- Home

- »

- Medical Devices

- »

-

Non-invasive Fat Reduction Market Size, Share Report, 2030GVR Report cover

![Non-invasive Fat Reduction Market Size, Share & Trends Report]()

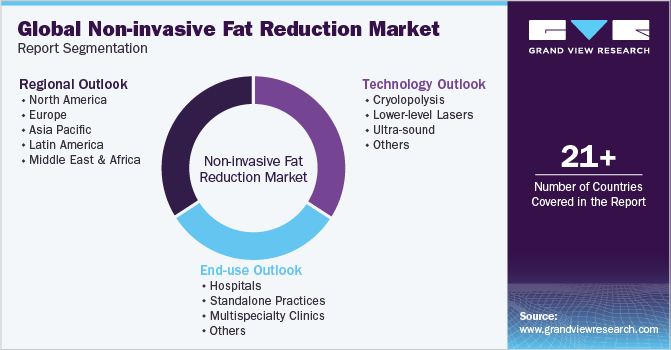

Non-invasive Fat Reduction Market Size, Share & Trends Analysis Report By Technology (Cryolipolysis, Ultrasound), By End-use (Hospitals, Standalone Practices, Multispecialty Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-740-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global non-invasive fat reduction market size was estimated at USD 1.3 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.2% from 2023 to 2030. Non-invasive fat reduction is a procedure carried out to remove excess fat from certain parts of the body by using methods, such as laser, lipolysis, cryolipolysis, and radiofrequency. Non-invasive devices used in these procedures are FDA-approved as their safety & efficiency have been tested and have shown significant results. In March 2023, the FDA approved the EON Smarter Body Contouring device manufactured by Dominion Aesthetics Technologies, Inc. for the treatment of back and thighs. The device is designed with state-of-the-art technology, which offers maximum flexibility and can be used for the treatment of all patients.

These procedures are to be carried out by professional practitioners who are technically sound to execute these treatments. Some of the famous brands for non-invasive fat reduction procedures are CoolSculpting, Kybella, Vanquish, and Sculpsure. The COVID-19 pandemic had a negative impact on the growth of this market. Since the lockdown guidelines instructed the delay of several elective procedures, the demand for non-invasive fat reduction devices was also reduced. Most of the clinics were on the verge of shutting down as a result of a lesser number of procedures and disruption in production and supply chain. However, with the easing of lockdown restrictions, a surge in aesthetic surgeries was observed in the following years.

According to a study published in the National Library of Medicine in January 2023, in 2021, the number of cosmetic surgeries related to aesthetic, plastic, and reconstructive surgeries increased by 49.4% compared to 2020 and 29.7% compared to 2019. The sedentary lifestyle of people is expected to further propel the growth of this market as it leads to obesity and other diseases. According to an article released by the World Health Organization in October 2022, around 500 million people around the globe are likely to develop obesity, heart disease, and other chronic disorders by 2030 due to their sedentary lifestyle.

Moreover, physical inactivity, tedious & long working hours, behavioral risk factors like alcohol consumption, and smoking, as well as stress increase the risk of developing conditions like diabetes and obesity. Rapid urbanization has limited people’s time to focus on their physical health and, therefore, they have to rely on alternate options to reduce stubborn fat. Increasing acceptance and rising demand for body contouring treatments, rise in healthcare expenditure, increasing disposable income, and high cases of obesity are the key factors boosting the growth of the market. For instance, an article released by the WHO in March 2022 suggests that more than 1 billion people in the world including 650 million adults and 340 million adolescents were obese, and this number is expected to increase further over the forecast period.

According to a global survey released by the International Society of Aesthetic Plastic Surgery in January 2023, nearly 17.5 million non-surgical procedures were performed in 2021, which shows an increase of 54.4% over the last four years. Treatments for males and females were 125,311 and 605,669 respectively. The technological advancements in this field that offer quick and efficient results can be attributed to this growth. Moreover, the ease of conducting such procedures and their affordability are attracting millennials, even more, to opt for these treatments.

