Share Report, 2030GVR Report cover

![Night Vision Device Market Size, Share & Trends Report]()

Night Vision Device Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Camera, Goggles, Scope, Monocular & Binoculars, Others), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-316-4

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Night Vision Device Market Summary

The global night vision device market size was estimated at USD 7.02 billion in 2022 and is projected to reach USD 16.32 billion by 2030, growing at a CAGR of 11.5% from 2023 to 2030. The growing popularity of these devices among nature enthusiasts and wildlife researchers is likely to propel the demand.

Key Market Trends & Insights

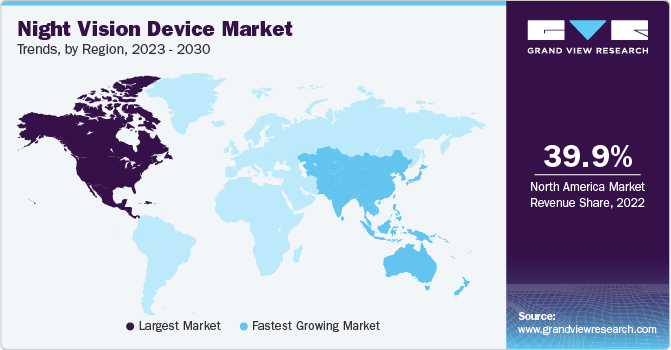

- North America dominated the market and accounted for the largest revenue share of 39.9% in 2022.

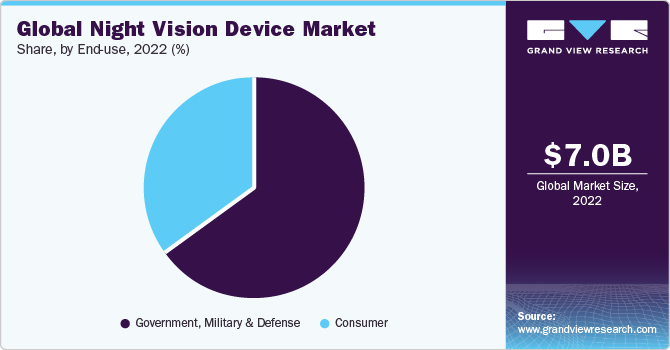

- By end use, the government, military & defense segment accounted for a dominant revenue share of 65.2% in 2022.

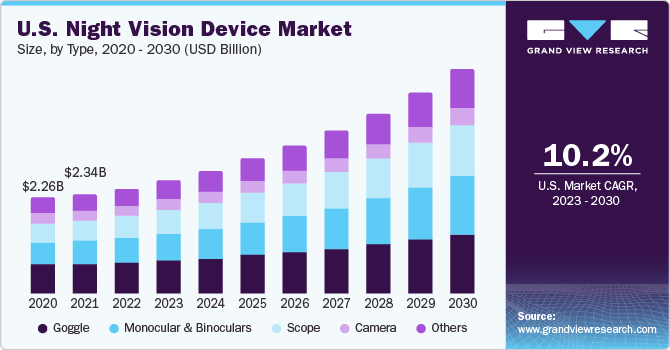

- By type, the goggles segment accounted for the largest revenue share of 29.6% in 2022.

- Based on technology, the thermal imaging segment accounted for the largest market share of 41.7% in 2022.

- By application, the security and surveillance segment accounted for the largest revenue share of 26.9% in the night vision device market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.02 Billion

- 2030 Projected Market Size: USD 16.32 Billion

- CAGR (2023-2030): 11.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, the reasonable cost and technical feasibility of providing soldiers with night vision devices that are capable of producing color images are expected to drive market growth in the coming years. Night vision devices such as goggles find several uses in the military sector, such as surveillance, navigation, rescue, and combat activities.

Law enforcement authorities use night goggles to conduct training activities and ensure the mission readiness of defense personnel. A suitable set of night-vision devices can allow clear visibility over 150-200 yards on a moonless, cloudy night. This factor is anticipated to drive product demand over the forecast period. Technological innovations such as improvements in the components used in night vision devices contribute to the development of this sector.

For instance, the integration of weapon locating devices such as rangefinders and viewfinders with goggles allows military personnel to aim at the target with great accuracy. The rising availability of such advanced products is also likely to drive industry growth. The demand for lightweight night vision devices is gaining traction in the market. Lightweight binocular devices offering high optical performance are presently available widely in the market.

