- Home

- »

- Next Generation Technologies

- »

-

Non-fungible Token Market Size, Share, Growth Report, 2030GVR Report cover

![Non-fungible Token Market Size, Share & Trends Report]()

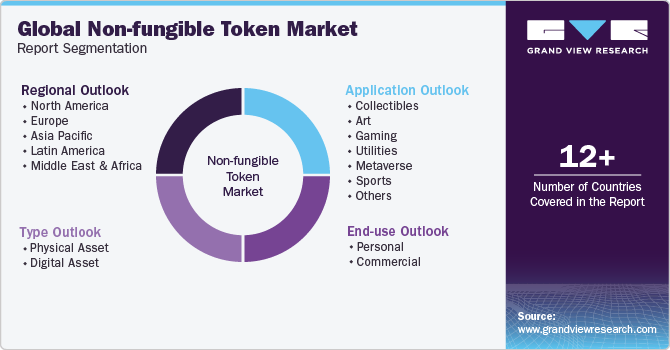

Non-fungible Token Market Size, Share & Trends Analysis Report By Application (Art, Sports), By Type (Physical Assets, Digital Assets), By End-use (Commercial, Personal), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-923-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Non-fungible Token Market Size & Trends

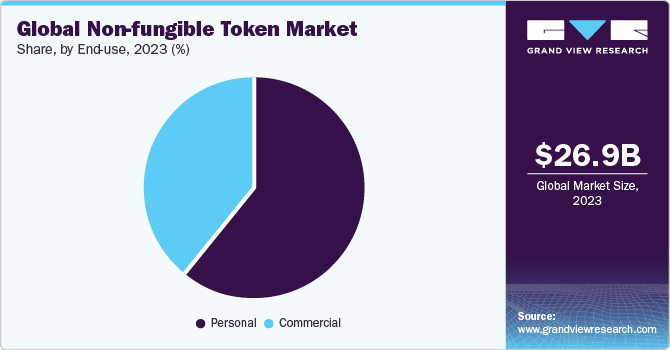

The global non-fungible token market size was estimated at USD 26.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 34.5% from 2024 to 2030. non-fungible token (NFTs) are assets that have been tokenized via a blockchain. These unique cryptographic tokens that exist on the blockchain cannot be replicated, and they can represent individual identities, property rights, and more. The rising adoption of cryptocurrencies, growing traction around Web 3.0, metaverse, and decentralized finance, and increasing popularity of non-fungible token marketplaces are contributing to the market’s growth.

The rising demand for low-cost digital currency payment systems is driving the adoption of cryptocurrencies. With the rising adoption of cryptocurrencies, investors are looking for ways to invest their cryptocurrencies/assets. NFTs provide such investors a medium for crypto investments as they are secure, and they reduce the chances of fraud since the ownership of the asset is registered on the blockchain. The growing adoption of cryptocurrencies and the need for crypto investments is driving the demand for NFTs, thus contributing to market growth.

The emergence of a public blockchain, along with the development of Web 3.0, has enabled users to take control of their data without involving any third parties. Furthermore, the launch of the metaverse has further accelerated digital investments worldwide. At this juncture, NFTs can act to represent ownership of unique virtual assets and digital identity in Web 3.0 and the metaverse, which bodes well for market's growth.

NFT marketplaces are used for digital identity and verification, where unique digital assets represent a user's identity or specific attributes. The growing scope of NFTs and marketplaces is thus attracting investments from traders. According to the cryptocurrency tracking website, CoinGecko, the total NFT trading volume across marketplaces increased from USD 573 million in November 2022 to USD 1.9 billion in February 2023. Such growth in trading volumes bodes well for market growth.

Despite the rising popularity of NFTs, there are several ways in which acquiring, owning, and disposing of these NFTs could give rise to identity and privacy risks. In metaverse or Web3 space, people create their avatars using NFTs, and when people are identified in the Web3 space based on their avatars, there may arise privacy and safety concerns. However, businesses are already finding solutions, such as the integration of smart contracts with NFTs. Such a solution will help the marketspace overcome its challenges.