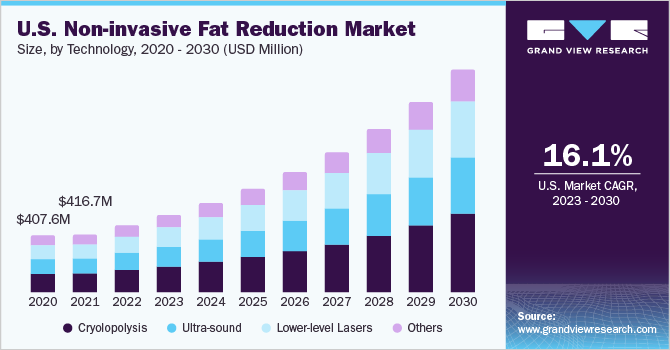

Technology Insights

On the basis of technology, the global market has been further segmented into cryolipolysis, ultrasound, low-level lasers, and others. The cryolipolysis segment accounted for the largest share of 34.3% of the overall revenue in 2022 and is expected to grow at the fastest CAGR of 16.7% over the forecast period. It is a non-invasive method where cold temperatures are used to freeze and kill the fat in the targeted area, which is then drained out of the body over two to six months by the metabolic pathways.

According to a survey by American Society for Dermatologic Surgery, approximately 257, 968 cryolipolysis treatments were carried out in 2019 and cryolipolysis was the most common non-surgical aesthetic procedure in 2021. The demand for cryolopolysis technology is expected to increase further as people are choosing a minimal risk-related treatment that delivers instant and long-term results. Moreover, it is a more cost-effective method with very common complications like temporary discomfort and no downtime. A lot of campaigns have been launched by various key players to create awareness regarding the safety and benefits of these devices.

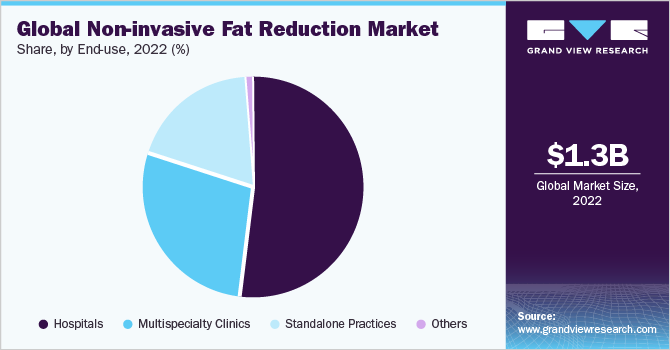

End-use Insights

On the basis of end-use, the market is segmented into hospitals, standalone practices, multispecialty clinics, and others. The hospital segment held the largest market share of 52.3% in 2022 and is expected to grow at the fastest CAGR of 16.4% over the forecast period. This is mainly because the hospital settings are well equipped with high-end technology, fat reduction devices, professional practitioners, and the necessary infrastructure to carry out such procedures. Moreover, there is a sense of trust and reliability when the treatment is conducted in a hospital, and hospital accreditation also influences the patient’s preference for undergoing aesthetic procedures.

The segment is expected to grow further due to the increasing prevalence of obesity and other diseases. For instance, in 2020, the WHO stated that obesity has been tripling since ancient times and the desire to cut down the fat is eventually growing. This is likely to boost the demand for non-invasive fat reduction and propel market growth over the forecast period. The multispecialty clinic segment is also expected to show significant growth in the forecast period as they serve all the needs of the patients in one convenient location with procedural variations and the availability of skilled practitioners.