BAE Systems, L3Harris Corporation, and DRS are engaged in the development of Enhanced Night Vision Goggles (ENVGs) and Family of Weapon Sights - Individual (FWS-I) as contracted with the U.S. Army. ENVGs help soldiers navigate easily in all conditions and levels of light, hence improving the functional value of night vision goggles. A major advantage is the rapid target detection that improves shooting accuracy by offering a simultaneous line of visibility that enables the shooter to aim effortlessly.

Stringent norms and regulations set by governments on product usage and the high intensity of market competition represent a major challenge for key players. In addition, substantial costs of manufacturing limit the production capacity, and therefore these devices are made available only to military forces. Moreover, the commercial availability for the general population increases the risk of security breaches in government premises, thus restraining market growth.

End-use Insights

The government, military & defense segment accounted for a dominant revenue share of 65.2% in 2022. Due to the recent increase in military activities globally, there is a rising demand for night vision devices by military and law enforcement agencies to help them operate better in low-light conditions. These agencies use night vision devices for a variety of purposes, including patrolling to deter crime & apprehend criminals, evidence gathering at crime scenes, and searching & rescuing missing persons or victims of natural disasters.

Countries such as the United States, India, and European Union economies have increased their spending on border surveillance in response to rising security threats, such as the India-China border conflict in 2020. During this period, India spent USD 2.6 billion on enhancing its military capabilities to address the challenges that arose from the conflict.

The consumer segment is expected to expand at the fastest CAGR of 13.6% over the forecast period, owing to the affordability & accessibility of night vision devices. This enables increased usage of these devices for a variety of purposes, such as security, recreation, and entertainment. Hiking during nighttime and camping are becoming increasingly popular among the population, along with night photography and videography, as people are looking for new ways to explore the outdoors.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.9% in 2022, owing to the extensive usage of night vision products in the U.S. Army. In addition, intensive R&D activities undertaken for devising advanced devices, along with the presence of a large number of vendors, contribute to the promising development of the regional market.

Asia Pacific is expected to advance at the fastest CAGR of 13.3% over the forecast period, which can be attributed to the rising instances of border disputes in the region, a noticeable rise in expenditure on weapons and devices in the defense sector, and a substantial growth in product demand from the commercial sector. Moreover, constant developments in technology and a notable rise in the use of military forces are likely to boost regional growth.

Type Insights

The goggles segment accounted for the largest revenue share of 29.6% in 2022. Goggles find extensive use in the defense sector across the globe due to their versatility during night operations. On the other hand, automotive manufacturers are also emphasizing on integrating these devices with Advanced Driver Assistance Systems (ADAS) for cars. Moreover, the rapidly developing trend of night tours for photography is creating lucrative growth prospects for this segment.

The scope segment also held a significant market share in 2022. The demand for scopes is relatively higher than goggles as they offer better performance. Scopes are mainly used as weapon sights despite the fact that they are large and heavier than goggles. In addition, they can be used for navigation and scouting purposes. The camera segment accounted for a substantial share in 2022 and is expected to register a steady CAGR through 2030. The segment growth is attributed to lower purchasing and maintenance costs for cameras. Moreover, they are more flexible, lightweight, and can be easily detached.

The monocular & binoculars segment is expected to expand at the fastest CAGR of 13.2% during the forecast period. Monocular are often used by military personnel in order to carry out low-light operations. Binoculars are suitable for missions that are ground-based, owing to the twin-viewing tubes that provide a wider field of view and are very suitable for imaging, surveillance, and scouting.

Technology Insights

Based on technology, the market is segmented into imaging intensifiers, thermal imaging, infrared illumination, and other emerging technologies. The thermal imaging segment accounted for the largest market share of 41.7% in 2022. There are two types of thermal imaging devices - uncooled and cryogenically-cooled. Uncooled devices are the most common ones operating and can function at room temperature. Cryogenically-cooled devices are relatively expensive and are highly susceptible to damage due to rough use.

The thermal imaging technique often serves the purpose of wildlife research as it amplifies the light and enables high visibility for objects perceived as identical in the daytime. It also spots variations in body temperature, which makes it easy to differentiate between animals and humans. Commonly used thermal imaging devices for hunting are imaging monoculars and thermal imaging rifle scopes.

The image intensifier segment is expected to advance at a CAGR of 11.2% over the forecast period, owing to the high popularity and significance of devices based on this technology. A generational categorization is done for these devices, with each significant change in night vision technology giving rise to a new generation. At present, Generation 3 devices are extensively used by the U.S. military owing to better resolution and sensitivity. Generation 4 devices are termed as filmless and gated since they function efficiently in both low- and high-light environments.