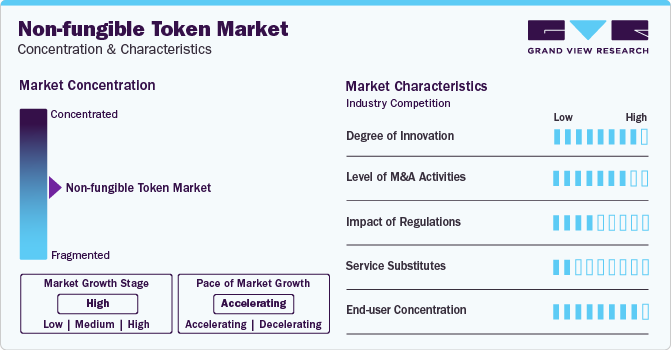

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The market can be characterized by a high degree of innovation with rapidly evolving technological advances. One such innovative trend includes virtual museums and galleries where users can exhibit their digital artwork, making them available to a wider audience.

The non-fungible token market is also characterized by a high level of merger and acquisition (M&A) activities by the leading players. This is due to several factors, including the desire to increase the product reach and leverage the technological capabilities of partner companies and the need to consolidate in a rapidly growing market.

Regulatory considerations for the NFT market include securities laws, Anti Money Laundering (AML), Know-your-customers (KYC) regulations, consumer protection, data privacy, taxation, and intellectual property among others. These regulatory considerations have a significant impact on the market and play a crucial role in protecting the consumer’s interests.

Non-fungible tokens (NFTs) are a relatively new concept, and there are no solid substitutes for NFTs as of now. Even though digital assets, or crypto wallets, act as substitutes, NFTs as a form of investment are more solid. That is, the substitute quality is inferior to the available NFT technology quality; hence, the service substitutes are considered low.

End-use concentration is high in this market. End-users adopt NFTs for personal as well as commercial purposes. Non-fungible tokens are widely adopted for personal use as a way to invest in digital assets. Moreover, people are investing in these tokens to buy art, games, collectibles, music, and utilities, among others.

Type Insights

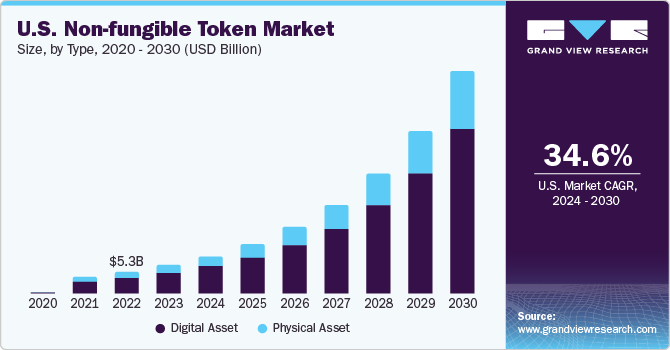

The digital assets segment accounted for the highest revenue share of 72.6% in 2023. This segment includes various types of NFTs, such as digital art, music, video games, and trade cards. Increasing use of NFTs for securing ownership of digital assets by artists worldwide is expected to drive segment growth. Artists can earn profits from their content by keeping ownership via NFTs and are not required to give it to other platforms for promotions. A rise in the use of NFTs to sell digital real estate in both physical and virtual worlds is also expected to drive segment growth.

The physical asset segment is expected to register the fastest CAGR from 2024 to 2030. NFTs can also be used for physical assets, such as a house, painting, and vehicle. NFTs are presented on physical items in the form of a barcode or tag, which can be encoded and traded in place of physical items. Demand for NFTs is growing as they enable people to claim their ownership and authenticate identity or fraudulent transactions that occur concerning their assets, thereby driving the segment growth.

Application Insights

The collectibles segment accounted for the largest revenue share in 2023. Collectibles are tokens that can be minted in NFT marketplaces. With NFT, the ownership of collectibles is encrypted and cannot be changed unless they are sold and officially transferred to the new owner. High demand for (crypto) collectibles can be attributed to their benefits, such as independence and ease in handling assets. For instance, sports collectibles allow fans to connect with their idols directly, game collectibles enable gamers to trade and play, and collectibles for artists enable them to connect with potential customers and sell their work. This growth in demand is anticipated to drive the segment’s growth.