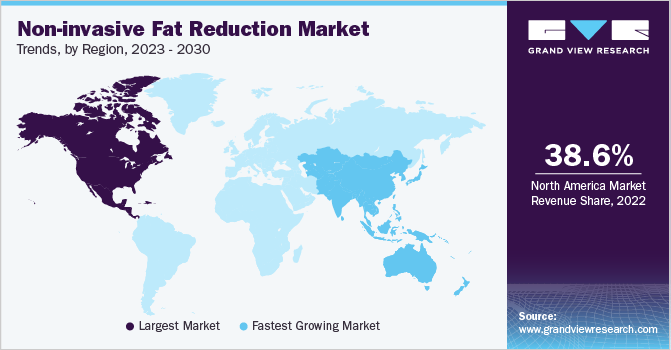

Regional Insights

North America dominated the market and accounted for the largest revenue share of 38.6% in 2022. This can be attributed to the rising obese population, increasing R&D in the region, the highest per capita disposable income, rising adoption of new technology, and constant awareness campaigns. The increasing need for perfect appearance and confidence through physical characteristics in the major fields of work is driving the regional market growth. The development of convenient procedures and easy access to healthcare facilities further add to the growth of the in the country.

According to the International Society of Aesthetic Plastic Surgery, the U.S. is the country with the most nonsurgical procedures, and 3,182,815 treatments were carried out in 2020. The Asia Pacific market is expected to witness the highest CAGR of 17.4 % over the forecast period. This growth can be attributed to the availability and benefits of body contouring treatments, rising patient awareness, low cost of treatment, rising demand for aesthetics, adoption of Western culture, and marketing strategies implemented by the key players. The combination of all these factors is expected to propel market growth in the Asia Pacific region over the forecast period.

Key Companies & Market Share Insights

Several players in the market are focusing on new product launches, geographical expansions, strategic collaborations, and partnerships through mergers and acquisitions. The major players are rigorously promoting their fat-reduction workstations by making use of various marketing strategies. Moreover, the rapid adoption of advanced technology and improved result output are expected to drive further competition in the market.

For instance, in September 2020, Cutera announced the launch of truSculpt Flex, which is the company’s body sculpting platform, in Canada. In January 2021, Allergan Aesthetics announced the expansion of its body contouring portfolio with the launch of the company’s next-generation fat reduction system, CoolSculpting Elite. It is FDA-cleared and is used for the treatment of fat in the abdomen, thigh, upper arm, and flank, along with back fat, bra fat, underneath the buttocks, and submandibular and submental areas. Some of the major players in the global non-invasive fat reduction market include:

-

Cynosure

-

Fosun Pharmaceuticals Co. Ltd

-

Cutera Inc

-

Zeltiq Aesthetics

-

Candela Corporation

-

BTL Industries

-

Venus Concept

-

Lynton Lasers Ltd.

-

AbbVie Inc.

-

Hologic, Inc.

Non-invasive Fat Reduction Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.5 billion

Revenue forecast in 2030

USD 4.3 billion

Growth rate

CAGR of 16.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany.; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cynosure; Fosun Pharmaceuticals Co. Ltd.; Cutera Inc.; Zeltiq Aesthetics; Candela Corp.; BTL Industries; Venus Concept; Lynton Lasers Ltd.; AbbVie Inc.; Hologic, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-invasive Fat Reduction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-invasive fat reduction market report on the basis of technology, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryolopolysis

-

Lower-level Lasers

-

Ultra-sound

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Standalone Practices

-

Multispecialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global non-invasive fat reduction market size was estimated at USD 1.3 billion in 2022 and is expected to reach USD 1.5 billion in 2023.

b. The global non-invasive fat reduction market is expected to grow at a compound annual growth rate of 16.2% from 2023 to 2030 to reach USD 4.3 billion by 2030.

b. North America dominated the non-invasive fat reduction market with a share of 38.6% in 2022. This is attributable to high personal disposable income, high expenditure on healthcare, a large pool of certified professionals, and the rising prevalence of obesity among the population.

b. Some key players operating in the non-invasive fat reduction market include Fosun Pharmaceutical Co. Ltd, Cutera Inc, Cynosure Inc, ZELTIQ Aesthetics Inc., Syneron Medical Ltd, BTL, Venus Concept, Lumenis Ltd., Candela Corporation, and Hologic Inc.

b. Key factors that are driving the non-invasive fat reduction market growth include the increasing prevalence of obesity and the rise in demand for non-invasive procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."