Application Insights

The security and surveillance segment accounted for the largest revenue share of 26.9% in the night vision device market in 2022. The continued expansion of military activities during night time and poor visibility conditions has led to a significant rise in demand for these devices. On the other hand, the wildlife spotting & hunting segment is anticipated to expand at the fastest CAGR of 12.8% over the forecast period.

Wildlife research activities necessitate the use of a variety of devices, especially during night, as surveillance & navigation form a major part of wildlife research. The thermal imaging technique is often used to serve this purpose as it amplifies the light and enables high visibility for objects perceived identical during day time. It also spots differences in body temperature, making it easy to differentiate between animals and humans.

Key Companies & Market Share Insights

Leading players in the market are undertaking strategies such as product developments, mergers & acquisitions, strategic partnerships, and business expansions to maintain their stronghold. For instance, in November 2022, L3Harris Technologies, Inc. announced the delivery of the 10,000th Enhanced Night Vision Goggle-Binocular to the United States Army. Simultaneously, the company secured a fresh production order for extra ENVG-B units.

Key Night Vision Device Companies:

- ATN Corp.

- Collins Aerospace

- Vista Outdoor Operations LLC

- L3Harris Technologies, Inc.

- FLIR Systems, Inc.

- BAE Systems

- Bharat Electronics

- Thales

- RTX

- Bushnell

- Yukon Advanced Optics Worldwide

- Adorama Camera, Inc.

- Elbit Systems Ltd.

Recent Developments

-

In April 2023, Shenzhen Mileseey Technology Co., Ltd. launched the TNV30, a new night vision thermal monocular. The device enables display customization and maximizes the imaging effects in different scenarios

-

In December 2022, China-based PARD, a specialist in night vision and thermal imaging, announced the imminent launch of NV007SP & NV007V, two digital clip-on night vision systems, in the North American market. Both systems are equipped with features such as advanced image sensors, Wi-Fi, and a built-in camera for recording and sharing videos

-

In October 2022, Israel-based Elbit Systems Ltd., a defense electronics company, announced that it had received an order worth USD 107 million for supplying Enhanced Night Vision Goggle - Binocular (ENVG-B) systems, logistics support, test equipment, and spare parts to the U.S. Army. The ENVG-B system offers enhanced night vision and situational awareness for soldiers in modern battlefields. It features high-performing white phosphor image intensifier tubes, AR overlay for rapid target acquisition, and wireless connectivity to rifle-mounted thermal weapon sites

-

In June 2022, the Indian Army released a Request For Information (RFI) to procure the digital night vision goggles, FBNVG and Duvi-B, from Tonbo Imaging, an India-based sensing solution manufacturing company. FBNVG is a military-qualified lightweight night vision goggle integrated with a modern high-resolution thermal imager, featuring optical sensor fusion technology and advanced night vision tubes

Night Vision Device Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.64 billion

Revenue forecast in 2030

USD 16.32 billion

Growth rate

CAGR of 11.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ATN Corp.; Collins Aerospace; Vista Outdoor Operations LLC; L3Harris Technologies, Inc.; FLIR Systems, Inc.; BAE Systems; Bharat Electronics; Thales; RTX; Bushnell; Yukon Advanced Optics Worldwide; Adorama Camera, Inc.; Elbit Systems Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Night Vision Device Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global night vision device market report on the basis of type, technology, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Camera

-

Goggle

-

Scope

-

Monocular & Binoculars

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging Intensifier

-

Thermal Imaging

-

Infrared Illumination

-

Other Emerging Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Surveillance

-

Wildlife Spotting & Hunting

-

Wildlife Conservation

-

Navigation

-

Paranormal Research

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government, Military & Defense

-

Consumer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global night vision device market size was estimated at USD 7.02 billion in 2022 and is expected to reach USD 7.64 billion in 2023.

b. The global night vision device market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030, to reach USD 16.32 billion by 2030.

b. North America dominated the night vision device market with a share of 39.9% in 2022. This is attributable to the extensive usage of products in the U.S. army. In addition, intensive R&D activities undertaken to devise advanced devices contribute to the promising development of the regional market.

b. Some key players operating in the night vision device market include American Technologies Network Corp., L3 Harris Technologies, Inc., Teledyne FLIR LLC, Raytheon Company, Yukon Advanced Optics Worldwide, Bushnell, Firefield, Apresys, Inc., Luna Optics, Inc.

b. Key factors that are driving the night vision device market growth include increasing military expenditure and growing adoption from law enforcement agencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.