The art segment is expected to register the fastest CAGR from 2024 to 2030. NFTs are gaining popularity in the sports sector worldwide as they allow athletes to promote their names and create opportunities to interact with fans by enhancing fan engagement. According to Deloitte Touche Tohmatsu Limited, up to five million sports fans are expected to be gifted or purchase an NFT in 2022, creating more than USD 2 billion in transactions, nearly double of 2021.

End-use Insights

The personal end-use segment led the market in 2023. NFTs are primarily adopted by investors scouting for making crypto investments for their personal use. As such, the growing preference for owning digitally-created content is driving the segment growth. Increasing spending on digital assets across the globe is one of the major factors driving segment growth. According to a report published by The White House (WH.GOV), over 16% of adult Americans purchased digital assets in 2022, and the percentage is expected to grow over the coming years. High investments in digital assets, driven by the growing valuation of NFTs, bodes well for the segment’s growth.

The commercial segment is anticipated to expand at the highest CAGR from 2024 to 2030. Growing use of NFTs for business purposes, such as innovating supply chain management and logistics, is expected to drive segment growth. Logistic companies are increasingly integrating blockchain technology in their operations, creating new opportunities for segment growth. For instance, in October 2021, VeChain, an enterprise-friendly blockchain project, announced a partnership with DHL, a logistics company, to issue NFTs on VeChainThor blockchain.

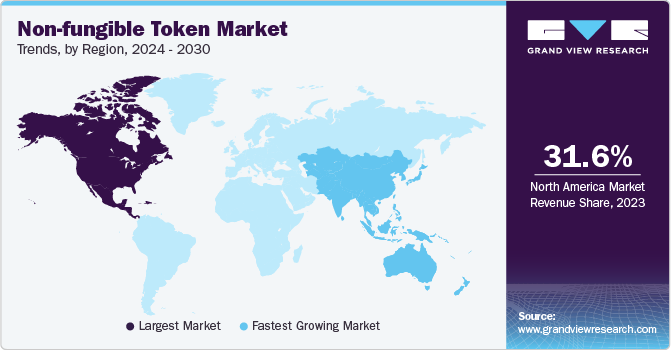

Regional Insights

North America accounted for the largest revenue share of 31.6% in 2023. Increasing product adoption by millennials in this region is driving the market growth. A rise in the number of artists creating digital artwork in countries, such as the U.S. and Canada, is also expected to drive market growth in this region. Furthermore, the presence of major players operating in the blockchain industry also bodes well for regional market growth. Moreover, high traction of metaverse and Web3.0 in North America is increasing the number of people being acquainted with digital work, and the artists who are creating digital art NFTs, which can be used in metaverse.

Asia Pacific is anticipated to witness significant growth from 2024 to 2030. The rising adoption of cryptocurrency across Asia Pacific countries is expected to drive regional market growth. An increase in the development of metaverse platforms by startups in this region is also expected to favor market growth. In addition, rapidly growing gaming industry in Asia Pacific is creating new opportunities for market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include OpenSea (Ozone Networks, Inc.); CryptoPunks - Larva Labs Studio; Funko Inc.; Dapper Labs, Inc., and Nifty Gateway (Gemini Trust Company, LLC).

-

OpenSea (Ozone Networks, Inc.) is an American company that offers a marketplace where NFTs can be sold directly through auctions or at a fixed price based on the Ethereum ERC-721 token standard and Polygon, the layer-2 scaling solution for the Ethereum blockchain. OpenSea’s NFT portfolio includes art, collectibles, music, photography, sports, trading cards, utility, and virtual worlds

-

Dapper Labs, Inc. is an NFT company that uses blockchain technology to offer NFTs and new modes of digital engagement to enthusiasts across the globe. Dapper Labs, Inc. is an NFT company that uses blockchain technology to offer NFTs and new modes of digital engagement to enthusiasts across the globe

YellowHeart, LLC, Cloudflare, Inc., PLBY Group, Inc., Dolphin Entertainment, and MakersPlace (Onchain Labs, Inc.) are some of the emerging market participants in the non-fungible token market.

-

YellowHeart, LLC is an NFT ticketing and collectibles platform that caters exclusively to artists, teams, and their fans. YellowHeart, LLC is leveraging blockchain to transform the way tickets and art are sold. The company is focusing on creating an asset class that ensures that creators earn a portion of all future profits derived from trading their creations and that buyers have a reliable way of tracing the origin of tradable items

-

Nifty Gateway (Gemini Trust Company, LLC.) is a digital auction platform for NFT art. The company has art NFTs by Beeple, Pak, Refik Anadol, and other popular NFT artists. The company collaborates with top artists to create limited-edition, high-quality NFT collections

Key Non-fungible Token Companies:

- YellowHeart, LLC.

- Cloudflare, Inc.

- PLBY Group, Inc.

- Dolphin Entertainment, Inc.

- Funko

- Ozone Networks, Inc.

- Takung Art Co., Ltd.

- Dapper Labs, Inc.

- Gemini Trust Company, LLC.

- Onchain Labs, Inc.

Recent Developments

-

In November 2023, Dapper Labs, Inc. announced its latest NFT platform, Disney Pinnacle. The upcoming platform is expected to revolutionize the conventional pin-collecting hobby by introducing a digital format showcasing characters from Disney, Pixar, and the Star Wars galaxy

-

In November 2023, a Web3 company, Treehouse, announced the intellectual property (IP) acquisition of Origins Analytics to improve its non-fungible token (NFT) product offering. Through this acquisition, Treehouse customers will have access to Origin Analytics' well-received tools, including AlphaStream, a system that uses algorithms to tag NFT wallets for notifications, NFT Analytics Bots, and an Application Programming Interface (API) for profiling NFT wallets

-

In April 2023, The NFT marketplace Sandbox revealed a strategic alliance with Ledger Enterprise, a platform focused on developing, expanding, and securing Web3 strategies. This collaboration aims to bolster security measures and elevate partner experiences. Via this partnership, Sandbox's associates can securely move their non-fungible token collections to the Ledger wallet, guaranteeing maximum security for their valuable assets. This integration aims to offer an extra level of protection and assurance for users engaged in the Sandbox ecosystem

Non-fungible Token Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.7 billion

Revenue forecast in 2030

USD 211.7 billion

Growth rate

CAGR of 34.5% from 2024 to 2030

Base year of estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Type, application, end-use, and region

Regional scope

North America Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

YellowHeart, LLC.; Cloudflare, Inc.; PLBY Group, Inc.; Dolphin Entertainment, Inc.; Funko; Ozone Networks, Inc.; Takung Art Co., Ltd.; Dapper Labs, Inc.; Gemini Trust Company, LLC.; Onchain Labs, Inc

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-fungible Token Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the non-fungible token market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical Asset

-

Digital Asset

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Collectibles

-

Video Clip

-

Audio Clip

-

Gamification

-

Others

-

-

Art

-

Pixel Art

-

Fractal/Algorithmic Art

-

Computer Generated Painting

-

2D/3D Painting

-

2D/3D Computer Graphics

-

GIFs

-

Others

-

-

Gaming

-

Trading Card Game (TCG)

-

Video Game

-

Strategy Role Playing Game (RPG)

-

Others

-

-

Utilities

-

Tickets

-

Domain Names

-

Assets Ownership

-

-

Metaverse

-

Sports

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-fungible token market size was estimated at USD 26.9 billion in 2023 and is expected to reach USD 35.7 billion in 2024.

b. The global non-fungible token market is expected to grow at a compound annual growth rate of 34.5% from 2024 to 2030 to reach USD 211.7 billion by 2030.

b. North America dominated the non-fungible token market with a share of 31.64% in 2023. The increasing adoption of NFTs by millennials in the region is driving regional market growth.

b. Some key players operating in the non-fungible token market include YellowHeart, LLC.; Cloudflare, Inc.; PLBY Group, Inc.; Dolphin Entertainment, Inc.; Funko; Ozone Networks, Inc.; Takung Art Co., Ltd.; Dapper Labs, Inc.; Gemini Trust Company, LLC.; Onchain Labs, Inc

b. Key factors that are driving the non-fungible token market growth include increasing demand for digital artworks and increasing demand for a decentralized marketplace

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."